As the launch of Hong Kong’s Bitcoin ETF draws near, surprising applications have emerged from some of the largest traditional asset managers in Mainland China.

Interest from Mainland China

Hong Kong’s upcoming ETF has been in development for months and has garnered significant attention in the global digital asset space. Unlike the traditional Bitcoin spot ETF model popular in the United States, Hong Kong's in-kind generation model offers a unique approach. Moreover, it serves as a crucial stepping stone for ETF acceptance in East Asia. The approved Hong Kong futures ETF surpassed $100 million in assets under management (AUM) in February, outperforming spot ETFs in other countries. Given the region's substantial capital investment and strong international financial connections, Hong Kong is poised to become a pioneering testing ground in this market.

Entry of Mainland Players

By late March 2024, several Hong Kong-based capital firms had shown interest in launching their ETFs, with a few submitting formal applications. However, a significant shift occurred on April 8th when prominent players from Mainland China entered the fray. Harvest Fund and Southern Fund, both managing over $200 billion in AUM, submitted applications through their HK-based subsidiaries. Additionally, reports indicated that China Asset Management, with $270 billion in AUM, formed a partnership with existing Bitcoin ETF providers in Hong Kong through its subsidiary.

Regulatory Dynamics

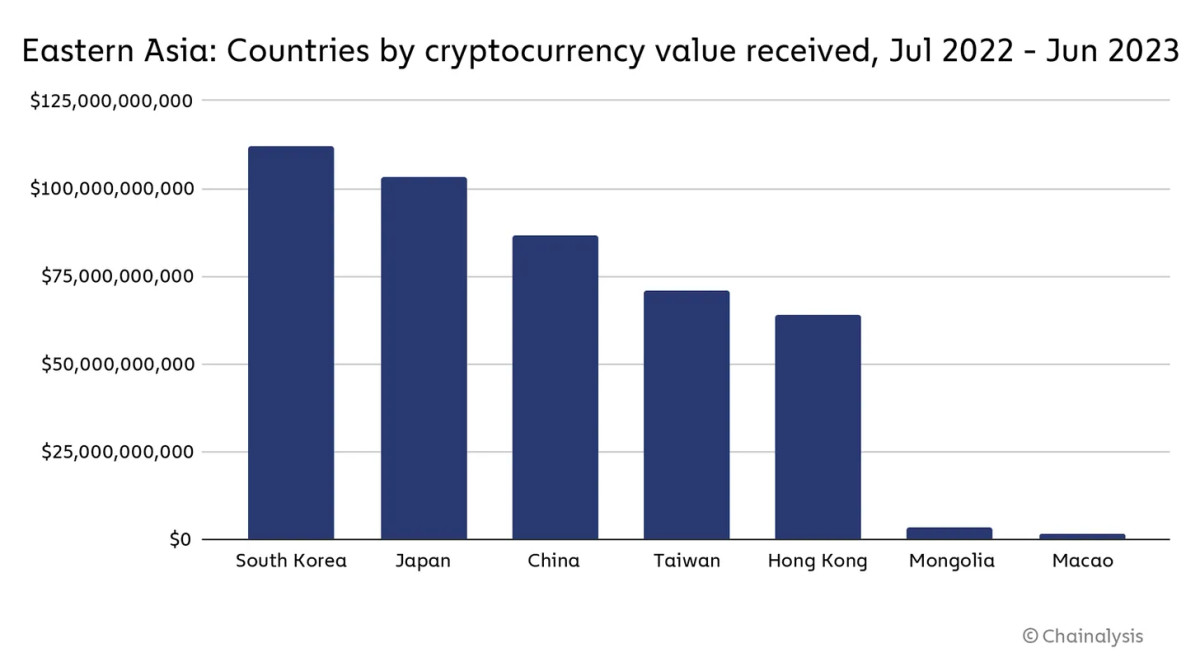

While the US ETF market shows signs of waning hype, the participation of these multibillion-dollar Mainland firms injects fresh momentum. Despite US giants like BlackRock and Fidelity commanding trillions in AUM, the entry of these Chinese firms is significant. However, questions arise regarding the interaction between Mainland firms and Hong Kong's financial regulations, especially considering China's restrictive stance on Bitcoin. Despite mainstream portrayals of a blanket ban, reports of substantial Bitcoin transactions in China challenge this narrative.

Changing Attitudes

Despite China's tightening regulations on Bitcoin, the market remains active through innovative methods. The recent interest from major Chinese asset managers in Hong Kong's Bitcoin ETF project signals a shift in perception. This move not only provides these firms with exposure to Bitcoin but also aligns them with a market of considerable trade volumes and global interest. Such developments could potentially reshape views on Bitcoin's role in China and pave the way for broader acceptance.

Regional Crypto Hub Aspirations

Hong Kong's commitment to becoming a regional crypto hub is evident through growing acceptance in the digital asset space. Initiatives like HashKey Global's expansion into Bermuda underscore the city's ambitions. With plans to rival US-based crypto exchanges, Hong Kong-based firms are positioning themselves for substantial growth. Chinese citizens abroad are key targets for these initiatives, showcasing a broader reach for the region.

Future Implications

The upcoming Bitcoin ETF in Hong Kong holds immense promise for the global financial landscape. The participation of Mainland Chinese firms and Hong Kong's ambitious crypto initiatives signal a potential shift in the industry. As developments unfold, the impact of these changes is likely to resonate across markets. With a bullish outlook on Bitcoin, the stage is set for transformative opportunities in the near future.

Frequently Asked Questions

Is gold a good investment IRA?

Anyone who is looking to save money can make gold an excellent investment. It's also a great way to diversify your portfolio. There's more to gold that meets the eye.

It has been used throughout history as currency and it is still a very popular method of payment. It is often called “the most ancient currency in the universe.”

But gold is mined from the earth, unlike paper currencies that governments create. It's hard to find and very rare, making it extremely valuable.

The supply and demand factors determine how much gold is worth. The economy that is strong tends to be more affluent, which means there are less gold miners. The value of gold rises as a consequence.

The flip side is that people tend to save money when the economy slows. This leads to more gold being produced which decreases its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you invest in gold, you'll benefit whenever the economy grows.

Additionally, you'll earn interest on your investments which will help you grow your wealth. In addition, you won’t lose any money if gold falls in value.

Can I buy gold using my self-directed IRA

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contract are financial instruments that depend on the gold price. They let you speculate on future price without having to own the metal. But physical bullion refers to real gold and silver bars you can carry in your hand.

Can I have a gold ETF in a Roth IRA

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

A traditional IRA allows contributions from both employee and employer. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

An Individual Retirement Annuity (IRA) is also available. An IRA allows for you to make regular income payments during your life. Contributions to IRAs do not have to be taxable

How do I Withdraw from an IRA with Precious Metals?

You first need to decide if you want to withdraw money from an IRA account. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, determine how much money you plan to withdraw from your IRA. This calculation is dependent on several factors like your age when you take the money out, how long you have had the account, and whether or not your plan to continue contributing.

Once you have an idea of the amount of your total savings you wish to convert into cash you will need to decide what type of IRA you want. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

Once you have completed these calculations, you need to open your brokerage account. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When it's time to make withdrawals from your precious-metal IRA, you'll need a place to keep your coins safe. Some storage areas will accept bullion, while others require you to purchase individual coins. Before you choose one, weigh the pros and cons.

Because you don't have to store individual coins, bullion bars take up less space than other items. You will need to count each coin individually. However, individual coins can be stored to make it easy to track their value.

Some prefer to store their coins in a vault. Others prefer to store their coins in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement accounts

finance.yahoo.com

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not legal – WSJ

How To

The best place to buy silver or gold online

You must first understand the workings of gold before you can purchase it. The precious metal gold is similar to platinum. Because of its resistance to corrosion and durability, it is very rare. It is very difficult to use and most people prefer to purchase jewelry made of it over actual bars of Gold.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They aren’t exchangeable in any currency exchange. A person can buy 100 grams of gold for $100. Each dollar spent earns the buyer 1 gram gold.

Next, you need to find out where to buy gold. There are many options for buying gold directly from dealers. First, your local currency shop is a good place to start. Another option is to go through a reputable site like eBay. Finally, you can look into purchasing gold through private sellers online.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. Private sellers charge a 10% to 15% commission per transaction. A private seller will usually return less money than a coin shop and eBay. This option is often a great one for investors in gold, as it gives you greater control over the item's value.

An alternative option to buying gold is to buy physical gold. It is easier to store physical gold than paper certificates. But, you still have to take care of it. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

When buying gold on your own, you can visit a bank or a pawnshop. A bank can offer you a loan for the amount that you need to buy gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks charge higher interest rates than those offered by pawn shops.

A third way to buy gold? Simply ask someone else! Selling gold can also be done easily. It is easy to sell gold by contacting a company like GoldMoney.com. You can create a simple account immediately and begin receiving payments.

—————————————————————————————————————————————————————————————–

By: Landon Manning

Title: Chinese Financial Institutions Embrace Hong Kong’s New Bitcoin ETF

Sourced From: bitcoinmagazine.com/markets/chinese-financial-institutions-turn-to-hong-kongs-new-bitcoin-etf-

Published Date: Thu, 11 Apr 2024 14:00:00 GMT