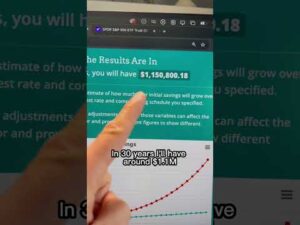

Discover the strategies that made Robert Kiyosaki, the renowned author of Rich Dad Poor Dad, a wealthy individual. Kiyosaki predicts that the future of stock and bond markets lies in resource startups, rather than Silicon Valley tech startups. He believes that resources will be the next big investment boom.

Robert Kiyosaki's Path to Success

Robert Kiyosaki, the co-author of the bestselling book Rich Dad Poor Dad, recently took to the social media platform X to share how he accumulated his wealth. Rich Dad Poor Dad, published in 1997 and co-authored by Kiyosaki and Sharon Lechter, has remained on the New York Times Best Seller List for over six years. It has sold more than 32 million copies in over 51 languages and across 109 countries.

Kiyosaki announced that he will be one of the keynote speakers at the Vancouver Resource Investment Conference (VRIC) taking place on January 20-21. He believes that this event will be the most significant investor conference of 2024. Kiyosaki highlighted:

"The future of stocks and bond markets will depend on startups in resources, not Silicon Valley technology startups. I have made most of my money in resources, not tech."

Kiyosaki started his journey as a startup at the VRIC 25 years ago. He invites others to join him at the conference to be part of the upcoming investment boom in the resource sector.

The VRIC is organized by Cambridge House International, a company specializing in promoting and organizing investment conferences for the resource sector. The event will bring together over 300 junior mining companies to showcase the exploration and production of critical commodities required to move forward in the 21st century. Jay Martin, the CEO of Cambridge House and the host of VRIC, stated:

"We are entering a new era of de-globalization. The trust that allowed for global trade over the last 30 years has shifted irreversibly… Demand for key resources will skyrocket."

Kiyosaki expressed during an interview with Stockpulse at last year's VRIC, "This is where real money is made." He emphasized that he learned more about entrepreneurship, business, and global trade from the experiences shared by miners at the conference than from any other source.

Aspiring entrepreneurs received valuable advice from Kiyosaki, urging them to gain knowledge through real-life experiences rather than relying solely on textbooks. He cautioned against listening to "fake teachers" and highlighted the lack of real-life experiences in college courses. However, he did acknowledge that gold mining is a challenging business with higher risks.

Kiyosaki stressed the importance of resources in the world, stating:

"The world runs on resources."

He revealed that he was particularly interested in gold, silver, and copper at the conference. Kiyosaki shared that he does not own any copper but has invested heavily in silver. He also disclosed his involvement in the Trixie Mine in Utah, which went public in July. Kiyosaki encouraged followers to pay attention to his actions rather than his words, as he owns substantial amounts of gold and silver.

The acclaimed author consistently advocates for gold and silver as sound investments. Additionally, he believes that Bitcoin is another excellent investment option, especially during unstable times. In November, Kiyosaki advised investors to buy Bitcoin before it's too late and has previously shared the reasons behind his ongoing Bitcoin purchases.

What are your thoughts on Robert Kiyosaki's advice and his explanation of how he amassed his fortune? Share your opinions in the comments section below.

Frequently Asked Questions

How to Open a Precious Metal IRA?

It is important to decide if you would like an Individual Retirement Account (IRA). To open the account, complete Form 8606. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. This form should be filled within 60 calendar days of opening the account. Once this is done, you can start investing. You could also opt to make a contribution directly from your paycheck by using payroll deduction.

You must complete Form 8903 if you choose a Roth IRA. Otherwise, the process will be identical to an ordinary IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. The IRS states that you must be at least 18 and have earned income. Your annual earnings cannot exceed $110,000 ($220,000 if you are married and file jointly) for any tax year. Additionally, you must make regular contributions. These rules apply whether you're contributing through an employer or directly from your paychecks.

An IRA for precious metals allows you to invest in gold and silver as well as platinum, rhodium, and even platinum. But, you'll only be able to purchase physical bullion. This means you won’t be able to trade stocks and bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option can be provided by some IRA companies.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they are not as liquid or as easy to sell as stocks and bonds. It's also more difficult to sell them when they are needed. They also don't pay dividends, like stocks and bonds. Therefore, you will lose more money than you gain over time.

What is the best precious metal to invest in?

Answering this question will depend on your willingness to take some risk and the return you seek. While gold is considered a safe investment option, it can also be a risky choice. For example, if you need a quick profit, gold may not be for you. Silver is a better investment if you have patience and the time to do it.

If you don’t desire to become rich quickly, gold may be your best option. If you want to invest in long-term, steady returns, silver is a better choice.

What is a Precious Metal IRA (IRA)?

A precious metal IRA allows for you to diversify your retirement savings in gold, silver, palladium and iridium. These metals are known as “precious” because they are rare and extremely valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Bullion is often used for precious metals. Bullion refers actually to the metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

With a precious metal IRA, you invest in bullion directly rather than purchasing shares of stock. You'll get dividends each year.

Precious metal IRAs are not like regular IRAs. They don't need paperwork and don't have to be renewed annually. Instead, you pay only a small percentage tax on your gains. Plus, you can access your funds whenever you like.

Should you open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. It is impossible to get back money if you lose your investment. This includes losing all your investments due to theft, fire, flood, etc.

Protect yourself against this type of loss by investing in physical gold or silver coins. These items can be lost because they have real value and have been around for thousands years. These items are worth more today than they were when first produced.

Consider a reputable business that offers low rates and good products when opening an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

If you decide to open an account, remember that you won't see any returns until after you retire. So, don't forget about the future!

Is it a good retirement strategy to buy gold?

While buying gold as an investment may seem unattractive at first glance it becomes worth the effort when you consider how much gold is consumed worldwide each year.

Physical bullion bar is the best way to invest in precious metals. However, there are many other ways to invest in gold. It is best to research all options and make informed decisions based on your goals.

For example, purchasing shares of companies that extract gold or mining equipment might be a better option if you aren't looking for a safe place to store your wealth. If you need cash flow to finance your investment, then gold stocks could be a good option.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs may include stocks that are owned by gold miners or precious metals refining companies as well as commodity trading firms.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

bbb.org

How To

Tips for Investing Gold

One of the most sought-after investment strategies is investing in gold. This is due to the many benefits of investing in gold. There are several options to invest in the gold. Some people purchase physical gold coins. Others prefer to invest their money in gold ETFs.

Before buying any type gold, it is important to think about these things.

- First, you must check whether your country allows you to own gold. If so, then you can proceed. Or, you might consider buying gold overseas.

- Second, it is important to know which type of gold coin you are looking for. You can choose between yellow gold and white gold as well as rose gold.

- You should also consider the price of gold. Start small and move up. Diversifying your portfolio is a key thing to remember when purchasing gold. Diversifying your portfolio should be a priority, including stocks, bonds and real estate.

- Don't forget to keep in mind that gold prices often change. It is important to stay up-to-date with the latest trends.

—————————————————————————————————————————————————————————————–

By: Kevin Helms

Title: Robert Kiyosaki Reveals How He Made a Fortune as the Author of Rich Dad Poor Dad

Sourced From: news.bitcoin.com/rich-dad-poor-dad-author-robert-kiyosaki-shares-how-he-made-most-of-his-money/

Published Date: Wed, 27 Dec 2023 01:30:09 +0000