Introduction

This article provides a heuristic analysis of GBTC (Grayscale Bitcoin Trust) outflows and aims to help readers understand the current state of GBTC selling and estimate the scale of future outflows. It is important to note that this analysis is not strictly mathematical, but rather serves as a tool to gain a high-level understanding of GBTC outflows.

The Impact of Spot ETF Approval

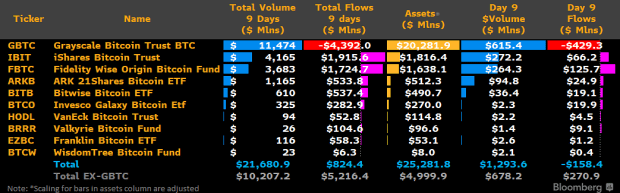

Since Wall Street entered the Bitcoin market with Spot ETF approval, the Grayscale Bitcoin Trust (GBTC) has been responsible for significant selling pressure. At its peak, GBTC held over 630,000 bitcoin. However, after the conversion from a closed-end fund to a Spot ETF, GBTC has seen outflows of more than $4 billion in the first 9 days of ETF trading. Surprisingly, despite the negative price action, there have been net inflows of approximately $824 million during this period.

Causes of GBTC Outflows

In order to forecast the price impact of Spot Bitcoin ETFs, it is crucial to understand the duration and magnitude of GBTC outflows. Several factors contribute to GBTC outflows:

1. GBTC Premium

During the 2020-2021 Bitcoin bull run, the GBTC premium played a significant role in driving the market higher. Market participants took advantage of the premium by acquiring shares at net asset value, which increased the demand for GBTC shares and subsequently drove the bidding for spot bitcoin. However, when the GBTC premium turned negative in February 2021, a series of liquidations occurred, causing the GBTC discount to negatively impact the entire industry.

2. Bankruptcy Estates

Following the collapse of Terra Luna in May 2022, bankruptcy estates, including FTX, Genesis Global, and an unidentified entity, started liquidating their GBTC shares. These bankruptcy sales continue to put

Frequently Asked Questions

Is it a good retirement strategy to buy gold?

Although buying gold as an investment might not sound appealing at first, when you look at the average annual gold consumption worldwide, it is worth looking into.

Physical bullion bars are the most popular way to invest in gold. But there are many other options for investing in gold. It's best to thoroughly research all options before you make a decision.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. Owning gold stocks should work well if you need cash flow from your investment.

You can also invest your money in exchange-traded fund (ETFs), which give you exposure to the gold price by holding securities related to gold. These ETFs may include stocks that are owned by gold miners or precious metals refining companies as well as commodity trading firms.

What is the cost of gold IRA fees

An Individual Retirement Account (IRA) fee is $6 per month. This includes account maintenance fees and investment costs for your chosen investments.

Diversifying your portfolio may require you to pay additional fees. These fees can vary depending on which type of IRA account you choose. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Most providers also charge annual management costs. These fees range from 0% to 1%. The average rate is.25% per year. These rates are often waived if a broker like TD Ameritrade is used.

What are the benefits of a Gold IRA?

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). You can withdraw it at any time, but it is tax-deferred. You have complete control over how much you take out each year. And there are many different types of IRAs. Some are better suited for college students. Some are for investors who seek higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This type account may make sense if it is your intention to retire early.

An IRA with a gold status is like any other IRA because you can put money into different asset classes. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. It means that you don’t have to remember to make deposits every month. To ensure that you never miss a payment, you could set up direct debits.

Finally, gold remains one of the best investment options today. Its value is stable because it's not tied with any one country. Even in times of economic turmoil gold prices tend to remain stable. It is therefore a great choice for protecting your savings against inflation.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement account

investopedia.com

cftc.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not legal – WSJ

How To

Tips for Investing with Gold

Investing in Gold has become a very popular investment strategy. There are many benefits to investing in gold. There are several options to invest in the gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

Before buying any kind of gold, you need to consider these things.

- First, check to see if your country permits you to possess gold. If your country allows you to own gold, then you are allowed to proceed. You might also consider buying gold in foreign countries.

- Second, it is important to know which type of gold coin you are looking for. You can go for yellow gold, white gold, rose gold, etc.

- Thirdly, you should take into consideration the price of gold. It is best to begin small and work your ways up. It is important to diversify your portfolio whenever you purchase gold. Diversifying your portfolio should be a priority, including stocks, bonds and real estate.

- Last but not least, remember that gold prices fluctuate frequently. You need to keep up with current trends.

—————————————————————————————————————————————————————————————–

By: David Bailey,Spencer Nichols

Title: Forecasting Total Bitcoin Selling Pressure & Market Impact: GBTC Outflows

Sourced From: bitcoinmagazine.com/markets/gbtc-outflows-forecasting-total-bitcoin-selling-pressure-market-impact-

Published Date: Fri, 26 Jan 2024 16:36:09 GMT

Related posts:

BlackRock’s Spot Bitcoin ETF Volume Outpacing GBTC Today, Indicating Market Shift

BlackRock’s Spot Bitcoin ETF Volume Outpacing GBTC Today, Indicating Market Shift

GBTC: Market Share in ETF Trade Volume Drops as $2 Billion BTC Exodus Occurs

GBTC: Market Share in ETF Trade Volume Drops as $2 Billion BTC Exodus Occurs

Grayscale’s Bitcoin Trust GBTC: Market Sentiment Shifts and Implications for Investors

Grayscale’s Bitcoin Trust GBTC: Market Sentiment Shifts and Implications for Investors

Grayscale’s GBTC Sees a Significant Decrease in Bitcoin Holdings Amid Growing Bitcoin ETF Competition

Grayscale’s GBTC Sees a Significant Decrease in Bitcoin Holdings Amid Growing Bitcoin ETF Competition