The Securities and Exchange Commission (SEC) is anticipated to rule in favor of approving spot Bitcoin Exchange-Traded Funds (ETFs) after January 8, 2024, according to Charles Gasparino of Fox Business. This development has instilled confidence among financial firms, signaling a potential milestone in the integration of Bitcoin into traditional investment portfolios.

Bitcoin ETFs to be Purchased with Cash Only

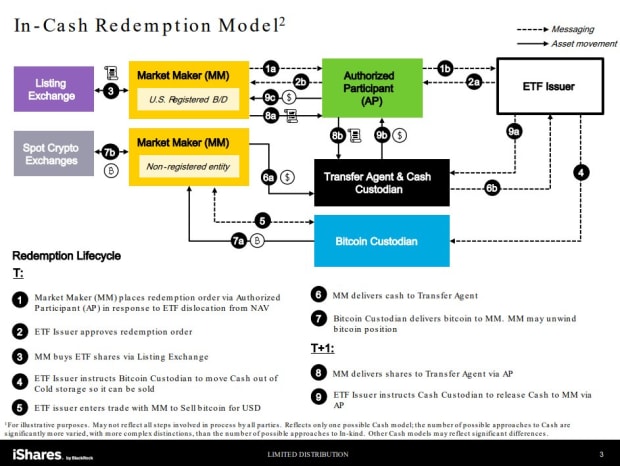

Gasparino's report highlights that Bitcoin ETF shares will only be available for purchase with cash, rather than with bitcoin itself. The SEC expresses concerns about potential money laundering activities associated with ETFs. As a result, the regulator is emphasizing a cash-only system to minimize such risks.

Notably, leading spot Bitcoin ETF issuers, including BlackRock, have been engaged in discussions with the SEC over the past few weeks. The main topic of these meetings is the choice between in-kind and in-cash creations for ETF shares.

SEC's Concerns about Money Laundering

Eric Balchunas, a senior ETF analyst at Bloomberg, commented on the SEC's focus on preventing money laundering through in-kind creations in spot Bitcoin ETFs. He noted that the regulator's emphasis on cash creates a more closed system, reducing the risks associated with illicit activities.

As a response to the SEC's concerns, BlackRock and other ETF issuers have complied and filed their ETFs for in-cash creations. While the ETFs will hold spot bitcoin, investors will purchase shares using cash. The selected ETF issuer will then use the cash to acquire the spot bitcoin to be held in the ETF.

Balchunas confirmed the shift towards a cash-only approach, stating, "BlackRock has gone cash only. That's basically a wrap. Debate over. In-kind will have to wait."

Significance of SEC Approval for Bitcoin ETFs

If the SEC approves these proposed Bitcoin ETFs, it would represent a significant milestone in legitimizing and integrating Bitcoin into traditional investment portfolios. Moreover, this move would reflect a shift in regulatory sentiment towards greater acceptance and regulation of Bitcoin.

While the SEC has not released any official statements regarding these discussions, Gasparino's report has generated interest and optimism within the financial industry. Stakeholders are eagerly anticipating potential approval of the Bitcoin ETFs around January 8.

Frequently Asked Questions

What is the tax on gold in Roth IRAs?

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

These rules vary from one state to another. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. Massachusetts allows you to delay withdrawals until April 1. And in New York, you have until age 70 1/2 . You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

What are the pros and disadvantages of a gold IRA

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. There are some disadvantages to this investment.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

You will also need to pay fees for managing your IRA. Many banks charge between 0.5%-2.0% per year. Others charge management fees that range from $10 to $50 per month.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. In order to make a claim, most insurers will require that you have a minimum amount in gold. Some insurers may require you to have insurance that covers losses up $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. Some providers restrict the amount you can own in gold. Others allow you the freedom to choose your own weight.

Also, you will need to decide if you want to buy physical gold futures contracts or physical gold. Physical gold is more expensive than gold futures contracts. However, futures contracts give you flexibility when buying gold. You can set up futures contracts with a fixed expiration date.

You will also have to decide which type of insurance coverage is best for you. The standard policy does NOT include theft protection and loss due to fire or flood. However, it does cover damage caused by natural disasters. You may consider adding additional coverage if you live in an area at high risk.

Insurance is not enough. You also need to think about the cost of gold storage. Insurance doesn't cover storage costs. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

A qualified custodian is required to help you open a Gold IRA. A custodian maintains track of all your investments and ensures you are in compliance with federal regulations. Custodians cannot sell your assets. They must instead keep them for as long as you ask.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. Your plan should include information about the investments you want to make, such as stocks, bonds, mutual funds, or real estate. It is also important to specify how much money you will invest each month.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. Once the company has received your application, they will review it and send you a confirmation email.

When opening a gold IRA, you should consider using a financial planner. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

What is the tax on gold in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. Gold is not subject to tax when it's purchased. It is not considered income. If you sell it later, you'll have a taxable gain if the price goes up.

Loans can be secured with gold. When you borrow against your assets, lenders try to find the highest return possible. This usually involves selling your gold. However, there is no guarantee that the lender would do this. They might just hold onto it. They might decide that they want to resell it. You lose potential profits in either case.

To avoid losing money, only lend against gold if you intend to use it for collateral. You should leave it alone if you don't intend to lend against it.

How do I Withdraw from an IRA with Precious Metals?

First, you must decide if you wish to withdraw money from your IRA account. Next, ensure you have enough cash on hand to pay any penalties or fees that could be associated with withdrawing funds.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, you need to determine how much money is going to be taken out from your IRA. This calculation will depend on many factors including your age at the time of withdrawal, how long the account has been in your possession, and whether you plan to continue contributing towards your retirement plan.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Once these calculations have been completed you will need to open an account with a brokerage. A majority of brokers offer free signup bonuses, as well as other promotions, to get people to open accounts. To avoid unnecessary fees, however, try opening an account using a debit card rather than a credit card.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will accept bullion bars, others require you to buy individual coins. Before you choose one, weigh the pros and cons.

Bullion bars require less space, as they don't contain individual coins. But, each coin must be counted separately. However, individual coins can be stored to make it easy to track their value.

Some prefer to keep their money in a vault. Others prefer to store their coins in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

bbb.org

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not exactly legal – WSJ

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was universally accepted and loved for its beauty, durability, purity and divisibility. Aside from its inherent value, it could be traded internationally. There were different measures and weights for gold, as there was no standard to measure it. For example, in England, one pound sterling was equal to 24 carats of silver; in France, one livre tournois was equal to 25 carats of gold; in Germany, one mark was equal to 28 carats of gold; etc.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. The result was a decrease in foreign currency demand, which led to an increase in their price. The United States began minting large quantities gold coins at this time, which led to a drop in the price. The U.S. government needed to find a solution to their debt because there was too much money in circulation. They decided to return some of the gold they had left to Europe.

Many European countries didn't trust the U.S. dollars and started to accept gold for payment. Many European countries started to accept paper money as a substitute for gold after World War I. The price of gold rose significantly over the years. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————–

By: Nik Hoffman

Title: SEC Expected to Approve Bitcoin ETFs, Boosting Crypto Integration in Traditional Investments

Sourced From: bitcoinmagazine.com/markets/fox-business-firms-feel-confident-sec-will-approve-spot-bitcoin-etfs-after-january-8

Published Date: Wed, 20 Dec 2023 16:03:12 GMT