Robert Kiyosaki's Recommendation: Get Into Bitcoin Now

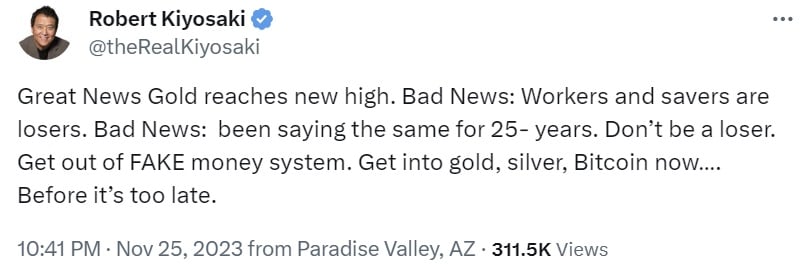

Renowned author and financial expert Robert Kiyosaki, best known for his book "Rich Dad Poor Dad," has once again emphasized the importance of investing in bitcoin. Kiyosaki suggests that investors should ditch fiat currency and seize the opportunity to invest in bitcoin before it's too late. According to him, workers and savers who rely on U.S. dollars are at a disadvantage. Kiyosaki has made several bullish predictions about the future price of bitcoin, ranging from $135,000 in the near term to $1 million.

In addition to his endorsement of bitcoin, Kiyosaki also recommends investing in gold and silver. "Rich Dad Poor Dad," co-authored by Kiyosaki and Sharon Lechter in 1997, has been a New York Times Best Seller for over six years. With over 32 million copies sold in more than 109 countries and translated into 51 languages, the book has become a financial education staple.

Fiat Currency vs. Real Money: Kiyosaki's Perspective

Kiyosaki frequently refers to fiat currency as "fake money." He argues that the U.S. dollar lost its value as real money when it was detached from the gold standard in 1971 by President Richard Nixon. Instead of being backed by tangible assets like gold, the U.S. dollar became reliant on the "full faith and credit" of the United States. In contrast, Kiyosaki considers gold and silver as "God's money," while bitcoin is referred to as "people's money."

Kiyosaki's concerns about fiat currency's safety are not new. He has repeatedly warned investors about the risks associated with central bankers and the Federal Reserve. He has expressed mistrust towards the Biden administration and Wall Street, highlighting the destructive impact of the Fed and Treasury on the U.S. dollar.

The financial expert predicts that individuals who own gold, silver, and bitcoin will experience significant wealth accumulation as the Federal Reserve continues to print trillions of dollars. He believes that those who solely rely on fiat money will ultimately be the biggest losers. Kiyosaki's stance on this issue has remained consistent, urging individuals to invest in "real money": gold, silver, and bitcoin.

Rich Dad's First Lesson: The Importance of Assets

Kiyosaki emphasizes that the wealthy do not rely on traditional jobs or paper assets. Instead, they focus on acquiring assets that generate real tax-free income. These assets include gold, silver, and bitcoin, which provide lifelong financial security and freedom. Kiyosaki firmly believes that investing in these assets is the key to securing a prosperous future.

Over the years, Kiyosaki has consistently recommended gold, silver, and bitcoin as essential investment options. He recently stated that bitcoin is the best protection against hyperinflation. Kiyosaki has made numerous bullish predictions about the future price of bitcoin, with estimates ranging from $135,000 to $1 million. He has also projected that gold could reach $75,000 and silver could reach $60,000 in the event of a global economic crisis. In February, Kiyosaki predicted that bitcoin would reach $500,000 by 2025, with gold and silver also experiencing significant price increases.

What are your thoughts on Robert Kiyosaki's advice? Share your opinions in the comments section below.

Frequently Asked Questions

What does gold do as an investment?

Supply and demand determine the gold price. It is also affected negatively by interest rates.

Due to limited supplies, gold prices are subject to volatility. You must also store physical gold somewhere to avoid the risk of it becoming stale.

How much tax is gold subject to in an IRA

The tax on the sale of gold is based on its fair market value when sold. You don't have tax to pay when you buy or sell gold. It is not considered income. If you decide to sell it later, there will be a taxable gain if its price rises.

Loans can be secured with gold. When you borrow against your assets, lenders try to find the highest return possible. This often means selling gold. This is not always possible. They may hold on to it. They may decide to resell it. You lose potential profits in either case.

To avoid losing money, only lend against gold if you intend to use it for collateral. It is better to leave it alone.

Who owns the gold in a Gold IRA?

The IRS considers gold owned by an individual to be “a type of money” and is subject taxation.

You must have at least $10,000 in gold and keep it for at most five years to qualify for this tax-free status.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

A financial planner or accountant should be consulted to discuss your options.

What amount should I invest in my Roth IRA?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. There are some rules that you need to keep in mind if you want to withdraw funds from these accounts before you reach 59 1/2. First, you can't touch your principal (the initial amount that was deposited). This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule is that you cannot withdraw your earnings without paying income taxes. You will pay income taxes when you withdraw your earnings. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. Let's further assume you earn $10,000 annually after contributing. Federal income taxes would apply to the earnings. You would be responsible for $3500 The remaining $6,500 is yours. Because you can only withdraw what you have initially contributed, this is all you can take out.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. Additionally, half of your earnings would be lost because they will be taxed at 50% (half the 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

Two types of Roth IRAs are available: Roth and traditional. Traditional IRAs allow you to deduct pretax contributions from your taxable income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. There are no restrictions on the amount you can withdraw from a Traditional IRA.

Roth IRAs don't allow you deduct contributions. Once you are retired, however, you may withdraw all of your contributions plus accrued interest. Unlike a traditional IRA, there is no minimum withdrawal requirement. You don't need to wait until your 70 1/2 year old age before you can withdraw your contribution.

Can the government take your gold?

You own your gold and therefore the government cannot seize it. You earned it through hard work. It belongs to you. This rule may not apply to all cases. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. If you owe taxes, your precious metals could be taken away. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

Should You Get Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

This could be changing, according to some experts. According to them, gold prices could soar if there is another financial crisis.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

Consider these things if you are thinking of investing in gold.

- First, consider whether or not you need the money you're saving for retirement. It is possible to save enough money to retire without investing in gold. However, you can still save for retirement without putting your savings into gold.

- Second, you need to be clear about what you are buying before you decide to buy gold. Each offers varying levels of flexibility and security.

- Keep in mind that gold may not be as secure as a bank deposit. Your gold coins may be lost and you might never get them back.

Do your research before you buy gold. Make sure to protect any gold you already own.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

bbb.org

investopedia.com

irs.gov

How To

How to Keep Physical Gold in an IRA

The most obvious way to invest in gold is by buying shares from companies producing gold. But, this approach comes with risks. These companies may not survive the next few years. Even if they do survive, there is still the possibility of losing money to fluctuating gold prices.

Another option is to purchase physical gold. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. This option offers the advantages of being able to purchase gold at low prices and easy access (you don’t need to deal directly with stock exchanges). It is easier to view how much gold has been stored. So you can see exactly what you have paid and if you missed any taxes, you will get a receipt. You are also less likely to be robbed than investing in stocks.

However, there can be some downsides. There are some disadvantages, such as the inability to take advantage of investment funds and interest rates from banks. You can't diversify your holdings, and you are stuck with the items you have bought. Finally, tax man may want to ask where you put your gold.

BullionVault.com has more information about how to buy gold in an IRA.

—————————————————————————————————————————————————————————————–

By: Kevin Helms

Title: Robert Kiyosaki's Advice: Why You Should Invest in Bitcoin Now

Sourced From: news.bitcoin.com/robert-kiyosakis-advice-get-into-bitcoin-now-before-its-too-late/

Published Date: Mon, 27 Nov 2023 03:30:08 +0000