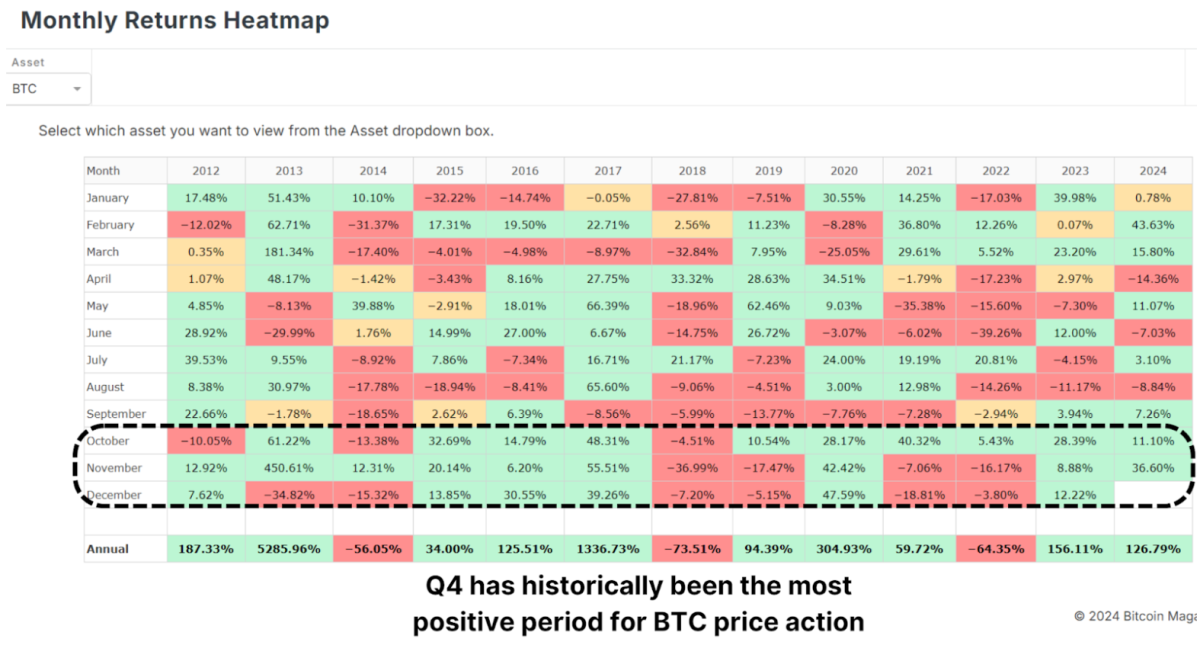

Bitcoin is concluding a remarkable month, with a surge of over $30,000 in November, indicating a renewed bullish sentiment in the market. As December approaches, investors are keen to know if Bitcoin's momentum can continue into 2025. With favorable macroeconomic conditions, historical trends, and on-chain data aligning, let's delve into what lies ahead.

November's Unprecedented Performance

November 2024 was a historic month for Bitcoin, with its price soaring from around $67,000 to nearly $100,000, marking a peak-to-trough increase of approximately 50%. This surge made it the best-performing month in terms of dollar increase, rewarding long-term holders who weathered months of consolidation post Bitcoin's previous all-time high of $74,000.

Historical Trends and Future Outlook

Traditionally, Q4 has been Bitcoin's strongest quarter, with November often standing out as a notable month. December, historically performing well in previous bull cycles, presents a promising outlook. However, temporary cooling after a rally is not unexpected.

Impact of Dollar Strength and Global Liquidity

Interestingly, Bitcoin's rise coincided with a strengthening U.S. Dollar Index (DXY), a scenario where Bitcoin usually underperforms. The inverse relationship between Bitcoin and DXY historically suggests that a stronger dollar leads to weaker Bitcoin prices and vice versa.

Moreover, the Global M2 money supply has shown a slight contraction recently. Bitcoin typically correlates positively with global liquidity, making its current performance against expectations. Improved liquidity conditions in the future could further boost Bitcoin's price.

Similarities to Previous Bull Markets

Bitcoin's current trajectory mirrors past bull cycles, notably the 2016–2017 cycle. These cycles began with gradual price increases, broke crucial resistance levels, and entered exponential growth phases.

If Bitcoin decisively breaks above the key $100,000 resistance level, we may witness a repeat of explosive price movements as Bitcoin enters a bullish phase of exponential growth.

Institutional Adoption and Accumulation

Institutions continue to accumulate Bitcoin, with Bitcoin ETFs adding substantial amounts of BTC to their holdings. Corporations like MicroStrategy have strengthened their Bitcoin strategies, holding close to 400,000 BTC. This institutional demand indicates growing confidence in Bitcoin as a long-term store of value, tightening supply and boosting prices.

Future Prospects and Conclusion

While December historically favors Bitcoin, short-term volatility may moderate gains post-November's rally. Institutional accumulation hints at a bullish longer-term outlook. The $100,000 level remains crucial, potentially paving the way for a significant rally in 2025. With favorable macroeconomic, technical, and on-chain metrics aligning, Bitcoin's future looks promising.

For more insights on this topic, watch a recent YouTube video: The BIGGEST Bitcoin Month EVER – So What Happens Next?

Don't miss our Black Friday Sale! Get 40% off all annual plans and access exclusive Bitcoin investing features. Upgrade now at https://www.bitcoinmagazinepro.com/subscribe/

Frequently Asked Questions

Is gold a good choice for an investment IRA?

Gold is an excellent investment for any person who wants to save money. It's also a great way to diversify your portfolio. But gold has more to it than meets the eyes.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is often called “the most ancient currency in the universe.”

Gold is not created by governments, but it is extracted from the earth. Because it is rare and difficult to make, it is extremely valuable.

The supply-demand relationship determines the gold price. If the economy is strong, people will spend more money which means less people can mine gold. The result is that gold's value increases.

On the other hand, people will save cash when the economy slows and not spend it. This causes more gold to be produced, which lowers its value.

It is this reason that gold investing makes sense for businesses and individuals. You'll reap the benefits of investing in gold when the economy grows.

Additionally, you'll earn interest on your investments which will help you grow your wealth. If gold's value falls, you don't have to lose any of your investments.

What is a Precious Metal IRA?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These metals are known as “precious” because they are rare and extremely valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Precious metals are often referred to as “bullion.” Bullion refers only to the actual metal.

You can buy bullion through various channels, including online retailers, large coin dealers, and some grocery stores.

With a precious metal IRA, you invest in bullion directly rather than purchasing shares of stock. This allows you to receive dividends every year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. You pay only a small percentage of your gains tax. Additionally, you have access to your funds at no cost whenever you need them.

Should You Purchase Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Some experts believe that this could change very soon. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

Consider these things if you are thinking of investing in gold.

- First, consider whether or not you need the money you're saving for retirement. You can save for retirement and not invest your savings in gold. The added protection that gold provides when you retire is a good option.

- Second, ensure you fully understand the risks involved in buying gold. Each offer varying degrees of security and flexibility.

- Keep in mind that gold may not be as secure as a bank deposit. If you lose your gold coins, you may never recover them.

Do your research before you buy gold. And if you already own gold, ensure you're doing everything possible to protect it.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

bbb.org

irs.gov

cftc.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement plans

How To

Investing in gold or stocks

This might make it seem very risky to invest gold as an investment tool. This is because many people believe gold is no longer financially profitable. This belief is based on the fact that gold prices are being driven down by global economic conditions. They fear that investing in gold will result in a loss of money. There are many benefits to investing in gold. Let's take a look at some of the benefits.

One of the oldest currencies known to man is gold. It has been in use for thousands of year. It was used by many people around the globe as a currency store. It's still used by countries like South Africa as a method of payment.

The first point to consider when deciding whether or not you should invest in gold is what price you want to pay per gram. When looking into buying gold bullion, you must decide how much you are willing to spend per gram. You could contact a local jeweler to find out what their current market rate is.

It is important to remember that even though gold prices have dropped in recent times, the cost of making gold has risen. The price of gold may have fallen, but the production costs haven’t.

The amount of gold that you are planning to purchase is another important consideration when deciding whether or not gold should be bought. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. However, if you are planning on doing so for long-term investments, then it is worth considering. Selling your gold at a higher value than what you bought can help you make money.

We hope this article has given you an improved understanding of gold investment tools. We recommend that you investigate all options before making any major decisions. Only after you have done this can you make an informed choice.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Will Bitcoin Price Surpass November's Record in December?

Sourced From: bitcoinmagazine.com/markets/will-december-surpass-novembers-record-breaking-bitcoin-price-increase

Published Date: Fri, 29 Nov 2024 14:00:00 GMT