Hey there, crypto enthusiasts! If you woke up to news of Bitcoin's price plummeting to $84,000, you're not alone. The market is experiencing some serious rollercoaster vibes as uncertainty looms large. But fear not, we're here to break it down for you!

Unpacking the Price Plunge

Market Volatility Strikes Again

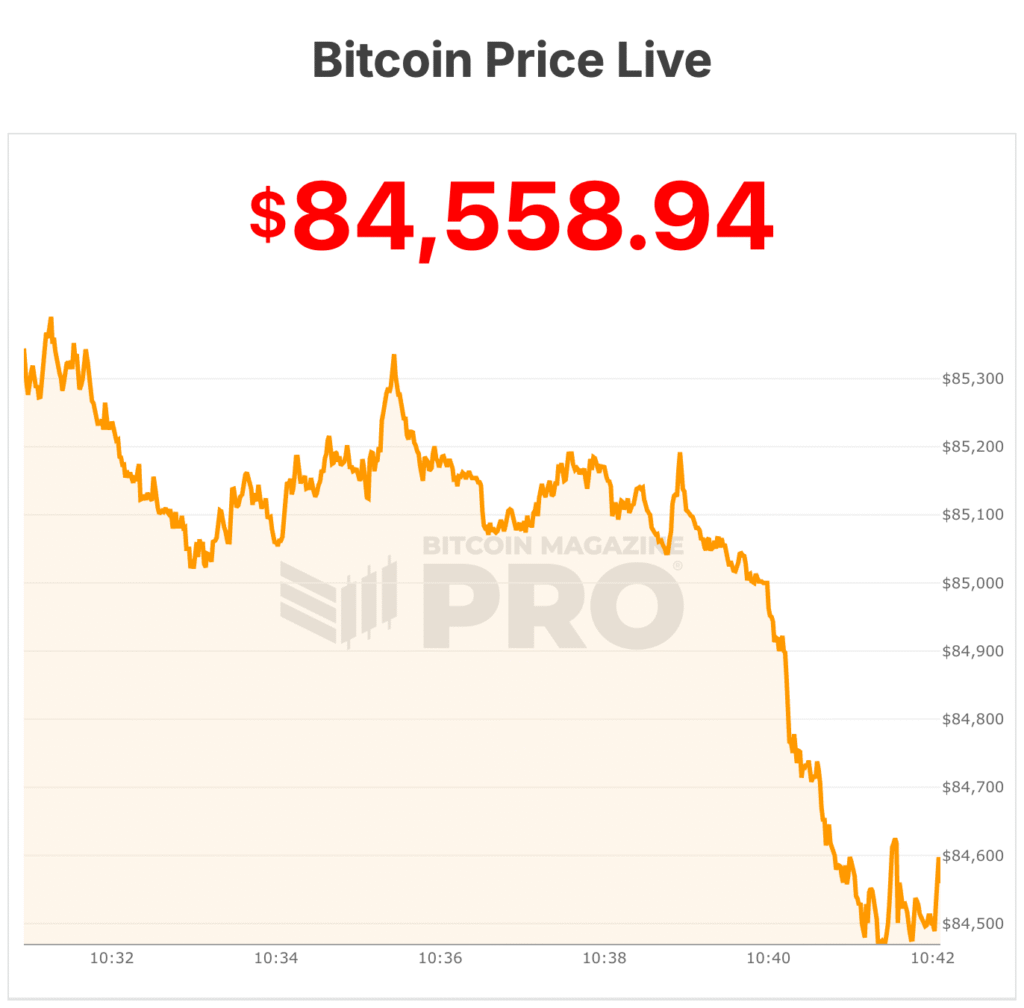

Picture this: Bitcoin's price taking a nosedive to $84,000 after dancing around the $90,000 mark. Yep, that's the reality we're dealing with. The market's shaky foundation and external uncertainties are calling the shots.

What Led to This?

Within a day, Bitcoin went from a high of $90,400 to a low of $84,416. The Federal Reserve's recent meeting played a starring role in this drama, adding fuel to the already blazing fire of volatility.

The $84,000 Lifeline

Critical Support Levels

Bitcoin is now in a tug of war to stay afloat above $84,000. Analysts are keeping a close eye on this level as a make-or-break point for stabilizing the ship. Drop below this, and we might be in for a rough ride towards the $72,000–$68,000 zone.

Bulls, Brace Yourselves!

The bulls are gearing up for battle to prevent a complete breakdown. You can almost hear them chanting, "Thou shall not pass $84,000!" The stakes are high, and the tension is real.

Looking Ahead

White House Showdown

Next on the agenda: a White House pow-wow on February 2 to hash out U.S. crypto legislation. The spotlight is on contentious issues, like the treatment of interest on stablecoins. Let's see if they can find common ground after the previous talks hit a deadlock.

As the dust settles, Bitcoin is currently trading at $84,437, with a daily volume of $48 billion. It's down 4% in the past day and 6% from its week's peak. The crypto rollercoaster seems to have found its temporary stop at $85,417.

So, buckle up, fellow crypto adventurers! The journey continues, and the twists and turns are all part of the ride. Stay informed, stay curious, and let's navigate these crypto waters together!

Frequently Asked Questions

Is gold a good choice for an investment IRA?

For anyone who wants to save some money, gold can be a good investment. It's also a great way to diversify your portfolio. But there is more to gold than meets the eye.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It's sometimes called “the world's oldest money”.

Gold is not created by governments, but it is extracted from the earth. That makes it very valuable because it's rare and hard to create.

The supply-demand relationship determines the gold price. The strength of the economy means people spend more, and so, there is less demand for gold. As a result, the value of gold goes up.

On the flip side, when the economy slows down, people hoard cash instead of spending it. This leads to more gold being produced which decreases its value.

This is why gold investment makes sense for both individuals and businesses. You will benefit from economic growth if you invest in gold.

Additionally, you'll earn interest on your investments which will help you grow your wealth. Additionally, you won't lose cash if the gold price falls.

How much gold should your portfolio contain?

The amount you make will depend on the amount of capital you have. If you want to start small, then $5k-$10k would be great. Then as you grow, you could move into an office space and rent out desks, etc. This way, you don't have to worry about paying rent all at once. Rent is only paid per month.

Consider what type of business your company will be running. My website design company charges clients $1000-2000 per month depending on the order. This is why you should consider what you expect from each client if you're doing this kind of thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. You may get paid just once every 6 months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Should You Buy or Sell Gold?

Gold was considered a safety net for investors during times of economic turmoil in the past. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

Although gold prices have shown an upward trend in recent years, they are still relatively low when compared to other commodities like oil and silver.

Some experts believe that this could change very soon. According to them, gold prices could soar if there is another financial crisis.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- Before you start saving money for retirement, think about whether you really need it. You can save money for retirement even if you don't invest in gold. However, you can still save for retirement without putting your savings into gold.

- Second, be sure to understand your obligations before you purchase gold. Each offer varying degrees of security and flexibility.

- Last but not least, gold doesn't provide the same level security as a savings account. If you lose your gold coins, you may never recover them.

You should do your research before buying gold. Protect your gold if you already have it.

What are the advantages of a gold IRA

It is best to put your retirement money in an Individual Retirement Account (IRA). It is tax-deferred until it's withdrawn. You have complete control over how much you take out each year. And there are many different types of IRAs. Some are better suited for people who want to save for college expenses. Some are for investors who seek higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. These earnings don't get taxed if they withdraw funds. This account is a good option if you plan to retire early.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. You won't have the hassle of making deposits each month. You could also set up direct debits to never miss a payment.

Finally, gold remains one of the best investment options today. It is not tied to any country so its value tends stay steady. Even in times of economic turmoil, gold prices tend not to fluctuate. Therefore, gold is often considered a good investment to protect your savings against inflation.

What is the tax on gold in Roth IRAs?

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

Each state has its own rules regarding these accounts. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you up to April 1st. New York is open until 70 1/2. To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Lawful – WSJ

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement account

How To

How to Hold Physical Gold in an IRA

The best way of investing in gold is to purchase shares from companies that produce gold. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. If they survive, there's still the risk of losing money due to fluctuations in the price of gold.

You can also buy gold directly. You will need to either open an online or bank account or simply buy gold from a reliable seller. The advantages of this option include the ease of access (you don't need to deal with stock exchanges) and the ability to make purchases when prices are low. It's also easier to see how much gold you've got stored. The receipt will show exactly what you paid. You'll also know if taxes were not paid. There's also less chance of theft than investing in stocks.

However, there are disadvantages. There are some disadvantages, such as the inability to take advantage of investment funds and interest rates from banks. You won't have the ability to diversify your holdings; you will be stuck with what you purchased. Finally, tax man may want to ask where you put your gold.

BullionVault.com is the best website to learn about gold purchases in an IRA.

—————————————————————————————————————————————————————————————–

By: Micah Zimmerman

Title: Why Bitcoin's Price Drop to $84,000 Signals Market Turbulence Ahead

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-crashes-5-to-85k

Published Date: Thu, 29 Jan 2026 15:43:18 +0000