Bitcoin’s price movements dominate headlines, but the real story of BTC lies beneath the surface. Beyond technical analysis and price speculation, on-chain data offers an unparalleled view of supply, demand, and investor behavior in real time. By leveraging these insights, traders and investors can anticipate market trends, follow institutional movements, and make data-driven decisions.

Realized Price & MVRV Z-Score

On-chain data refers to the publicly available transaction records on Bitcoin’s blockchain. Unlike traditional markets, where investor actions are obscured, Bitcoin’s transparency allows for real-time analysis of every transaction, wallet movement, and network activity. This information helps investors identify major trends, accumulation zones, and potential price inflection points.

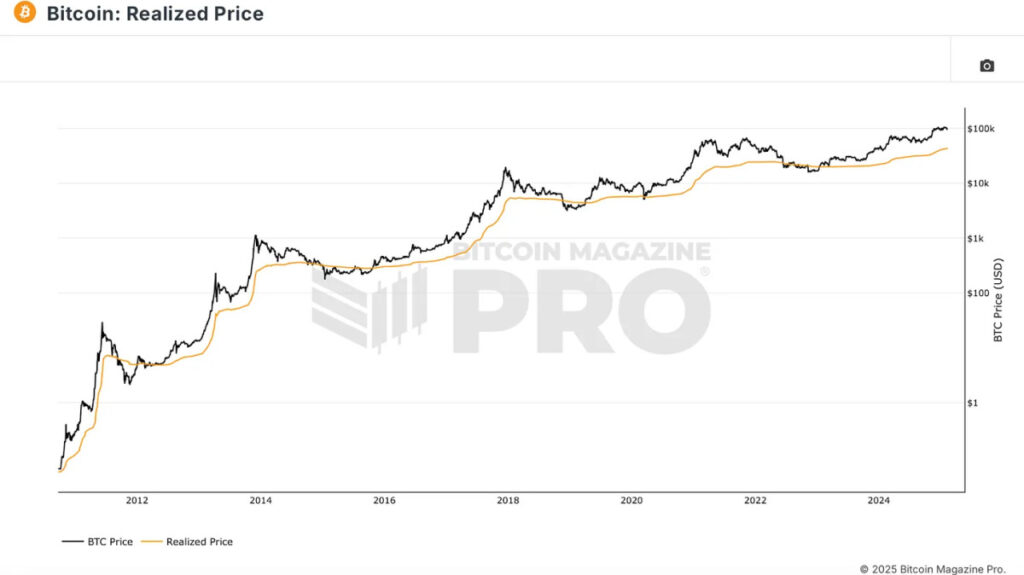

One of the most crucial on-chain metrics is Realized Price, which reflects the average cost basis of all BTC in circulation. Unlike traditional assets, where investor cost bases are difficult to determine, Bitcoin provides real-time visibility into when the majority of holders are in profit or loss.

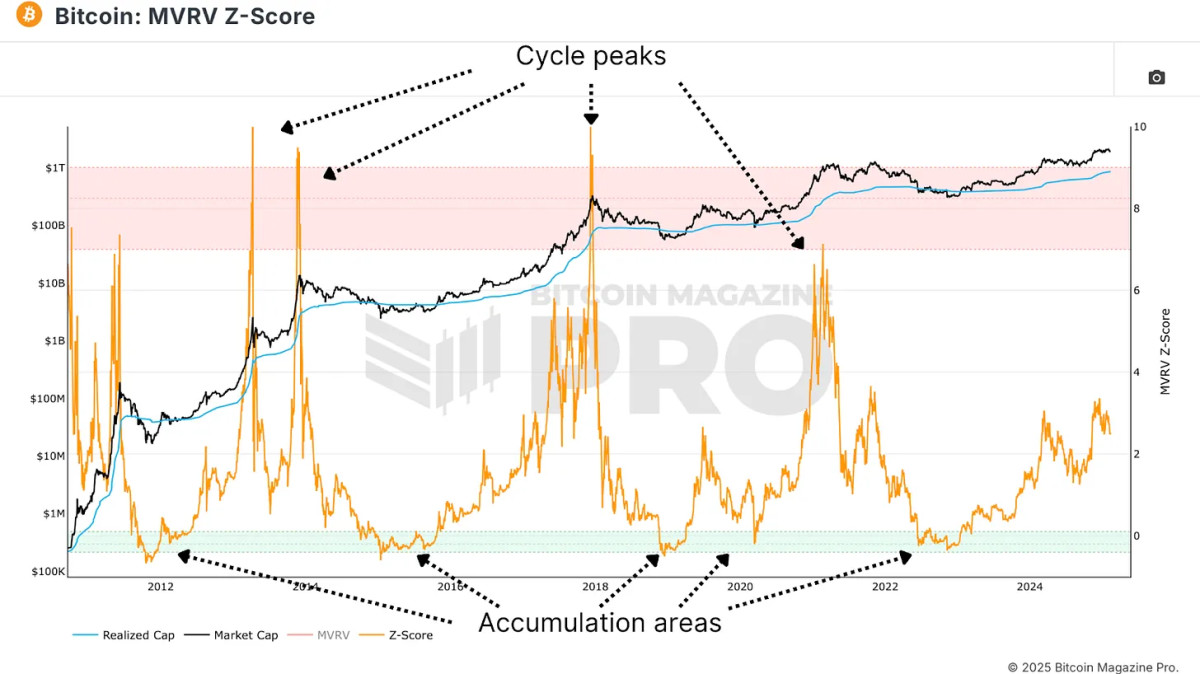

To enhance the utility of Realized Price, analysts employ the MVRV Z-Score, which measures the deviation between market value and realized value, standardized for Bitcoin’s volatility. This indicator has historically identified optimal buying zones when it enters the lower range and potential overvaluation when it enters the red zone.

Monitoring Long-Term Holders

Another key metric is the 1+ Year HODL Wave, which tracks Bitcoin addresses that haven’t moved funds for at least a year. A rising HODL wave indicates that investors are choosing to hold, reducing circulating supply and creating upward price pressure. Conversely, when this metric starts declining, it suggests profit-taking and potential distribution.

HODL Waves visualizes the entire distribution of Bitcoin ownership by age bands. Filtering to new market participants of 3 months or less reveals typical retail participation levels. Peaks in short-term holders typically signal market tops, while low levels indicate ideal accumulation zones.

Spotting Whale Movements

Supply Adjusted Coin Days Destroyed quantifies the total BTC moved, weighted by how long it was held, and standardizes that data by the circulating supply at that time. This metric is invaluable for detecting whale activity and institutional profit-taking. When long-dormant coins suddenly move, it often signals large holders exiting positions.

Realized Gains & Losses

The Spent Output Profit Ratio (SOPR) reveals the profitability of BTC transactions. By observing SOPR spikes, traders can identify euphoric profit-taking, while SOPR declines often accompany bear market capitulations.

Relying on a single metric can be misleading. To increase the probability of accurate signals, investors should seek confluence between multiple on-chain indicators.

Bitcoin’s on-chain data provides a transparent, real-time view of market dynamics, offering investors an edge in decision-making. By tracking supply trends, investor psychology, and accumulation/distribution cycles, Bitcoiners can better position themselves for long-term success.

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin's price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Frequently Asked Questions

What are the fees associated with an IRA for gold?

$6 per month is the Individual Retirement Account Fee (IRA). This includes the account maintenance fees and any investment costs associated with your chosen investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees can vary depending on which type of IRA account you choose. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

Most providers also charge annual management costs. These fees range from 0% to 1%. The average rate for a year is.25%. These rates are often waived if a broker like TD Ameritrade is used.

Can I have a gold ETF in a Roth IRA

You may not have this option with a 401(k), however, you might want to consider other options, like an Individual retirement account (IRA).

Traditional IRAs allow for contributions from both employees and employers. An Employee Stock Ownership Plan (ESOP) is another way to invest in publicly traded companies.

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

You can also get an Individual Retirement Annuity, or IRA. An IRA allows for you to make regular income payments during your life. Contributions to IRAs will not be taxed

What are some of the benefits of a gold IRA

You can save money on retirement by putting your money into an Individual Retirement Account. It's tax-deferred until you withdraw it. You have complete control over how much you take out each year. There are many types available. Some are better suited for people who want to save for college expenses. Others are designed for investors looking for higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. But once they start withdrawing funds, those earnings aren't taxed again. This type account may make sense if it is your intention to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. It means that you don’t have to remember to make deposits every month. Direct debits could be set up to ensure you don't miss a single payment.

Finally, gold remains one of the best investment options today. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even during economic turmoil, gold prices tend to stay relatively stable. This makes it a great investment option to protect your savings from inflation.

Is gold a good choice for an investment IRA?

Gold is an excellent investment for any person who wants to save money. It is also an excellent way to diversify you portfolio. But there is more to gold than meets the eye.

It has been used as a currency throughout history and is still a popular method of payment. It is often called “the most ancient currency in the universe.”

But unlike paper currencies, which governments create, gold is mined out of the earth. That makes it very valuable because it's rare and hard to create.

The supply and demand for gold determine the price of gold. When the economy is strong, people tend to spend more money, which means fewer people mine gold. The value of gold rises as a consequence.

On the other hand, people will save cash when the economy slows and not spend it. This causes more gold to be produced, which lowers its value.

This is why gold investment makes sense for both individuals and businesses. You'll reap the benefits of investing in gold when the economy grows.

You'll also earn interest on your investments, which helps you grow your wealth. Additionally, you won't lose cash if the gold price falls.

How much should precious metals be included in your portfolio?

This question can only be answered if we first know what precious metals are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them valuable in investment and trading. Today, gold is the most commonly traded precious metal.

There are many other precious metals, such as silver and platinum. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is also not affected by inflation and depression.

In general, prices for precious metals tend increase with the overall marketplace. However, they may not always move in synchrony with each other. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. Investors expect lower interest rate, making bonds less appealing investments.

However, when an economy is strong, the reverse effect occurs. Investors favor safe assets like Treasury Bonds, and less precious metals. They are more rare, so they become more expensive and less valuable.

Diversifying across precious metals is a great way to maximize your investment returns. You should also diversify because precious metal prices can fluctuate and it is better to invest in multiple types of precious metals than in one.

What Precious Metals Can You Invest in for Retirement?

These precious metals are among the most attractive investments. Both can be easily bought and sold, and have been around since forever. If you want to diversify your portfolio, you should consider adding them to your list.

Gold: Gold is one the oldest forms currency known to man. It is stable and very secure. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: Silver has always been popular among investors. It's a good choice for those who want to avoid volatility. Unlike gold, silver tends to go up instead of down.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. It's durable and resists corrosion, just like gold and silver. It's however much more costly than any of its counterparts.

Rhodium: Rhodium can be used in catalytic convertors. It's also used in jewelry making. It is also quite affordable compared with other types of precious metals.

Palladium: Palladium has a similarity to platinum but is more rare. It's also more accessible. This is why it has become a favourite among investors looking for precious metals.

What is the tax on gold in Roth IRAs?

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

The rules governing these accounts vary by state. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. Massachusetts allows you up to April 1st. New York has a maximum age limit of 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

finance.yahoo.com

investopedia.com

bbb.org

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The best place to buy silver or gold online

You must first understand the workings of gold before you can purchase it. Gold is a precious metallic similar to Platinum. Because of its resistance to corrosion and durability, it is very rare. It is very difficult to use and most people prefer to purchase jewelry made of it over actual bars of Gold.

There are two types today of gold coins. One is legal tender while the other is bullion. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They can't be exchanged in currency exchange systems. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Every dollar spent on gold purchases, the buyer receives one gram of gold.

Next, you need to find out where to buy gold. You have a few options to choose from if you are looking to buy gold directly through a dealer. You can start by visiting your local coin shop. You might also consider going through a reputable online seller like eBay. Finally, you can look into purchasing gold through private sellers online.

Private sellers are individuals that offer gold at wholesale or retail prices. Private sellers typically charge 10% to 15% commission on each transaction. This means that you will get less back from a private seller than if you sell it through a coin shop or on eBay. This option is often a great one for investors in gold, as it gives you greater control over the item's value.

Another option for buying gold is to invest in physical gold. Physical gold is much easier to store than paper certificates, but you still have to worry about storing it safely. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank can provide you with a loan to cover the amount you wish to invest in gold. The pawnshop is a small business that allows customers to borrow money to buy items. Banks charge higher interest rates than those offered by pawn shops.

The final option is to ask someone to buy your gold! Selling gold is also easy. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Unlocking Bitcoin's Potential: A Deep Dive into On-Chain Data

Sourced From: bitcoinmagazine.com/markets/mastering-bitcoin-on-chain-data-

Published Date: Tue, 18 Feb 2025 13:59:20 GMT

Did you miss our previous article…

https://altcoinirareview.com/szabos-micropayments-and-mental-transaction-costs-25-years-later/