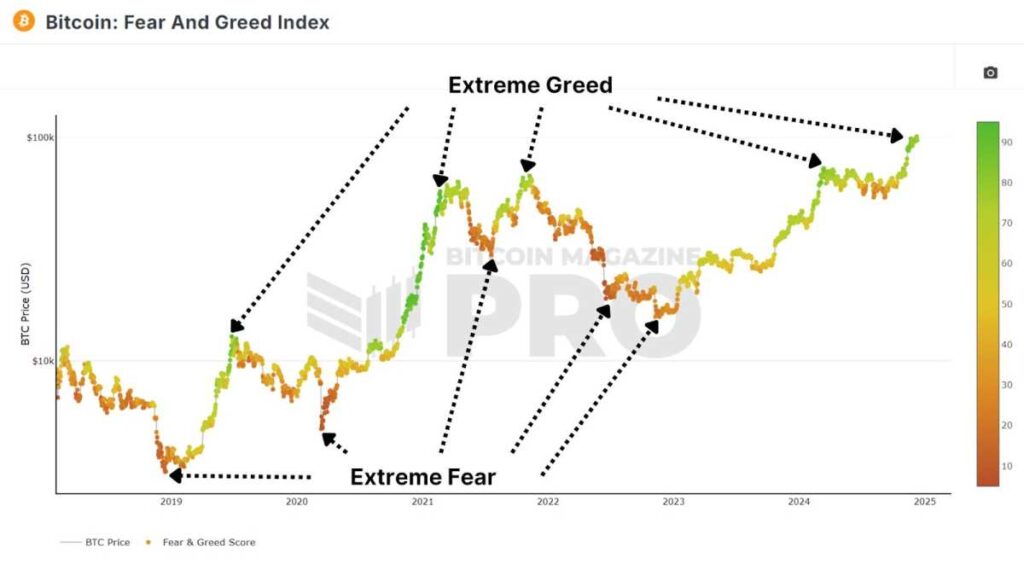

The Bitcoin Fear and Greed Index serves as a valuable sentiment analysis tool in the realm of cryptocurrency trading, capturing the prevailing mood of Bitcoin traders and investors. This index, ranging from 0 to 100, gauges market emotions from extreme fear to extreme greed. While widely utilized by analysts, there exist skeptics. Let's delve into the data to ascertain the efficacy of this index in enhancing investment decisions.

Understanding Investor Sentiment

The Fear and Greed Index amalgamates diverse metrics to offer a snapshot of market sentiment, including:

- Price Volatility: Significant price fluctuations often instigate fear, particularly during market downturns.

- Momentum and Volume: Increased buying activity typically indicates a greedy market sentiment.

- Social Media Sentiment: Public discussions on Bitcoin platforms reflect collective optimism or pessimism.

- Bitcoin Dominance: Higher Bitcoin dominance relative to altcoins signals cautious market behavior.

- Google Trends: Interest in Bitcoin search terms mirrors public sentiment.

By amalgamating this data, the index offers a straightforward visual representation: red zones denote fear (lower values), while green zones signify greed (higher values).

Embracing Contrarian Strategies

An interesting observation is that this tool accentuates the effectiveness of contrarian strategies. Essentially, when the majority is bearish, a bullish stance might be more advantageous and vice versa.

Evaluating Contrarian Approach

A test was conducted using data dating back to February 2018 to assess the efficacy of the Fear and Greed Index. The strategy employed was simple: allocate 1% of capital to Bitcoin on days with an index reading of 20 or below and sell 1% of Bitcoin holdings on days with an index of 80 or above. The results revealed that this strategy outperformed a basic buy-and-hold approach.

Quantifying Results

The Fear and Greed strategy yielded a remarkable 1,145% return on investment, surpassing the 1,046% ROI achieved through a Buy & Hold Strategy during the same period. This disparity underscores the potential of scaling into and out of Bitcoin based on market sentiment to enhance returns.

Final Thoughts

The Fear and Greed Index capitalizes on human psychology and market overreactions. By capitalizing on these extremes, the strategy effectively leverages irrational market behavior, highlighting the importance of buying during fear and selling during greed. While profitable, this strategy necessitates careful trade management and consideration of fees and taxes.

When used judiciously, the Fear and Greed Index aligns with the adage of "buy when others are fearful, sell when others are greedy," a mantra followed by numerous successful investors. It is advisable to complement this index with on-chain data and macroeconomic indicators for comprehensive analysis.

For an in-depth exploration of this subject, refer to a recent YouTube video titled: Does The Bitcoin Fear & Greed Index ACTUALLY Work?

Stay abreast of Bitcoin's price action with live data, charts, indicators, and comprehensive research on Bitcoin Magazine Pro.

Disclaimer: This article provides information for educational purposes and does not constitute financial advice. It is imperative to conduct thorough research before making any investment decisions.

Frequently Asked Questions

Can I hold physical gold in my IRA?

Gold is money, not just paper currency or coinage. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

Gold has historically performed better during financial panics than other assets. Between August 2011 to early 2013, gold prices rose close to 100 percent while the S&P 500 fell 21 per cent. During these turbulent market times, gold was among few assets that outperformed the stocks.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Your shares will still be yours even if your stock portfolio drops. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, the liquidity that gold provides is unmatched. You can sell your gold at any time without worrying about finding a buyer, which is a major advantage over other investments. You can buy gold in small amounts because it is so liquid. This allows you to profit from short-term fluctuations on the gold market.

Should You Buy or Sell Gold?

Gold was once considered an investment safe haven during times of economic crisis. Today, many people are looking to precious metals like gold and avoiding traditional investments like bonds and stocks.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Experts think this could change quickly. According to them, gold prices could soar if there is another financial crisis.

They also noted that gold is growing in popularity because of its perceived value as well as potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- Consider first whether you will need the money to save for retirement. You can save money for retirement even if you don't invest in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, you need to be clear about what you are buying before you decide to buy gold. Each type offers varying levels and levels of security.

- Keep in mind that gold may not be as secure as a bank deposit. It is possible to lose your gold coins.

Do your research before you buy gold. If you already have gold, make sure you protect it.

Can the government steal your gold?

You own your gold and therefore the government cannot seize it. It is yours because you worked hard for it. It belongs entirely to you. However, there may be some exceptions to this rule. You could lose your gold if convicted of fraud against a federal government agency. You can also lose precious metals if you owe taxes. However, even if taxes are not paid, gold is still your property.

How much are gold IRA fees?

The Individual Retirement Account (IRA), fee is $6 per monthly. This includes account maintenance fees and investment costs for your chosen investments.

If you want to diversify, you may be required to pay extra fees. These fees can vary depending on which type of IRA account you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Many providers also charge annual management fees. These fees range from 0% to 1%. The average rate per year is.25%. These rates are often waived if a broker like TD Ameritrade is used.

Is gold a good choice for an investment IRA?

If you are looking for a way to save money, gold is a great investment. It is also an excellent way to diversify you portfolio. There's more to gold that meets the eye.

It's been used as a form of payment throughout history. It is often called “the oldest currency in the world.”

Gold is not created by governments, but it is extracted from the earth. Because it is rare and difficult to make, it is extremely valuable.

The supply and demand for gold determine the price of gold. If the economy is strong, people will spend more money which means less people can mine gold. Gold's value rises as a result.

On the flip side, when the economy slows down, people hoard cash instead of spending it. This results in more gold being produced, which drives down its value.

This is why gold investment makes sense for both individuals and businesses. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

You'll also earn interest on your investments, which helps you grow your wealth. In addition, you won’t lose any money if gold falls in value.

What does a gold IRA look like?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase gold bullion coins in physical form at any moment. You don't have a retirement date to invest in gold.

You can keep gold in an IRA forever. Your gold assets will not be subjected tax upon your death.

Your heirs will inherit your gold, and not pay capital gains taxes. Because your gold doesn't belong to the estate, it's not necessary to include it on your final estate plan.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. Once you've done so, you'll be given an IRA custodian. This company acts like a middleman between the IRS and you.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual reports.

Once you've set up your gold IRA, it's possible to buy gold bullion. Minimum deposit is $1,000 The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

Taxes will apply to gold that you take out of an IRA. You will be liable for income taxes and penalties if you take the entire amount.

However, if you only take out a small percentage, you may not have to pay taxes. There are exceptions. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

It's best not to take out more 50% of your total IRA investments each year. You could end up with severe financial consequences.

What amount should I invest in my Roth IRA?

Roth IRAs let you save tax on retirement by allowing you to deposit your own money. These accounts cannot be withdrawn until you turn 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. First, you cannot touch your principal (the original amount deposited). This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

You cannot withhold your earnings from income taxes. Also, taxes will be due on any earnings you take. Let's assume that you contribute $5,000 each year to your Roth IRA. Let's say you earn $10,000 each year after contributing. Federal income taxes would apply to the earnings. You would be responsible for $3500 The remaining $6,500 is yours. Since you're limited to taking out only what you initially contributed, that's all you could take out.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. You can withdraw as much as you want from a traditional IRA.

Roth IRAs do not allow you to deduct your contributions. Once you are retired, however, you may withdraw all of your contributions plus accrued interest. Unlike a traditional IRA, there is no minimum withdrawal requirement. It doesn't matter if you are 70 1/2 or older before you withdraw your contribution.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

cftc.gov

irs.gov

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options? Types, Spreads. Example. And Risk Metrics

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was popular because of its purity, divisibility. uniformity. scarcity and beauty. Because of its intrinsic value, it was also widely traded. Different weights and measurements existed around the world, however, because there were not international standards to measure gold. For example in England, a pound sterling equals 24 carats. In France, a livre tournois equals 25. Carats of golden. Germany had one mark which equals 28. Carats.

The United States started issuing American coins in the 1860s made of 90% copper and 10% zinc. This led to a decline in demand for foreign currencies, which caused their price to increase. In this period, large amounts of gold coin were minted by the United States, which caused the gold price to drop. The U.S. government needed to find a solution to their debt because there was too much money in circulation. To do this, they decided that some of their excess gold would be sold back to Europe.

Since most European countries were not confident in the U.S. dollar they began accepting gold as payment. However, many European nations stopped using gold to pay after World War I and started using paper currency instead. The price of gold has risen significantly since then. Even though the price fluctuates, gold is still one of best investments.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Maximizing Returns: A Deep Dive into the Bitcoin Fear and Greed Index Strategy

Sourced From: bitcoinmagazine.com/markets/how-a-bitcoin-fear-and-greed-index-trading-strategy-beats-buy-and-hold-investing

Published Date: Fri, 13 Dec 2024 14:22:54 GMT

Related posts:

Bitcoin Sentiment Analysis: Leveraging the Fear and Greed Index for Strategic Investments

Bitcoin Sentiment Analysis: Leveraging the Fear and Greed Index for Strategic Investments

The Crypto Fear and Greed Index Indicates Bullish Sentiments in the Bitcoin Market

The Crypto Fear and Greed Index Indicates Bullish Sentiments in the Bitcoin Market

Bitcoin’s Steadfastness: Fear and Greed Index Indicative of Market Stability

Bitcoin’s Steadfastness: Fear and Greed Index Indicative of Market Stability

7 Best Gold IRA Companies 2023 (Ranked by customer reviews)

7 Best Gold IRA Companies 2023 (Ranked by customer reviews)