An erroneous report alleging the U.S. Securities and Exchange Commission's (SEC) approval of Blackrock's Ishares spot bitcoin exchange-traded fund led to the liquidation of short positions worth $78.92 million. This figure constituted 57% of the total $136.29 million in short positions liquidated in the past 24 hours.

False SEC Decision News Causes Turmoil in Bitcoin Market, Wiping Out Millions in Short Positions

On a recent Monday, Cointelegraph, a crypto-centric media platform, erroneously disseminated unverified information via a social media platform and its Telegram channel. The false report caused Bitcoin's (BTC) value to spike by over 10% against the U.S. dollar.

The digital currency momentarily rose to $29,900 per coin, then abruptly fell to $28,100 per unit when the news was proven false. Although Cointelegraph issued a public apology, it was unable to stave off the market turmoil that resulted in the liquidation of $78.92 million worth of short positions.

Coinglass Data Reveals Impact of Fake News on Bitcoin

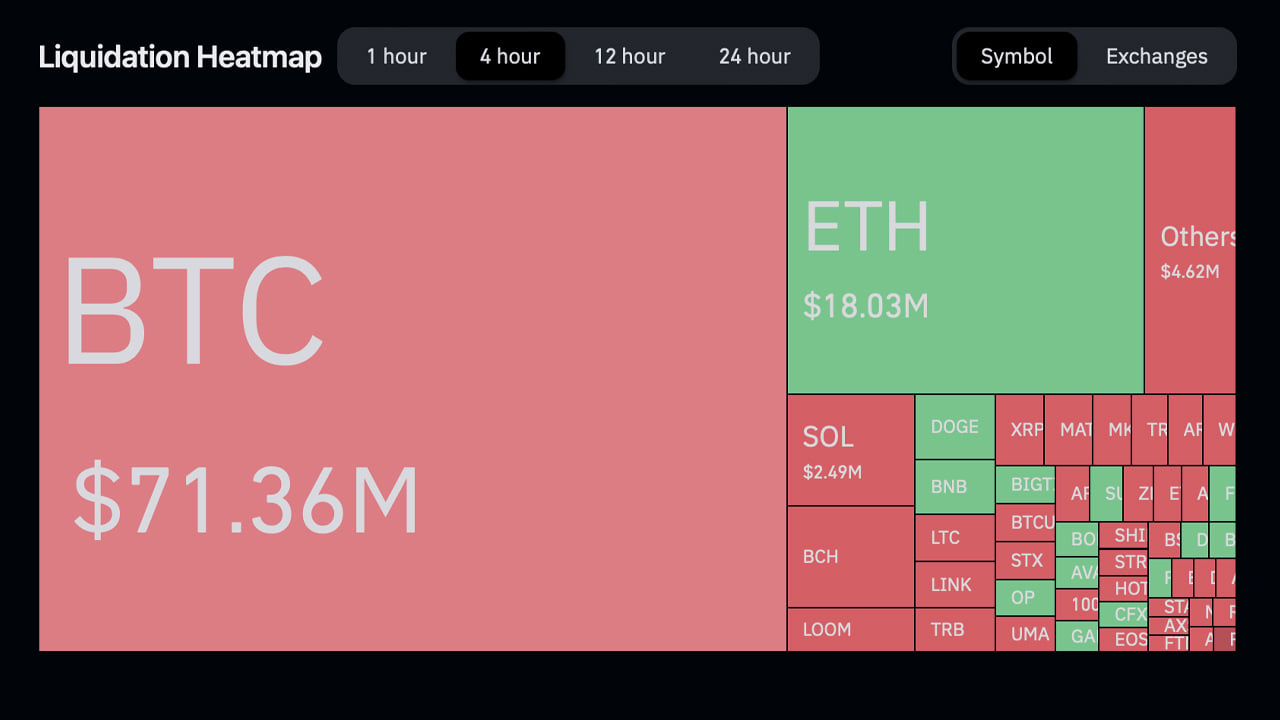

Coinglass data shows that within four hours, $71.36 million of the liquidated shorts were BTC short positions. In addition, around $2.49 million in Solana (SOL) short positions were liquidated among others.

The $78.92 million accounted for an astounding 57% of the total short positions liquidated in the past 24 hours. In the same four-hour period, Ethereum (ETH) long positions amounting to more than $18 million were also liquidated.

False Report Triggered Massive Liquidation; Bitfinex Sees Drastic Drop in Short Positions

Following the revelation of the fake news, Bitfinex saw a significant drop in short positions. Simultaneously, long positions on Bitfinex experienced a surge before the news was debunked, but have since decreased.

The baseless news event resulted in a substantial number of traders facing liquidation, possibly dampening the anticipation surrounding the actual decision. The most significant liquidations occurred with BTC, ETH, XRP, BNB, and SOL.

The Repercussions of False News on Short Traders

What are your thoughts on the short traders who faced liquidation due to the fake news? We invite you to share your views and opinions on this topic below.

Frequently Asked Questions

How do I open a Precious Metal IRA

It is important to decide if you would like an Individual Retirement Account (IRA). Open the account by filling out Form 8606. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. You must complete this form within 60 days of opening your account. Once this has been completed, you can begin investing. You may also choose to contribute directly from your paycheck using payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, the process is identical to an ordinary IRA.

To be eligible for a precious metals IRA, you will need to meet certain requirements. The IRS requires that you are at least 18 years old and have earned an income. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). Contributions must be made on a regular basis. These rules apply regardless of whether you are contributing directly to your paychecks or through your employer.

You can use a precious metals IRA to invest in gold, silver, palladium, platinum, rhodium, or even platinum. You can only purchase bullion in physical form. This means that you will not be allowed to trade shares or bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option is available from some IRA providers.

An IRA is a great way to invest in precious metals. However, there are two important drawbacks. First, they are not as liquid or as easy to sell as stocks and bonds. They are therefore more difficult to sell when necessary. They also don't pay dividends, like stocks and bonds. You'll lose your money over time, rather than making it.

Is gold buying a good retirement option?

Although buying gold as an investment might not sound appealing at first, when you look at the average annual gold consumption worldwide, it is worth looking into.

Physical bullion bar is the best way to invest in precious metals. There are other ways to invest gold. The best thing to do is research all options thoroughly and then make an informed decision based on what you want from your investments.

If you don’t have the funds to invest in safe places, such as a safe deposit box or mining equipment companies, buying shares of these companies might be a better investment. If you require cash flow, gold stocks can work well.

ETFs are an exchange-traded investment that allows you to gain exposure to the market for gold. You hold gold-related securities and not actual gold. These ETFs can include stocks of precious metals refiners and gold miners.

What are the fees associated with an IRA for gold?

The Individual Retirement Account (IRA), fee is $6 per monthly. This includes account maintenance and any investment costs.

Diversifying your portfolio may require you to pay additional fees. The fees you pay will vary depending on the type of IRA that you choose. Some companies offer free checking, but charge monthly fees for IRAs.

A majority of providers also charge annual administration fees. These fees can range from 0% up to 1%. The average rate per year is.25%. However, these rates are typically waived if you use a broker like TD Ameritrade.

Should You Invest in Gold for Retirement?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. Consider investing in both.

In addition to being a safe investment, gold also offers potential returns. Retirement investors will find gold a worthy investment.

While most investments offer fixed rates of return, gold tends to fluctuate. Its value fluctuates over time.

This doesn't mean that you should not invest in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit of gold is that it's a tangible asset. Unlike stocks and bonds, gold is easier to store. It can be easily transported.

You can always access gold as long your place it safe. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

It's also a good idea to have a portion your savings invested in something which isn't losing value. Gold usually rises when stocks fall.

Another advantage to investing in gold is the ability to sell it whenever you wish. As with stocks, your position can be liquidated whenever you require cash. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

Also, don't buy too much at once. Begin by buying a few grams. Then add more as needed.

Don't expect to be rich overnight. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

How much gold should you have in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. A small investment of $5k-10k would be a great option if you are looking to start small. As you grow, it is possible to rent desks or office space. This will allow you to pay rent monthly, and not worry about it all at once. You only pay one month.

It is also important to decide what kind of business you want to run. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. So if you do this kind of thing, you need to consider how much income you expect from each client.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. You might get paid only once every six months.

You need to determine what kind or income you want before you decide how much of it you will need.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

How Much of Your IRA Should Be Made Up Of Precious Metals

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don’t need to have a lot of money to invest. There are many ways to make money on silver and gold investments without spending too much.

You may consider buying physical coins such as bullion bars or rounds. You could also buy shares in companies that produce precious metals. You might also want to use an IRA rollover program offered through your retirement plan provider.

You will still reap the benefits of owning precious metals, regardless of which option you choose. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

And unlike traditional investments, they tend to increase in value over time. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

Is it a good idea to open a Precious Metal IRA

You should be aware that precious metals cannot be covered by insurance. You cannot recover any money you have invested. This includes losing all your investments due to theft, fire, flood, etc.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items are timeless and have a lifetime value. If you were to offer them for sale today, they would likely fetch you more than you paid when you bought them.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Do not open an account unless you're ready to retire. Don't forget the future!

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

investopedia.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

finance.yahoo.com

How To

Gold IRAs: A Growing Trend

As investors seek to diversify their portfolios while protecting themselves from inflation, the trend towards gold IRAs is on the rise.

Gold IRA owners can now invest in physical gold bullion or bars. It is a tax-free investment that can be used to grow wealth and offers an alternative investment option to those who are concerned about stocks or bonds.

Investors can have confidence in their investments and avoid market volatility with a gold IRA. Investors can protect themselves from inflation and other possible problems by using the gold IRA.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

A gold IRA provides many additional benefits. One is the ability for heirs to quickly transfer ownership of gold. Another is the fact that gold is not considered a currency or a commodities by the IRS.

All this means that the gold IRA is becoming increasingly popular among investors seeking a haven during financial uncertainty.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: Unfounded SEC Approval News Triggers $71M Bitcoin Short Positions Liquidation

Sourced From: news.bitcoin.com/wipe-out-fake-sec-approval-report-erases-71m-in-bitcoin-short-positions/

Published Date: Mon, 16 Oct 2023 17:30:18 +0000

Did you miss our previous article…

https://altcoinirareview.com/exposing-the-8-billion-glitch-and-extravagant-expenditures-an-inside-story-from-ftxs-former-engineering-director/