When it comes to Bitcoin, valuing it requires a unique lens due to its diverse nature. Bitcoin isn't just a currency; it's a commodity, a payment network, all rolled into one. This complexity opens the door to various valuation methods that set it apart from traditional assets.

The Evolution of Bitcoin Valuation

The Multifaceted Value of Bitcoin

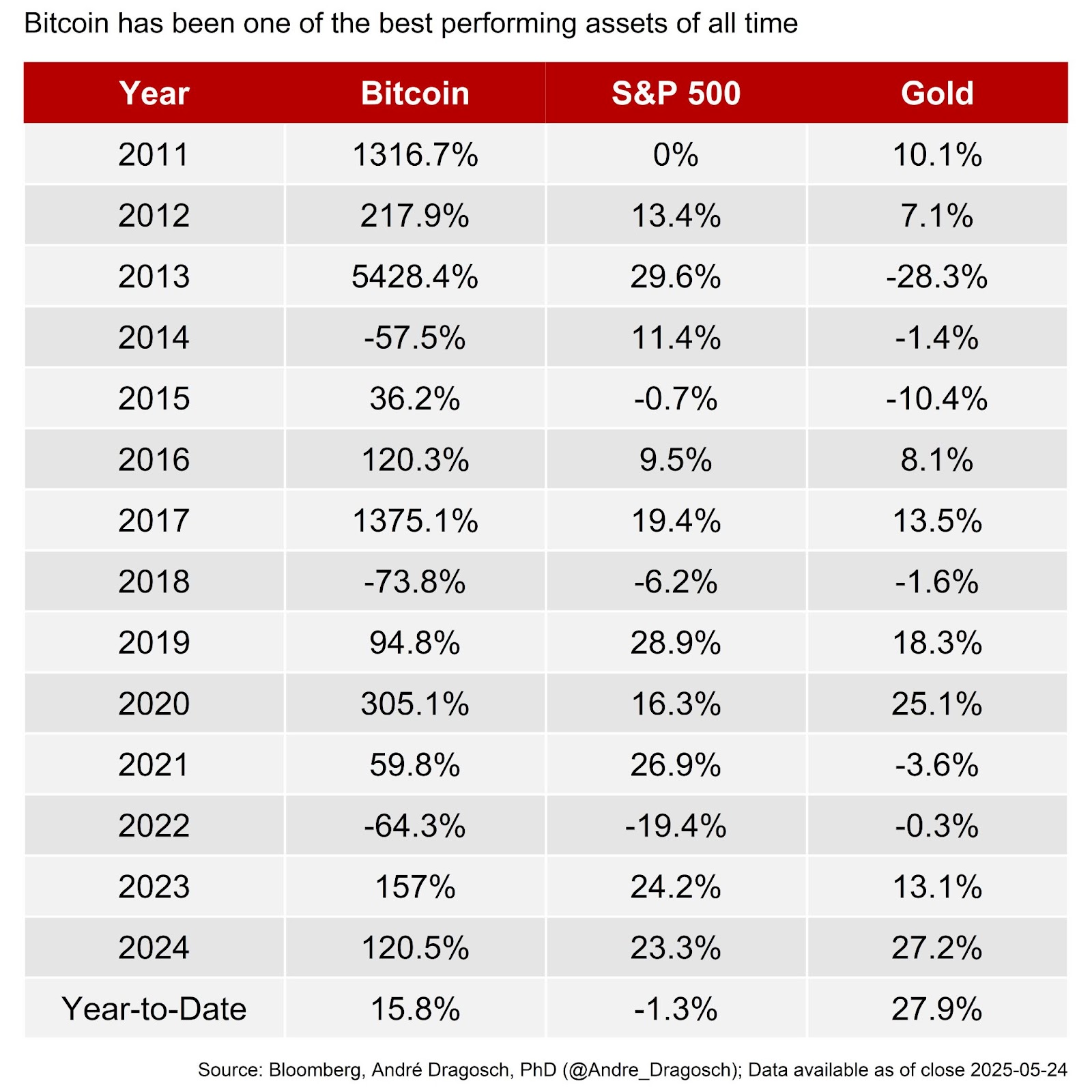

Bitcoin's performance as a "store of value" investment has eclipsed traditional assets like U.S. equities and gold by a significant margin over the past decade. Its potential lies in being a shield against consumer price inflation, which has chipped away at purchasing power since the fiat standard emerged in 1971.

Individuals who embrace Bitcoin as their primary store of value witness their purchasing power flourish over time, setting them apart from their peers. This trend creates a domino effect, nudging others to follow suit to stay relevant—think of it as a digital Schelling Point guiding financial decisions.

Embracing Bitcoin Across Sectors

- Individuals

Bitcoin's allure extends to asset managers seeking to boost portfolio performance without adding undue risk. Integrating Bitcoin into multi-asset portfolios has consistently led to superior returns, outshining even the most renowned hedge funds.

Asset managers who resist this trend risk falling behind, facing mounting pressure from clients and peers who recognize Bitcoin's value-boosting potential.

- Asset Managers

Corporations, like Metaplanet in Japan, have witnessed transformative growth by adopting Bitcoin as a strategic treasury asset. Such moves have not only shielded balance sheets from value erosion but also propelled stock performance to unprecedented heights.

Metaplanet's success story underscores the shift towards leveraging Bitcoin's potential, signaling a new era of corporate financial strategy.

The Ripple Effect of Institutional Bitcoin Adoption

- Corporations

Nations, like El Salvador, embracing Bitcoin as legal tender have reaped economic benefits, evident in enhanced credit ratings and accelerated GDP growth. The shift to a Bitcoin standard has not only bolstered financial resilience but also spurred socio-economic vitality.

Expectations loom large for other nations eyeing Bitcoin adoption to fortify their economic landscape, echoing the success stories of early adopters.

- Sovereigns

The global wave of Bitcoin adoption is underpinned by economic incentives, with sovereign nations eyeing Bitcoin to fortify FX reserves, slash debt default risks, and elevate credit ratings. The strategic embrace of Bitcoin by nations marks a pivotal turn towards financial stability and growth.

Social Dynamics Driving Bitcoin Adoption

Accelerators of Bitcoin Adoption

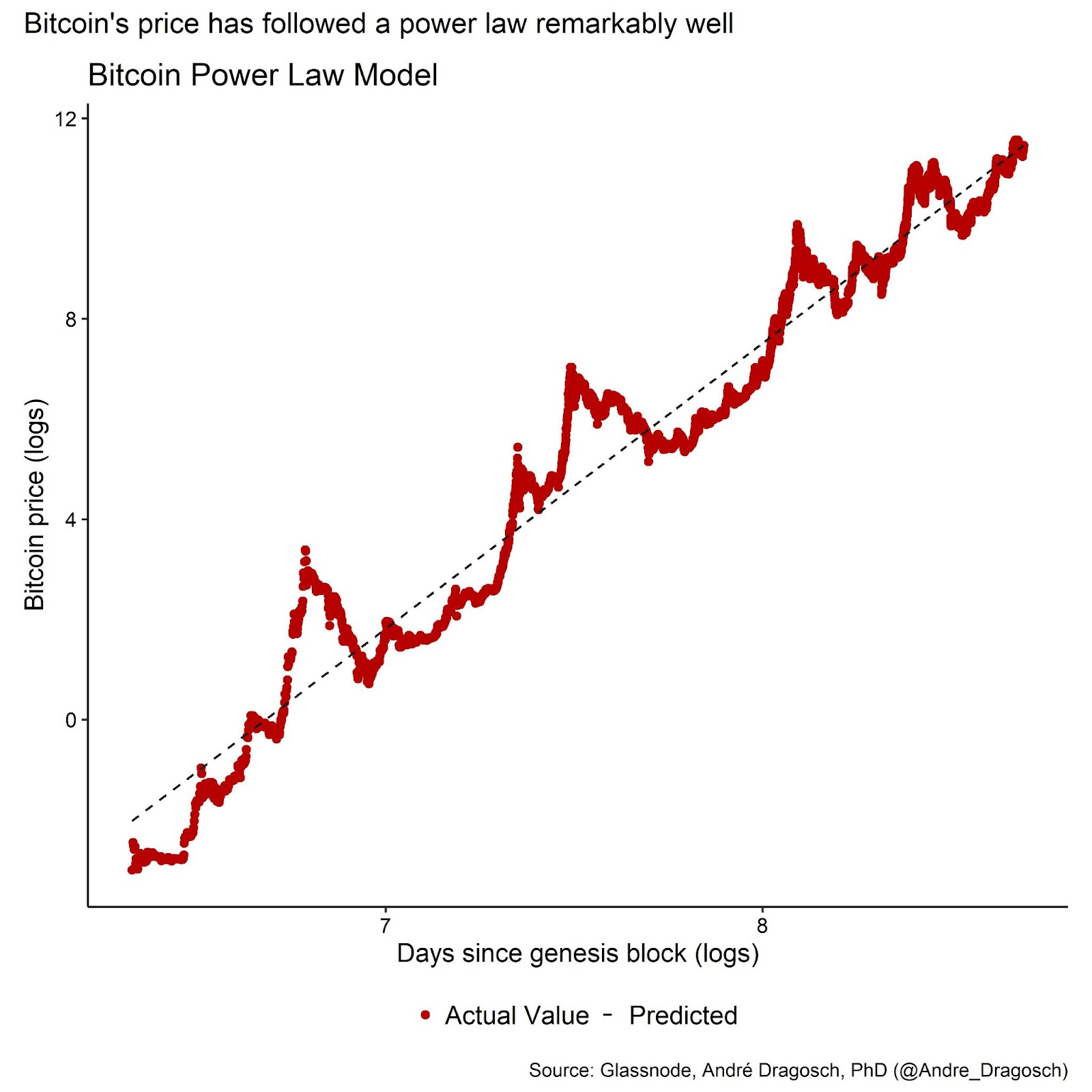

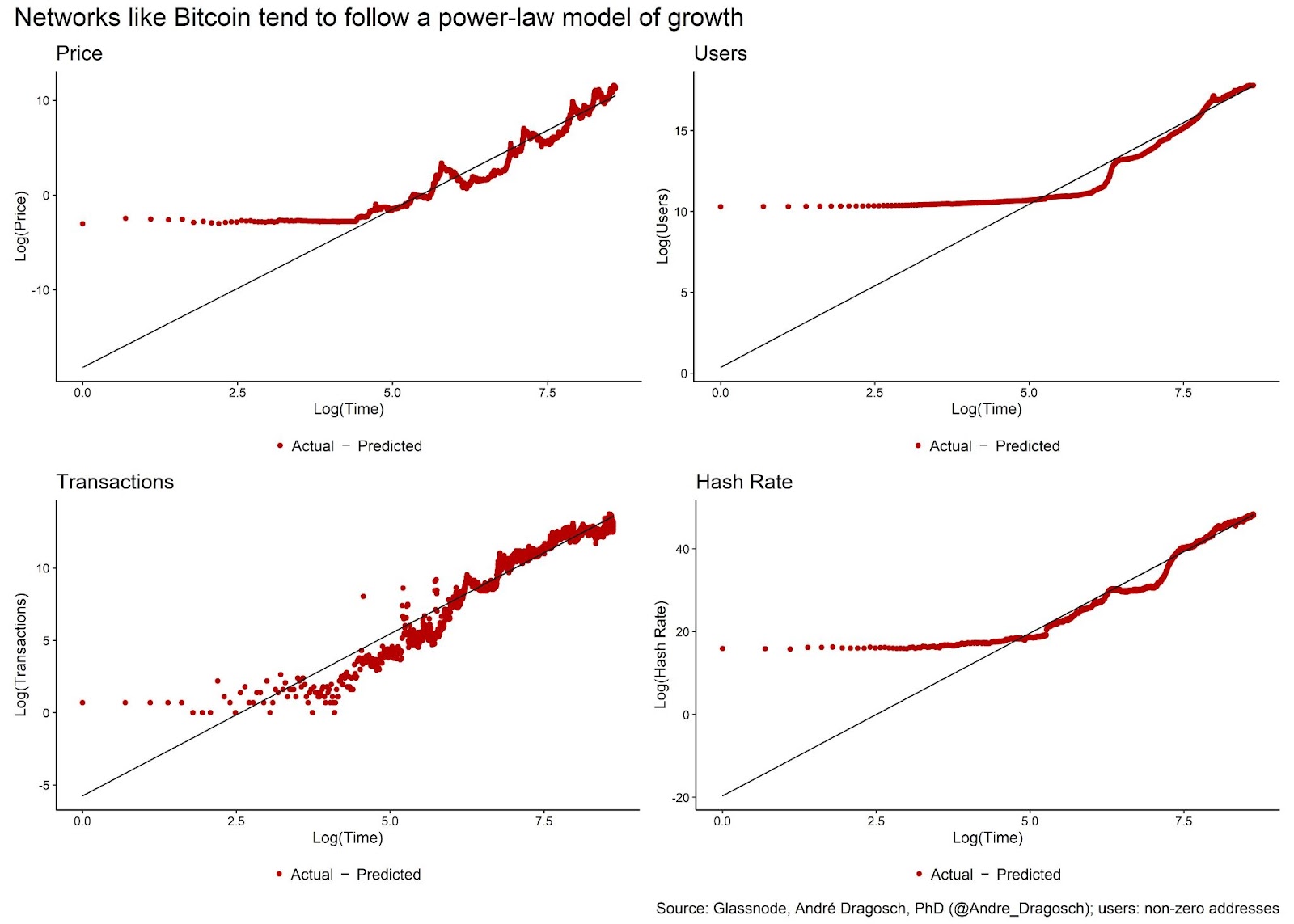

Bitcoin's journey towards mainstream adoption is fueled by compelling behavioral phenomena: network effects, the Lindy effect, and the Dunning-Kruger effect.

Network Effects

Bitcoin's expanding network enhances its utility, making it more attractive as more users join the ecosystem. This self-reinforcing cycle propels Bitcoin towards wider adoption, underpinned by its multifaceted value propositions.

- Bitcoin's network effects underscore its growth trajectory, laying a robust foundation for sustained adoption across diverse user segments.

The Lindy Effect

The longevity of Bitcoin underscores its resilience, with each successful day reinforcing its position as a lasting financial innovation. This effect cements Bitcoin's role as a transformative force in the digital economy.

- The longer Bitcoin thrives, the more entrenched it becomes, signaling a promising future as a cornerstone of the financial landscape.

The Dunning-Kruger Effect

The initial skepticism around Bitcoin often gives way to accelerated adoption as users grasp its transformative potential. Overcoming early misconceptions fuels Bitcoin's journey towards broader acceptance and integration.

- Early criticisms of Bitcoin pave the way for informed adoption, marking a crucial phase in its evolution towards mainstream acceptance.

Unveiling the Future: Bitcoin's Path to Global Adoption

Bitcoin's journey from a niche asset to a global financial powerhouse is shaped by a confluence of valuation methodologies, institutional endorsements, and societal dynamics. As Bitcoin's narrative evolves, its transformative impact on individuals, businesses, and nations heralds a new era of financial innovation and resilience.

Join the Bitcoin revolution today and unlock a world of investment opportunities that transcend traditional boundaries!

Frequently Asked Questions

Can I hold a gold ETF in a Roth IRA?

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

Traditional IRAs allow contributions from both the employer and employee. An Employee Stock Ownership Plan (ESOP) is another way to invest in publicly traded companies.

An ESOP can provide tax advantages, as employees are allowed to share in company stock and the profits generated by the business. The money you invest in the ESOP will be taxed at a lower rate than if it were directly held by the employee.

An Individual Retirement Annuity (IRA) is also available. You can make regular payments to your IRA throughout your life, and you will also receive income when you retire. Contributions made to IRAs are not taxable.

Are gold investments a good idea for an IRA?

Anyone who is looking to save money can make gold an excellent investment. It is also an excellent way to diversify you portfolio. But gold has more to it than meets the eyes.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It's sometimes called “the world's oldest money”.

But gold is mined from the earth, unlike paper currencies that governments create. It is very valuable, as it is rare and hard to create.

The supply and demand for gold determine the price of gold. If the economy is strong, people will spend more money which means less people can mine gold. As a result, the value of gold goes up.

The flip side is that people tend to save money when the economy slows. This means that more gold is produced, which reduces its value.

This is why it makes sense to invest in gold for individuals and companies. If you have gold to invest, you will reap the rewards when the economy expands.

In addition to earning interest on your investments, this will allow you to grow your wealth. You won't lose your money if gold prices drop.

What amount should I invest in my Roth IRA?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. You cannot withdraw funds from these accounts until you reach 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. You cannot touch your principal (the amount you originally deposited). This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. You must pay taxes on the difference if you want to take out more than what you initially contributed.

You cannot withhold your earnings from income taxes. So, when you withdraw, you'll pay taxes on those earnings. Let's take, for example, $5,000 in annual Roth IRA contributions. Let's also assume that you make $10,000 per year from your Roth IRA contributions. You would owe $3,500 in federal income taxes on the earnings. That leaves you with only $6,500 left. Because you can only withdraw what you have initially contributed, this is all you can take out.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. Additionally, half of your earnings would be lost because they will be taxed at 50% (half the 40%). So, even though you ended up with $7,000 in your Roth IRA, you only got back $4,000.

There are two types of Roth IRAs: Traditional and Roth. Traditional IRAs allow for pre-tax deductions from your taxable earnings. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. You can withdraw as much as you want from a traditional IRA.

A Roth IRA doesn't allow you to deduct your contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. Unlike a traditional IRA, there is no minimum withdrawal requirement. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

Can I buy gold with my self-directed IRA?

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. They allow you to speculate on future prices without owning the metal itself. However, physical bullion is real gold or silver bars you can hold in your hands.

Is it a good retirement strategy to buy gold?

Although buying gold as an investment might not sound appealing at first, when you look at the average annual gold consumption worldwide, it is worth looking into.

Physical bullion bars are the most popular way to invest in gold. There are other ways to invest gold. The best thing to do is research all options thoroughly and then make an informed decision based on what you want from your investments.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you are looking for cash flow from your investment, buying gold stocks will work well.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs often include stocks of gold miners, precious metals refiners, and commodity trading companies.

Who owns the gold in a Gold IRA?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

You must have gold at least $10,000 and it must be stored for at the least five years in order to take advantage of this tax-free status.

While gold may be a great investment to help prevent inflation and volatility in the market, it's not wise to keep it if you won't use it.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

You should consult a financial planner or accountant to see what options are available to you.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

finance.yahoo.com

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Lawful – WSJ

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

How to Hold Physical Gold in an IRA

The best way to invest in Gold is by purchasing shares of companies that produce it. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. Even if they do survive, there is still the possibility of losing money to fluctuating gold prices.

Another option is to purchase physical gold. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. This option is convenient because you can access your gold when it's low and doesn't require you to deal with stock brokers. It is also easier to check how much gold you have stored. You will receive a receipt detailing exactly what you paid. You are also less likely to be robbed than investing in stocks.

However, there are disadvantages. You won't get the bank's interest rates or investment money. You can't diversify your holdings, and you are stuck with the items you have bought. The taxman might also ask you questions about where your gold is located.

BullionVault.com offers more information on buying gold for an IRA.

—————————————————————————————————————————————————————————————–

By: André Dragosh

Title: The Future of Bitcoin: Unlocking Institutional Investment Opportunities

Sourced From: bitcoinmagazine.com/bigread/institutional-capital-bitcoin-bigread

Published Date: Fri, 18 Jul 2025 15:30:00 +0000