As we delve into the realm of Bitcoin, two compelling narratives stand out prominently: the surge in Bitcoin's corporate treasuries and the burgeoning bitcoin mining sector. From (Micro)Strategy's monumental billion-dollar Bitcoin acquisitions to the prominence of MetaPlanet and the exponential growth of bitcoin mining companies, institutional and industrial adoption are now pillars fortifying the network's foundation. However, after years of consistent accumulation and market outperformance, data indicates a pivotal turning point on the horizon — one that could shape the future…

Unpacking Bitcoin Treasury Accumulation

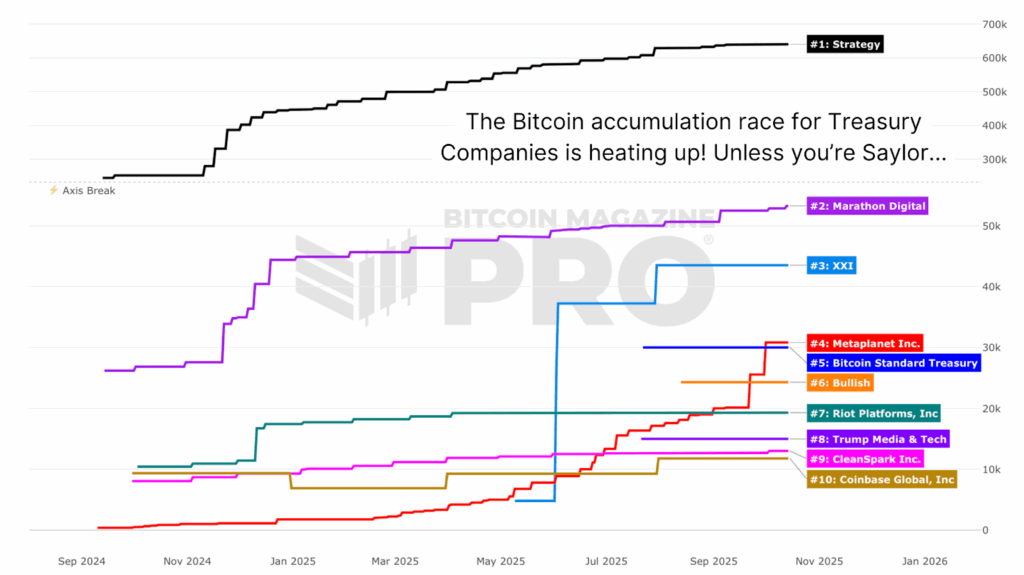

Our innovative Bitcoin Treasury Tracker offers a day-to-day glimpse into the substantial Bitcoin holdings of major public and private treasury entities, detailing their accumulation timelines and evolution of positions. Together, these treasuries now possess a colossal stash of over 1 million BTC, a remarkable figure exceeding 5% of the total circulating supply.

The Impact of Accumulation

The sheer magnitude of this accumulation has been a linchpin in bolstering Bitcoin's current cycle robustness. Nevertheless, some of these companies are encountering mounting pressure as their stock valuations struggle to mirror Bitcoin's price surge.

Assessing Valuation Compression Among Bitcoin Treasuries

Leading the pack in corporate Bitcoin integration, (Micro)Strategy / MSTR remains a key player as a publicly traded Bitcoin holder. Yet, recent times have witnessed its stock performance trailing behind Bitcoin's price trajectory. While Bitcoin has been consolidating within a wide range, MSTR's equity has taken a steeper decline, driving its Net Asset Value (NAV) Premium closer to parity at 1.0x.

Understanding Equity Leverage Dynamics

This shift signifies that investors are increasingly valuing the company based on its direct Bitcoin exposure, with minimal premium for management prowess, future scalability, or strategic advancements. In previous cycles, MSTR commanded a substantial premium as markets lauded its leveraged exposure…

A Pivotal Moment for Bitcoin and Bitcoin Mining Stocks

A significant perspective emerges from the BTCUSD to MSTR ratio, a metric gauging how many MSTR shares can be obtained with one Bitcoin. Currently, the ratio stands at approximately 350 shares per BTC, positioning it at a critical historical support-turned-resistance level that has historically dictated price action turning points.

Deciphering Historical Support Levels

This ratio unveils a crucial cycle support zone, underlining the intricate dance between Bitcoin's performance and that of prominent Bitcoin-holding companies. As we stand at this juncture, the interplay between these elements could shape the trajectory of the market in the days to come.

Embrace the evolving landscape of Bitcoin and its interconnected entities, for within these transformations lie opportunities for growth and strategic decision-making. Stay informed, stay engaged, and let the dynamics of this digital realm empower your financial journey.

Frequently Asked Questions

What's the advantage of a Gold IRA?

There are many advantages to a gold IRA. You can diversify your portfolio with this investment vehicle. You have control over how much money goes into each account.

You also have the option to transfer funds from other retirement plans into a IRA. This makes for an easy transition if you decide to retire early.

The best part is that you don't need special skills to invest in gold IRAs. They are readily available at most banks and brokerages. Withdrawals can be made instantly without the need to pay fees or penalties.

There are, however, some drawbacks. Gold is historically volatile. So it's essential to understand why you're investing in gold. Are you seeking safety or growth? Is it for insurance purposes or a long-term strategy? Only then will you be able make informed decisions.

If you are planning to keep your Gold IRA indefinitely you will want to purchase more than one ounce. One ounce doesn't suffice to cover all your needs. You may need several ounces, depending on what you intend to do with your precious gold.

You don’t necessarily need a lot if you’re looking to sell your gold. Even a single ounce can suffice. These funds won't allow you to purchase anything else.

Can I keep a Gold ETF in a Roth IRA

You may not have this option with a 401(k), however, you might want to consider other options, like an Individual retirement account (IRA).

Traditional IRAs allow for contributions from both employees and employers. A Employee Stock Ownership Plan, or ESOP, is another way to invest publicly traded companies.

An ESOP can provide tax advantages, as employees are allowed to share in company stock and the profits generated by the business. The money you invest in the ESOP will be taxed at a lower rate than if it were directly held by the employee.

You can also get an Individual Retirement Annuity, or IRA. An IRA allows for you to make regular income payments during your life. Contributions to IRAs do not have to be taxable

Can the government take your gold

Your gold is yours and the government cannot take it. You have earned it by working hard for it. It belongs entirely to you. But, this rule is not universal. If you are convicted of fraud against the federal government, your gold can be forfeit. If you owe taxes, your precious metals could be taken away. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

What Should Your IRA Include in Precious Metals?

It is important to remember that precious metals can be a good investment for anyone. They don't require you to be wealthy to invest in them. In fact, there are many ways to make money from gold and silver investments without spending much money.

You could also consider buying physical coins like bullion bars, rounds or bullion bars. You could also buy shares in companies that produce precious metals. You might also want to use an IRA rollover program offered through your retirement plan provider.

Regardless of your choice, you'll still benefit from owning precious metals. Even though they aren't stocks, they still offer the possibility of long-term growth.

Their prices rise with time, which is a different to traditional investments. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

finance.yahoo.com

irs.gov

forbes.com

bbb.org

How To

3 Ways to Invest Gold for Retirement

It is crucial to understand how you can incorporate gold into your retirement plans. You can invest in gold through your 401(k), if you have one at work. You may also want to consider investing in gold outside of your workplace. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. You might also consider purchasing precious metals directly from a trusted dealer if they are not already yours.

These are the three rules to follow if you decide to invest in gold.

- Buy Gold With Your Cash – Do not use credit cards to purchase gold. Instead, deposit cash into your accounts. This will help you to protect yourself against inflation while also preserving your purchasing power.

- Physical Gold Coins to Own – Physical gold coin ownership is better than having a paper certificate. It's easier to sell physical gold coins rather than certificates. Also, there are no storage fees associated with physical gold coins.

- Diversify Your Portfolio – Never put all of your eggs in one basket. This is how you spread your wealth. You can invest in different assets. This will reduce your risk and give you more flexibility in times of market volatility.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Why Bitcoin Mining Stocks are Surpassing Bitcoin and Corporate Treasuries in the Latest Market Rally

Sourced From: bitcoinmagazine.com/markets/bitcoin-mining-stocks-corporate-treasuries

Published Date: Fri, 17 Oct 2025 19:04:41 +0000