The Reason Behind Robert Kiyosaki's Ongoing Investments

Robert Kiyosaki, the co-author of the bestselling book Rich Dad Poor Dad, has recently shared the motivation behind his continued investments in gold, silver, and bitcoin. Rich Dad Poor Dad, which Kiyosaki co-authored with Sharon Lechter, has remained on the New York Times Best Seller List for over six years and has sold more than 32 million copies in over 51 languages worldwide.

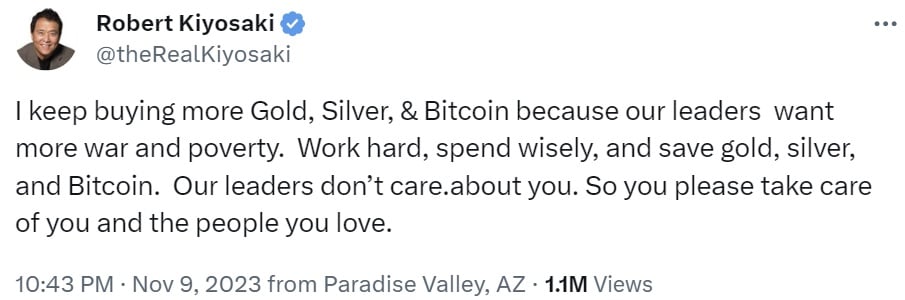

Kiyosaki took to social media platform X on Thursday to explain that his consistent purchases of gold, silver, and bitcoin stem from his belief that U.S. leaders are pushing for "more war and poverty." He advises individuals to safeguard their wealth by investing in these three asset classes.

The Three Asset Classes for Lifelong Financial Security

For quite some time, Kiyosaki has been advocating for gold, silver, and bitcoin, emphasizing that they provide "lifelong financial security and freedom" and are particularly suited for "unstable times." He recommends allocating 75% of investment portfolios to these assets, with the remaining 25% invested in real estate and oil stocks. Kiyosaki believes that this mix will help individuals weather the potential impact of the greatest crash in world history.

In addition, Kiyosaki suggests using dollar cost averaging rather than attempting to pick individual stocks, stating that he does not follow the same strategy as Warren Buffett.

Bullish Predictions and Future Outlook

Kiyosaki has made several bullish predictions regarding the price of bitcoin. In the near term, he anticipates the price to reach $135,000, with the potential to surge to $1 million in the event of a global economic crisis. Similarly, he foresees gold reaching $75,000 and silver hitting $60,000 under the same circumstances.

Looking further ahead, Kiyosaki projects that by 2025, the price of bitcoin could soar to $500,000, while gold and silver could rise to $5,000 and $500, respectively.

Furthermore, Kiyosaki urges investors to purchase bitcoin immediately, expecting a rush to buy BTC as stock, bond, and real estate markets experience a crash. He firmly believes in the future of cryptocurrency and expresses his disdain for fiat money, referring to it as "fake money." Kiyosaki has also issued warnings about the potential crash of real estate, stocks, and bonds and cautions against the negative effects of the Federal Reserve raising interest rates on the U.S. dollar.

Share Your Thoughts

What are your thoughts on Robert Kiyosaki's explanation for his continued investments in gold, silver, and bitcoin? Let us know in the comments section below.

Frequently Asked Questions

How Does Gold Perform as an Investment?

The supply and demand for gold affect the price of gold. It is also affected by interest rates.

Gold prices are volatile due to their limited supply. There is also a risk in owning gold, as you must store it somewhere.

Who is the owner of the gold in a gold IRA

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

While gold may be a great investment to help prevent inflation and volatility in the market, it's not wise to keep it if you won't use it.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

You should consult a financial planner or accountant to see what options are available to you.

How much of your portfolio should you hold in precious metals

To answer this question we need to first define precious metals. Precious metals have elements with an extremely high worth relative to other commodity. This makes them very valuable in terms of trading and investment. Gold is today the most popular precious metal.

There are many other precious metals, such as silver and platinum. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is also unaffected significantly by inflation and Deflation.

In general, all precious metals have a tendency to go up with the market. But they don't always move in tandem with one another. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

However, when an economy is strong, the reverse effect occurs. Investors prefer safe assets such as Treasury Bonds and demand fewer precious metals. Since these are scarce, they become more expensive and decrease in value.

To maximize your profits when investing in precious metals, diversify across different precious metals. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

Should You Invest in gold for Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. If you are unsure of which option to invest in, consider both.

In addition to being a safe investment, gold also offers potential returns. This makes it a worthwhile choice for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. Because of this, gold's value can fluctuate over time.

But this doesn't mean you shouldn't invest in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit to gold? It's a tangible asset. Gold can be stored more easily than stocks and bonds. It can also be transported.

You can always access your gold as long as it is kept safe. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

A portion of your savings can be invested in something that doesn't go down in value. When the stock market drops, gold usually rises instead.

Another advantage to investing in gold is the ability to sell it whenever you wish. You can also liquidate your gold position at any time you need cash, just like stocks. You don’t even need to wait until retirement to liquidate your position.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Don't buy too many at once. Start small, buying only a few ounces. Then add more as needed.

Don't expect to be rich overnight. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

Even though gold is not the best investment, it could be an excellent addition to any retirement plan.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

irs.gov

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Lawful – WSJ

finance.yahoo.com

How To

How to Buy Physical Gold in An IRA

The best way of investing in gold is to purchase shares from companies that produce gold. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. If they survive, there's still the risk of losing money due to fluctuations in the price of gold.

The alternative is to buy physical gold. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. These options offer the convenience of easy access, as you don't need stock exchanges to do so. You can also make purchases at lower prices. It's also easier to see how much gold you've got stored. You will receive a receipt detailing exactly what you paid. You are also less likely to be robbed than investing in stocks.

However, there are some disadvantages too. There are some disadvantages, such as the inability to take advantage of investment funds and interest rates from banks. You won't have the ability to diversify your holdings; you will be stuck with what you purchased. Finally, the tax man might ask questions about where you've put your gold!

Visit BullionVault.com to find out more about gold buying in an IRA.

—————————————————————————————————————————————————————————————–

By: Kevin Helms

Title: Robert Kiyosaki Reveals Why He Continues to Invest in Bitcoin

Sourced From: news.bitcoin.com/rich-dad-poor-dad-author-robert-kiyosaki-reveals-why-he-keeps-buying-bitcoin/

Published Date: Sun, 12 Nov 2023 01:30:42 +0000

Did you miss our previous article…

https://altcoinirareview.com/nigerian-central-bank-confirms-demonetized-naira-banknotes-still-legal-tender/

Related posts:

Robert Kiyosaki Urges Investors to Get Into Crypto Now, Before Biggest Economic Crash in World History

Robert Kiyosaki Urges Investors to Get Into Crypto Now, Before Biggest Economic Crash in World History

Robert Kiyosaki Reveals His Investment Strategy: A Divergence from Warren Buffett

Robert Kiyosaki Reveals His Investment Strategy: A Divergence from Warren Buffett

Bitcoin Primed for $135,000 and Gold for Takeoff, According to Robert Kiyosaki

Bitcoin Primed for $135,000 and Gold for Takeoff, According to Robert Kiyosaki

Robert Kiyosaki Warns Fed Rate Hikes Will Destroy US Economy — Says Invest in ‘Real Money’ Naming Bitcoin

Robert Kiyosaki Warns Fed Rate Hikes Will Destroy US Economy — Says Invest in ‘Real Money’ Naming Bitcoin