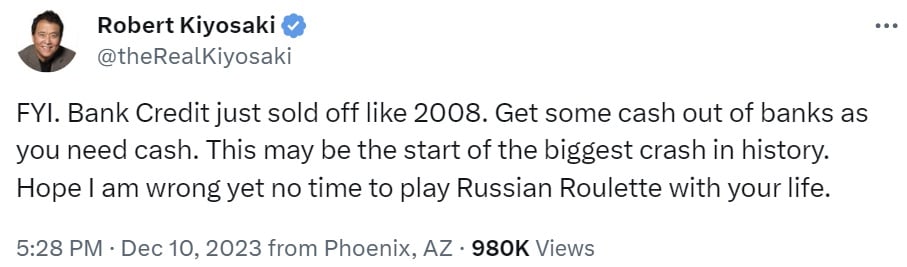

Robert Kiyosaki Doubles Down on Crash Warning

Robert Kiyosaki, the author of the best-selling book Rich Dad Poor Dad, has issued a stark warning about the possibility of the biggest crash in history. He highlights the bankruptcy of the U.S. banking system and predicts that the S&P 500 will soon collapse, resulting in significant losses for millions of U.S. retirement plans. Kiyosaki emphasizes that there is no time to take risks with one's financial future.

Rich Dad Poor Dad: A Global Sensation

Rich Dad Poor Dad, co-authored by Robert Kiyosaki and Sharon Lechter, has achieved remarkable success since its publication in 1997. The book has spent over six years on the New York Times Best Seller List and has sold more than 32 million copies worldwide. Translated into 51 languages and available in 109 countries, it has become a must-read for those seeking financial education and wealth-building strategies.

Kiyosaki's Recent Warnings

Kiyosaki recently took to social media to express his concerns. He cited the sell-off of bank credit, similar to that seen in 2008, as a potential signal of the impending crash. He urges individuals not to underestimate the gravity of the situation and not to gamble with their financial well-being.

Furthermore, Kiyosaki mentioned his previous recommendation to invest in silver, which he made as early as 2010. Despite facing ridicule, he stands by his advice and encourages people to consider alternative investments, such as gold, silver, and bitcoin, due to the current state of the banking system.

Learn from History

Reflecting on his past predictions, Kiyosaki reminds readers of his accurate forecasts in Rich Dad Poor Dad. He stated that "savers are losers" and that "your home is not an asset" in the 1997 edition, both of which proved true during the 2008 financial crisis. Despite the skepticism he faced at the time, Kiyosaki believes that history may repeat itself and encourages individuals to be prepared for potential market turbulence.

Next Warning: The S&P 500

Kiyosaki's ongoing warnings include his prediction that the S&P 500 will be the next casualty, resulting in substantial losses for 401(k)s and IRAs. He advises investors to remain vigilant and to prioritize safeguarding their retirement plans in the face of potential market volatility.

Continued Concerns and Caution

This is not the first time Kiyosaki has expressed concerns about an impending crash. He has previously discussed the possibility of a depression, a significant market collapse, and challenging times ahead. In addition, he has advocated for investing in bitcoin as a protective measure against economic uncertainty.

What are your thoughts on Robert Kiyosaki's warnings? Share your opinions in the comments below.

Frequently Asked Questions

Can I keep physical gold in an IRA?

Not just paper money or coins, gold is money. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

One reason is that gold historically performs better than other assets during financial panics. The S&P 500 dropped 21 percent in the same time period, while gold prices rose by nearly 100 percent between August 2011-early 2013. During these turbulent market times, gold was among few assets that outperformed the stocks.

Another benefit to investing in gold? It has virtually zero counterparty exposure. If your stock portfolio goes down, you still own your shares. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold provides liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. The liquidity of gold makes it a good investment. This allows for you to benefit from the short-term fluctuations of the gold market.

What is the Performance of Gold as an Investment?

Supply and demand determine the gold price. It is also affected by interest rates.

Gold prices are volatile due to their limited supply. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

Who has the gold in a IRA gold?

The IRS considers any individual who holds gold “a form of income” that is subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

A financial planner or accountant should be consulted to discuss your options.

What precious metals could you invest in to retire?

Gold and silver are the best precious metal investments. They are both simple to purchase and sell, and they have been around for a long time. Consider adding them to the list if you're looking to diversify and expand your portfolio.

Gold: The oldest form of currency known to man is gold. It's stable and safe. It's a great way to protect wealth in times of uncertainty.

Silver: Investors have always loved silver. It's a great option for those who want stability. Silver, unlike gold, tends not to go down but up.

Platinium: Another form of precious metal is platinum, which is becoming more popular. It's durable and resists corrosion, just like gold and silver. It is, however, more expensive than its competitors.

Rhodium – Rhodium is used to make catalytic conversions. It is also used in jewelry-making. It is also very affordable in comparison to other types.

Palladium (or Palladium): Palladium can be compared to platinum, but is much more common. It's also less expensive. For these reasons, it's become a favorite among investors looking to add precious metals to their portfolios.

How is gold taxed within an IRA?

The fair value of gold sold to determines the price at which tax is due. You don't pay taxes when you buy gold. It's not considered income. If you sell it after the purchase, you will get a tax-deductible gain if you increase the price.

For loans, gold can be used to collateral. Lenders will seek the highest return on your assets when you borrow against them. This usually involves selling your gold. This is not always possible. They may hold on to it. They may decide to resell it. You lose potential profits in either case.

If you plan on using your gold as collateral, then you shouldn't lend against it. It's better to keep it alone.

How much of your portfolio should be in precious metals?

To answer this question we need to first define precious metals. Precious metals are those elements that have an extremely high value relative to other commodities. This makes them very valuable in terms of trading and investment. Gold is currently the most widely traded precious metal.

There are also many other precious metals such as platinum and silver. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It is also unaffected significantly by inflation and Deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. That said, they do not always move in lockstep with each other. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. This is because investors expect lower interest rates, making bonds less attractive investments.

The opposite effect happens when the economy is strong. Investors prefer safe assets such as Treasury Bonds and demand fewer precious metals. These precious metals are rare and become more costly.

Diversifying across precious metals is a great way to maximize your investment returns. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Lawful – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

bbb.org

How To

How to keep physical gold in an IRA

The easiest way to invest is to buy shares in companies that make gold. However, this method comes with many risks because there's no guarantee that these companies will continue to survive. Even if they do survive, there is still the possibility of losing money to fluctuating gold prices.

Alternative options include buying physical gold. You will need to either open an online or bank account or simply buy gold from a reliable seller. This option has many advantages, including the ease of access (you don’t have to deal with stock markets) and the ability of making purchases at low prices. It's also easier to see how much gold you've got stored. You will receive a receipt detailing exactly what you paid. There's also less chance of theft than investing in stocks.

There are however some disadvantages. There are some disadvantages, such as the inability to take advantage of investment funds and interest rates from banks. You won't have the ability to diversify your holdings; you will be stuck with what you purchased. Finally, tax man may want to ask where you put your gold.

If you'd like to learn more about buying gold in an IRA, visit the website of BullionVault.com today!

—————————————————————————————————————————————————————————————–

By: Kevin Helms

Title: The Biggest Crash in History May Be Starting, Warns Rich Dad Poor Dad Author

Sourced From: news.bitcoin.com/robert-kiyosaki-doubles-down-on-biggest-crash-prediction-no-time-to-play-russian-roulette-with-your-life/

Published Date: Tue, 12 Dec 2023 02:00:08 +0000

Related posts:

Rich Dad Poor Dad Author Robert Kiyosaki Recommends Bitcoin ETFs for Investment

Rich Dad Poor Dad Author Robert Kiyosaki Recommends Bitcoin ETFs for Investment

Robert Kiyosaki Urges Investors to Get Into Crypto Now, Before Biggest Economic Crash in World History

Robert Kiyosaki Urges Investors to Get Into Crypto Now, Before Biggest Economic Crash in World History

Robert Kiyosaki Reveals Why He Continues to Invest in Bitcoin

Robert Kiyosaki Reveals Why He Continues to Invest in Bitcoin

Robert Kiyosaki’s Advice: Why You Should Invest in Bitcoin Now

Robert Kiyosaki’s Advice: Why You Should Invest in Bitcoin Now