Introduction

Renowned economist Harry Dent has recently issued a dire prediction for the global economy, stating that 2024 will be the year of the most significant financial crash in living memory. Dent's analysis, which takes into account overvalued markets, excessive stimulus spending, and artificial inflation of asset prices, paints a grim picture of the near future. With Dent's reputation for contrarian yet often accurate forecasts, his warnings carry weight in financial circles.

The Current Economic Situation

Harry Dent, known for his unconventional yet insightful market analyses, has stated in an interview with Fox News that the current economic situation is "100% artificial." He attributes this to unprecedented levels of money printing and deficit spending, which have amounted to $27 trillion over the past 15 years. According to Dent, this artificial inflation sets the stage for a dangerous and inevitable downturn.

Complex Economic Landscape

As we approach 2024, the U.S. economy displays a juxtaposition of growth and uncertainty. While there are concerns about rising unemployment rates due to the Federal Reserve's persistent interest rate hikes, expert forecasts for 2024 range from continued expansion to potential recession.

The "Everything Bubble"

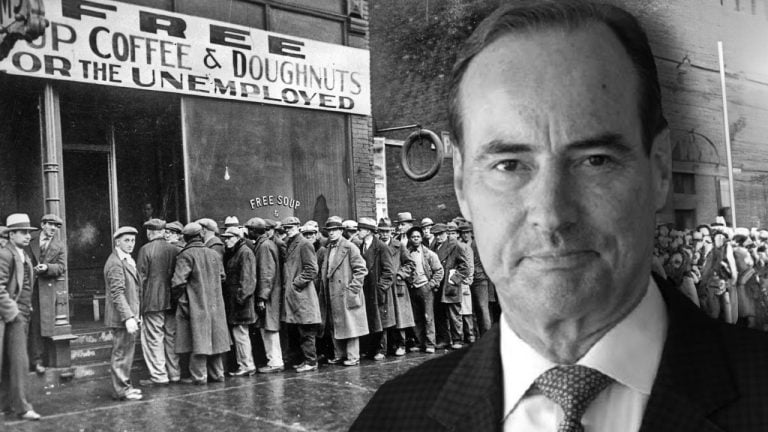

Dent's argument revolves around what he calls the "everything bubble," a phenomenon he believes began in late 2021, post-COVID-19 pandemic. Unlike previous market bubbles, which were typically confined to certain sectors, Dent argues that this bubble encompasses nearly all asset classes, making its potential burst far more devastating. He points to the real estate and stock markets as prime examples of this overvaluation. Dent warns against complacency, emphasizing that the impending crash will not be a mere correction but a catastrophic fall similar to the Great Depression.

Predictions

Dent predicts an 86% crash in the S&P and a 92% crash in the Nasdaq, with even greater losses in the crypto economy. He believes that the rich will be significantly affected, losing 50% to 80% of their lifetime accumulated net worth. The average person, on the other hand, may lose their job for six months to two years. Dent also anticipates a subsequent boom led by the millennial generation, which will last until around 2037.

Criticism of Market Rally

Challenging the optimistic outlook of many investors and analysts, Dent criticizes the recent market rally, including the record highs of the Dow Jones Industrial Average. He views these as temporary and misleading, advising investors to prepare for the impending financial storm.

The Federal Reserve's Role

Dent argues that the Federal Reserve's recent hints at ending its campaign against inflation and the possibility of rate cuts will not prevent the looming crisis. He believes that these efforts are too little too late and predicts a shift from disinflation to deflation, a scenario not seen since the 1930s.

Potential Economic Slowdown

A significant concern raised by Dent is the potential for a protracted economic slowdown following the burst of the "everything bubble." He cautions that this could last for 12 to 14 years, exacerbating the wealth gap in America. However, Dent concludes with a somewhat optimistic note, predicting a recovery led by the millennial generation in the long term.

Conclusion

Harry Dent's prediction concerning the 2024 financial crash has sparked significant debate. It is essential for individuals and investors to carefully consider these forecasts and their potential implications. Share your thoughts and opinions about Dent's prediction in the comments section below.

Frequently Asked Questions

Should You Buy Gold?

Gold was considered a safety net for investors during times of economic turmoil in the past. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Some experts believe that this could change very soon. According to them, gold prices could soar if there is another financial crisis.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- First, consider whether or not you need the money you're saving for retirement. You can save for retirement and not invest your savings in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, ensure you fully understand the risks involved in buying gold. Each offers varying levels of flexibility and security.

- Remember that gold is not as safe as a bank account. You may lose your gold coins and never be able to recover them.

So, if you're thinking about buying gold, make sure you do your research first. If you already have gold, make sure you protect it.

How much of your IRA should include precious metals?

It is important to remember that precious metals can be a good investment for anyone. They don't require you to be wealthy to invest in them. You can actually make money without spending a lot on gold or silver investments.

You might think about buying physical coins such a bullion bar or round. It is possible to also purchase shares in companies that make precious metals. Or, you might want to take advantage of an IRA rollover program offered by your retirement plan provider.

You'll still get the benefit of precious metals no matter which country you live in. They are not stocks but offer long-term growth.

Their prices are more volatile than traditional investments. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

Is buying gold a good option for retirement planning?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

Physical bullion bars are the most popular way to invest in gold. You can also invest in gold in other ways. Research all options carefully and make an informed decision about what you desire from your investments.

If you don’t need a safe place for your wealth, then buying shares of mining companies or companies that extract it might be a better alternative. If you need cash flow from an investment, purchasing gold stocks is a good choice.

You can also invest your money in exchange-traded fund (ETFs), which give you exposure to the gold price by holding securities related to gold. These ETFs can include stocks of precious metals refiners and gold miners.

What is the tax on gold in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. You don't pay taxes when you buy gold. It's not considered income. If you sell it later you will have a taxable profit if the price goes down.

You can use gold as collateral to secure loans. When you borrow against your assets, lenders try to find the highest return possible. For gold, this means selling it. There's no guarantee that the lender will do this. They may just keep it. They might decide that they want to resell it. The bottom line is that you could lose potential profit in any case.

If you plan on using your gold as collateral, then you shouldn't lend against it. You should leave it alone if you don't intend to lend against it.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement plans

bbb.org

investopedia.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The best way to buy gold (or silver) online

Understanding how gold works is essential before you buy it. It is a precious metal that is very similar to platinum. It is rare and used as money due to its durability and resistance against corrosion. It is very difficult to use and most people prefer to purchase jewelry made of it over actual bars of Gold.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coins can only be used as investment currency. They increase in value due to inflation.

They aren't circulated in any currency exchange systems. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. For every dollar spent, the buyer gets 1 gram of Gold.

You should also know where to buy your gold. There are several options available if your goal is to purchase gold from a dealer. First off, you can go through your local coin shop. You can also go to a reputable website such as eBay. You might also consider buying gold from an online private seller.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. Private sellers typically charge 10% to 15% commission on each transaction. Private sellers will typically get you less than a coin shop, eBay or other online retailers. This option is often a great one for investors in gold, as it gives you greater control over the item's value.

An alternative option to buying gold is to buy physical gold. While physical gold is easier than paper certificates to store, you still need to make sure it is safe. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank can provide you with a loan to cover the amount you wish to invest in gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks tend to charge higher interest rates, while pawnshops are typically lower.

You can also ask for help to purchase gold. Selling gold can be as easy as selling. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: Renowned Economist Harry Dent Predicts Major Financial Crash in 2024

Sourced From: news.bitcoin.com/economist-harry-dents-grim-prediction-2024-market-crash-to-eclipse-great-depression/

Published Date: Thu, 21 Dec 2023 20:00:10 +0000

Did you miss our previous article…

https://altcoinirareview.com/the-importance-of-geographic-location-in-bitcoin-mining/

Related posts:

Robert Kiyosaki Urges Investors to Get Into Crypto Now, Before Biggest Economic Crash in World History

Robert Kiyosaki Urges Investors to Get Into Crypto Now, Before Biggest Economic Crash in World History

The Biggest Crash in History May Be Starting, Warns Rich Dad Poor Dad Author

The Biggest Crash in History May Be Starting, Warns Rich Dad Poor Dad Author

8 Best Precious Metals IRA Companies in 2022 [Definitive Guide]

8 Best Precious Metals IRA Companies in 2022 [Definitive Guide]

7 Best Gold IRA Companies 2023 (Ranked by customer reviews)

7 Best Gold IRA Companies 2023 (Ranked by customer reviews)