Introduction

An investigation conducted by the Organized Crime and Corruption Reporting Project (OCCRP) claims that Nayib Bukele, the President of El Salvador, diverted hundreds of millions of dollars granted by the Central American Bank for Economic Integration (CABEI) to fund the development of bitcoin as legal tender in the country.

The OCCRP Investigation

The OCCRP recently published a report that reveals the findings of their investigation into Nayib Bukele's alleged embezzlement of funds for Bitcoin-related projects in El Salvador. The report, released on October 31, states that the government used funds provided by CABEI as a loan to finance the process of making bitcoin legal tender in the nation.

The CABEI Loan

The loan, which was granted by CABEI in 2021, was intended to address the economic challenges faced by the nation and provide financial support to small and medium enterprises (SMEs) during the Covid-19 pandemic. However, according to the investigation, only $20 million out of the $600 million loan was used for its intended purpose.

Diversion of Funds

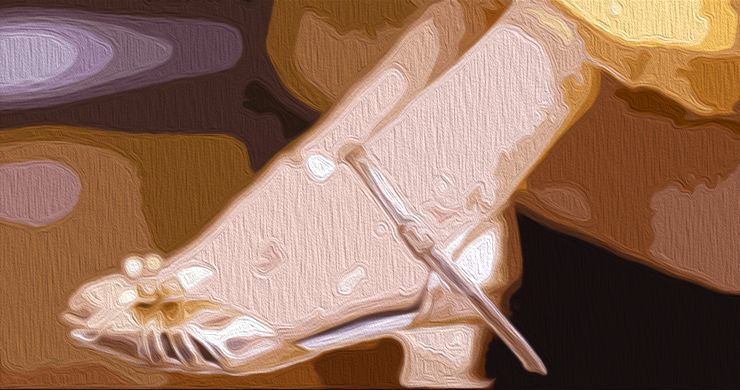

Instead of being used as intended, budget documents reviewed by OCCRP associates in the country suggest that $425 million of the loan was allocated to fulfill "general state obligations." Shockingly, more than $200 million of these funds were allegedly used to facilitate the process of making bitcoin legal tender in El Salvador.

CABEI's Support for Bitcoin

At the time, CABEI publicly expressed its support for the Bitcoin project. In June 2021, the president of CABEI, Dante Mossi, stated that the institution would assist the country in this transformative process. However, the terms of the $600 million loan explicitly prohibited the use of these funds for Bitcoin-related activities, as extensive legal and regulatory reforms were required, which would necessitate additional funding.

Cristosal's Complaints

The "bitcoinization" process in El Salvador has also faced legal challenges from Cristosal, a nonprofit organization. In November 2022, Cristosal filed three legal actions against the Salvadoran government regarding the management of funds used by Bukele for bitcoin purchases, the construction of the Chivo national network of Bitcoin ATMs, and allegations of identity theft involving over 200 citizens using the Chivo network.

Conclusion

The recently published OCCRP report has shed light on the alleged embezzlement of funds by El Salvador's President for Bitcoin projects. This investigation raises serious concerns about the misuse of funds provided by CABEI and the legality of the country's "bitcoinization" process. It remains to be seen how these allegations will be addressed and what impact they will have on the future of Bitcoin in El Salvador.

What are your thoughts on the OCCRP report? Share your opinions in the comments section below.

Frequently Asked Questions

Is gold buying a good retirement option?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

Physical bullion bar is the best way to invest in precious metals. You can also invest in gold in other ways. It is best to research all options and make informed decisions based on your goals.

If you're not looking to secure your wealth, it may be worth considering purchasing shares in mining equipment or companies that extract gold. If you require cash flow, gold stocks can work well.

You can also invest your money in exchange-traded fund (ETFs), which give you exposure to the gold price by holding securities related to gold. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

How much do gold IRA fees cost?

A monthly fee of $6 for an Individual Retirement Account is charged. This includes account maintenance fees and investment costs for your chosen investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees will vary depending upon the type of IRA chosen. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

Many providers also charge annual management fees. These fees can range from 0% up to 1%. The average rate is.25% per year. These rates are usually waived if you use a broker such as TD Ameritrade.

What is a Precious Metal IRA (IRA)?

You can diversify your retirement savings by investing in precious metal IRAs. This allows you to invest in gold, silver and platinum as well as iridium, osmium and other rare metals. These are called “precious” metals because they're very hard to find and very valuable. They are great investments for your money, and they can protect you from inflation or economic instability.

Precious metals are sometimes called “bullion.” Bullion refers simply to the physical metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

A precious metal IRA lets you invest in bullion direct, instead of purchasing stock. This allows you to receive dividends every year.

Precious metal IRAs have no paperwork or annual fees. Instead, you only pay a small percentage on your gains. You can also access your funds whenever it suits you.

What are the advantages of a gold IRA

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). It is tax-deferred until it's withdrawn. You have complete control over how much you take out each year. There are many types available. Some are better for those who want to save money for college. Some are better suited for investors who want higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This account may be worth considering if you are looking to retire earlier.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. That means you won't have to think about making deposits every month. To make sure you don't miss any payments, you can also set up direct deductions.

Gold is one of today's most safest investments. It is not tied to any country so its value tends stay steady. Even in times of economic turmoil, gold prices tend not to fluctuate. It is therefore a great choice for protecting your savings against inflation.

Who is the owner of the gold in a gold IRA

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Is the government allowed to take your gold

You own your gold and therefore the government cannot seize it. You earned it through hard work. It belongs exclusively to you. But, this rule is not universal. Your gold could be taken away if your crime was fraud against federal government. Also, if you owe taxes to the IRS, you can lose your precious metals. However, even if taxes are not paid, gold is still your property.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

irs.gov

cftc.gov

How To

Investing in gold or stocks

This might make it seem very risky to invest gold as an investment tool. This is because many people believe gold is no longer financially profitable. This belief comes from the fact most people see gold prices falling due to the global economy. They fear that investing in gold will result in a loss of money. In reality, however, there are still significant benefits that you can get when investing in gold. Below we'll look at some of them.

Gold is one of the oldest forms of currency known to man. There are thousands of records that show gold was used over the years. It was used all around the world as a reserve of value. It's still used by countries like South Africa as a method of payment.

It is important to determine the price per Gram that you will pay for gold when making a decision about whether or not to invest. The first thing you should do when considering buying gold bullion is to decide how much you will spend per gram. You can always ask a local jeweler what the current market rate is if you don't have it.

Noting that gold prices have fallen in recent years, it is worth noting that the cost to produce gold has gone up. So while the price of gold has declined, production costs haven't changed.

When deciding whether to buy gold, another thing to consider is how much gold you intend on buying. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. However, if you are planning on doing so for long-term investments, then it is worth considering. Profitable gold can be sold at a lower price than it was when you bought it.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. We recommend you do your research before making any final decisions. Only then can informed decisions be made.

—————————————————————————————————————————————————————————————–

By: Sergio Goschenko

Title: The Alleged Embezzlement of Funds by El Salvador's President for Bitcoin Projects

Sourced From: news.bitcoin.com/occrp-investigation-alleges-bukele-embezzled-200-million-for-bitcoin-projects-in-el-salvador/

Published Date: Thu, 02 Nov 2023 22:00:09 +0000

Did you miss our previous article…

https://altcoinirareview.com/ceo-of-jpmorgan-chase-warns-of-persistent-inflation-and-more-interest-rate-hikes/