Introduction

Last week, the U.S. Securities and Exchange Commission (SEC) approved the launch of 11 different spot bitcoin exchange-traded funds (ETFs). These ETFs experienced a significant trading volume of $7.65 billion in their first two days on the market. While many of these new entrants saw strong inflows, Grayscale's GBTC witnessed notable outflows. This coincided with the fund's discount to net asset value (NAV) reaching its lowest point since February 2021.

Reduced NAV Discount Prompts GBTC Outflows

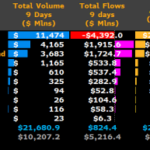

Eric Balchunas, the senior ETF analyst for Bloomberg, shared insights on the "nine newborn" spot bitcoin ETFs. These ETFs have attracted an impressive $1.4 billion in cash, surpassing the $579 million outflow from the Grayscale Bitcoin Trust (GBTC). This led to a net investment growth of $819 million. Balchunas noted that these trades had an average premium of 20 basis points.

When asked about the significant withdrawal from GBTC, Balchunas explained that many traders entered the market to take advantage of the closing discount. They are now leaving to take profits. Additionally, there are average investors who may have decided to endure the tax hit in order to escape the 1.5% fee. Balchunas expects more outflows from GBTC in the future.

This observation aligns with the recent outflows from GBTC, as onchain analysts noticed a significant movement of 4,000 BTC, valued at $175 million, leaving GBTC's bitcoin wallet holdings. This coincided with GBTC's discount to NAV reaching its lowest point since February 2021. It is worth noting that GBTC previously had a premium status before February 23, 2021. Alongside this shift to a more normalized NAV discount, Grayscale's ETF management fees stand out as the highest among the 11 approved ETFs.

Competitive Management Fees

Among the 11 newly approved ETFs, seven funds have management fees below 0.30%. Bitwise's BITB leads with a minimal 0.20% fee. Ark's ARKB, Fidelity's FBTC, Blackrock's IBIT, Valkyrie's BRRR, and Vaneck's HODL each offer a competitive 0.25% fee. Franklin Templeton's EZBC follows closely with a 0.29% fee, while Wisdomtree's BTCW charges 0.30%. Invesco's fee is slightly higher at 0.39%. Hashdex's DEFI fund has a substantial 0.94% fee, approaching GBTC's 1.5% management fee. The more favorable fees of these new funds could be a factor in investors shifting away from GBTC.

Additionally, seven of the 11 newly approved spot bitcoin ETFs in the U.S. are currently waiving management fees for a limited time, providing an attractive incentive for early investors. This is a significant change from GBTC, which previously charged a 2% management fee when traded over-the-counter (OTC). The fee was later reduced in anticipation of its transition to an ETF. Despite the outflows, GBTC still holds a substantial amount of 618,000 BTC, far exceeding the recent inflows to these new ETFs.

Conclusion

The recent outflows from Grayscale's GBTC, driven by the closing NAV discount and high management fees, indicate a shift in investor preferences towards the newly approved spot bitcoin ETFs. These ETFs offer more competitive and favorable fee structures, attracting significant inflows. It remains to be seen how GBTC will adapt to this changing landscape and whether it can regain investor confidence.

What are your thoughts on GBTC's outflows? Share your opinions in the comments section below.

Frequently Asked Questions

How much of your portfolio should be in precious metals?

First, let's define precious metals to answer the question. Precious elements are those elements which have a high price relative to other commodities. This makes them extremely valuable for trading and investing. Today, gold is the most commonly traded precious metal.

However, many other types of precious metals exist, including silver and platinum. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is also unaffected significantly by inflation and Deflation.

In general, all precious metals have a tendency to go up with the market. But they don't always move in tandem with one another. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

When the economy is healthy, however, the opposite effect occurs. Investors choose safe assets such Treasury Bonds over precious metals. They become less expensive and have a lower value because they are limited.

To maximize your profits when investing in precious metals, diversify across different precious metals. You should also diversify because precious metal prices can fluctuate and it is better to invest in multiple types of precious metals than in one.

What precious metal should I invest in?

Answering this question will depend on your willingness to take some risk and the return you seek. While gold is considered a safe investment option, it can also be a risky choice. If you are looking for quick profits, gold might not be the right investment. If you have time and patience, you should consider investing in silver instead.

If you don’t desire to become rich quickly, gold may be your best option. Silver may be a better option for investors who want long-term steady returns.

What is a Precious Metal IRA (IRA)?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These precious metals are extremely rare and valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Precious metals often refer to themselves as “bullion.” Bullion is the physical metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. This allows you to receive dividends every year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. You pay only a small percentage of your gains tax. Additionally, you have access to your funds at no cost whenever you need them.

What are the fees associated with an IRA for gold?

A monthly fee of $6 for an Individual Retirement Account is charged. This includes account maintenance fees and investment costs for your chosen investments.

Diversifying your portfolio may require you to pay additional fees. These fees can vary depending on which type of IRA account you choose. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Most providers also charge an annual management fee. These fees are usually between 0% and 1%. The average rate per year is.25%. These rates are usually waived if you use a broker such as TD Ameritrade.

Do you need to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. You cannot recover any money you have invested. This includes any loss of investments from theft, fire, flood or other circumstances.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items have been around for thousands of years and represent real value that cannot be lost. These items are worth more today than they were when first produced.

Consider a reputable business that offers low rates and good products when opening an IRA. It's also wise to consider using a third-party custodian who will keep your assets safe while giving you access to them anytime.

Do not open an account unless you're ready to retire. Do not forget about the future!

Should You Purchase Gold?

Gold was a safe investment option for those who were in financial turmoil. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

Although gold prices have shown an upward trend in recent years, they are still relatively low when compared to other commodities like oil and silver.

Some experts think that this could change in the near future. According to them, gold prices could soar if there is another financial crisis.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

Here are some things to consider if you're considering investing in gold.

- Before you start saving money for retirement, think about whether you really need it. It is possible to save enough money to retire without investing in gold. Gold does offer an extra layer of protection for those who reach retirement age.

- Second, be sure to understand your obligations before you purchase gold. Each offer varying degrees of security and flexibility.

- Keep in mind that gold may not be as secure as a bank deposit. Your gold coins may be lost and you might never get them back.

Don't buy gold unless you have done your research. And if you already own gold, ensure you're doing everything possible to protect it.

How much tax is gold subject to in an IRA

The tax on the sale of gold is based on its fair market value when sold. You don't pay taxes when you buy gold. It's not considered income. If you sell it later, you'll have a taxable gain if the price goes up.

For loans, gold can be used to collateral. When you borrow against your assets, lenders try to find the highest return possible. For gold, this means selling it. It's not guaranteed that the lender will do it. They may hold on to it. They might decide to sell it. You lose potential profits in either case.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. You should leave it alone if you don't intend to lend against it.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

investopedia.com

forbes.com

bbb.org

cftc.gov

How To

The best way to buy gold (or silver) online

To buy gold, you must first understand how it works. Gold is a precious metallic similar to Platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

Two types of gold coins are available today: the legal tender type and the bullion type. Legal tender coins are minted for circulation in a country and usually include denominations like $1, $5, $10, etc.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They cannot be used in currency exchanges. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. Each dollar spent earns the buyer 1 gram gold.

The next thing you should know when looking to buy gold is where to do it from. If you want to purchase gold directly from a dealer, then a few options are available. You can start by visiting your local coin shop. You could also look into eBay or other reputable websites. You can also look into buying gold online from private sellers.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. Private sellers typically charge 10% to 15% commission on each transaction. You would receive less money from a private buyer than you would from a coin store or eBay. This is a great option for gold investing because you have more control over the item’s price.

Another option for buying gold is to invest in physical gold. While physical gold is easier than paper certificates to store, you still need to make sure it is safe. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

You can either visit a bank, pawnshop or bank to buy gold. A bank will provide you with a loan that allows you to purchase the amount of gold you desire. These are small businesses that let customers borrow money against the items they bring to them. Banks tend to charge higher interest rates, while pawnshops are typically lower.

You can also ask for help to purchase gold. Selling gold is easy too. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: GBTC’s Closing NAV Discount and Steep Fees Trigger Outflows, ETF Analyst Expects ‘More Over Time’

Sourced From: news.bitcoin.com/gbtcs-closing-nav-discount-and-steep-fees-trigger-outflows-etf-analyst-expects-more-over-time/

Published Date: Sat, 13 Jan 2024 14:30:07 +0000

Related posts:

Grayscale’s Bitcoin Trust GBTC: Market Sentiment Shifts and Implications for Investors

Grayscale’s Bitcoin Trust GBTC: Market Sentiment Shifts and Implications for Investors

Forecasting Total Bitcoin Selling Pressure & Market Impact: GBTC Outflows

Forecasting Total Bitcoin Selling Pressure & Market Impact: GBTC Outflows

GBTC: Market Share in ETF Trade Volume Drops as $2 Billion BTC Exodus Occurs

GBTC: Market Share in ETF Trade Volume Drops as $2 Billion BTC Exodus Occurs

Grayscale’s GBTC Sees a Significant Decrease in Bitcoin Holdings Amid Growing Bitcoin ETF Competition

Grayscale’s GBTC Sees a Significant Decrease in Bitcoin Holdings Amid Growing Bitcoin ETF Competition