Ever wondered how Michael Saylor and his team at Strategy (formerly known as MicroStrategy) managed to outshine Bitcoin itself in terms of returns? Well, the secret lies in leveraging the power of data and smart strategies. In this guide, we'll dive into the world of MSTR investing and show you how to supercharge your returns through insightful market data.

Unveiling Key Insights

The Rise of MSTR Over Bitcoin

Strategy, previously MicroStrategy, has been making waves with its bold Bitcoin investments. Surpassing a whopping 3,000% in returns since venturing into the realm of Bitcoin, Strategy has clearly outpaced Bitcoin's growth of around 700%. This success story emphasizes the lucrative potential of companies holding substantial Bitcoin reserves.

Decoding Essential Metrics for MSTR Investment

Mastering MVRV Z-Score

One of the essential metrics for MSTR investing is the MVRV Z-Score. This powerful tool helps determine whether Bitcoin is undervalued or overvalued by comparing market cap to realized cap. By identifying optimal buying and selling points, investors can navigate the market effectively.

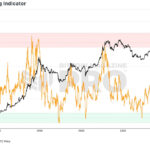

Active Address Sentiment Indicator Unleashed

Keeping an eye on the Active Address Sentiment Indicator can provide valuable insights into network utilization and user behavior changes. This indicator offers a peek into market sentiment and guides decisions on when to cash in profits or expand your portfolio.

Global Liquidity Dynamics

Don't underestimate the impact of global liquidity trends on MSTR's performance. By monitoring liquidity shifts, investors can anticipate market movements that influence MSTR's stock price. Adapting the analysis timeframe can further enhance predictive accuracy.

Strategic Insights for MSTR Investment

Utilizing MVRV Z-Score for MSTR

The MVRV Z-Score isn't just for Bitcoin—it's a game-changer for MSTR too. When the score enters the green zone, it's a green light to buy, while the red zone signals a potential selling opportunity. This metric's application to MSTR underscores its correlation with Bitcoin.

Active Address Sentiment Indicator Demystified

Keep a close watch on the Active Address Sentiment Indicator to gauge market sentiment based on user activity changes. Knowing when the market is overheated or undervalued can guide your investment decisions, helping you capitalize on profitable opportunities.

The Ripple Effect of Global Liquidity on MSTR

Global liquidity trends wield substantial influence over MSTR's performance. By analyzing liquidity patterns, investors gain insights into future price actions. Understanding the correlation between global liquidity and MSTR can be a game-changer in strategic decision-making.

Insightful Value Days Destroyed Indicator

The Value Days Destroyed Indicator showcases how Bitcoin price movements impact MSTR. By studying this correlation, investors can pinpoint ideal moments to buy or sell MSTR shares. This metric's effectiveness, especially in leveraging Bitcoin's volatility, makes it a valuable tool for MSTR investors.

Crafting Data-Driven MSTR Strategies

Aligning MSTR strategies with Bitcoin metrics can unlock new avenues for success. By harnessing tools like the MVRV Z-Score, Active Address Sentiment Indicator, and global liquidity analysis, investors can elevate their MSTR investment game.

With Michael Saylor's ongoing Bitcoin accumulation, the prospects for MSTR look promising. Stay informed and empowered by monitoring these key indicators to streamline your investment choices and potentially maximize your returns.

If you've found these insights valuable, dive deeper into resources and analytics to stay ahead of the curve on both Bitcoin and MSTR. Remember, informed decisions fuel successful investment journeys!

Frequently Asked Questions

What's the advantage of a Gold IRA?

A gold IRA has many benefits. It is an investment vehicle that can diversify your portfolio. You control how much money goes into each account and when it's withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. This will allow you to transition easily if it is your decision to retire early.

The best part about gold IRAs? You don't have to be an expert. They are readily available at most banks and brokerages. You don't have to worry about penalties or fees when withdrawing money.

However, there are still some drawbacks. Gold is known for being volatile in the past. It is important to understand why you are investing in gold. Do you want safety or growth? Do you want to use it as an insurance strategy or for long-term growth? Only after you have this information will you make an informed decision.

If you want to keep your gold IRA open for life, you might consider purchasing more than one ounce. One ounce doesn't suffice to cover all your needs. You may need several ounces, depending on what you intend to do with your precious gold.

You don't have to buy a lot of gold if your goal is to sell it. You can even live with just one ounce. But you won't be able to buy anything else with those funds.

Is gold a good choice for an investment IRA?

Anyone who is looking to save money can make gold an excellent investment. You can also diversify your portfolio by investing in gold. There is much more to gold than meets your eye.

It's been used as a form of payment throughout history. It is often called “the oldest currency in the world.”

Gold, unlike other paper currencies created by governments is mined directly from the earth. This makes it highly valuable as it is hard and rare to produce.

The price of gold fluctuates based on supply and demand. If the economy is strong, people will spend more money which means less people can mine gold. The value of gold rises as a consequence.

On the flipside, people may save cash rather than spend it when the economy slows. This results in more gold being produced, which drives down its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

Your investments will also generate interest, which can help you increase your wealth. Additionally, you won't lose cash if the gold price falls.

Is buying gold a good option for retirement planning?

While buying gold as an investment may seem unattractive at first glance it becomes worth the effort when you consider how much gold is consumed worldwide each year.

The best form of investing is physical bullion, which is the most widely used. You can also invest in gold in other ways. Research all options carefully and make an informed decision about what you desire from your investments.

If you don’t need a safe place for your wealth, then buying shares of mining companies or companies that extract it might be a better alternative. Owning gold stocks should work well if you need cash flow from your investment.

You can also invest your money in exchange-traded fund (ETFs), which give you exposure to the gold price by holding securities related to gold. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

cftc.gov

investopedia.com

finance.yahoo.com

How To

The best place to buy silver or gold online

Understanding how gold works is essential before you buy it. Gold is a precious metallic similar to Platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It's difficult to use, so most people prefer purchasing jewelry made from it rather than actual bars.

Two types of gold coins are available today: the legal tender type and the bullion type. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They aren’t exchangeable in any currency exchange. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. The buyer receives 1 gram of gold for every dollar spent.

The next thing you should know when looking to buy gold is where to do it from. You have a few options to choose from if you are looking to buy gold directly through a dealer. First, go to your local coin shop. You might also consider going through a reputable online seller like eBay. Finally, you can look into purchasing gold through private sellers online.

Private sellers are individuals who offer gold for sale, either at wholesale prices or retail prices. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. You would receive less money from a private buyer than you would from a coin store or eBay. This option can be a good choice for investing in gold because it allows you to control the price.

The other option is to purchase physical gold. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. The pawnshop is a small business that allows customers to borrow money to buy items. Banks usually charge higher interest rates that pawn shops.

The final option is to ask someone to buy your gold! Selling gold is simple too. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————–

By: Mark Mason

Title: Unlocking Success: Boost Your MSTR Returns with Bitcoin Market Data Insights

Sourced From: bitcoinmagazine.com/markets/pro-tips-mstr-bitcoin-market-data

Published Date: Wed, 07 May 2025 14:20:25 +0000