The U.S. Bureau of Labor Statistics released a report on September 13 that showed the consumer price index (CPI), inflation rose by 8.3% per year in August. Market analysts expect that the U.S. Federal Reserve would continue to hike its rates in the future, although this was less than anticipated.

According to the latest CPI Report, US consumer prices rose at 8.3% annually and 8% annual pace.

According to calculations published by the U.S. Bureau of Labor Statistics, August's U.S. inflation figures are now in. According to the Bureau of Labor Statistics, Tuesday's August "consumer price index (CPI) for all urban consumers (Utilities Price Index)" rose by 0.1 percent on a seasonally adjusted base after remaining unchanged in July. Over the past 12 months, the index of all items increased 8.3 percent without seasonal adjustment.

CPI 8.3% pic.twitter.com/wY7iYm26ox

— Sven Henrich (@NorthmanTrader) September 13, 2022

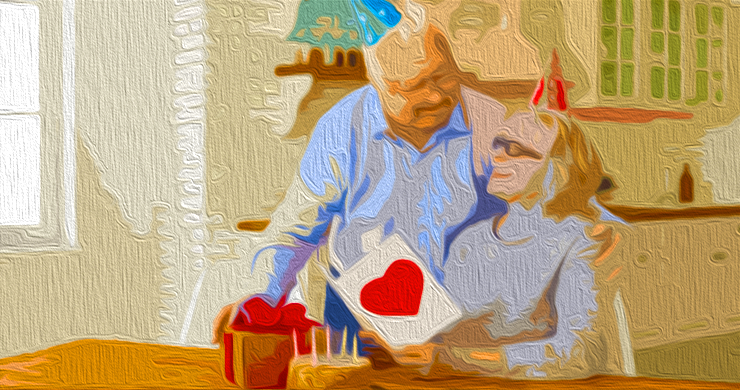

Market strategists didn't expect an inflation rate so high, as reports indicate that economists expected prices to drop 0.1% over August and slow to 8% annually. The economist and gold bug Peter Schiff quickly criticized the U.S. dollar. Schiff tweeted Tuesday, "Once more the market's reaction [to] a] much higher-than expected inflation is wrong." "Inflation will not go away, even with rate increases," Schiff tweeted on Tuesday. Schiff said that this is very bullish for the dollar, and extremely bearish for gold.

All four major Wall Street indexes (NYSE/Nadaq/Dow Jones, S&P 500, and Nasdaq) suffered significant losses amid the disappointing inflation report. All five precious metals (gold and silver, palladium platinum, rhodium, and palladium) suffered losses against the U.S. Dollar over the past 24 hours. Gold was down 1.47%. The crypto economy also lost 5.8% against dollar after printing gains the day before. The bitcoin (BTC), which has lost 6% USD, and ethereum(ETH) by 8% over the past day.

Analyst at Bankrate.com Says CPI is Far from the Fed's 2% Destination. Gold Bug Peter Schiff says Sub-2% Inflation Rates are a Thing Of The Past and Will Never Return

Investors are predicting that the Fed will raise the benchmark rate at its next meeting by citing Tuesday's CPI data. Mark Hamrick, senior economic analyst at Bankrate.com believes that the August inflation report won't convince the Fed to be more dovish next week. Hamrick believes that the U.S. central banks will keep the federal rate low until inflation is under control.

Hamrick stated that they want to move their benchmark rate into "economically restrictive territory" and keep it there for longer. "They want to take their benchmark rate into [economically] restrictive territory and keep it there for longer," Hamrick stated. Schiff stated in a Monday tweet:

Inflation below 2% is no more. The 2008 Financial Crisis and 2021 financial crisis were an anomaly. There is no way to go back. With QE, the inflation chickens that the Fed released have finally returned to their nest. These price increases are only the beginning.

What are your thoughts on the most recent inflation report? Comment below to let us know your thoughts on this topic.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: US Inflation Rate in August Runs Hot at 8.3%, Peter Schiff Says America’s ‘Days of Sub-2% Inflation Are Gone’

Sourced From: news.bitcoin.com/us-inflation-rate-in-august-runs-hot-at-8-3-peter-schiff-says-americas-days-of-sub-2-inflation-are-gone/

Published Date: Tue, 13 Sep 2022 16:00:16 +0000

Did you miss our previous article…

https://altcoinirareview.com/what-is-bitcoin-mining-the-complete-guide/