Renowned author and financial expert Robert Kiyosaki, best known for his book "Rich Dad Poor Dad," has recently suggested that investors consider buying bitcoin exchange-traded funds (ETFs) as part of their investment strategy. With concerns about a global economic slowdown and the potential devaluation of traditional currencies, Kiyosaki believes that taking action now is crucial to safeguarding one's wealth.

Robert Kiyosaki and the Advantages of Bitcoin ETFs

Kiyosaki, co-author of the best-selling book "Rich Dad Poor Dad," has long been an advocate for alternative investments such as gold and silver. In addition to these precious metals, he now recommends considering bitcoin ETFs as a viable option. By investing in bitcoin ETFs, investors can gain exposure to the potential growth of bitcoin without directly owning the cryptocurrency.

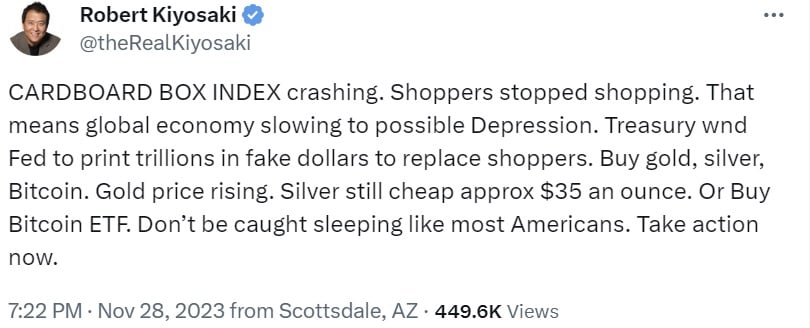

In a recent social media post, Kiyosaki expressed his concerns about the Cardboard Box Index, an indicator used to gauge consumer goods production. He believes that the current decline in consumer spending could signal an impending global economic downturn and even a depression. To counteract this, Kiyosaki suggests that the U.S. Treasury and Federal Reserve will resort to printing trillions of dollars, leading to a devaluation of traditional currencies.

Given this outlook, Kiyosaki advises investors to diversify their portfolios and consider alternative assets like gold, silver, and bitcoin. While gold and silver have historically been seen as safe havens during economic uncertainty, Kiyosaki highlights the potential of bitcoin as a digital store of value. By investing in bitcoin ETFs, investors can gain exposure to bitcoin's potential upside while minimizing the risks associated with direct ownership.

It is important to note that Kiyosaki did not specify which bitcoin ETFs he recommends. In the United States, there are currently bitcoin futures ETFs available, but a spot bitcoin ETF has yet to receive approval from the U.S. Securities and Exchange Commission (SEC). However, SEC Chairman Gary Gensler has recently indicated that the regulator is considering several spot bitcoin ETF applications, which could open up new investment opportunities for retail and institutional investors alike.

This is not the first time Kiyosaki has warned about the possibility of a global economic downturn. In previous predictions, he has highlighted the potential for a depression and the devaluation of the U.S. dollar. Kiyosaki believes that gold, silver, and bitcoin are alternative forms of currency that may provide protection against the erosion of traditional fiat currencies.

In conclusion, Robert Kiyosaki, the author of "Rich Dad Poor Dad," recommends considering bitcoin ETFs as part of a diversified investment strategy. By investing in bitcoin ETFs, investors can potentially benefit from the growth of bitcoin without directly owning the cryptocurrency. As the global economy faces uncertainties, Kiyosaki's advice serves as a reminder to be proactive and explore alternative investment options.

What are your thoughts on Robert Kiyosaki's recommendation? Share your opinions in the comments below.

Frequently Asked Questions

What Is a Precious Metal IRA?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These rare metals are often called “precious” as they are very difficult to find and highly valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Precious metals often refer to themselves as “bullion.” Bullion refers to the actual physical metal itself.

Bullion can be bought via various channels, such as online retailers, large coin dealers and grocery stores.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. This ensures that you will receive dividends each and every year.

Precious metal IRAs have no paperwork or annual fees. Instead, you only pay a small percentage on your gains. You also have unlimited access to your funds whenever and wherever you wish.

How Much of Your IRA Should Be Made Up Of Precious Metals

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don't have to be rich to invest in them. There are many methods to make money off of silver and gold investments.

You might consider purchasing physical coins, such as bullion bars and rounds. It is possible to also purchase shares in companies that make precious metals. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

You'll still get the benefit of precious metals no matter which country you live in. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

And, unlike traditional investments, their prices tend to rise over time. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

What precious metals could you invest in to retire?

Silver and gold are two of the most valuable precious metals. They are both easy to trade and have been around for years. These are great options to diversify your portfolio.

Gold: This is the oldest form of currency that man has ever known. It is also extremely safe and stable. It is a good way for wealth preservation during uncertain times.

Silver: Silver has been a favorite among investors for years. It's a good choice for those who want to avoid volatility. Silver tends to move up, not down, unlike gold.

Platinum: A new form of precious metal, platinum is growing in popularity. It is very durable and resistant against corrosion, much like silver and gold. It is however more expensive than its counterparts.

Rhodium: Rhodium is used in catalytic converters. It is also used as a jewelry material. It's also relatively inexpensive compared to other precious metals.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It's also more affordable. Investors looking to add precious and rare metals to their portfolios love it for these reasons.

Who is entitled to the gold in a IRA that holds gold?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Is buying gold a good option for retirement planning?

Although buying gold as an investment might not sound appealing at first, when you look at the average annual gold consumption worldwide, it is worth looking into.

The best form of investing is physical bullion, which is the most widely used. But there are many other options for investing in gold. You should research all options thoroughly before making a decision on which option you prefer.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you require cash flow, gold stocks can work well.

ETFs are an exchange-traded investment that allows you to gain exposure to the market for gold. You hold gold-related securities and not actual gold. These ETFs often include stocks of gold miners, precious metals refiners, and commodity trading companies.

What is the best precious-metal to invest?

This question depends on how risky you are willing to take, and what return you want. While gold is considered a safe investment option, it can also be a risky choice. Gold may not be right for you if you want quick profits. If patience and time are your priorities, silver is the best investment.

Gold is the best investment if you aren't looking to get rich quick. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Lawful – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

bbb.org

investopedia.com

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was accepted worldwide and became popular due to its durability, purity, divisibility, uniformity, scarcity, and beauty. It was also traded internationally due to its high value. Different weights and measurements existed around the world, however, because there were not international standards to measure gold. For example, in England, one pound sterling was equal to 24 carats of silver; in France, one livre tournois was equal to 25 carats of gold; in Germany, one mark was equal to 28 carats of gold; etc.

The United States started issuing American coins in the 1860s made of 90% copper and 10% zinc. This led to a decrease of demand for foreign currencies which in turn caused their prices to rise. This was when the United States started minting large quantities of gold coins. The result? Gold prices began to fall. The U.S. government needed to find a solution to their debt because there was too much money in circulation. To do this, they decided that some of their excess gold would be sold back to Europe.

Because most European countries did not trust the U.S. dollar, they started accepting gold as payment. However, many European nations stopped using gold to pay after World War I and started using paper currency instead. The price of gold has risen significantly since then. Even though the price fluctuates, gold is still one of best investments.

—————————————————————————————————————————————————————————————–

By: Kevin Helms

Title: Rich Dad Poor Dad Author Robert Kiyosaki Recommends Bitcoin ETFs for Investment

Sourced From: news.bitcoin.com/rich-dad-poor-dad-author-robert-kiyosaki-recommends-buying-bitcoin-etfs/

Published Date: Thu, 30 Nov 2023 02:30:00 +0000

Did you miss our previous article…

https://altcoinirareview.com/cardanos-charles-hoskinson-clashes-with-blockstreams-adam-back-over-crypto-security-classification/

Related posts:

Robert Kiyosaki’s Advice: Why You Should Invest in Bitcoin Now

Robert Kiyosaki’s Advice: Why You Should Invest in Bitcoin Now

Robert Kiyosaki Reveals Why He Continues to Invest in Bitcoin

Robert Kiyosaki Reveals Why He Continues to Invest in Bitcoin

Robert Kiyosaki Urges Investors to Get Into Crypto Now, Before Biggest Economic Crash in World History

Robert Kiyosaki Urges Investors to Get Into Crypto Now, Before Biggest Economic Crash in World History

Bitcoin Primed for $135,000 and Gold for Takeoff, According to Robert Kiyosaki

Bitcoin Primed for $135,000 and Gold for Takeoff, According to Robert Kiyosaki