Bull runs are like wildfires: they need a combination of conditions to get started.

A wildfire needs a long period of no rain, high temperatures, and then high winds at the point of ignition.

Yes – wildfires have been exacerbated by record methane emissions that Bitcoin helps mitigate, but that’s not what this article’s about: this time it’s just an analogy.

The Role of Halvings

Halvings cause a drying up of new supply of Bitcoin (no rain). They draw increased interest in timing Bitcoin market entry (high temperature). But they also need high winds and an ignition event.

That high wind is the winds of change around the Bitcoin ESG narrative.

The ignition event will be the first large ESG Investment Committee backing Bitcoin for ESG reasons.

The Problem Faced by ESG Investors

By 2026, ESG-focused institutional investment will have rocketed to 33.9 trillion dollars. That’s more than $1 for every $5 of assets under management according to a PwC report.

But the more important takeaway from the report that should alert Bitcoin hodlers current and future is that right now ESG investors have a problem: demand for solid ESG investment outstrips supply. ESG investors take a long time to find suitable ESG investments, with a very high 30% of investors saying they struggle to find attractive ESG investment opportunities.

Bitcoin is now in pole position to answer that problem. Here’s why:

The Opportunity For Bitcoin

2023 marked the turning of the tide in the ESG narrative around Bitcoin.

In just 53 halcyon days from Aug 1-Sept 22 this year, five events helped flip the Bitcoin ESG narrative. They were:

1. KPMG Report concludes that Bitcoin supports the ESG imperative (1 Aug)

2. Peer-reviewed research supports the thesis that Bitcoin can be good for the environment (8 Aug)

3. Cambridge acknowledges Bitcoin energy overestimation (30 Aug)

4. Bloomberg Intelligence charts show Bitcoin mining leading decarbonization (14 Sept)

5. Institute of Risk Management concludes Bitcoin helps renewable transition (22 Sept)

These reports and papers were produced independently, from highly reputable researchers and organizations, and rather than concluding Bitcoin is "not as bad for the environment as we thought," they reached the much stronger conclusion that Bitcoin was net positive as an ESG asset.

This wind of change has the potential to intensify into the high wind that Bitcoin needs to complete the set of conditions needed for a bull run.

What This Means

Information is power. Right now, there is an information asymmetry. The narrative has changed based on new data. But most ESG investors don’t have this data. Yet. Until they get this new data, they’ll keep believing the old "Bitcoin is net negative for the environment" narrative.

In case we needed evidence of that, here’s a DM I got from a fund manager just the other day.

This type of ESG investor still cannot deploy a higher percentage into Bitcoin because their ESG information on Bitcoin is several years out of date and they are not yet aware of the five narrative-flipping events described above.

While the Bitcoin-views of ESG Investment Committee members are often strongly negative, it has been my experience that unlike environmental NGOs, their views are also loosely held. When I was in Sydney recently, a young Australian enthusiastically bounded up to me and said "Dan – I used your charts to orange-peel our investment committee!"

So what will happen when this information asymmetry is blown away by the high winds of the new Bitcoin ESG narrative?

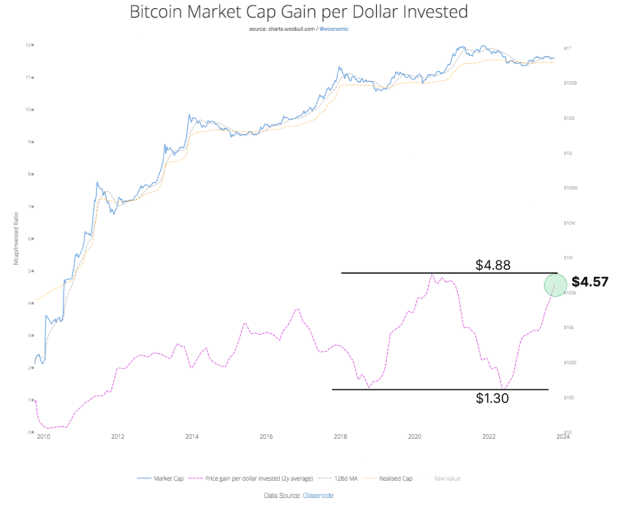

Thanks to Willy Woo’s analysis, we can quantify what that will mean to Bitcoin’s market cap within a range.

Quantifying How ESG = NGU

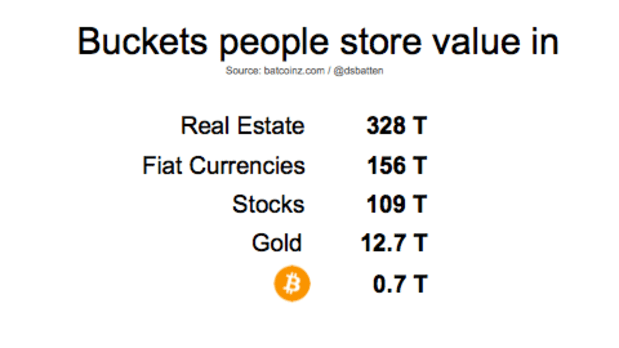

ESG adoption of Bitcoin is very bullish for Bitcoin’s relatively thimble-sized market of $713Bln at the time of writing. Woo argues that Bitcoin needs to stay above 1 Tr before the institutions that hold the wealth of nation-states and/or retirement funds feel comfortable investing in it en masse.

What then would happen to Bitcoin’s market cap if ESG investors deployed 1% of their 2026 AUM (Assets Under Management) into Bitcoin?"

At today’s market-cap-increase-per-dollar-invested ratio – Bitcoin’s market cap would increase to a healthy $2.26 Trillion. That’s more than triple what it is today.

If 2.5% of ESG funds AUM was deployed into Bitcoin, it would increase market cap to $3.87 Trillion. That’s more than 5 times today’s market cap. This puts it squarely on the roadmap for institutional investors, which leads to more capital deployment, which in turn creates a very bullish positive feedback loop.

Even without this feedback loop though, a 2.5% ESG deployment could catalyze a Bitcoin price of around $193,000 during a possible 2026 bear market.

This is not a prediction but a simulation. I am saying if ESG ICs deployed 1-2.5% of AUM, then the consequence for Bitcoin’s market cap could be 2-5x.

That said, Bitcoin has the unique potential of becoming the world’s first Greenhouse Negative industry without offsets: something that would require Bitcoin mining methane mitigation on just 35 mid-sized venting landfills. Should that occur by the aggressive yet possible timeframe of 2026, I would be surprised if Bitcoin did not achieve a 2.5% deployment of ESG investor AUM or greater.

Ignition

As if we needed more confirmation that the winds of ESG narrative change are swirling, recently I spoke at the 2023 Plan₿ Forum in Lugano on the topic "Bitcoin is the World’s best ESG Asset". I had the idea of using a claim both Michael Saylor and Baseload have previously made and making it into a keynote backed up with supporting data.

The recording is currently the most-watched talk from the 2023 conference on YouTube not because of any great notoriety on my part (there were much better-known speakers) but because as Victor Hugo once remarked "Nothing is more powerful than an idea whose time has come."

Bitcoin as an ESG asset is an idea whose time has come. Bitcoin has now demonstrated its ability to increase renewable energy capacity and reduce methane emissions at a time when the world urgently needs solutions to both. By contrast, now Ethereum has migrated to Proof of Stake, it can no longer assist with either of these urgent needs.

In early 2022, most Bitcoiners were still trying to "defend" Bitcoin against ESG attacks through me-tooism such as "But Tumble Dryers use more energy than us". But by 2023, Bitcoiners started taking the game into the opponent’s half, with consistent success. The strategy of sharing fact-based reports and inspiring stories about the positive ESG case for Bitcoin is working: This year both The Hill and Bloomberg began publishing positive press on Bitcoin mining. Positive mainstream news coverage outnumbered negative accounts 4:1. And then of course there were those 53 days of narrative flips.

Every four years, a new false-narrative is hatched. However, every four years, it’s also "tick tock, next false-narrative for the chopping block."

The story that Bitcoin "destroys the environment" if not dead, is at least a Nearly Headless Nick.

The approaching halving will further dry up Bitcoin supply while simultaneously heating up investor interest. All the while, the winds of change in the ESG narrative are picking up knots. The conditions are now perfect for the inevitable igniting spark of large ESG fund deployment into Bitcoin.

ESG = NGU.

Daniel Batten is the founder of CH4Capital, who provides infrastructure financing to Bitcoin mining companies powered by vented methane from landfills.

This is a guest post by Daniel Batten. Opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

Can the government take your gold?

Your gold is yours, so the government cannot confiscate it. You earned it through hard work. It belongs exclusively to you. However, there may be some exceptions to this rule. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. You can also lose precious metals if you owe taxes. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

Should You Buy Gold?

In the past, gold was considered a haven for investors during economic turmoil. Today, many people are looking to precious metals like gold and avoiding traditional investments like bonds and stocks.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Experts believe this could change soon. They say that gold prices could rise dramatically with another global financial crisis.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

These are some important things to remember if your goal is to invest in gold.

- Before you start saving money for retirement, think about whether you really need it. It's possible to save for retirement without putting your savings into gold. The added protection that gold provides when you retire is a good option.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each one offers different levels security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. Losing your gold coins could result in you never being able to retrieve them.

If you are thinking of buying gold, do your research. And if you already own gold, ensure you're doing everything possible to protect it.

Do You Need to Open a Precious Metal IRA

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. You cannot recover any money you have invested. All your investments can be lost due to theft, fire or flood.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These coins have been around for thousands and represent a real asset that can never be lost. They are likely to fetch more today than the price you paid for them in their original form.

You should choose a reputable firm that offers competitive rates. You should also consider using a third party custodian to protect your assets and give you access at any time.

When you open an account, keep in mind that you won't receive any returns until your retirement. Don't forget the future!

What tax is gold subject in an IRA

The fair value of gold sold to determines the price at which tax is due. You don't have tax to pay when you buy or sell gold. It is not income. If you decide to sell it later, there will be a taxable gain if its price rises.

For loans, gold can be used to collateral. Lenders seek to get the best return when you borrow against your assets. This usually involves selling your gold. It's not guaranteed that the lender will do it. They may just keep it. They might decide to sell it. In either case, you risk losing potential profits.

To avoid losing money, only lend against gold if you intend to use it for collateral. If you don't plan to use it as collateral, it is better to let it be.

Is physical gold allowed in an IRA.

Gold is money and not just paper currency. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Today, many Americans invest in precious metals such as gold and silver rather than stocks and bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. During these turbulent market times, gold was among few assets that outperformed the stocks.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Your stock portfolio can fall, but you will still own your shares. Gold can be worth more than its investment in a company that defaults on its obligations.

Finally, gold provides liquidity. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. The liquidity of gold makes it a good investment. This allows one to take advantage short-term fluctuations within the gold price.

How much gold do you need in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. Start small with $5k-10k. Then as you grow, you could move into an office space and rent out desks, etc. This way, you don't have to worry about paying rent all at once. It's only one monthly payment.

You also need to consider what type of business you will run. My website design company charges clients $1000-2000 per month depending on the order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. Therefore, you might only get paid one time every six months.

Before you can determine how much gold you'll need, you must decide what type of income you want.

I recommend starting with $1k to $2k of gold, and then growing from there.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

cftc.gov

irs.gov

How To

Guidelines for Gold Roth IRA

Start saving as soon as possible to save for your retirement. As soon as you become eligible, which is usually around age 50, start saving and keep it up throughout your career. To ensure sufficient growth, it is vital that you contribute enough each year.

You also want to take advantage of tax-free opportunities such as a traditional 401(k), SEP IRA, or SIMPLE IRA. These savings vehicles allow you to make contributions without paying taxes on earnings until they are withdrawn from the account. This makes them a great choice for people who don’t have access employer matching funds.

The key is to save regularly and consistently over time. If you don't contribute the maximum amount, you will miss any tax benefits.

—————————————————————————————————————————————————————————————–

By: Daniel Batten

Title: Why The New ESG Narrative About Bitcoin Will Power The Next Bull Run

Sourced From: bitcoinmagazine.com/markets/why-the-new-esg-narrative-about-bitcoin-will-power-the-next-bull-run

Published Date: Fri, 01 Dec 2023 17:00:00 GMT

Did you miss our previous article…

https://altcoinirareview.com/the-future-of-ai-revolutionizing-the-crypto-industry-with-cogwise/