As we dive into the captivating saga of Bitcoin, one thing is clear – its evolution has been nothing short of a thrilling rollercoaster ride. Back in August 2010, when Bitcoin's price was a mere $0.07, who would have predicted its meteoric surge to over $100,000 by 2025? This digital currency has not only reshaped the landscape of investments but has also firmly established itself as a linchpin in the future financial realm.

The Unprecedented Success Story

Unlocking Bitcoin's Profitable Streak

Delving into the data from Bitcoin Magazine Pro unveils a remarkable revelation – out of the 5,442 days since Bitcoin entered the trading arena, a staggering 5,441 days have yielded profits at today's valuation, boasting an astounding success rate of 99.98%. For the visionary early adopters who weathered the storm of volatility, the returns have been nothing short of historic.

The Relentless Growth Trajectory

An in-depth analysis of Bitcoin's daily price movements discloses an intriguing fact – over 80% of all trading days have culminated in profits, signaling that the current price consistently outstrips the historical values. This unwavering consistency serves as a beacon of assurance for long-term investors, instilling in them the confidence to 'hodl' steadfastly.

The Bitcoin Revolution: A Hedge Against Inflation

Bitcoin's Journey Amidst Global Financial Dynamics

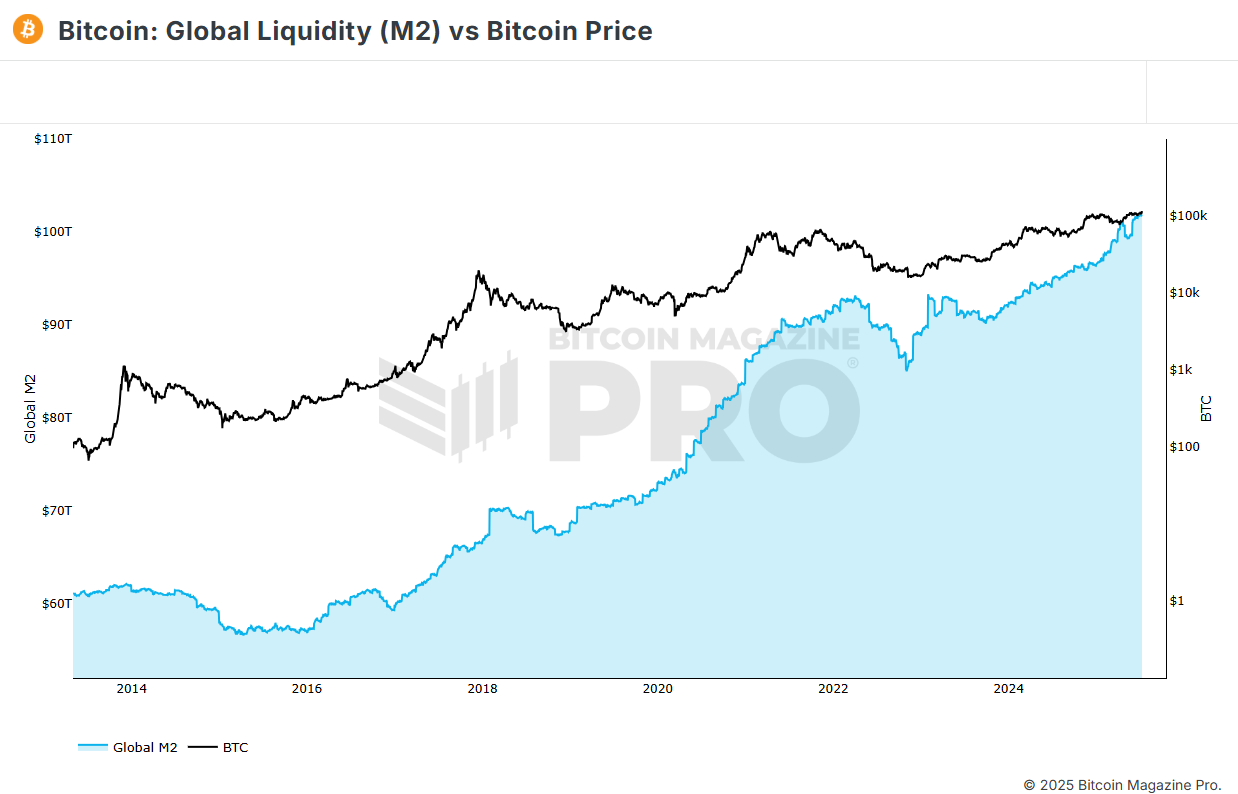

Zooming out to observe the broader financial landscape, we witness a fascinating correlation between the exponential growth of global money supply (M2) – escalating from $61 trillion to over $102 trillion since 2013 – and Bitcoin's price surge from $113 to a peak exceeding $118,000. This symbiotic relationship underscores Bitcoin's role as a potent hedge against inflation and a dependable reservoir of value.

Bitcoin's Investment Magic Unveiled

The Power of Dollar-Cost Averaging

Picture this: if you had consistently invested $100 monthly in Bitcoin over the past nine years using the dollar-cost averaging strategy, your initial $10,900 investment would have blossomed into a staggering $230,670 today, reflecting an exceptional return of over 2,016%. In stark comparison, traditional assets like gold, Apple stock, or the DJI pale in comparison, with Bitcoin emerging as the undisputed champion of returns.

Bitcoin Magazine Pro's Insightful Tool

Empowering users to navigate the realm of Bitcoin investments across diverse timeframes, the Dollar Cost Average Strategies tool from Bitcoin Magazine Pro offers a holistic view. By juxtaposing Bitcoin's performance against stalwarts like the US dollar, gold, Apple stock, and the DJI, this tool accentuates Bitcoin's prowess as a premier store of value within a well-rounded investment portfolio. Explore the transformative data from Bitcoin Magazine Pro here.

Embark on this thrilling journey with Bitcoin Magazine and seize the boundless opportunities that lie ahead.

Frequently Asked Questions

What Precious Metals Can You Invest in for Retirement?

It is gold and silver that are the best precious metal investment. They're both easy to buy and sell and have been around forever. If you want to diversify your portfolio, you should consider adding them to your list.

Gold: Gold is one of man's oldest forms of currency. It is stable and very secure. This makes it a good option to preserve wealth in uncertain times.

Silver: Silver has been a favorite among investors for years. This is a great choice for people who want to avoid volatility. Unlike gold, silver tends to go up instead of down.

Platinium is another precious metal that is becoming increasingly popular. It's durable and resists corrosion, just like gold and silver. It's however much more costly than any of its counterparts.

Rhodium: The catalytic converters use Rhodium. It is also used in jewelry-making. It's also relatively inexpensive compared to other precious metals.

Palladium: Palladium has a similarity to platinum but is more rare. It is also cheaper. It's a popular choice for investors who want to add precious metals into their portfolios.

Is gold a good investment IRA option?

If you are looking for a way to save money, gold is a great investment. You can also diversify your portfolio by investing in gold. But gold is not all that it seems.

It has been used as a currency throughout history and is still a popular method of payment. It is often called “the oldest currency in the world.”

But unlike paper currencies, which governments create, gold is mined out of the earth. It's hard to find and very rare, making it extremely valuable.

The price of gold fluctuates based on supply and demand. When the economy is strong, people tend to spend more money, which means fewer people mine gold. The value of gold rises as a consequence.

The flip side is that people tend to save money when the economy slows. This results in more gold being produced, which drives down its value.

This is why investing in gold makes sense for individuals and businesses. If you invest in gold, you'll benefit whenever the economy grows.

You'll also earn interest on your investments, which helps you grow your wealth. Plus, you won't lose money if the value of gold drops.

What is the best precious metal to invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. Gold has been traditionally considered a haven investment, but it's not always the most profitable choice. For example, if your goal is to make quick money, gold may not suit you. If patience and time are your priorities, silver is the best investment.

If you're not looking to make quick money, gold is probably your best choice. If you want to invest in long-term, steady returns, silver is a better choice.

Can the government seize your gold?

Because you have it, the government can't take it. You worked hard to earn it. It belongs entirely to you. There may be exceptions to this rule. Your gold could be taken away if your crime was fraud against federal government. Also, if you owe taxes to the IRS, you can lose your precious metals. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

How much of your portfolio should you hold in precious metals

Before we can answer this question, it is important to understand what precious metals actually are. Precious Metals are elements that have a very high relative value to other commodities. This makes them very valuable in terms of trading and investment. Gold is currently the most widely traded precious metal.

There are many other precious metals, such as silver and platinum. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is also unaffected significantly by inflation and Deflation.

In general, prices for precious metals tend increase with the overall marketplace. They do not always move in the same direction. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

Contrary to this, when the economy performs well, the opposite happens. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. They are more rare, so they become more expensive and less valuable.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

How much gold should your portfolio contain?

The amount you make will depend on the amount of capital you have. Start small with $5k-10k. As you grow, you can move into an office and rent out desks. You don't need to worry about paying rent every month. Rent is only paid per month.

You also need to consider what type of business you will run. In my case, we charge clients between $1000-2000/month, depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. You may get paid just once every 6 months.

Decide what kind of income do you want before you calculate how much gold is needed.

I suggest starting with $1k-2k gold and building from there.

How do I Withdraw from an IRA with Precious Metals?

First, you must decide if you wish to withdraw money from your IRA account. After that, you need to decide if you want to withdraw funds from an IRA account. Next, make sure you have enough money in order for you pay any fees or penalties.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. This option will require you to pay taxes on the amount that you withdraw.

Next, calculate how much money your IRA will allow you to withdraw. This calculation will depend on many factors including your age at the time of withdrawal, how long the account has been in your possession, and whether you plan to continue contributing towards your retirement plan.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. Before you choose one, weigh the pros and cons.

Because you don't have to store individual coins, bullion bars take up less space than other items. You will need to count each coin individually. However, you can easily track the value of individual coins by storing them in separate containers.

Some prefer to keep their money in a vault. Others prefer to store their coins in a vault. Regardless of the method you prefer, ensure that your bullion is safe so that you can continue to enjoy its benefits for many years.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

bbb.org

cftc.gov

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

How To

The growing trend of gold IRAs

The gold IRA trend is growing as investors seek ways to diversify their portfolios while protecting against inflation and other risks.

Owners of the gold IRA can use it to invest in physical bars and bullion gold. It is a tax-free investment that can be used to grow wealth and offers an alternative investment option to those who are concerned about stocks or bonds.

Investors can manage their assets with a gold IRA without worrying about market volatility. They can use the gold IRA to protect themselves against inflation and other potential problems.

Investors also benefit from physical gold's unique properties, such as durability and portability.

In addition, the gold IRA offers several other advantages, including the ability to quickly transfer ownership of the gold to heirs and the fact that the IRS does not consider gold a currency or a commodity.

This means that investors who are looking for financial safety and security are becoming more interested in the gold IRA.

—————————————————————————————————————————————————————————————–

By: Oscar Zarraga Perez

Title: Unveiling Bitcoin's Phenomenal Journey: Profits Soaring and Records Shattering

Sourced From: bitcoinmagazine.com/news/bitcoin-breaks-records-with-100-profitable-days-and-unmatched-returns

Published Date: Fri, 11 Jul 2025 19:26:02 +0000