Bitcoin, the digital currency that has been making waves in the financial world, is about to undergo a significant change that will solidify its position as a store of value. With the upcoming Bitcoin halving, the annual inflation rate of Bitcoin is set to drop below that of gold, a traditional symbol of wealth and stability.

The Bitcoin Halving Events

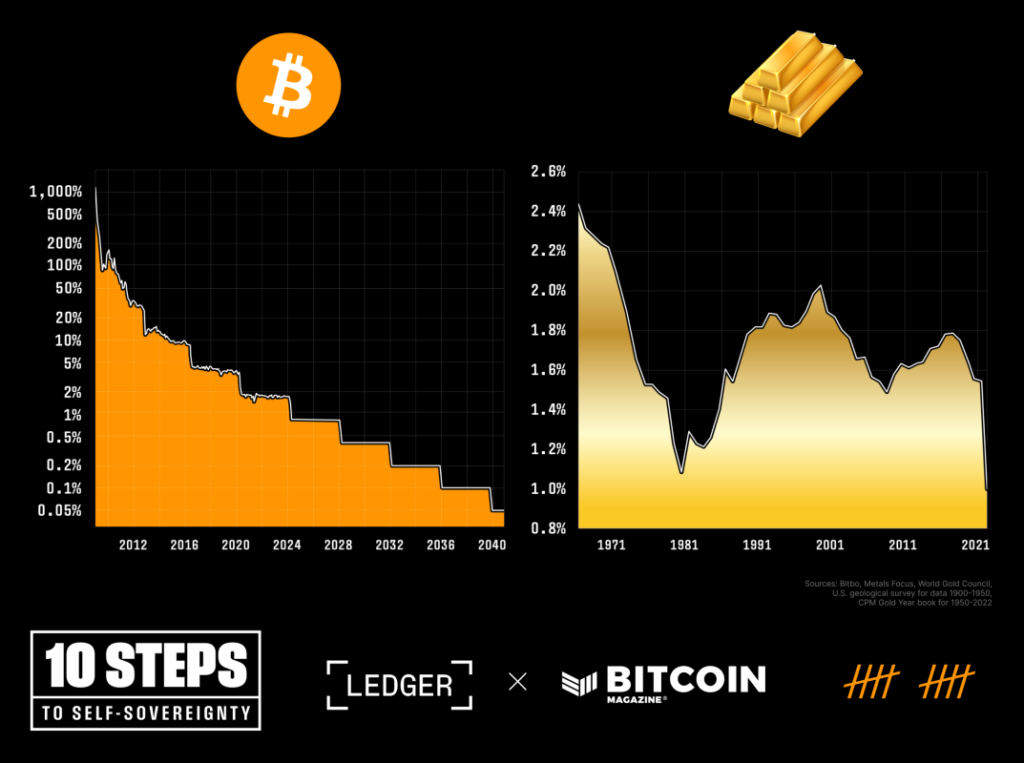

Since its inception, Bitcoin has experienced three halving events that have gradually decreased the supply of new coins entering the market. The first halving took place on November 28, 2012, followed by the second halving on July 9, 2016, and the most recent halving on May 20, 2020. Each halving event has reduced the block subsidy, leading to a decrease in the annual inflation rate of Bitcoin.

Bitcoin vs. Gold Supply

At Bitcoin block height 840,000, the annual supply of Bitcoin will be halved, resulting in an annual inflation rate of 0.85%. In comparison, the supply of gold is expected to increase by 1-2% annually, depending on various factors. The upcoming fourth Bitcoin halving, projected to occur on April 20, 2024, will further reduce the newly supplied bitcoin per block, making Bitcoin scarcer than ever.

The Historical Significance of Gold

Gold has long been considered a reliable store of value, with its value often compared to the price of a high-quality suit over time. Despite its historical significance, gold comes with challenges such as verification costs, transportation issues, and storage concerns. These challenges have led to the evolution of monetary assets beyond traditional precious metals.

Bitcoin’s Evolution as a Store of Value

Initially viewed as a speculative asset, Bitcoin has transformed into a sought-after store of value with unique properties. Its digital scarcity, fixed supply cap of 21 million coins, durability, and immutability make it an attractive alternative to traditional currencies and precious metals. Bitcoin's market capitalization has surged, indicating growing acceptance and recognition of its value.

Bitcoin’s Monetary Attributes

Bitcoin's scarcity, durability, and immutability make it a compelling monetary asset in the digital age. Its finite supply, resistance to inflation, and secure blockchain technology contribute to its growing adoption as a store of value. The upcoming halving event will further enhance Bitcoin's scarcity, positioning it as a robust alternative to gold.

Embracing the Future of Value Storage

As Bitcoin continues to redefine the concept of scarcity and value storage, its role in the global economy is set to expand. With the impending halving event, Bitcoin is poised to surpass gold in scarcity, signaling a new era in digital asset dominance. Investors and market participants are increasingly recognizing Bitcoin's potential as a reliable store of value, paving the way for its continued growth and adoption.

In conclusion, Bitcoin's upcoming halving represents a significant milestone in its journey towards becoming a superior store of value. With its scarcity surpassing that of gold, Bitcoin is poised to shine brightly in the evolving landscape of digital assets.

Frequently Asked Questions

What are some of the benefits of a gold IRA

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). It will be tax-deferred up until the time you withdraw it. You are in complete control of how much you take out each fiscal year. There are many types of IRAs. Some are more suitable for students who wish to save money for college. Others are made for investors seeking higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This account is a good option if you plan to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. For people who would rather invest than spend their money, gold IRA accounts are a good option.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. You won't have the hassle of making deposits each month. To avoid missing a payment, direct debits can be set up.

Finally, the gold investment is among the most reliable. Its value is stable because it's not tied with any one country. Even in times of economic turmoil gold prices tend to remain stable. This makes it a great investment option to protect your savings from inflation.

Which precious metals are best to invest in retirement?

It is gold and silver that are the best precious metal investment. Both can be easily bought and sold, and have been around since forever. Consider adding them to the list if you're looking to diversify and expand your portfolio.

Gold: The oldest form of currency known to man is gold. It is stable and very secure. It's a great way to protect wealth in times of uncertainty.

Silver: Silver has always been popular among investors. It's a good choice for those who want to avoid volatility. Unlike gold, silver tends to go up instead of down.

Platinium: Another form of precious metal is platinum, which is becoming more popular. It's like silver or gold in that it is durable and resistant to corrosion. It is, however, more expensive than its competitors.

Rhodium: Rhodium is used in catalytic converters. It is also used as a jewelry material. And, it's relatively cheap compared to other types of precious metals.

Palladium: Palladium has a similarity to platinum but is more rare. It is also cheaper. This is why it has become a favourite among investors looking for precious metals.

How does a gold IRA work?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase gold bullion coins in physical form at any moment. To start investing in gold, it doesn't matter if you are retired.

An IRA allows you to keep your gold forever. Your gold assets will not be subjected tax upon your death.

Your heirs will inherit your gold, and not pay capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. Once you've done that, you'll receive an IRA custody. This company acts as an intermediary between you and IRS.

Your gold IRA custodian is responsible for handling all paperwork and submitting the required forms to the IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. Minimum deposit required is $1,000 A higher interest rate will be offered if you invest more.

You'll have to pay taxes if you take your gold out of your IRA. If you are withdrawing your entire balance, you will owe income tax plus a 10% penalty.

A small percentage may mean that you don't have to pay taxes. There are some exceptions, though. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

It's best not to take out more 50% of your total IRA investments each year. You'll be facing severe financial consequences if you do.

How does gold perform as an investment?

Supply and demand determine the gold price. It is also affected by interest rates.

Due to the limited supply of gold, prices for gold are highly volatile. You must also store physical gold somewhere to avoid the risk of it becoming stale.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

irs.gov

How To

The growing trend of gold IRAs

The gold IRA trend is growing as investors seek ways to diversify their portfolios while protecting against inflation and other risks.

Owners of the gold IRA can use it to invest in physical bars and bullion gold. It is tax-free and can be used by investors who aren't concerned about stocks and bond.

Investors can manage their assets with a gold IRA without worrying about market volatility. They can use the gold IRA to protect themselves against inflation and other potential problems.

Investors also have the benefit of physical gold, which has unique properties such durability, portability and divisibility.

The gold IRA also offers many other benefits, such as the ability to quickly transfer the ownership of the gold to heirs, and the fact the IRS doesn't consider gold a currency.

Investors looking for financial security are increasingly turning to the gold IRA.

—————————————————————————————————————————————————————————————–

By: Bitcoin Magazine

Title: Bitcoin Halving: Redefining Scarcity in Comparison to Gold

Sourced From: bitcoinmagazine.com/sponsored/quality-money-bitcoin-to-become-scarcer-than-gold-post-halving

Published Date: Thu, 11 Apr 2024 15:55:35 GMT