Introduction

In a surprising turn of events, Coinbase, the publicly-traded cryptocurrency exchange, has announced favorable financial results for the third quarter of 2023, despite the ongoing slump in the crypto market. The company's net income reached $2 million, while adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) stood at $181 million. This article delves into Coinbase's Q3 earnings report and highlights the key factors contributing to its success.

Coinbase's Q3 Earnings Report

Coinbase recently published its shareholder letter, revealing its financial performance for the third quarter. Although the company experienced a decline in total revenue from $736 million to $674 million compared to the previous quarter, it managed to generate a net profit despite the challenging market conditions. Coinbase attributed this success to various factors, including reduced cryptocurrency volatility and declining global spot trading volumes.

Revenue Breakdown

Within the revenue breakdown, transaction revenue, which is the main contributor, saw a sequential drop of 12% to $289 million. However, subscription and services revenue remained relatively steady at $334 million. Notably, stablecoin revenue experienced a 14% increase, reaching $172 million, primarily driven by higher interest rates. On the other hand, blockchain rewards revenue fell by 15%, and interest income dropped by 21%.

Operating Expenses and Available Resources

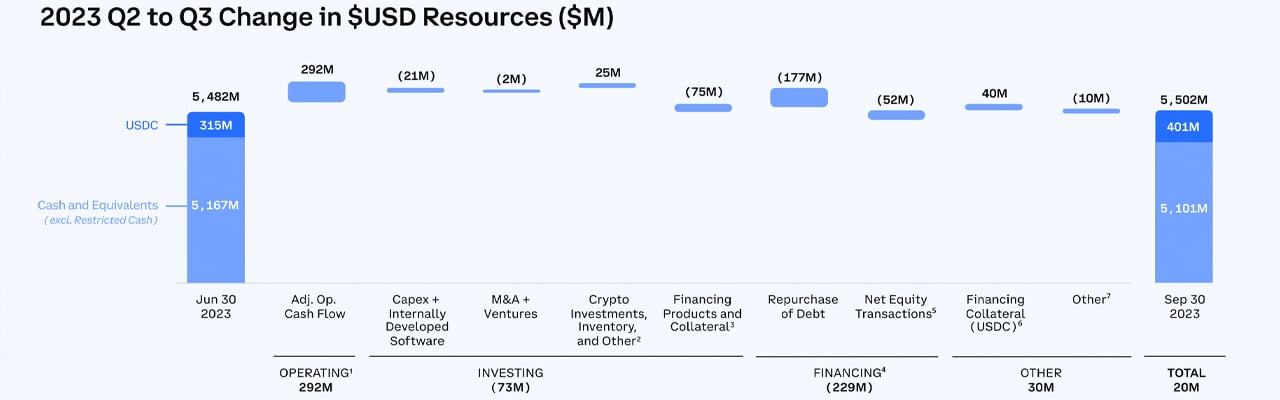

Coinbase managed to decrease its operating expenses by 4% sequentially, amounting to $754 million. This reduction was mainly attributed to a 1% collective decrease in technology and development, sales and marketing, and general and administrative expenses. The company also reported an increase in available liquid resources, with $5.5 billion at the end of the third quarter, up $20 million from the previous quarter.

Fourth Quarter Projections

Looking ahead to the fourth quarter, Coinbase anticipates generating approximately $105 million in transaction revenue for October. Subscription and services revenue is expected to remain relatively flat sequentially. The company also projects a decrease in expenses due to reduced stock-based compensation. This positive outlook is reflected in the recent increase in Coinbase shares, which have risen more than 10% over the past five days and over 13% in the last month.

Future Plans and Regulatory Advocacy

Despite the uncertain market conditions, Coinbase remains focused on product development and international expansion. The company is actively working on bringing regulated crypto derivatives to the U.S. and other markets. In terms of regulations, Coinbase continues to advocate for clear legislation in the United States, highlighting the need for regulatory clarity in the crypto industry.

Legal Battle with the SEC

Coinbase's ongoing court battle with the U.S. Securities and Exchange Commission (SEC) is progressing, with oral arguments scheduled for January 2024. The outcome of this case will have significant implications for the future of cryptocurrency regulation in the United States. Coinbase remains committed to advocating for a favorable regulatory environment and is closely monitoring developments in this area.

Global Crypto Regulations

In its shareholder letter, Coinbase emphasized the importance of global crypto regulations. It highlighted that 83% of G20 nations have implemented crypto regulations, emphasizing the need for the United States to follow suit. Coinbase believes that clear and comprehensive regulations are essential for the growth and stability of the cryptocurrency industry.

Conclusion

Coinbase's Q3 earnings report demonstrates its ability to navigate the challenges of a volatile crypto market and achieve profitability. The company's focus on product development, international expansion, and regulatory advocacy positions it as a trailblazer in the cryptocurrency industry. As Coinbase continues to innovate and adapt to changing market conditions, it remains committed to driving the adoption and acceptance of cryptocurrencies worldwide.

What are your thoughts on Coinbase's Q3 earnings? Share your opinions and insights in the comments section below.

Frequently Asked Questions

How much do gold IRA fees cost?

$6 per month is the Individual Retirement Account Fee (IRA). This fee includes account maintenance fees as well as any investment costs related to your selected investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees can vary depending on which type of IRA account you choose. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Most providers also charge annual management costs. These fees range from 0% to 1%. The average rate for a year is.25%. These rates are often waived if a broker like TD Ameritrade is used.

Should You Open a Precious Metal IRA?

Precious metals are not insured. This is the most important fact to know before you open an IRA account. You cannot recover any money you have invested. This includes all investments that are lost to theft, fire, flood, or other causes.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items have been around for thousands of years and represent real value that cannot be lost. These items are worth more today than they were when first produced.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

If you decide to open an account, remember that you won't see any returns until after you retire. Don't forget the future!

What are the pros & cons of a Gold IRA?

An Individual Retirement account (IRA) is a better option than regular savings accounts in that interest earned is exempted from tax. This makes an IRA great for people who want to save money but don't want to pay tax on the interest they earn. But, this type of investment comes with its own set of disadvantages.

You could lose all of your accumulated money if you take out too much from your IRA. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. If you do decide to withdraw funds from your IRA, you'll likely need to pay a penalty fee.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

You can purchase insurance if you want to keep your money out of a bank. In order to make a claim, most insurers will require that you have a minimum amount in gold. Some insurers may require you to have insurance that covers losses up $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers restrict the amount you can own in gold. Others allow you to pick your weight.

It's also important to decide whether or not to buy gold futures contracts. Futures contracts for gold are less expensive than physical gold. However, futures contracts give you flexibility when buying gold. They allow you to set up a contract with a specific expiration date.

You will also have to decide which type of insurance coverage is best for you. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. However, it does cover damage caused by natural disasters. You may consider adding additional coverage if you live in an area at high risk.

Insurance is not enough. You also need to think about the cost of gold storage. Storage costs are not covered by insurance. For safekeeping, banks typically charge $25-40 per month.

You must first contact a qualified custodian before you open a gold IRA. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians aren't allowed to sell your assets. They must instead keep them for as long as you ask.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. Your monthly investment goal should be stated.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. Once the company has received your application, they will review it and send you a confirmation email.

When opening a gold IRA, you should consider using a financial planner. A financial planner is an expert in investing and can help you choose the right type of IRA for you. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

What is the value of a gold IRA

There are many benefits to a gold IRA. You can diversify your portfolio with this investment vehicle. You decide how much money is put in each account and when it is withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. This is a great way to make a smooth transition if you want to retire earlier.

The best part is that you don't need special skills to invest in gold IRAs. They are offered by most banks and brokerage companies. You don't have to worry about penalties or fees when withdrawing money.

But there are downsides. Gold has always been volatile. It's important to understand the reasons you're considering investing in gold. Are you looking for safety or growth? Are you trying to find safety or growth? Only once you know, that will you be able to make an informed decision.

If you are planning to keep your Gold IRA indefinitely you will want to purchase more than one ounce. One ounce won't be enough to meet all your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don't have to buy a lot of gold if your goal is to sell it. Even a single ounce can suffice. These funds won't allow you to purchase anything else.

How much gold can you keep in your portfolio

The amount that you want to invest will dictate how much money it takes. You can start small by investing $5k-10k. As your business grows, you might consider renting out office space or desks. So you don't have all the hassle of paying rent. It's only one monthly payment.

Consider what type of business your company will be running. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. This means that you may only be paid once every six months.

Decide what kind of income do you want before you calculate how much gold is needed.

I recommend starting with $1k-$2k in gold and working my way up.

How to open a Precious Metal IRA

It is important to decide if you would like an Individual Retirement Account (IRA). You must complete Form 8606 to open an account. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should be filled within 60 calendar days of opening the account. You can then start investing once you have this completed. You can also contribute directly to your paycheck via payroll deduction.

To get a Roth IRA, complete Form 8903. The process for an ordinary IRA will not be affected.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS requires that you are at least 18 years old and have earned an income. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). And, you have to make contributions regularly. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

An IRA for precious metals allows you to invest in gold and silver as well as platinum, rhodium, and even platinum. But, you'll only be able to purchase physical bullion. This means you won’t be able to trade stocks and bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option is offered by some IRA providers.

An IRA is a great way to invest in precious metals. However, there are two important drawbacks. First, they're not as liquid as stocks or bonds. It is therefore harder to sell them when required. Second, they don’t produce dividends like stocks or bonds. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

Which precious metal is best to invest in?

This depends on what risk you are willing take and what kind of return you desire. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. If you are looking for quick profits, gold might not be the right investment. If you have time and patience, you should consider investing in silver instead.

If you don’t want to be rich fast, gold might be the right choice. If you want to invest in long-term, steady returns, silver is a better choice.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement accounts

cftc.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Do you want to keep your IRA gold at home? It's not legal – WSJ

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options? Types, Spreads. Example. And Risk Metrics

How To

Gold Roth IRA guidelines

The best way to invest for retirement is by starting early. Start saving as soon and as often as you're eligible (usually around 50 years old) and keep going until retirement. You must contribute enough each year to ensure that you have adequate growth.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles allow you to make contributions without paying taxes on earnings until they are withdrawn from the account. They are a great option for those who do not have access to employer matching money.

Save regularly and continue to save over time. If you aren't contributing the maximum amount permitted, you could miss out on tax benefits.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: Coinbase Reports Profit in Q3 Despite Crypto Market Slump

Sourced From: news.bitcoin.com/coinbase-turns-the-tide-q3-earnings-show-net-profit-amid-crypto-market-slump/

Published Date: Fri, 03 Nov 2023 15:30:54 +0000