The Growing Interest in Bitcoin

Over the past few years, there has been a subtle shift in social media conversations and mainstream media coverage surrounding Bitcoin. The once obscure cryptocurrency has now become a hot topic of discussion among Wall Street investors and the general public alike. People are no longer asking "What is Bitcoin?" but rather "How do I buy it?" This change in sentiment is a clear indication that something fundamental has shifted in the market.

The Recognition of a Monetary Revolution

As more individuals become aware of the limitations and fragility of fiat currencies, they are starting to recognize the potential of Bitcoin as a sound form of money and a means of preserving individual sovereignty. The questions surrounding Bitcoin are no longer about whether to buy it, but rather about the best way to buy it and the strategies for accumulating and holding it.

Understanding the Risks and Rewards

Before diving into Bitcoin, it is important to understand that there is no one-size-fits-all approach. Each individual's journey into Bitcoin is unique and should be shaped by their own circumstances and risk tolerance. It is crucial to invest time in researching and understanding how to use the Bitcoin network effectively. While giants in the asset management industry like BlackRock and Fidelity have expressed bullish views on Bitcoin, it is still essential to do your own research and make informed decisions.

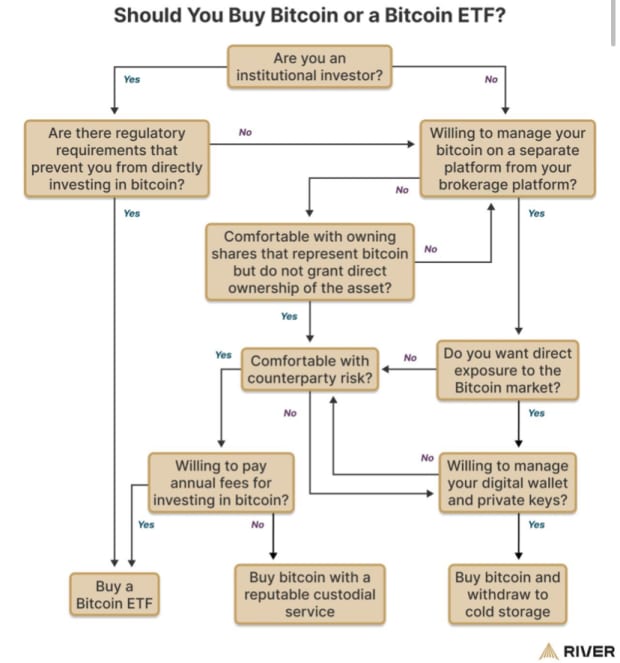

Choosing the Right Path

When it comes to owning Bitcoin, there are different alternatives depending on individual needs and preferences. Some may prefer to have absolute ownership and be their own custodian by holding their own keys with a hardware wallet. Others may opt for third-party custodians or Bitcoin ETFs, depending on their level of trust and comfort with responsibility. It is important to evaluate factors such as ownership, privacy, and personal circumstances when deciding on the best approach.

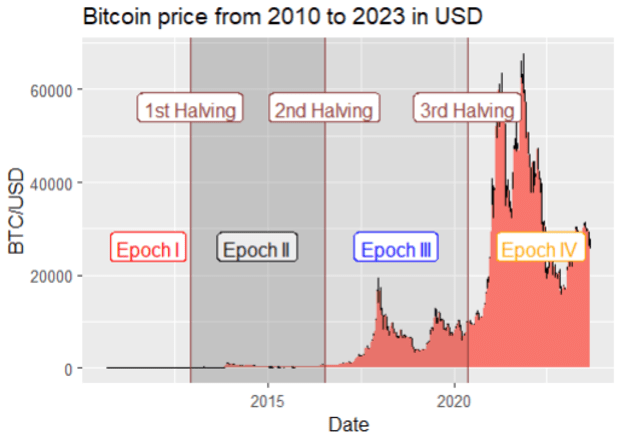

The Halving and Its Impact

One crucial consideration for Bitcoin investors is the concept of the Halving, which occurs approximately every four years. During the Halving, the amount of new bitcoins put into circulation is halved, leading to a decrease in the growth rate of the monetary base. The current epoch, Epoch IV, began in 2020 and will end in 2024, with the next Halving expected around April. Understanding the Halving and its impact on the Bitcoin network can provide valuable insights for investors.

The Future of Bitcoin

While the four-year cycle of the Halving has been a notable pattern in Bitcoin's history, there are ongoing discussions about whether this cycle will continue indefinitely. Some argue that as awareness of the Halving grows, its impact on the market may be priced in earlier, altering the cycle. Additionally, it is important to note that the total supply of bitcoins is limited to 21 million, with over 93% already in circulation. The remaining bitcoins will be mined gradually, with miners relying on transaction fees for income after the year 2140.

Investing in Bitcoin is a personal decision that requires careful consideration and research. By understanding the current market sentiment, the potential of Bitcoin as a monetary revolution, and the factors that impact its price and supply, investors can make informed choices to navigate this ever-evolving digital landscape.

Disclaimer: The views and opinions expressed in this article are solely those of the author and do not reflect the official policy or position of any company or organization.

Frequently Asked Questions

What is a gold IRA account?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

Physical gold bullion coin can be purchased at any time. To start investing in gold, it doesn't matter if you are retired.

An IRA lets you keep your gold for life. Your gold holdings won't be subject to taxes when you pass away.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. Once you've done so, you'll be given an IRA custodian. This company acts as an intermediary between you and IRS.

Your gold IRA custodian can handle all paperwork and submit necessary forms to IRS. This includes filing annual reporting.

After you have established your gold IRA you will be able purchase gold bullion coin. The minimum deposit required to purchase gold bullion coins is $1,000 However, you'll receive a higher interest rate if you put in more.

You will pay taxes when you withdraw your gold from your IRA. If you are withdrawing your entire balance, you will owe income tax plus a 10% penalty.

You may not be required to pay taxes if you take out only a small amount. There are exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

You should avoid taking out more than 50% of your total IRA assets yearly. Otherwise, you'll face steep financial consequences.

Who is the owner of the gold in a gold IRA

The IRS considers any individual who holds gold “a form of income” that is subject to taxation.

You must have gold at least $10,000 and it must be stored for at the least five years in order to take advantage of this tax-free status.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

You will need to declare the value of gold if you intend on selling it one day. This could impact how capital gains taxes you owe for cash investments.

Consult a financial advisor or accountant to determine your options.

Can I have physical gold in my IRA

Gold is money, not just paper currency or coinage. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

Gold has historically performed better during financial panics than other assets. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. Gold was one asset that outperformed stocks in turbulent market conditions.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Even if your stock portfolio is down, your shares are still yours. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Gold provides liquidity. You can sell your gold at any time without worrying about finding a buyer, which is a major advantage over other investments. You can buy gold in small amounts because it is so liquid. This allows one to take advantage short-term fluctuations within the gold price.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

finance.yahoo.com

cftc.gov

bbb.org

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Tips for Investing in Gold

Investing in Gold remains one of the most preferred investment strategies. There are many advantages to investing in Gold. There are several ways to invest in gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before you buy any type of gold, there are some things that you should think about.

- First, check to see if your country permits you to possess gold. If so, then you can proceed. Otherwise, you can look into buying gold from abroad.

- The second is to decide which kind of gold coin it is you want. You can go for yellow gold, white gold, rose gold, etc.

- Thirdly, it is important to take into account the gold price. It is best to begin small and work your ways up. You should diversify your portfolio when buying gold. Diversify your investments in stocks, bonds or real estate.

- Don't forget to keep in mind that gold prices often change. Be aware of the current trends.

—————————————————————————————————————————————————————————————–

By: Santiago Varela

Title: The Rise of Bitcoin: A Guide for New Investors

Sourced From: bitcoinmagazine.com/culture/the-no-coiner-texts-arrive-a-bull-market-beckons

Published Date: Fri, 09 Feb 2024 15:47:52 GMT

Related posts:

Current Block Times Suggest Bitcoin’s Halving Is Coming Sooner Than Expected

Current Block Times Suggest Bitcoin’s Halving Is Coming Sooner Than Expected

Robert Kiyosaki Emphasizes the Importance of Bitcoin Halving

Robert Kiyosaki Emphasizes the Importance of Bitcoin Halving

Bitcoin’s Hashrate Skyrockets: An In-depth Look at the Impending Reward Halving Amidst Market Challenges

Bitcoin’s Hashrate Skyrockets: An In-depth Look at the Impending Reward Halving Amidst Market Challenges

Skybridge Capital Founder Anticipates Bitcoin Price to Surge Past $170,000 in 2022

Skybridge Capital Founder Anticipates Bitcoin Price to Surge Past $170,000 in 2022