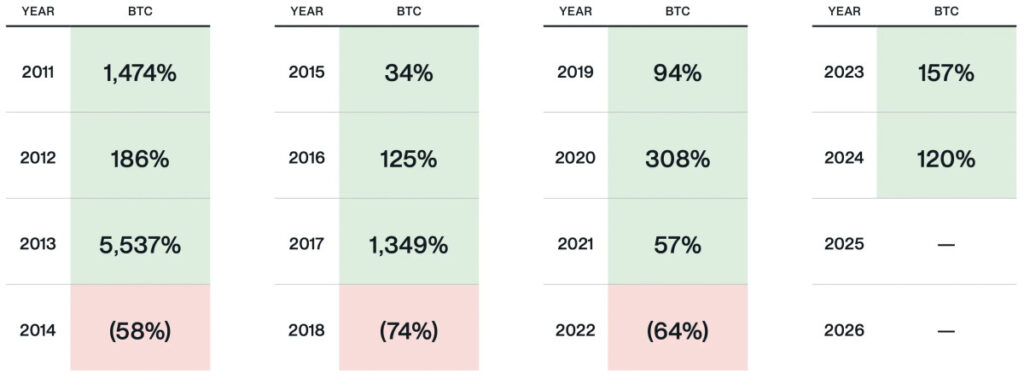

The Bitcoin market has long been defined by its seemingly immutable four-year cycle, a pattern of three years of surging prices followed by a sharp correction. However, a seismic shift in policy from Washington, led by former President Donald Trump, may shatter this cycle and usher in a new era of prolonged growth for the cryptocurrency industry.

The Four-Year Cycle: A Recap

Matt Hougan, Chief Investment Officer at Bitwise Asset Management, recently posed an intriguing question: Can Trump’s Executive Order break crypto’s four-year cycle? His answer, though nuanced, leans towards an emphatic yes.

Hougan clarifies his personal belief that the four-year Bitcoin market cycle is not driven by Bitcoin's halving events. He states, "People try to link it to bitcoin’s quadrennial ‘halving,’ but those halvings are misaligned with the cycle, having occurred in 2016, 2020, and 2024."

Bitcoin’s four-year cycle has been historically driven by a mix of investor sentiment, technological breakthroughs, and market dynamics. Typically, a bull run emerges following a significant catalyst—be it infrastructure improvements or institutional adoption—which attracts new capital and fuels speculation. Over time, leverage accumulates, excesses emerge, and a major event—such as regulatory crackdowns or financial fraud—triggers a brutal correction.

The Executive Order: A Game Changer

The fundamental question Hougan explores is whether Trump’s recent Executive Order, which prioritizes the development of the digital asset ecosystem in the U.S., will disrupt the established cycle. The order, which outlines a clear regulatory framework and even envisions a national digital asset stockpile, represents the most bullish stance on Bitcoin from any sitting or former U.S. president.

The implications are profound:

Regulatory Clarity: By eliminating legal uncertainty, the EO paves the way for institutional capital to flow into Bitcoin at an unprecedented scale.

Wall Street Integration: With the SEC and financial regulators now pro-crypto, major banks can enter the space, offering Bitcoin custody, lending, and structured products to their clients.

Government Adoption: The concept of a national digital asset stockpile hints at a future where the U.S. Treasury could hold Bitcoin as a reserve asset, solidifying its status as digital gold.

The End of Crypto Winters?

If history were to repeat itself, Bitcoin would continue its ascent through 2025 before facing a significant pullback in 2026. However, Hougan suggests this time may be different. While he acknowledges the risk of speculative excess and leverage-driven bubbles, he argues that the sheer scale of institutional adoption will prevent the kind of prolonged bear markets seen in the past.

This is a crucial distinction. In previous cycles, Bitcoin lacked a strong base of value-oriented investors. Today, with ETFs making it easier for pensions, hedge funds, and sovereign wealth funds to allocate to Bitcoin, the asset is no longer solely dependent on retail enthusiasm. The result? Corrections may still occur, but they will likely be shallower and shorter-lived.

What Comes Next?

Bitcoin has already crossed the $100,000 mark, and projections from industry leaders, including BlackRock CEO Larry Fink, suggest it could reach $700,000 in the coming years. If Trump’s policies accelerate institutional adoption, the typical four-year pattern could be replaced by a more traditional asset-class growth trajectory—akin to how gold responded to the end of the gold standard in the 1970s.

While risks remain—including unforeseen regulatory reversals and excessive leverage—the direction of travel is clear: Bitcoin is becoming a mainstream financial asset. If the four-year cycle was driven by Bitcoin’s infancy and speculative nature, its maturation may render such cycles obsolete.

Conclusion

For over a decade, investors have used the four-year cycle as a roadmap for Bitcoin’s market movements. But Trump’s Executive Order could be the defining moment that disrupts this pattern, replacing it with a more sustained and institutionally-driven growth phase. As Wall Street, corporations, and even governments increasingly embrace Bitcoin, the question is no longer if crypto winter will come in 2026—but rather if it will come at all.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct thorough independent research before making investment decisions.

Frequently Asked Questions

How to Open a Precious Metal IRA

First, decide if an Individual Retirement Account is right for you. You must complete Form 8606 to open an account. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. This form should not be completed more than 60 days after the account is opened. Once you have completed this form, it is possible to begin investing. You can also choose to pay your salary directly by making a payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, it will be the same process as an ordinary IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. The IRS says you must be 18 years old and have earned income. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. And, you have to make contributions regularly. These rules apply whether you're contributing through an employer or directly from your paychecks.

You can use a precious metals IRA to invest in gold, silver, palladium, platinum, rhodium, or even platinum. However, you won't be able purchase physical bullion. This means that you will not be allowed to trade shares or bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option is offered by some IRA providers.

There are two major drawbacks to investing via an IRA in precious metals. They aren't as liquid as bonds or stocks. They are therefore more difficult to sell when necessary. Second, they don’t produce dividends like stocks or bonds. So, you'll lose money over time rather than gain it.

How much gold do you need in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. You can start small by investing $5k-10k. As you grow, you can move into an office and rent out desks. This way, you don't have to worry about paying rent all at once. You just pay per month.

Consider what type of business your company will be running. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. So if you do this kind of thing, you need to consider how much income you expect from each client.

If you are doing freelance work, you probably won't have a monthly salary like I do because the project pays freelancers. You might get paid only once every six months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I recommend starting with $1k to $2k of gold, and then growing from there.

Can I hold a gold ETF in a Roth IRA?

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

A traditional IRA allows for contributions from both employer and employee. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

Also available is an Individual Retirement Annuity. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs will not be taxed

How does a gold IRA account work?

Gold Ira accounts are tax-free investment vehicles for people who want to invest in precious metals.

You can purchase physical gold bullion coins anytime. You don't have to wait until retirement to start investing in gold.

An IRA lets you keep your gold for life. You won't have to pay taxes on your gold investments when you die.

Your heirs can inherit your gold and avoid capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. Once you've completed this step, an IRA administrator will be appointed to your account. This company acts as a mediator between you, the IRS.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual reports.

Once you've set up your gold IRA, it's possible to buy gold bullion. The minimum deposit required for gold bullion coins purchase is $1,000 A higher interest rate will be offered if you invest more.

Taxes will be charged on gold you have withdrawn from an IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

Even if your contribution is small, you might not have to pay any taxes. There are some exceptions, though. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

You should avoid taking out more than 50% of your total IRA assets yearly. You could end up with severe financial consequences.

Is gold a good investment IRA?

Gold is an excellent investment for any person who wants to save money. It can be used to diversify your portfolio. But there is more to gold than meets the eye.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It's often referred to as “the world's oldest currency.”

But unlike paper currencies, which governments create, gold is mined out of the earth. It is very valuable, as it is rare and hard to create.

The price of gold fluctuates based on supply and demand. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. The value of gold rises as a consequence.

On the flip side, when the economy slows down, people hoard cash instead of spending it. This causes more gold to be produced, which lowers its value.

It is this reason that gold investing makes sense for businesses and individuals. If you invest in gold, you'll benefit whenever the economy grows.

Your investments will also generate interest, which can help you increase your wealth. Plus, you won't lose money if the value of gold drops.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

irs.gov

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement account

How To

How to keep physical gold in an IRA

The most obvious way to invest in gold is by buying shares from companies producing gold. But, this approach comes with risks. These companies may not survive the next few years. If they survive, there's still the risk of losing money due to fluctuations in the price of gold.

You can also buy gold directly. You will need to either open an online or bank account or simply buy gold from a reliable seller. The advantages of this option include the ease of access (you don't need to deal with stock exchanges) and the ability to make purchases when prices are low. It's also easy to see how many gold you have. You will receive a receipt detailing exactly what you paid. You have less risk of theft when investing in stocks.

There are however some disadvantages. You won't be able to benefit from investment funds or interest rates offered by banks. You won't have the ability to diversify your holdings; you will be stuck with what you purchased. Finally, the tax man might ask questions about where you've put your gold!

BullionVault.com has more information about how to buy gold in an IRA.

—————————————————————————————————————————————————————————————–

By: Mark Mason

Title: Will Trump's Executive Order Break the Four-Year Bitcoin Market Cycle?

Sourced From: bitcoinmagazine.com/markets/will-trumps-executive-order-break-bitcoins-four-year-market-cycle-

Published Date: Thu, 30 Jan 2025 17:24:24 GMT