Introduction

The Securities and Exchange Commission (SEC) has recently held meetings with potential issuers of spot Bitcoin Exchange Traded Funds (ETFs) to discuss their active applications. As a result of these meetings, it has been decided that a cash creation methodology will be adopted by these issuers, instead of the usual "in kind" transfers. This change has sparked a range of reactions, from the absurd to the serious. While the overall impact on investors is expected to be minimal, it will have a relatively meaningful effect on the issuers and may reflect poorly on the SEC as a whole.

Understanding Exchange Traded Funds (ETFs)

In order to provide context, it is important to understand the basic structure of Exchange Traded Funds. ETF issuers work with Authorized Participants (APs) who have the ability to exchange a predetermined amount of the fund's assets (such as stocks, bonds, or commodities) or a defined amount of cash, or a combination of both, for a fixed amount of ETF shares. Normally, an "in kind" creation unit would involve exchanging 100 Bitcoin for 100,000 ETF shares. However, with the adoption of cash creation, the Issuer is now required to publish the cash amount in real time as the price of Bitcoin fluctuates, in order to acquire the necessary Bitcoin. Likewise, the issuer must also publish the cash amount at which 100,000 ETF shares can be redeemed in real time. The issuer is then responsible for purchasing the required Bitcoin or selling it in the case of a redemption, to ensure compliance with the fund's covenants.

Impact on Fund Backing and Performance

Contrary to claims that cash creation means the fund will not be backed 100% by Bitcoin, this mechanism ensures that the fund remains fully backed. While there may be a brief delay after creation before the Issuer acquires the necessary Bitcoin, any prolonged delay increases the risk for the issuer. If the issuer needs to pay more than the quoted price, the fund will have a negative cash balance, which can lower its Net Asset Value and impact its performance. On the other hand, if the issuer can buy the Bitcoin for less than the cash deposited by APs, the fund will have a positive cash balance, potentially improving its performance.

Incentives for Issuers and Impact on Spreads

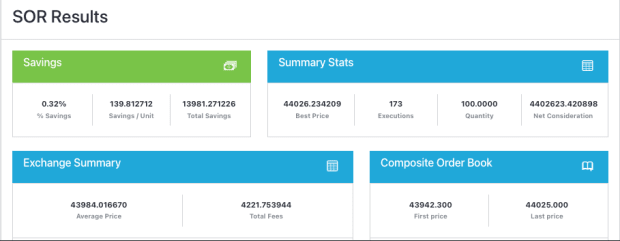

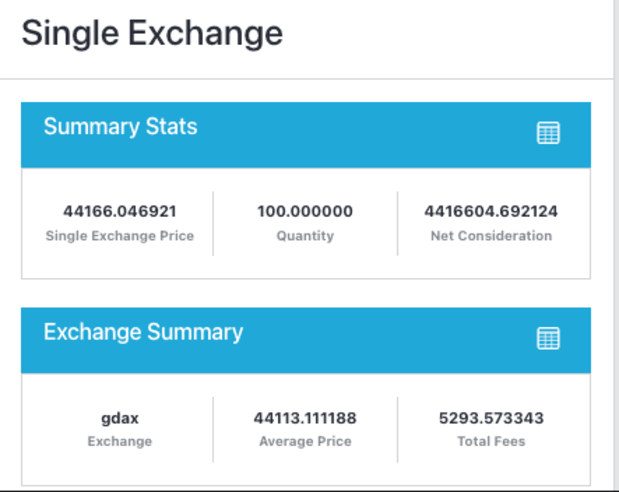

Issuers now face the challenge of quoting a tight spread between creation and redemption cash amounts, while ensuring they can trade at or better than the quoted amounts. This requires access to sophisticated technology. For example, using multiple regulated exchanges to trade Bitcoin can result in a lower cost compared to trading on a single exchange like Coinbase alone. This technology hurdle highlights the need for issuers to have access to advanced trading tools to achieve the best results.

Variation in Pricing and Costs

Not all issuers are expected to follow the same trading strategies, leading to potentially significant variation in pricing and costs among different Bitcoin ETFs. Issuers with access to superior trading technology will be able to offer tighter spreads and superior performance.

Reasoning behind Cash Creation

The SEC's decision to enforce the use of cash creation/redemption is primarily due to the fact that Authorized Participants (APs), who are regulated broker dealers, are not currently approved to trade spot Bitcoin directly. This regulatory limitation makes the "in kind" process unfeasible. While there have been various conspiracy theories surrounding this decision, the simple explanation is the regulatory framework surrounding spot Bitcoin trading.

Conclusion

Spot Bitcoin ETFs are expected to be a significant development for the Bitcoin industry. However, it is crucial for investors to research and understand the trading mechanisms employed by each issuer to predict which ETFs may perform best. Other factors such as custodial processes and fees should also be considered. Ignoring the trading aspect of these ETFs could lead to costly decisions.

Please note that this is a guest post by David Weisberger. The opinions expressed in this article are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

What is the benefit of a gold IRA?

There are many advantages to a gold IRA. It is an investment vehicle that can diversify your portfolio. You can control how much money is deposited into each account as well as when it's withdrawn.

You can also rollover funds from other retirement accounts to a gold IRA. This will allow you to transition easily if it is your decision to retire early.

The best thing about investing in gold IRAs is that you don’t need any special skills. They are readily available at most banks and brokerages. You do not need to worry about fees and penalties when you withdraw money.

But there are downsides. Gold is historically volatile. It is important to understand why you are investing in gold. Do you want safety or growth? Are you looking for growth or insurance? Only by knowing the answer, you will be able to make an informed choice.

If you want to keep your gold IRA open for life, you might consider purchasing more than one ounce. A single ounce isn't enough to cover all of your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don't have to buy a lot of gold if your goal is to sell it. Even one ounce is enough. But you won't be able to buy anything else with those funds.

What are the pros & cons of a Gold IRA?

An Individual Retirement account (IRA) is a better option than regular savings accounts in that interest earned is exempted from tax. An IRA is a good choice for those who want a way to save some money but don’t want the tax. This type of investment has its downsides.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

Another disadvantage is that you must pay fees to manage your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management costs ranging from $10-50.

Insurance is necessary if you wish to keep your money safe from the banks. Insurance companies will usually require that you have at least $500,000. Some insurers may require you to have insurance that covers losses up $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. Some providers restrict the amount you can own in gold. Others allow you to pick your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Futures contracts for gold are less expensive than physical gold. Futures contracts offer flexibility for buying gold. They let you set up a contract that has a specific expiration.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does provide coverage for damage from natural disasters, however. You may consider adding additional coverage if you live in an area at high risk.

Apart from insurance, you should consider the costs of storing your precious metals. Insurance doesn't cover storage costs. In addition, most banks charge around $25-$40 per month for safekeeping.

A qualified custodian is required to help you open a Gold IRA. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians are not allowed to sell your assets. Instead, they must retain them for as long and as you require.

Once you've decided which type of IRA best suits your needs, you'll need to fill out paperwork specifying your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. Also, you should specify how much each month you plan to invest.

After completing the forms, send them along with a check or a small deposit to your chosen provider. The company will review your application and send you a confirmation letter.

You should consult a financial planner before opening a Gold IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

Can I purchase gold with my self directed IRA?

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. These contracts allow you to speculate on future gold prices without actually owning it. However, physical bullion is real gold or silver bars you can hold in your hands.

Are gold investments a good idea for an IRA?

Gold is an excellent investment for any person who wants to save money. It's also a great way to diversify your portfolio. But gold has more to it than meets the eyes.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is often called “the most ancient currency in the universe.”

But gold, unlike paper currency, which is created by governments, is mined out from the ground. It is very valuable, as it is rare and hard to create.

The supply and demand for gold determine the price of gold. The economy that is strong tends to be more affluent, which means there are less gold miners. This results in gold prices rising.

On the flipside, people may save cash rather than spend it when the economy slows. This increases the production of gold, which in turn drives down its value.

It is this reason that gold investing makes sense for businesses and individuals. You will benefit from economic growth if you invest in gold.

You'll also earn interest on your investments, which helps you grow your wealth. Plus, you won't lose money if the value of gold drops.

How much gold do you need in your portfolio?

The amount of capital required will affect the amount you make. A small investment of $5k-10k would be a great option if you are looking to start small. As your business grows, you might consider renting out office space or desks. You don't need to worry about paying rent every month. You only pay one month.

It's also important to determine what type business you'll run. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. So you might only get paid once every 6 months or so.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

Should You Open a Precious Metal IRA?

It is essential to be aware of the fact that precious metals do not have insurance coverage before opening an IRA. There are no ways to recover the money you lost in an investment. This includes investments that have been damaged by fire, flooding, theft, and so on.

This type of loss can be avoided by investing in physical silver and gold coins. These items have been around thousands of years and are irreplaceable. These items are worth more today than they were when first produced.

Consider a reputable business that offers low rates and good products when opening an IRA. It's also wise to consider using a third-party custodian who will keep your assets safe while giving you access to them anytime.

When you open an account, keep in mind that you won't receive any returns until your retirement. So, don't forget about the future!

How to Open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. Open the account by filling out Form 8606. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. This form should be completed within 60 days after opening the account. You can then start investing once you have this completed. You can also choose to pay your salary directly by making a payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. Otherwise, the process will be identical to an ordinary IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. The IRS states that you must be at least 18 and have earned income. You can't earn more than $110,000 per annum ($220,000 in married filing jointly) for any given tax year. And, you have to make contributions regularly. These rules apply to contributions made directly or through employer sponsorship.

You can invest in precious metals IRAs to buy gold, palladium and platinum. But, you'll only be able to purchase physical bullion. You won't have the ability to trade stocks or bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. Some IRA providers offer this option.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they aren't as liquid than stocks and bonds. It's also more difficult to sell them when they are needed. Second, they don’t produce dividends like stocks or bonds. Therefore, you will lose more money than you gain over time.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

cftc.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's not exactly legal – WSJ

How To

Investing in gold or stocks

It might seem risky to invest in gold as an investment vehicle these days. The reason behind this is that many people believe that gold is no longer profitable to invest in. This belief is due to the fact that many people see gold prices dropping because of the global economy. They feel that gold investment would cause them to lose money. There are many benefits to investing in gold. Below are some of them.

Gold is one of the oldest forms of currency known to man. There are thousands of records that show gold was used over the years. It has been used as a store for value by people all over the globe. It continues to be used in South Africa, as a way of paying their citizens.

When deciding whether to invest in gold, the first thing you need to do is to decide what price per gram you are willing to pay. You must determine how much gold bullion you can afford per gram before you consider buying it. If you don’t know what the current market price is, you can always call a local jewelry store and ask them their opinion.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. Although the price of gold has dropped, production costs have not.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. If you plan to do so as long-term investments, it is worth looking into. Selling your gold at a higher value than what you bought can help you make money.

We hope that this article has helped you gain a better understanding and appreciation for gold as an investment option. We recommend that you investigate all options before making any major decisions. Only then can informed decisions be made.

—————————————————————————————————————————————————————————————–

By: David Weisberger

Title: The Impact of Cash Creation on Spot Bitcoin ETFs

Sourced From: bitcoinmagazine.com/markets/the-real-implications-of-cash-creation-instead-of-in-kind

Published Date: Thu, 04 Jan 2024 18:02:39 GMT

Did you miss our previous article…

https://altcoinirareview.com/coinmarketcap-selects-gaimin-for-incubation-of-gmrx-token/