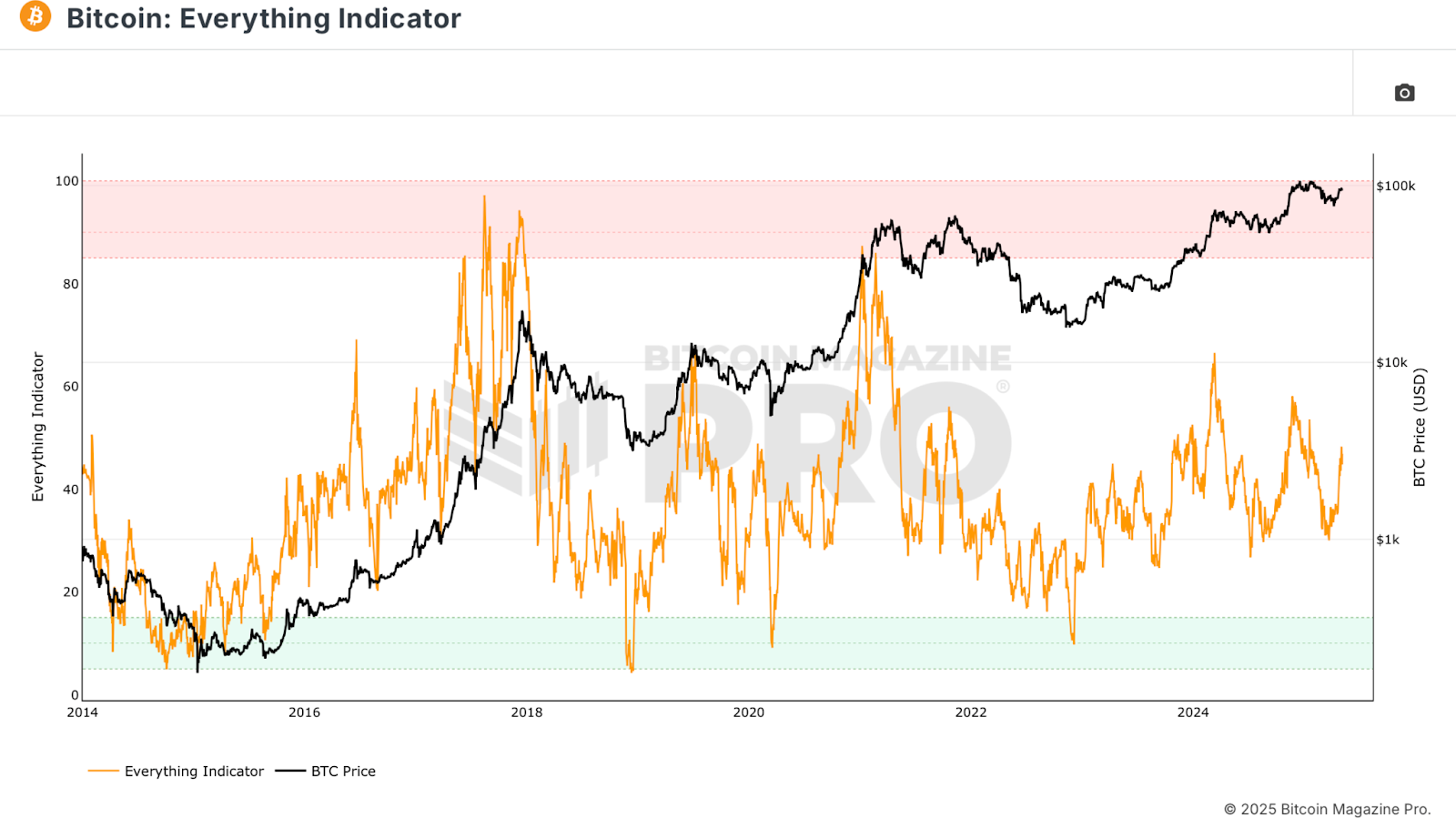

Welcome to the world of the Bitcoin Everything Indicator, a powerful tool that unveils the secrets behind BTC price movements. This indicator dives deep into on-chain, macro, technical, and fundamental aspects to provide you with a holistic view of the market. Today, we're here to reveal how a simple tweak can supercharge this tool, offering you more insights and opportunities to boost your profits without compromising accuracy.

Unveiling the Bitcoin Everything Indicator

Let's start by understanding the Bitcoin Everything Indicator. This comprehensive tool is a blend of various signals that include:

- On-chain metrics like MVRV Z-Score and SOPR

- Macroeconomic factors such as Global M2 Money Supply

- Network data like active address sentiment

- Technical overlays such as the Crosby Ratio

- Mining health metrics incorporating the Puell Multiple

Diving Deeper into the Indicator

These signals work together to create a balanced score that reflects the overall dynamics of the Bitcoin market. Unlike single indicators, this composite tool captures the essence of various domains influencing Bitcoin's price movements. Through rigorous backtesting, it has consistently predicted crucial market turning points, guiding investors through different market cycles.

Enhancing Signal Frequency

While the original Everything Indicator was exceptional at spotting long-term trends, it lacked day-to-day guidance for active investors. To address this, we introduced a simple yet effective solution.

Introducing Moving Averages

By incorporating a moving average into the Everything Indicator, we unlocked a new dimension of insights. Similar to how we analyze price trends, this moving average strategy identifies directional shifts in the indicator's score.

When the Everything Indicator crosses above the moving average, it signifies a bullish trend, indicating an optimal entry point. On the other hand, a crossover below the moving average suggests a potential downturn, signaling a strategic exit or risk management opportunity.

Maximizing Opportunities

To cater to active traders, we recommend shortening the moving average period to increase signal frequency. This tweak allows for more entry and exit signals per cycle without compromising the indicator's core functionality.

Unlocking the Full Potential

Reducing the moving average period offers several advantages, including early signals at market lows, frequent accumulation guidance, timely exit prompts during overheated conditions, and opportunities to avoid prolonged drawdowns.

In Summary

The enhanced Bitcoin Everything Indicator strikes the perfect balance between macro insights and day-to-day guidance. By incorporating moving averages, this tool now caters to both long-term investors seeking validation and active traders looking for real-time signals. With its proven track record, this strategy has consistently outperformed traditional buy-and-hold approaches, showcasing its effectiveness across various market conditions.

So, if you're already leveraging Bitcoin Magazine Pro's arsenal of indicators, it's time to elevate your strategy. Experiment with overlays, adjust moving averages, and fine-tune your approach to unlock the full potential of these tools. The more customized your strategy, the more impactful and intuitive your trading experience will be!

Disclaimer: This article aims to inform and inspire, not provide financial advice. Always conduct thorough research before making investment decisions.

Frequently Asked Questions

Who has the gold in a IRA gold?

The IRS considers gold owned by an individual to be “a type of money” and is subject taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

What are the fees for an IRA that holds gold?

An Individual Retirement Account (IRA) fee is $6 per month. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

To diversify your portfolio you might need to pay additional charges. These fees will vary depending upon the type of IRA chosen. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

Many providers also charge annual management fees. These fees range from 0% to 1%. The average rate for a year is.25%. However, these rates are typically waived if you use a broker like TD Ameritrade.

How Do You Make a Withdrawal from a Precious Metal IRA?

First decide if your IRA account allows you to withdraw funds. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, figure out how much money will be taken out of your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. However, a debit card is better than a card. This will save you unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. Before you choose one, weigh the pros and cons.

Bullion bars require less space, as they don't contain individual coins. But you will have to count each coin separately. However, you can easily track the value of individual coins by storing them in separate containers.

Some prefer to keep their money in a vault. Some prefer to keep them in a vault. You can still enjoy the benefits of bullion for many years, regardless of which method you choose.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

irs.gov

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

finance.yahoo.com

How To

The best place to buy silver or gold online

You must first understand the workings of gold before you can purchase it. Gold is a precious metallic similar to Platinum. It is rare and used as money due to its durability and resistance against corrosion. It's difficult to use, so most people prefer purchasing jewelry made from it rather than actual bars.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins are minted for circulation in a country and usually include denominations like $1, $5, $10, etc.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They aren't circulated in any currency exchange systems. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. For every dollar spent, the buyer gets 1 gram of Gold.

The next thing you should know when looking to buy gold is where to do it from. If you want to purchase gold directly from a dealer, then a few options are available. First, go to your local coin shop. You can also try going through a reputable website like eBay. You can also purchase gold through private online sellers.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. Private sellers typically charge 10% to 15% commission on each transaction. A private seller will usually return less money than a coin shop and eBay. This option can be a good choice for investing in gold because it allows you to control the price.

An alternative option to buying gold is to buy physical gold. It is easier to store physical gold than paper certificates. But, you still have to take care of it. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

A bank or pawnshop can help you buy gold. A bank can give you a loan up to the amount you intend to invest in Gold. Pawnshops are small establishments allowing customers to borrow money against items they bring. Banks tend to charge higher interest rates, while pawnshops are typically lower.

Finally, another way to buy gold is to simply ask someone else to do it! Selling gold is also easy. Contact a company such as GoldMoney.com, and you can set up a simple account and start receiving payments immediately.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: The Ultimate Guide to Maximizing Profits with the Bitcoin Everything Indicator

Sourced From: bitcoinmagazine.com/markets/bitcoin-everything-indicator-profits

Published Date: Fri, 09 May 2025 13:12:27 +0000