Introduction

Discreet Log Contracts (DLCs) have been around for a while and were initially proposed by Thaddeus Dryja, the co-creator of the Lightning Network protocol, in 2017. DLCs are a smart contract structure designed to address three key issues with previous contract schemes: scalability, data integration, and user privacy.

Scalability

One of the main challenges with smart contracts is their scalability. DLCs solve this problem by requiring only a single transaction to fund the contract and a single transaction to settle it. This streamlined process reduces on-chain footprints and ensures efficient contract execution.

Data Integration

DLCs also tackle the issue of integrating external data into the blockchain for contract settlement. An oracle is used to announce the price of Bitcoin, for example, and participants bet on the price. The oracle publishes commitments to the signed messages that announce the price at a specific time. The Contract Execution Transactions (CETs) are designed in a way that each participant's signature is encrypted using adapter signatures. This ensures that the settlement can only be decrypted with information from the signed oracle message, maintaining the privacy of the smart contract users.

User Privacy

Privacy is another crucial aspect of DLCs. Oracles blindly broadcast data to the public without gaining insight into who is using them as an oracle in a contract. This means that oracles cannot selectively harm a single user by signing for an improper settlement. In the DLC model, when an oracle signs a message, it is used to settle every DLC connected to that settlement message and time. This eliminates the possibility of malicious actions towards a single party.

DLC Markets

While DLCs have been primarily focused on retail consumers, there is a need to cater to the requirements of institutional actors. LN Markets, for example, has introduced a DLC specification tailored towards institutional customers. This new specification addresses issues such as the free options problem, margin calls, and capital efficiency.

DLC Coordinator

To overcome the free options problem, LN Markets has introduced the concept of a DLC coordinator. Instead of direct coordination between peers, the coordinator facilitates contract negotiations. Participants submit their signatures for contract execution and funding transactions to the coordinator, ensuring that neither party has access to the signatures needed to fund the contract. The coordinator holds both signatures and has a direct incentive to submit the funding transaction after the DLC has been negotiated and signed.

Efficient Coordination

The involvement of a coordinator also streamlines the coordination process of constructing the DLC. Participants can register an extended public key (xpub) and some unspent transaction outputs (UTXOs) with the coordinator, along with their offers for contract terms. When someone accepts an existing offer, the coordinator has all the necessary information to construct the CETs. The signatures are then transmitted to the coordinator, who combines them and submits the funding transaction.

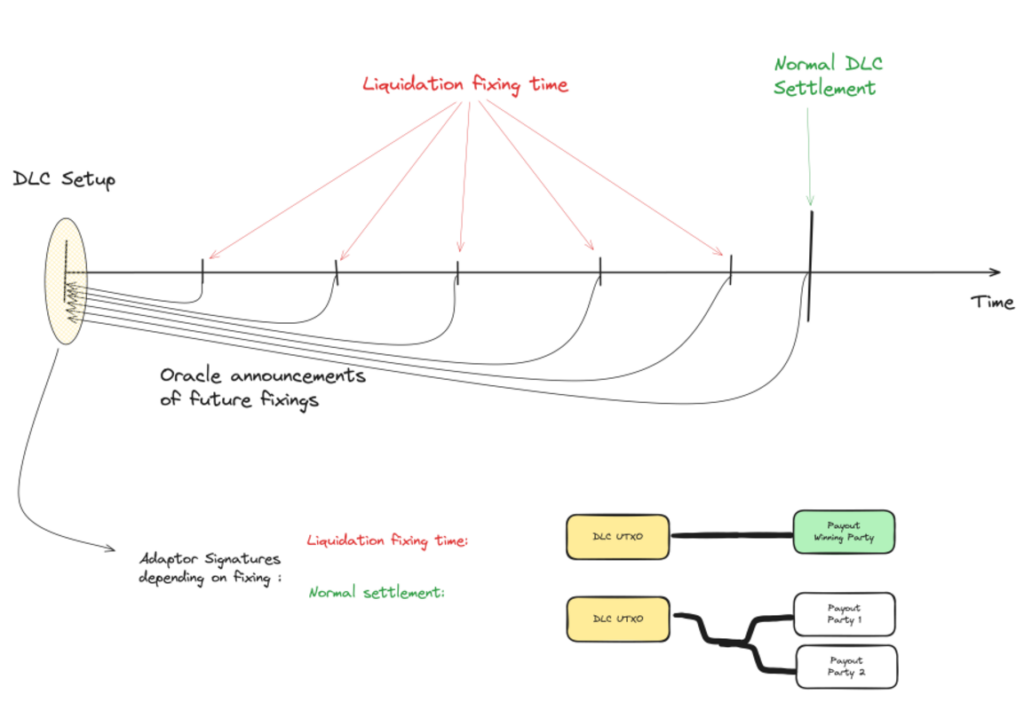

Liquidations

The coordinator's involvement also facilitates liquidations and adding additional margin to the DLC. Special settlement transactions are created for periods before the contract expiry, allowing parties to settle the contract earlier if the price is outside the contract range. If one party is approaching a liquidation point, they can coordinate with the coordinator to add margin to the contract. This collaborative process allows the winning party to withdraw funds while ensuring contract integrity.

The Potential of DLCs

While the modifications to the original DLC specification may seem small, they have significant implications for institutional use. By addressing the shortcomings of previous DLC designs, these changes make DLCs more suitable for larger economic actors and pools of capital. If the Lightning Network was a major advancement for transactional use of Bitcoin, DLCs have the potential to revolutionize capital and financial markets' use of Bitcoin.

Conclusion

It is essential to recognize the potential of DLCs, even if they may not be a primary use case for everyone. As an open system, Bitcoin allows for anyone to build upon it, and DLCs offer a powerful tool for smart contract applications. With their scalability, data integration capabilities, and user privacy features, DLCs are poised to play a significant role in the future of blockchain-based contracts.

Frequently Asked Questions

What precious metal is best for investing?

This question depends on how risky you are willing to take, and what return you want. Although gold has been considered a safe investment, it is not always the most lucrative. If you are looking for quick profits, gold might not be the right investment. If you have the patience to wait, then you might consider investing in silver.

Gold is the best investment if you aren't looking to get rich quick. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

What are some of the advantages and disadvantages to a gold IRA

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. But, this type of investment comes with its own set of disadvantages.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. The IRS may prevent you from taking out your IRA funds until you reach 59 1/2. If you do withdraw funds, you'll need to pay a penalty.

A disadvantage to managing your IRA is the fact that fees must be paid. Many banks charge between 0.5% and 2.0% per year. Others charge management fees that range from $10 to $50 per month.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. In order to make a claim, most insurers will require that you have a minimum amount in gold. Insurance that covers losses upto $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. Some providers limit how many ounces you can keep. Others allow you the freedom to choose your own weight.

It's also important to decide whether or not to buy gold futures contracts. Gold futures contracts are more expensive than physical gold. Futures contracts offer flexibility for buying gold. They let you set up a contract that has a specific expiration.

It is also important to choose the type of insurance coverage that you need. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does offer coverage for natural disasters. You may consider adding additional coverage if you live in an area at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs are not covered by insurance. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

To open a IRA in gold, you will need to first speak with a qualified custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians can't sell assets. Instead, they must keep your assets for as long you request.

Once you've decided which type of IRA best suits your needs, you'll need to fill out paperwork specifying your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). It is also important to specify how much money you will invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. After receiving your application, the company will review it and mail you a confirmation letter.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

How do you withdraw from an IRA that holds precious metals?

First, decide if it is possible to withdraw funds from an IRA. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

You should open a taxable brokerage account if you're willing to pay a penalty if you withdraw early. This option will require you to pay taxes on the amount that you withdraw.

Next, calculate how much money your IRA will allow you to withdraw. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. Some storage facilities can accept bullion bar, while others require you buy individual coins. Before choosing one, consider the pros and disadvantages of each.

Bullion bars are easier to store than individual coins. You will need to count each coin individually. However, you can easily track the value of individual coins by storing them in separate containers.

Some prefer to store their coins in a vault. Others prefer to store their coins in a vault. You can still enjoy the benefits of bullion for many years, regardless of which method you choose.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

investopedia.com

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not exactly legal – WSJ

cftc.gov

How To

3 Ways To Invest in Gold For Retirement

It is crucial to understand how you can incorporate gold into your retirement plans. There are several options to invest in precious metals if your employer has a 401k. You might also be interested to invest in gold outside the workplace. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. If you don't have any precious metals yet, you might want to buy them from a reputable dealer.

If you do invest in gold, follow these three simple rules:

- Buy Gold with Your Cash – Don't use credit cards or borrow money to fund your investments. Instead, invest in cash. This will protect you from inflation and help keep your purchasing power high.

- Physical Gold Coins – Physical gold coins are better than a paper certificate. Physical gold coins can be sold much faster than paper certificates. Physical gold coins are also free from storage fees.

- Diversify Your Portfolio – Never put all of your eggs in one basket. This means that you should diversify your wealth by investing in different assets. This can reduce market volatility and help you be more flexible.

—————————————————————————————————————————————————————————————–

By: Shinobi

Title: Discreet Log Contracts: Evolving to Meet Institutional Needs

Sourced From: bitcoinmagazine.com/technical/dlcs-evolving-to-meet-institutional-needs

Published Date: Wed, 14 Feb 2024 19:01:37 GMT