Chinese Investors Seeking Profitability in Crypto

Chinese investors are increasingly diversifying their investment portfolios by allocating a portion to cryptocurrency, driven by the current state of the national stock market. Despite the ban on purchasing and trading cryptocurrency in China since 2021, investors have managed to find ways to enter the crypto market and take advantage of potential earnings.

Utilizing Exchanges and Payment Methods

To access the cryptocurrency market, Chinese investors are using popular exchanges like Binance and Okx, as well as local exchanges in Hong Kong. They are also leveraging traditional payment methods such as Alipay and Wechat to purchase stablecoins from local dealers. Additionally, over-the-counter exchanges are available, providing further accessibility to cryptocurrencies.

A senior executive from a Hong Kong-based exchange confirmed this trend, stating that the current instability of the mainland stock market has pushed investors to seek offshore investment opportunities. He noted that mainland investors are increasingly entering the cryptocurrency market on a daily basis.

Institutions Joining the Crypto Movement

It's not just individual investors who are exploring the cryptocurrency market. Institutions that have experienced setbacks in traditional investment markets are also seeking alternative investment options to diversify their portfolios.

The same senior executive mentioned that Chinese brokerages, faced with a sluggish stock market, weak demand for IPOs, and shrinking businesses, need a compelling growth story to present to their shareholders and board members. This has led them to consider investing in cryptocurrencies.

Chinese Crypto Market Growth

The rebound of cryptocurrency as an investment tool for Chinese investors is evident in the market data. Chainalysis, a blockchain intelligence company, reports that Chinese crypto numbers have significantly increased. In 2023, China ranked 13th in global peer-to-peer markets, a significant jump from its position at 144th in 2022. Transactions in the Chinese crypto market amounted to $86.4 billion between July 2022 and June 2023, surpassing the trading volume in Hong Kong during the same period.

Share Your Thoughts

What are your thoughts on the resurgence of cryptocurrency as an investment option for Chinese investors? Share your opinions and insights in the comments section below.

Frequently Asked Questions

What are the pros and disadvantages of a gold IRA

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. An IRA is a great way to save money and not have to pay taxes on the interest you earn. However, there are also disadvantages to this type of investment.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. The IRS may prevent you from taking out your IRA funds until you reach 59 1/2. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

Another problem is the cost of managing your IRA. Many banks charge between 0.5% and 2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. In order to make a claim, most insurers will require that you have a minimum amount in gold. Insurance that covers losses upto $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers limit how many ounces you can keep. Some providers allow you to choose your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Physical gold is more costly than gold futures. However, futures contracts give you flexibility when buying gold. They allow you to set up a contract with a specific expiration date.

You will also have to decide which type of insurance coverage is best for you. The standard policy does NOT include theft protection and loss due to fire or flood. It does include coverage for damage due to natural disasters. You may consider adding additional coverage if you live in an area at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs are not covered by insurance. Banks charge between $25 and $40 per month for safekeeping.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians can't sell assets. Instead, they must maintain them for as long a time as you request.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). It is also important to specify how much money you will invest each month.

After completing the forms, send them along with a check or a small deposit to your chosen provider. After reviewing your application, the company will send you a confirmation mail.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. A financial planner can help you decide the type of IRA that is right for your needs. They can also help you lower your expenses by finding cheaper alternatives to purchasing insurance.

What is the Performance of Gold as an Investment?

Gold's price fluctuates depending on the supply and demand. Interest rates also have an impact on the price of gold.

Due to limited supplies, gold prices are subject to volatility. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

Is gold a good investment IRA?

Anyone who is looking to save money can make gold an excellent investment. It can be used to diversify your portfolio. But there is more to gold than meets the eye.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is sometimes called the “oldest currency in the world”.

But gold, unlike paper currency, which is created by governments, is mined out from the ground. It is very valuable, as it is rare and hard to create.

The supply and demand for gold determine the price of gold. When the economy is strong, people tend to spend more money, which means fewer people mine gold. As a result, the value of gold goes up.

On the other hand, people will save cash when the economy slows and not spend it. This causes more gold to be produced, which lowers its value.

This is why investing in gold makes sense for individuals and businesses. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

In addition to earning interest on your investments, this will allow you to grow your wealth. In addition, you won’t lose any money if gold falls in value.

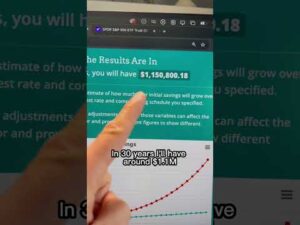

How much should I contribute to my Roth IRA account?

Roth IRAs allow you to deposit your money tax-free. These accounts are not allowed to be withdrawn before the age of 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. You cannot touch your principal (the amount you originally deposited). You cannot withdraw more than the original amount you contributed. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule is that your earnings cannot be withheld without income tax. Also, taxes will be due on any earnings you take. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's also assume that you make $10,000 per year from your Roth IRA contributions. This would mean that you would have to pay $3,500 in federal income tax. The remaining $6,500 is yours. This is the maximum amount you can withdraw because you are limited to what you initially contributed.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

Two types of Roth IRAs are available: Roth and traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. You can withdraw as much as you want from a traditional IRA.

Roth IRAs won't let you deduct your contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal limit, unlike traditional IRAs. It doesn't matter if you are 70 1/2 or older before you withdraw your contribution.

What are the advantages of a gold IRA

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It's tax-deferred until you withdraw it. You have complete control over how much you take out each year. There are many types to choose from when it comes to IRAs. Some are better for those who want to save money for college. Some are better suited for investors who want higher returns. Roth IRAs, for example, allow people to contribute after they turn 59 1/2. They also pay taxes on any earnings when they retire. The earnings earned after they withdraw the funds aren't subject to any tax. This type account may make sense if it is your intention to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. This eliminates the need to constantly make deposits. Direct debits could be set up to ensure you don't miss a single payment.

Gold is one of today's most safest investments. Because it's not tied to any particular country, its value tends to remain steady. Even during economic turmoil, gold prices tend to stay relatively stable. It is therefore a great choice for protecting your savings against inflation.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

irs.gov

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options? Types, Spreads, Example and Risk Metrics

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

cftc.gov

How To

The best way to buy gold (or silver) online

To buy gold, you must first understand how it works. Gold is a precious metal similar to platinum. It's rare and often used to make money due its resistance and durability to corrosion. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

There are two types currently available: legal tender and bullion. Legal tender coins are minted for circulation in a country and usually include denominations like $1, $5, $10, etc.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They can't be exchanged in currency exchange systems. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Each dollar spent by the buyer is worth 1 gram.

When you are looking to purchase gold, the next thing to know is where to get it. There are several options available if your goal is to purchase gold from a dealer. First, go to your local coin shop. You could also look into eBay or other reputable websites. You may also be interested in buying gold through private sellers online.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. You pay a commission fee between 10% and 15% for each transaction when you sell gold through private sellers. That means you would get back less money from a private seller than from a coin shop or eBay. This option is often a great choice for investing gold as it allows you more control over its price.

The other option is to purchase physical gold. It is easier to store physical gold than paper certificates. But, you still have to take care of it. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank will provide you with a loan that allows you to purchase the amount of gold you desire. These are small businesses that let customers borrow money against the items they bring to them. Banks often charge higher interest rates then pawnshops.

The final option is to ask someone to buy your gold! Selling gold is simple too. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————–

By: Sergio Goschenko

Title: Chinese Investors Turn to Cryptocurrency Amidst National Stock Market Slump

Sourced From: news.bitcoin.com/chinese-investors-are-turning-to-crypto-amidst-a-national-stock-market-slump/

Published Date: Sat, 27 Jan 2024 00:30:04 +0000

Did you miss our previous article…

https://altcoinirareview.com/sec-delays-decisions-on-spot-ethereum-etfs-proposed-by-blackrock-and-grayscale/

Related posts:

Cryptocurrency Is Virtual Property That Is Protected by Law, Chinese Court Rules

Cryptocurrency Is Virtual Property That Is Protected by Law, Chinese Court Rules

Chinese Currency Breaches 7:1 Exchange Rate Against US Dollar for First Time in Two Years

Chinese Currency Breaches 7:1 Exchange Rate Against US Dollar for First Time in Two Years

As Biden Drains the SPR Down to 1984 Levels, Chinese State Media Claims US Dollar ‘Is Once Again the World’s Problem’

As Biden Drains the SPR Down to 1984 Levels, Chinese State Media Claims US Dollar ‘Is Once Again the World’s Problem’

7 Best Gold IRA Companies 2023 (Ranked by customer reviews)

7 Best Gold IRA Companies 2023 (Ranked by customer reviews)