For years, skeptics have hesitated to jump into the world of Bitcoin, thinking they missed the boat. However, the truth is, it's never too late. Bitcoin continues to shine as a top investment choice, whether you're investing $25 weekly or millions.

Bitcoin Magazine Pro's Portfolio Analysis Tool

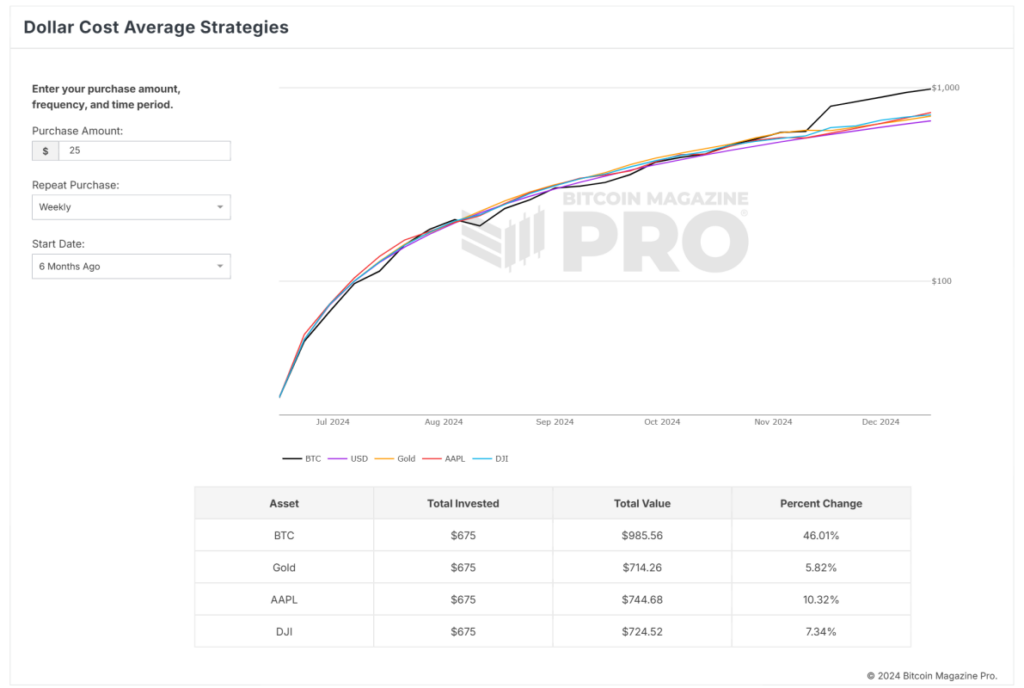

Bitcoin Magazine Pro offers a free tool called Dollar Cost Average (DCA) Strategies. This tool allows investors to compare Bitcoin's performance with traditional assets like gold, Dow Jones, and Apple stock. By consistently investing over time, even small amounts can lead to significant returns.

Understanding Bitcoin Dollar Cost Averaging

Dollar cost averaging involves investing a fixed amount at regular intervals, regardless of the asset's price. This strategy removes emotions from investing and smooths out market volatility, helping investors benefit from market dips while growing their portfolios steadily.

Outperforming Traditional Assets

Let's look at the numbers using the DCA Strategies tool over different timeframes:

– 6 Months: Investing $25 weekly in Bitcoin would have grown to $985.56, a 46.01% return. In comparison, gold increased by 5.82%, Apple by 10.32%, and Dow Jones by 7.34%.

– 1 Year: With a $1,325 investment in Bitcoin, your portfolio would now be worth $2,140.20, a 61.52% return. Gold increased by 14.50%, Apple by 22.80%, and Dow Jones by 11.36%.

– 2 Years: A $2,650 investment in Bitcoin would now be valued at $7,145.42, a 169.64% return. Gold rose by 26.56%, Apple by 36.22%, and Dow Jones by 21.13%.

– 4 Years: A $5,250 investment in Bitcoin would now be worth $14,877.77, a remarkable 183.39% return. Gold increased by 37.26%, Apple by 54.05%, and Dow Jones by 27.32%.

The Irrelevance of Market Timing

Timing the market is unnecessary when adopting a DCA strategy. Bitcoin's long-term performance proves the effectiveness of consistent investments over time. With institutional adoption and technological advancements, Bitcoin's future looks promising.

The Future Potential of Bitcoin

Despite Bitcoin's impressive performance, its market capitalization is still small compared to traditional assets like gold. There's room for significant growth as more individuals and institutions recognize its value. Bitcoin's market cap needs to increase about 9.24 times to reach parity with gold, projecting a price of $934,541 per BTC.

Empowering Investors with Tools

Bitcoin Magazine Pro's DCA Strategies tool allows investors to customize their investment parameters, compare against other assets, and create tailored strategies aligned with their financial goals.

Seizing the Opportunity

It's never too late to start investing in Bitcoin. With a DCA strategy, even cautious investors can benefit from long-term growth. Take action now and use Bitcoin Magazine Pro's tool to shape your investment approach.

Remember, this article is for informational purposes only. Always conduct your research before making investment decisions.

Frequently Asked Questions

What proportion of your portfolio should you have in precious metals

To answer this question, we must first understand what precious metals are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them valuable in investment and trading. Gold is by far the most common precious metal traded today.

However, many other types of precious metals exist, including silver and platinum. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is also unaffected significantly by inflation and Deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. That said, they do not always move in lockstep with each other. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. Investors expect lower interest rate, making bonds less appealing investments.

Contrary to this, when the economy performs well, the opposite happens. Investors choose safe assets such Treasury Bonds over precious metals. They become less expensive and have a lower value because they are limited.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

What is a Precious Metal IRA, and how can you get one?

An IRA with precious metals allows you to diversify retirement savings into gold and silver, palladium, rhodiums, iridiums, osmium, or other rare metals. These are “precious metals” because they are hard to find, and therefore very valuable. They are great investments for your money, and they can protect you from inflation or economic instability.

Bullion is often used for precious metals. Bullion refers simply to the physical metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

You can invest directly in bullion with a precious metal IRA instead of buying shares of stock. This will ensure that you receive annual dividends.

Precious metal IRAs are not like regular IRAs. They don't need paperwork and don't have to be renewed annually. Instead, you pay a small percentage tax on the gains. You also have unlimited access to your funds whenever and wherever you wish.

What amount should I invest in my Roth IRA?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. You cannot touch your principal (the amount you originally deposited). You cannot withdraw more than the original amount you contributed. If you are able to take out more that what you have initially contributed, you must pay taxes.

The second rule states that income taxes must be paid before you can withdraw earnings. Withdrawing your earnings will result in you paying taxes. Let's assume that you contribute $5,000 each year to your Roth IRA. Let's also say that you earn $10,000 per annum after contributing. You would owe $3,500 in federal income taxes on the earnings. This leaves you with $6,500 remaining. Because you can only withdraw what you have initially contributed, this is all you can take out.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types: Roth IRAs that are traditional and Roth. Traditional IRAs allow for pre-tax deductions from your taxable earnings. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. You have the option to withdraw any amount from a traditional IRA.

A Roth IRA doesn't allow you to deduct your contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. Unlike a traditional IRA, there is no minimum withdrawal requirement. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Do you want to keep your IRA gold at home? It's not exactly legal – WSJ

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement funds

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads. Example. And Risk Metrics

How To

The best way online to buy gold or silver

To buy gold, you must first understand how it works. Gold is a precious metallic similar to Platinum. It's rare and often used to make money due its resistance and durability to corrosion. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

Two types of gold coins are available today: the legal tender type and the bullion type. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They cannot be used in currency exchanges. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Each dollar spent by the buyer is worth 1 gram.

When looking to buy precious metals, the next thing you should be aware of is where it can be purchased. There are a few options if you wish to buy gold directly from a dealer. First, go to your local coin shop. You can also try going through a reputable website like eBay. You can also purchase gold through private online sellers.

Private sellers are individuals who offer gold for sale, either at wholesale prices or retail prices. Private sellers typically charge 10% to 15% commission on each transaction. You would receive less money from a private buyer than you would from a coin store or eBay. This option is often a great one for investors in gold, as it gives you greater control over the item's value.

You can also invest in gold physical. Physical gold is much easier to store than paper certificates, but you still have to worry about storing it safely. Physical gold must be kept safe in an impassible container, such as a vault.

You can either visit a bank, pawnshop or bank to buy gold. A bank can offer you a loan for the amount that you need to buy gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks charge higher interest rates than those offered by pawn shops.

A third way to buy gold? Simply ask someone else! Selling gold is also easy. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————–

By: Mark Mason

Title: Why Investing in Bitcoin is Still a Smart Move

Sourced From: bitcoinmagazine.com/markets/why-its-not-too-late-to-invest-in-bitcoin

Published Date: Wed, 11 Dec 2024 20:14:04 GMT