Introduction

With the upcoming halvening event in Bitcoin mining, operators are facing a critical challenge. The key to weathering this battle lies in optimizing operations and reducing energy costs. In this article, we will explore the significance of geographic location in determining the profitability of mining operations.

The Role of Energy Cost

While factors like mining revenue, bitcoin price, and network hashrate are important, energy cost plays a crucial role in determining profitability. In the long run, energy cost is the kingmaker. Even older models like the Antminer S9 can remain profitable with affordable energy.

Different Scales of Mining Operators

Mining operators can be categorized based on their power usage:

- Residential: Less than 30 kW, typically home miners with 1 to 10 mining machines

- Commercial: 30 kW – 1 MW, small to medium-sized businesses with 10 to 300 mining machines

- Industrial: More than 1 MW, operations with over 300 mining machines

All three categories share the need for cost-efficient power to maximize profitability.

Jurisdictional Arbitrage and Negotiating Power

While some miners are limited by geographical constraints, others actively explore regions with affordable energy rates through jurisdictional arbitrage. Industrial-scale operators have the advantage of negotiating lower rates through power purchase agreements.

Running the Numbers

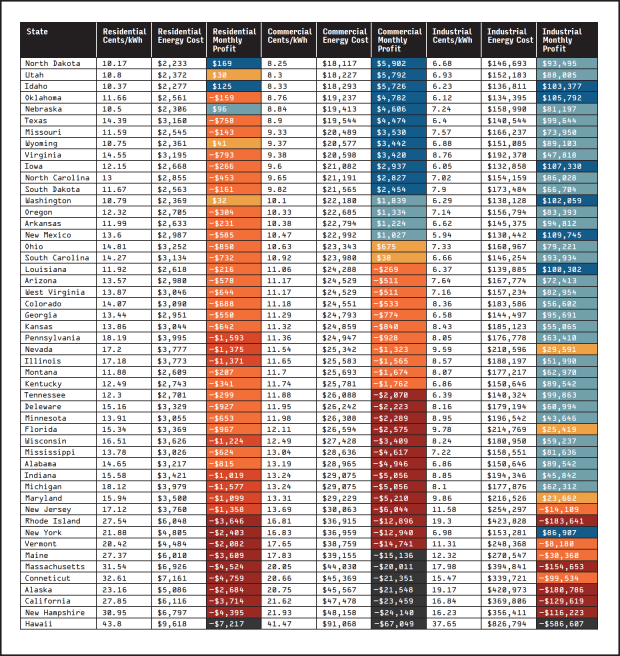

Using simulated data points, let's examine the profitability of mining operations across the U.S. under the following conditions:

- BTC price at $30,000

- Network hashrate at 400EH/s

- Bitmain Antminer S19j Pro 100TH/s at 3kW per unit

- Residential scale: 10 Bitcoin Miners

- Commercial scale: 100 Bitcoin Miners

- Industrial scale: 1000 Bitcoin Miners

- Energy rates at 2023 YTD (EIA)

The results show that mining is unprofitable in most states, especially at residential scale. Commercial rates offer more promise, extending profitability to a greater number of states. Industrial-scale miners have the highest chance of profitability, but challenges still remain in certain states.

The Battle Ahead

Surviving the battle in Bitcoin mining requires operators to find efficiencies and reduce costs. Geographic location emerges as the most critical success factor. For many parts of the country, operating a mining operation may not be feasible. However, opportunities still exist for ambitious miners willing to explore different regions and adapt to changing conditions.

Ultimately, the high ground in this battle will be claimed by those who carefully consider their geographic positioning and make informed decisions based on hash recon. The future of mining lies in the hands of those who can adapt and find success in the ever-evolving landscape of the Bitcoin industry.

Frequently Asked Questions

Should You Open a Precious Metal IRA?

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. If you lose money in your investment, nothing can be done to recover it. This includes all investments that are lost to theft, fire, flood, or other causes.

Protect yourself against this type of loss by investing in physical gold or silver coins. These items have been around thousands of years and are irreplaceable. You would probably get more if you sold them today than you paid when they were first created.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Do not open an account unless you're ready to retire. Keep your eyes open for the future.

What precious metal is best for investing?

This depends on what risk you are willing take and what kind of return you desire. Gold has been traditionally considered a haven investment, but it's not always the most profitable choice. For example, if you need a quick profit, gold may not be for you. If you have the patience to wait, then you might consider investing in silver.

Gold is the best investment if you aren't looking to get rich quick. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

What is the Performance of Gold as an Investment?

The supply and demand for gold affect the price of gold. It is also affected by interest rates.

Due to the limited supply of gold, prices for gold are highly volatile. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

Should You Buy or Sell Gold?

In the past, gold was considered a haven for investors during economic turmoil. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

This could be changing, according to some experts. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

These are some important things to remember if your goal is to invest in gold.

- Before you start saving money for retirement, think about whether you really need it. You can save money for retirement even if you don't invest in gold. The added protection that gold provides when you retire is a good option.

- Second, ensure you fully understand the risks involved in buying gold. Each one offers different levels security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. It is possible to lose your gold coins.

Don't buy gold unless you have done your research. Make sure to protect any gold you already own.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Legal – WSJ

finance.yahoo.com

investopedia.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement account

How To

Guidelines for Gold Roth IRA

It is best to start saving early for retirement. It is best to start saving for retirement as soon you can (typically at age 50). To ensure sufficient growth, it is vital that you contribute enough each year.

You also want to take advantage of tax-free opportunities such as a traditional 401(k), SEP IRA, or SIMPLE IRA. These savings vehicles permit you to make contributions, but not pay any tax until your earnings are withdrawn. This makes them a great choice for people who don’t have access employer matching funds.

It's important to save regularly and over time. You will lose any potential tax advantages if you don't contribute enough.

—————————————————————————————————————————————————————————————–

By: Joe Rodgers

Title: The Importance of Geographic Location in Bitcoin Mining

Sourced From: bitcoinmagazine.com/markets/hash-recon-

Published Date: Thu, 21 Dec 2023 21:00:50 GMT