China's special administrative area of Hong Kong will test a digital version its dollar in the early part of this year. This is to prepare for eventual rollout. It is working to catch up to those who have already launched digital currency central banks, such as the People's Republic's digital yuan initiative.

For Q4, trials of digital Hong Kong dollar are planned

In the remaining months of this year, Hong Kong will begin to test a currency called e-HKD. This digital version of the Hong Kong dollars, is being tested in Hong Kong. According to the Hong Kong Monetary Authority, (HKMA), the trials will be made easier by the adoption and construction of the necessary infrastructure.

After consultations to collect feedback on possible demand, privacy aspects and other issues around the issuance central bank digital currencies (CBDC), the pilot phase is now in place. Howard Lee, deputy chief executives of the HKMA (which plays the role of a bank), elaborated:

eHKD might not be used in an immediate context, but the HKMA will continue to pave the way for eHKD implementation, taking into consideration the results of our study, market consultation, and international development feedback.

A high-ranking official noted that CBDCs are being explored by many jurisdictions. The consultations were held by the banking authority. Participants expressed concern that Hong Kong is behind the international trend and need to catch up.

Selected banks, payment service providers, and tech companies will participate in the trials. Lee explained that these entities will test the use of the digital currency by their employees and clients. Lee explained that the e-HKD was introduced to give customers more options. He stressed that the move would not impact Hong Kong's three note-issuing bank branches.

HKMA will Set a Timeline for eHKD Launch after Tests

Colin Pou, executive director of financial infrastructure at HKMA, stated that the Hong Kong Monetary Authority (HKMA) will determine the timeline for launching e-HKD after the pilot phase. In June 2021, the regulator announced the CBDC plan as part of Fintech 2025. The white paper was published in October, and consultations closed in May.

Hundreds of central banks have studied digital currencies around the globe and taken steps to create theirs. People's Bank of China has been running pilot programs in a variety of cities for its digital yuan, (e-CNY), and recently announced that the pilot area will be expanded to four more provinces.

Howard Lee, an earlier this month, revealed that Hong Kong also has conducted small-scale tests using the e-CNY in this year's Hong Kong. The region's financial authorities announced last summer that they would link the digital Yuan to their domestic payments system. The HKMA has been working closely with the PBOC and other central banks in Thailand and the United Arab Emirates to facilitate cross-border CBDC payments.

Are you optimistic that Hong Kong will catch up to mainland China with its digital currency project. Please leave your comments below.

Frequently Asked Questions

Who holds the gold in a gold IRA?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

Consult a financial advisor or accountant to determine your options.

How much of your IRA should include precious metals?

It is important to remember that precious metals can be a good investment for anyone. You don’t need to have a lot of money to invest. There are many methods to make money off of silver and gold investments.

You might consider purchasing physical coins, such as bullion bars and rounds. You could also buy shares in companies that produce precious metals. Your retirement plan provider may offer an IRA rollingover program.

You can still get benefits from precious metals regardless of what choice you make. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

Their prices are more volatile than traditional investments. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

What's the advantage of a Gold IRA?

There are many advantages to a gold IRA. It's an investment vehicle that allows you to diversify your portfolio. You control how much money goes into each account and when it's withdrawn.

You also have the option to transfer funds from other retirement plans into a IRA. This allows you to easily transition if your retirement is early.

The best thing is that investing in gold IRAs doesn't require any special skills. They're readily available at almost all banks and brokerage firms. Withdrawals can happen automatically, without any fees or penalties.

But there are downsides. Gold is known for being volatile in the past. So it's essential to understand why you're investing in gold. Are you seeking safety or growth? Is it for insurance purposes or a long-term strategy? Only when you are clear about the facts will you be able take an informed decision.

If you are planning to keep your Gold IRA indefinitely you will want to purchase more than one ounce. You won't need to buy more than one ounce of gold to cover all your needs. You may need several ounces, depending on what you intend to do with your precious gold.

You don't need to have a lot of gold if you are selling it. You can even manage with one ounce. But, those funds will not allow you to buy anything.

Is it a good idea to open a Precious Metal IRA

It is essential to be aware of the fact that precious metals do not have insurance coverage before opening an IRA. If you lose money in your investment, nothing can be done to recover it. This includes investments that have been damaged by fire, flooding, theft, and so on.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items can be lost because they have real value and have been around for thousands years. You would probably get more if you sold them today than you paid when they were first created.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. You should also consider using a third party custodian to protect your assets and give you access at any time.

When you open an account, keep in mind that you won't receive any returns until your retirement. Do not forget about the future!

Is it possible to hold a gold ETF within a Roth IRA

You may not have this option with a 401(k), however, you might want to consider other options, like an Individual retirement account (IRA).

A traditional IRA allows for contributions from both employer and employee. You can also invest in publicly traded businesses by creating an Employee Stock Ownership Plan (ESOP).

An ESOP can provide tax advantages, as employees are allowed to share in company stock and the profits generated by the business. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

An Individual Retirement Annuity (IRA) is also available. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs do not have to be taxable

What are the pros and cons of a gold IRA?

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. An IRA is a great way to save money and not have to pay taxes on the interest you earn. There are some disadvantages to this investment.

You could lose all of your accumulated money if you take out too much from your IRA. You may also be prohibited by the IRS from making withdrawals from an IRA after you turn 59 1/2. If you do withdraw funds, you'll need to pay a penalty.

The downside is that managing your IRA requires fees. Most banks charge 0.5% to 2.0% per annum. Other providers charge monthly management fees ranging from $10 to $50.

You can purchase insurance if you want to keep your money out of a bank. Insurance companies will usually require that you have at least $500,000. You might be required to buy insurance that covers losses up to $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. Some providers limit the number of ounces of gold that you can own. Others let you choose your weight.

It's also important to decide whether or not to buy gold futures contracts. Physical gold is more expensive than gold futures contracts. Futures contracts provide flexibility for purchasing gold. Futures contracts allow you to create a contract with a specified expiration date.

You'll also need to decide what kind of insurance coverage you want. The standard policy does not include theft protection or loss caused by fire, flood, earthquake. However, it does cover damage caused by natural disasters. If you live in a high-risk area, you may want to add additional coverage.

You should also consider the cost of storage for your gold. Insurance doesn't cover storage costs. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

To open a IRA in gold, you will need to first speak with a qualified custodian. A custodian maintains track of all your investments and ensures you are in compliance with federal regulations. Custodians aren't allowed to sell your assets. Instead, they must retain them for as long and as you require.

Once you've chosen the best type of IRA for you, you need to fill in paperwork describing your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. It is also important to specify how much money you will invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. After receiving your application, the company will review it and mail you a confirmation letter.

Consider consulting a financial advisor when opening a golden IRA. Financial planners are experts at investing and can help you determine which type of IRA is best for you. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

Statistics

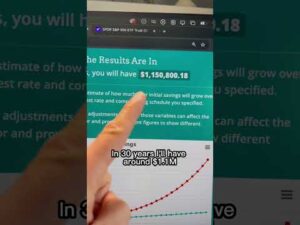

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement plans

cftc.gov

irs.gov

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

How to hold physical gold in an IRA

The easiest way to invest is to buy shares in companies that make gold. This method is not without risks. There's no guarantee these companies will survive. Even if they do survive, there is still the possibility of losing money to fluctuating gold prices.

The alternative is to buy physical gold. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. This option offers the advantages of being able to purchase gold at low prices and easy access (you don’t need to deal directly with stock exchanges). It's also easy to see how many gold you have. The receipt will show exactly what you paid. You'll also know if taxes were not paid. You also have a lower chance of theft than stocks.

However, there are some disadvantages too. Bank interest rates and investment funds won't help you. You can't diversify your holdings, and you are stuck with the items you have bought. Finally, tax man may want to ask where you put your gold.

BullionVault.com has more information about how to buy gold in an IRA.

—————————————————————————————————————————————————————————————–

By: Lubomir Tassev

Title: Hong Kong to Start Testing Digital Currency in Coming Months

Sourced From: news.bitcoin.com/hong-kong-to-start-testing-digital-currency-in-coming-months/

Published Date: Thu, 22 Sep 2022 08:30:12 +0000

Did you miss our previous article…

https://altcoinirareview.com/argentine-airline-flybondi-to-adopt-nft-technology-for-ticket-issuance/