Introduction

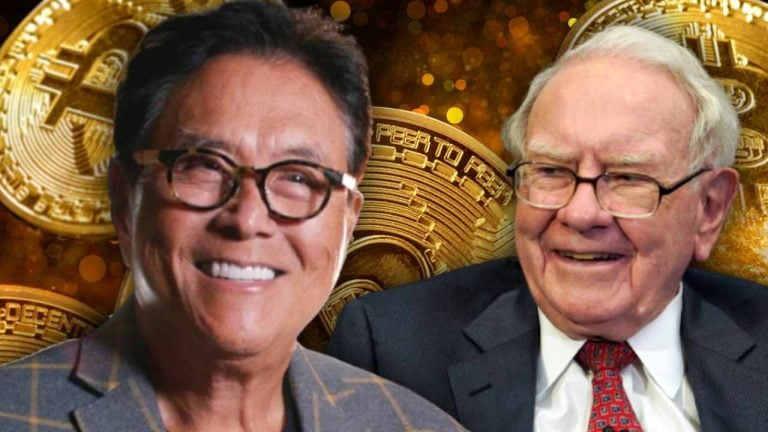

Robert Kiyosaki, the renowned author of the best-selling book Rich Dad Poor Dad, has recently shared his investment strategy, highlighting its differences from the approach favored by investing legend Warren Buffett. In this article, we will delve into Kiyosaki's investment philosophy and compare it to Buffett's value investing strategy.

Robert Kiyosaki's Investment Approach

Kiyosaki describes himself as an average investor who focuses on accumulating assets for the long term. Instead of trying to time the market or pick the perfect entry point, he believes in steadily acquiring assets that he believes in. Over the years, Kiyosaki has been accumulating assets such as gold, silver, bitcoin, and real estate.

He emphasizes the concept of dollar cost averaging, which involves regularly investing a fixed amount of money into a particular asset regardless of its price fluctuations. Kiyosaki believes that by consistently accumulating assets over time, average investors can build wealth and achieve financial success. He shares his personal experience of buying a gold coin for $50, which is now worth $2,000, to illustrate the potential gains from this approach.

Warren Buffett's Value Investing Strategy

On the other hand, Warren Buffett is a well-known proponent of value investing. He looks for businesses with strong economic characteristics and trustworthy management teams. Buffett believes in investing in companies that have long-term growth potential and are undervalued by the market.

Buffett's investment philosophy revolves around identifying quality businesses and holding onto them for the long term. He emphasizes the importance of conducting thorough research and making informed investment decisions based on fundamental analysis.

Kiyosaki's Recommendations on Gold, Silver, and Bitcoin

Kiyosaki has been a vocal advocate for investing in gold, silver, and bitcoin. He has made several predictions regarding the prices of these assets. According to Kiyosaki, the price of bitcoin is expected to reach $135,000, while gold is anticipated to surpass $2,100 and silver is projected to increase from $23 to $68 per ounce.

It is worth noting that Kiyosaki's predictions are based on his own analysis and should be taken with caution. The cryptocurrency market and precious metals market are known for their volatility, and prices can fluctuate significantly.

Warren Buffett's Stance on Bitcoin

Unlike Kiyosaki, Warren Buffett is not a fan of bitcoin. He has famously referred to the cryptocurrency as "rat poison squared" and has expressed skepticism about its long-term value. Buffett believes that bitcoin lacks intrinsic value and considers it to be more of a speculative asset rather than a reliable investment.

Buffett's reservations about bitcoin stem from his preference for investing in businesses with tangible assets and proven track records. He has consistently emphasized the importance of investing in companies with strong economic moats and trustworthy management teams.

Conclusion

In conclusion, Robert Kiyosaki and Warren Buffett have different investment strategies. Kiyosaki focuses on accumulating assets for the long term, using dollar cost averaging as a key principle. He recommends investing in gold, silver, and bitcoin. On the other hand, Buffett is a proponent of value investing, emphasizing the importance of investing in quality businesses with strong fundamentals.

Both strategies have their merits, and it is up to individual investors to decide which approach aligns with their investment goals and risk tolerance. It is crucial to conduct thorough research, seek professional advice, and make informed investment decisions based on individual circumstances.

Frequently Asked Questions

Who is the owner of the gold in a gold IRA

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

What are the pros and cons of a gold IRA?

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. However, there are disadvantages to this type investment.

You could lose all of your accumulated money if you take out too much from your IRA. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

You will also need to pay fees for managing your IRA. Most banks charge 0.5% to 2.0% per annum. Other providers charge monthly management charges ranging anywhere from $10 to $50.

If you prefer your money to be kept out of a bank, then you will need insurance. In order to make a claim, most insurers will require that you have a minimum amount in gold. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. Some providers limit the number of ounces of gold that you can own. Others allow you the freedom to choose your own weight.

It's also important to decide whether or not to buy gold futures contracts. Physical gold is more expensive than gold futures contracts. Futures contracts provide flexibility for purchasing gold. They allow you to set up a contract with a specific expiration date.

You will also have to decide which type of insurance coverage is best for you. The standard policy does not include theft protection or loss caused by fire, flood, earthquake. The policy does not cover natural disasters. If you live near a high-risk region, you might want to consider additional coverage.

Apart from insurance, you should consider the costs of storing your precious metals. Insurance won't cover storage costs. For safekeeping, banks typically charge $25-40 per month.

To open a IRA in gold, you will need to first speak with a qualified custodian. Custodians keep track of your investments and ensure compliance with federal regulations. Custodians don't have the right to sell assets. Instead, they must maintain them for as long a time as you request.

After you have decided on the type of IRA that best suits you, you will need to complete paperwork detailing your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. You should also specify how much you want to invest each month.

After completing the forms, send them along with a check or a small deposit to your chosen provider. After receiving your application, the company will review it and mail you a confirmation letter.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can also help you lower your expenses by finding cheaper alternatives to purchasing insurance.

How to Open a Precious Metal IRA?

First, you must decide if your Individual Retirement Account (IRA) is what you want. Once you have decided to open an Individual Retirement Account (IRA), you will need to complete Form 806. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. This form should be filled within 60 calendar days of opening the account. After this, you are ready to start investing. You can also choose to pay your salary directly by making a payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, it will be the same process as an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS stipulates that you must have earned income and be at least 18-years old. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. And, you have to make contributions regularly. These rules apply whether you're contributing through an employer or directly from your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. However, physical bullion will not be available for purchase. This means you can't trade shares of stock and bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option can be provided by some IRA companies.

There are two major drawbacks to investing via an IRA in precious metals. They aren't as liquid as bonds or stocks. It's also more difficult to sell them when they are needed. They don't yield dividends like bonds and stocks. Therefore, you will lose money over time and not gain it.

Can I have physical gold in my IRA

Gold is money, not just paper currency or coinage. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Today, investors invest in gold as part a diversified portfolio. This is because gold tends do better in financial turmoil.

Many Americans today prefer to invest in precious metals, such as silver and gold, over stocks and bonds. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

One reason is that gold has historically performed better than other assets during periods of financial panic. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Your stock portfolio can fall, but you will still own your shares. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, the liquidity that gold provides is unmatched. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. The liquidity of gold makes it a good investment. This allows you take advantage of the short-term fluctuations that occur in the gold markets.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Do you want to keep your IRA gold at home? It's not legal – WSJ

cftc.gov

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads. Example. And Risk Metrics

bbb.org

How To

Three Ways to Invest In Gold For Retirement

It's important to understand how gold fits in with your retirement plan. There are several options to invest in precious metals if your employer has a 401k. It is also possible to invest in gold from outside of your work environment. One example is opening a custodial accounts at Fidelity Investments if an IRA (Individual Retirement Account), if you already own one. Or, if you don't already own any precious metals, you may want to consider buying them directly from a reputable dealer.

These are the three rules to follow if you decide to invest in gold.

- Buy Gold with Cash – Avoid using credit cards or borrowing money to fund investments. Instead, invest in cash. This will protect your against inflation and increase your purchasing power.

- Physical Gold Coins to Own – Physical gold coin ownership is better than having a paper certificate. The reason is that it's much easier to sell physical gold coins than certificates. You don't have to store physical gold coins.

- Diversify Your Portfolio. Never place all your eggs in the same basket. In other words, spread your wealth around by investing in different assets. This helps reduce risk and gives you more flexibility during market volatility.

—————————————————————————————————————————————————————————————–

By: Kevin Helms

Title: Robert Kiyosaki Reveals His Investment Strategy: A Divergence from Warren Buffett

Sourced From: news.bitcoin.com/robert-kiyosaki-shares-his-investment-strategy-says-hes-not-trying-to-be-warren-buffett/

Published Date: Wed, 25 Oct 2023 00:30:12 +0000

Did you miss our previous article…

https://altcoinirareview.com/bukele-likely-to-step-down-as-president-to-seek-a-second-term/

Related posts:

Bitcoin Primed for $135,000 and Gold for Takeoff, According to Robert Kiyosaki

Bitcoin Primed for $135,000 and Gold for Takeoff, According to Robert Kiyosaki

7 Best Gold IRA Companies 2023 (Ranked by customer reviews)

7 Best Gold IRA Companies 2023 (Ranked by customer reviews)

Robert Kiyosaki Urges Investors to Get Into Crypto Now, Before Biggest Economic Crash in World History

Robert Kiyosaki Urges Investors to Get Into Crypto Now, Before Biggest Economic Crash in World History

Robert Kiyosaki Warns Fed Rate Hikes Will Destroy US Economy — Says Invest in ‘Real Money’ Naming Bitcoin

Robert Kiyosaki Warns Fed Rate Hikes Will Destroy US Economy — Says Invest in ‘Real Money’ Naming Bitcoin