The Impact of Ordinals Protocol on Bitcoin Miners

Bitcoin miners have faced abnormal circumstances in recent months due to the increased demand on Bitcoin's blockchain. The use of BRC-20s and image inscriptions, made possible by the Ordinals protocol, has contributed significantly to this demand. The protocol allows users to inscribe unique data on small denominations of bitcoin, creating new "tokens" directly on the blockchain. As a result, even small amounts of bitcoin can be bought and sold multiple times, leading to increased transactions and high demand during the minting process.

The Role of Bitcoin Miners in the Digital Economy

Bitcoin miners play a crucial role in verifying transactions and ensuring the smooth flow of the digital economy. While their primary purpose is to generate new bitcoin, the computations performed by specialized mining hardware also validate the blockchain's transactions. With the current high network usage, miners have ample opportunities to earn revenue by processing these transactions, overshadowing the production of newly-issued bitcoin. This situation has led to higher mining difficulty and increased profits for the industry.

The Introduction of Data Collection by Federal Regulators

In a regulatory development that disrupted the mining ecosystem, the EIA, a subsidiary of the US Department of Energy, announced a survey of electricity use by all miners operating in the United States. The survey aims to examine the evolving energy demand of cryptocurrency mining, identify areas of high growth, and determine the sources of electricity used. The language used by regulators has raised concerns within the Bitcoin community, as it suggests a potential threat to the industry and hints at future data collection requirements.

Potential Impacts of Government Pressure on Miners

The government's perception of the mining industry as a potential threat has caused unease among miners. Claims about increased carbon emissions, strain on electrical infrastructure, and public nuisance have been made, but some of these assertions can be easily refuted. Nevertheless, hostile government actions could disrupt the mining ecosystem. Additionally, the upcoming Bitcoin halving, which will reduce mining rewards, is already causing concern about the industry's future. The worst case scenarios and the most likely outcomes need to be examined.

Market Factors Affecting Bitcoin Miners

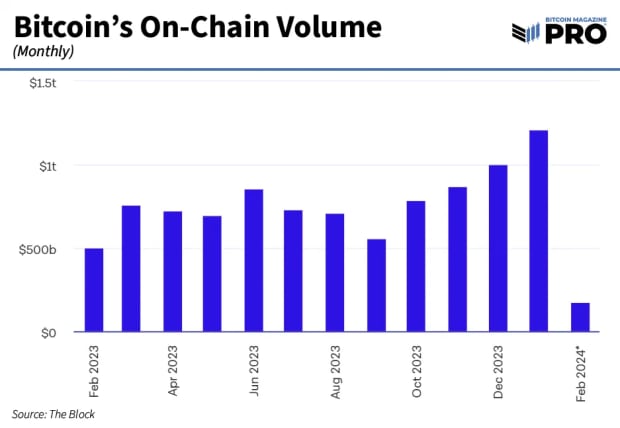

Regardless of government pressure, certain factors within the Bitcoin ecosystem are likely to impact miners. The reliance on token sales through the Ordinals protocol for revenue may become less dependable as the demand for blockspace diminishes. However, regular bitcoin transactions are thriving, with trading volume reaching its highest level since late 2022. This suggests that there will be continued demand for new bitcoin minting.

Preparing for the Bitcoin Halving

The impending Bitcoin halving, which will automatically reduce mining rewards, presents both opportunities and challenges for miners. However, this event is not unexpected, and many firms have been preparing for it. Miners have been selling their bitcoin reserves to upgrade equipment and strengthen their operations. Well-capitalized firms are better positioned to weather the halving and may benefit from the closure of less efficient mining companies.

The Government's Concerns and Miner Resilience

The federal government's concerns about the environmental impact and societal costs of the mining industry are driving their actions. However, the most efficient mining operations are likely to survive the halving and economic consequences. As less efficient miners exit the market, the remaining players will have a larger share of a smaller pie. Leading mining firms have expressed their readiness to fight against any crackdown on the industry. The current survey by the EIA is still in its early stages, and its impact remains uncertain.

The Changing Landscape and Bitcoin's Resilience

Despite concerns about government pressure and the survey by the EIA, the Bitcoin ecosystem is constantly evolving. By the time regulators are ready to take action, the market conditions may have already shifted. The resilient and innovative nature of the industry has allowed it to adapt to changing rules and circumstances. Bitcoin's opponents face an uphill battle against a decentralized and rapidly changing ecosystem.

Overall, Bitcoin miners are navigating a changing market influenced by factors such as the Ordinals protocol, the upcoming halving, and government pressure. While challenges and uncertainties exist, opportunities for revenue generation and growth remain. The ability of miners to adapt and innovate will play a significant role in shaping the future of the industry.

Frequently Asked Questions

Should You Invest in Gold for Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. If you are unsure which option to choose, consider investing in both options.

Not only is it a safe investment but gold can also provide potential returns. It's a great investment for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. This causes its value to fluctuate over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. You should just factor the fluctuations into any overall portfolio.

Another benefit to gold is its tangible value. Gold can be stored more easily than stocks and bonds. It's also portable.

You can always access your gold as long as it is kept safe. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold tends to rise when the stock markets fall.

Gold investment has another advantage: You can sell it anytime. You can easily liquidate your investment, just as with stocks. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

Don't buy too many at once. Start with just a few drops. Continue adding more as necessary.

The goal is not to become rich quick. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

How is gold taxed in Roth IRA?

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

However, if the money is deposited into a traditional IRA/401(k), the tax on the withdrawal of the money is not applicable. You pay taxes only on earnings from dividends and capital gains — which apply only to investments held longer than one year.

These rules vary from one state to another. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. In Massachusetts, you can wait until April 1st. And in New York, you have until age 70 1/2 . To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

Can I buy gold with my self-directed IRA?

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts are financial instruments based on the price of gold. They let you speculate on future price without having to own the metal. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

Which precious metal is best to invest in?

This question depends on how risky you are willing to take, and what return you want. Gold is a traditional haven investment. However, it is not always the most profitable. You might not want to invest in gold if you're looking for quick returns. If you have time and patience, you should consider investing in silver instead.

If you don’t want to be rich fast, gold might be the right choice. Silver may be a better option for investors who want long-term steady returns.

What is the benefit of a gold IRA?

There are many benefits to a gold IRA. It can be used to diversify portfolios and is an investment vehicle. You decide how much money is put in each account and when it is withdrawn.

Another option is to rollover funds from another retirement account into a IRA with gold. If you are planning to retire early, this makes it easy to transition.

The best part? You don’t need to have any special skills to invest into gold IRAs. They're readily available at almost all banks and brokerage firms. Withdrawals can happen automatically, without any fees or penalties.

However, there are still some drawbacks. Gold has always been volatile. So it's essential to understand why you're investing in gold. Do you want safety or growth? Do you want to use it as an insurance strategy or for long-term growth? Only by knowing the answer, you will be able to make an informed choice.

If you are planning to keep your Gold IRA indefinitely you will want to purchase more than one ounce. You won't need to buy more than one ounce of gold to cover all your needs. Depending on the purpose of your gold, you might need more than one ounce.

You don't need to have a lot of gold if you are selling it. You can even live with just one ounce. But you won't be able to buy anything else with those funds.

What is a Precious Metal IRA (IRA)?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These rare metals are often called “precious” as they are very difficult to find and highly valuable. They are great investments for your money, and they can protect you from inflation or economic instability.

Precious metals are sometimes called “bullion.” Bullion is the physical metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

A precious metal IRA allows you to invest directly in bullion, rather than buying stock shares. You'll get dividends each year.

Precious metal IRAs have no paperwork or annual fees. Instead, your gains are subject to a small tax. You can also access your funds whenever it suits you.

How Does Gold Perform as an Investment?

Supply and demand determine the gold price. It is also affected by interest rates.

Due to the limited supply of gold, prices for gold are highly volatile. Additionally, physical gold can be volatile because it must be stored somewhere.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

cftc.gov

irs.gov

How To

The best place online to buy silver and gold

First, understand the basics of gold. Gold is a precious metallic similar to Platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It's difficult to use, so most people prefer purchasing jewelry made from it rather than actual bars.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coins can only be used as investment currency. They increase in value due to inflation.

They aren't circulated in any currency exchange systems. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. The buyer receives 1 gram of gold for every dollar spent.

You should also know where to buy your gold. There are many options for buying gold directly from dealers. First, you can visit your local coin store. You can also try going through a reputable website like eBay. You might also consider buying gold from an online private seller.

Private sellers are individuals who offer gold for sale, either at wholesale prices or retail prices. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. A private seller will usually return less money than a coin shop and eBay. This option is often a great choice for investing gold as it allows you more control over its price.

Another option for buying gold is to invest in physical gold. While physical gold is easier than paper certificates to store, you still need to make sure it is safe. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank can offer you a loan for the amount that you need to buy gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks usually charge higher interest rates that pawn shops.

A third way to buy gold? Simply ask someone else! Selling gold is simple too. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————–

By: Landon Manning

Title: Bitcoin Miners: Navigating Changing Market Conditions and Government Pressure

Sourced From: bitcoinmagazine.com/markets/eia-mining-survey-looms-large-over-bitcoin-mining-industry

Published Date: Wed, 07 Feb 2024 16:33:16 GMT

Did you miss our previous article…

https://altcoinirareview.com/the-sec-delays-decision-on-invesco-galaxy-ethereum-etf/