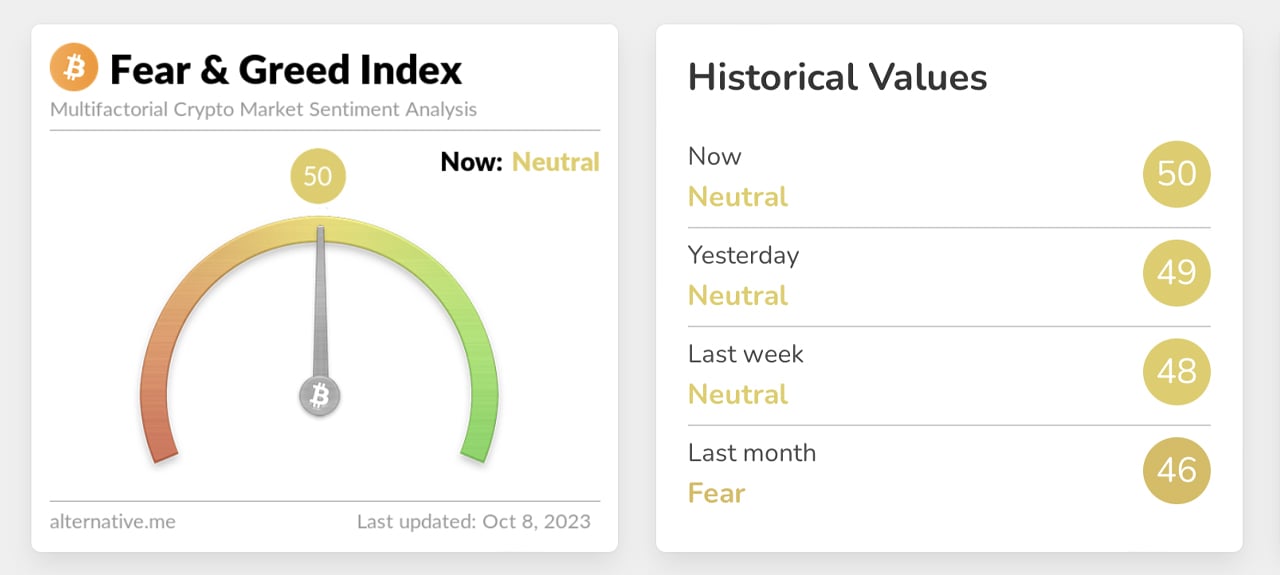

As we delve into October 2023, the price of bitcoin sways gently beneath the $28K mark, signifying a moderate 2.6% upsurge in the past week. The Crypto Fear and Greed Index (CFGI) meanwhile, has settled comfortably at an unbiased 50, a standing maintained throughout the preceding week. Supporting evidence within the technical data mirrors this equilibrium, suggesting a constriction in the volatility of bitcoin's price movement.

Bitcoin Maneuvers along the Thin Line as the Fear and Greed Index Portrays Equivocal Emotions

A week ago, every bitcoin was valued at a respectable $27,189. Fast forward 24 hours, this figure vacillated between $28,103 and $27,770, marking a 2.6% weekly and an impressive 7.9% monthly upswing in bitcoin's estimation.

Despite these noticeable value oscillations, the CFGI has maintained its composure, consistently broadcasting its "neutral" assessment – a position that remained unchanged not only for the day but extended through the entire preceding week. Essentially, the CFGI acts as a weather vane, measuring the prevailing sentiment within the bitcoin marketplace. Its ultimate objective? To equip traders with a better understanding of the communal sentiment permeating the market.

The hypothesis posits that extreme fear can result in plummeting prices, whereas uncontrolled greed may lead to price inflation. By tapping into current market emotions, traders can potentially identify opportune moments to buy or sell. The CFGI broadly categorises sentiments into extreme fear, fear, neutrality, greed, and extreme greed.

Bitcoin Market Steadfast amid Prevailing Neutrality

On October 8, 2023, alternative.me sets the CFGI at 50, a marginal increase from the previous week's 48. Coinmarketcap.com's "Fear and Greed" index concurs with this evaluation, registering a balanced score of 46 on the day. These indicators, coupled with the market's prevailing neutrality, and bitcoin's steady performance indicate a state of indecision within the marketplace.

The neutrality reflects a state sans dominant sentiment, a kind of equilibrium where the bears of pessimism and the bulls of optimism coexist without overpowering each other. Yet, neutrality does not denote market inertia. While prices may fluctuate, the index reflects an equilibrium between the bullish and bearish forces at play.

Bitcoin's Technical Metrics Reflect Stability

Certain technical metrics used for bitcoin, such as oscillators like the Relative Strength Index (RSI) and the Stochastic (14, 3, 3), highlight this weekend's neutral sentiment. Neutrality in such oscillators suggests the asset isn't subject to overbuying or overselling.

With the RSI currently situated around 61, and the Stochastic reading oscillating near 75, there's an observed equilibrium between the buying and selling pressures. Based on both the oscillator readings and the CFGI score, one might infer the market is in a phase of consolidation, on the lookout for future cues or triggers.

Thoughts on the Current Market Stirring?

Do you anticipate more market consolidation with the current Fear and Greed indicators? We value your thoughts and invite you to share your opinions on this topic below.

Frequently Asked Questions

How is gold taxed by Roth IRA?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Only earnings from capital gains and dividends are subject to tax. These taxes do not apply to investments that have been held for more than one year.

Each state has its own rules regarding these accounts. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York has a maximum age limit of 70 1/2. To avoid penalties, you should plan ahead and take distributions as soon as possible.

Can I keep a Gold ETF in a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

An IRA traditional allows both employees and employers to contribute. A Employee Stock Ownership Plan, or ESOP, is another way to invest publicly traded companies.

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The money invested in the ESOP is then taxed at lower rates than if it were held directly in the hands of the employee.

A Individual Retirement Annuity is also possible. An IRA allows you to make regular payments throughout your life and earn income in retirement. Contributions to IRAs do not have to be taxable

Should You Buy Gold?

Gold was a safe investment option for those who were in financial turmoil. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

Some experts believe that this could change very soon. According to them, gold prices could soar if there is another financial crisis.

They also point out that gold is becoming popular because of its perceived value and potential return.

These are some important things to remember if your goal is to invest in gold.

- Before you start saving money for retirement, think about whether you really need it. It is possible to save for retirement while still investing your gold savings. That said, gold does provide an additional layer of protection when you reach retirement age.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each account offers different levels of security and flexibility.

- Last but not least, gold doesn't provide the same level security as a savings account. Losing your gold coins could result in you never being able to retrieve them.

Don't buy gold unless you have done your research. Protect your gold if you already have it.

Is the government allowed to take your gold

You own your gold and therefore the government cannot seize it. You earned it through hard work. It belongs entirely to you. But, this rule is not universal. Your gold could be taken away if your crime was fraud against federal government. Also, if you owe taxes to the IRS, you can lose your precious metals. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

How much tax is gold subject to in an IRA

The fair market value of gold sold is the basis for tax. If you buy gold, there are no taxes. It is not considered income. If you sell it after the purchase, you will get a tax-deductible gain if you increase the price.

You can use gold as collateral to secure loans. Lenders look for the highest return when you borrow against assets. For gold, this means selling it. The lender might not do this. They might just hold onto it. They may decide to resell it. Either way, you lose potential profit.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. It's better to keep it alone.

What does a gold IRA look like?

Gold Ira accounts are tax-free investment vehicles for people who want to invest in precious metals.

Physical gold bullion coin can be purchased at any time. You don’t have to wait to begin investing in gold.

An IRA allows you to keep your gold forever. You won't have to pay taxes on your gold investments when you die.

Your heirs inherit your gold without paying capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). Once you've done so, you'll be given an IRA custodian. This company acts like a middleman between the IRS and you.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

After you have established your gold IRA you will be able purchase gold bullion coin. The minimum deposit required to purchase gold bullion coins is $1,000 The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

Taxes will be charged on gold you have withdrawn from an IRA. You will be liable for income taxes and penalties if you take the entire amount.

If you only take out a very small percentage of your income, you may not need to pay tax. There are some exceptions, though. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

It's best not to take out more 50% of your total IRA investments each year. You'll be facing severe financial consequences if you do.

What is the best precious metal to invest in?

This question depends on how risky you are willing to take, and what return you want. Gold has been traditionally considered a haven investment, but it's not always the most profitable choice. For example, if you need a quick profit, gold may not be for you. If patience and time are your priorities, silver is the best investment.

If you don’t want to be rich fast, gold might be the right choice. Silver may be a better option for investors who want long-term steady returns.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

irs.gov

cftc.gov

How To

Gold Roth IRA guidelines

You should start investing early to ensure you have enough money for retirement. You should start as soon as you are eligible (usually at age 50) and continue saving throughout your career. It is essential to save enough money each year in order to maintain a steady growth rate.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles allow you the freedom to contribute without having to pay tax on your earnings until they are withdrawn. These savings vehicles are great for those who don't have access or can't get employer matching funds.

The key is to save regularly and consistently over time. You will lose any potential tax advantages if you don't contribute enough.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: Bitcoin's Steadfastness: Fear and Greed Index Indicative of Market Stability

Sourced From: news.bitcoin.com/bitcoin-lingers-in-a-neutral-phase-as-the-fear-and-greed-index-signals-market-consolidation/

Published Date: Sun, 08 Oct 2023 16:30:46 +0000

Did you miss our previous article…

https://altcoinirareview.com/chainalysis-trims-down-the-impact-and-implications/