The dynamic between Bitcoin and the financial advisory sector is intriguing and often overlooked. Financial advisors, wealth management professionals, and family offices wield control over a staggering amount of capital, estimated in the trillions. This article will delve into the complex relationship between this mighty industry and Bitcoin, the digital currency that has disrupted traditional financial systems.

The Current State of Wealth Management

Family offices, the wealth management industry, and global wealth management command assets worth $15 trillion, $100 trillion, and $103 trillion respectively, as per estimates from 2023. This represents the most substantial collective of regulated capital globally. However, this enormous industry is plagued with misaligned incentives, particularly regarding its relationship with Bitcoin. The industry's attitude towards Bitcoin as an asset class has been skewed since the cryptocurrency's inception. However, this might be on the verge of a significant shift.

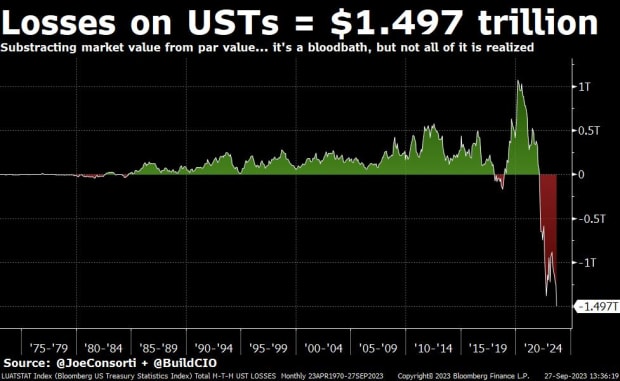

The Misconception of 'Risk-Free Rate'

The entire wealth management and investment advisory sector is constructed around the idea that the 'risk-free rate' is the universal benchmark against which all investments should be measured. The risk-free rate usually refers to the current yield of the 10-year treasury bond. However, the reality is that the 'risk-free rate' is entirely manipulated, controlled centrally by non-elected officials. This manipulation has resulted in a global economy making investment decisions based on an inaccurate benchmark, detached from the free market dynamics.

The Misunderstanding of the CPI

Another misconception prevalent in the wealth management industry is the collective misunderstanding of the Consumer Price Index (CPI), which is widely regarded as the current inflation rate. Many Bitcoin proponents have been advocating for over a decade that this number is heavily manipulated. Alternatives to measure inflation, such as the increase in M2 money supply or the Chapwood Index, should be considered. The diverging narratives of an artificial benchmark and the real inflation rate present a potentially dangerous recipe for economic disaster.

Bitcoin's Role in Wealth Management

The wealth management industry, responsible for managing $100 trillion in assets, is largely oblivious to this deception. This unawareness could create a colossal bubble if the industry realizes the truth too late. Bitcoin's role becomes crucial in this situation, as it provides a solution to these distortions. Bitcoin fixes the problem of losing purchasing power almost anywhere you try to invest or store wealth if you denominate in USD.

Fiduciary Responsibility & Misaligned Incentives

The investment advisory industry operates on the concept of "fiduciary responsibility." A fiduciary acts on behalf of another person or entity, prioritizing their clients' interests over their own. However, currently, investment advisors have completely misaligned incentives related to Bitcoin. This misalignment could be rectified with the approval of a spot ETF in the US, which would trigger a significant shift in the industry.

Spot Bitcoin ETF: A Game-Changer?

Approval of a spot Bitcoin ETF by Blackrock, the world's largest capital manager, could revolutionize Bitcoin's legitimacy within the entire wealth management industry. It aligns with the incentives of the investment advisors, allowing them to offer access to clients in a similar way they allocate to equities or mutual funds. Furthermore, the Spot Bitcoin ETF would start to infiltrate the existing models that the wealth management industry relies on, providing a diversification opportunity unavailable anywhere else. As a result, once the Spot ETF is approved, it will slowly make its way into the existing models that make up the world's capital allocation. This could potentially turn on the entire Wealth Management industry to Bitcoin as a must-own asset in every client's portfolio.

Frequently Asked Questions

What is the tax on gold in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. Gold is not subject to tax when it's purchased. It is not considered income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

You can use gold as collateral to secure loans. Lenders try to maximize the return on loans that you take against your assets. For gold, this means selling it. However, there is no guarantee that the lender would do this. They may hold on to it. They might decide that they want to resell it. In either case, you risk losing potential profits.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. You should leave it alone if you don't intend to lend against it.

How much are gold IRA fees?

$6 per month is the Individual Retirement Account Fee (IRA). This includes the account maintenance fees and any investment costs associated with your chosen investments.

If you wish to diversify your portfolio, you may need to pay additional fees. These fees will vary depending upon the type of IRA chosen. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

A majority of providers also charge annual administration fees. These fees range between 0% and 1 percent. The average rate is.25% each year. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

Which precious metal is best to invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. Although gold has been considered a safe investment, it is not always the most lucrative. For example, if your goal is to make quick money, gold may not suit you. If you have the patience to wait, then you might consider investing in silver.

If you don't care about getting rich quickly, gold is probably the way to go. Silver may be a better option for investors who want long-term steady returns.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

irs.gov

How To

Tips for Investing In Gold

Investing in Gold remains one of the most preferred investment strategies. There are many advantages to investing in Gold. There are several options to invest in the gold. Some people prefer to buy gold coins in physical form, while others prefer to invest in gold ETFs.

Before buying any kind of gold, you need to consider these things.

- First, find out if your country allows gold ownership. If so, then you can proceed. Otherwise, you can look into buying gold from abroad.

- The second thing you need to do is decide what type of gold coins you want. You can choose between yellow gold and white gold as well as rose gold.

- Thirdly, it is important to take into account the gold price. It is best to start small and work your way up. You should diversify your portfolio when buying gold. Diversifying your portfolio includes stocks, bonds, mutual funds, real estate, commodities, and mutual funds.

- Lastly, you should never forget that gold prices change frequently. You need to keep up with current trends.

—————————————————————————————————————————————————————————————–

By: Dillon Healy

Title: Unraveling the Bitcoin Connection in the Financial Advisory Industry

Sourced From: bitcoinmagazine.com/markets/after-an-etf-you-just-need-to-orange-pill-financial-advisors

Published Date: Thu, 19 Oct 2023 15:45:00 GMT

Did you miss our previous article…

https://altcoinirareview.com/uncertainty-in-global-markets-as-middle-east-tensions-escalate/