A Significant Drop in NFT Sales in 2023

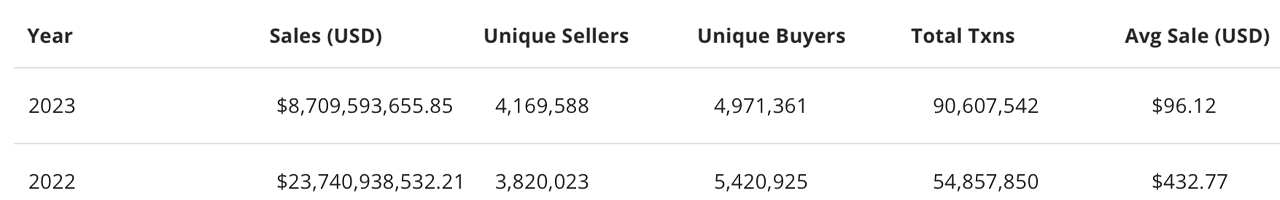

Recent statistics reveal that non-fungible token (NFT) sales in 2023 reached $8.70 billion. However, this figure represents a substantial decrease of $15.04 billion or 63.35% compared to the previous year, 2022.

A Closer Look at NFT Sales in 2023

Despite a surge in demand towards the end of 2023, the total annual sales still experienced a significant drop from the $23.74 billion recorded in 2022. In fact, the $8.70 billion in sales is the lowest since 2019's $3.75 billion. However, it's worth noting that the number of NFT transactions in 2023 reached an all-time high of 90,607,554, surpassing the 54,857,850 recorded in 2022.

The Number of Sellers and Buyers in the NFT Market

In 2023, there were 4.16 million sellers and 4.97 million buyers of NFTs. Although the number of sellers increased compared to 2022, it didn't surpass the 5,420,925 buyers recorded in the previous year. Interestingly, Bitcoin and Solana witnessed a significant increase in NFT sales towards the end of 2023, with Bitcoin even outperforming Ethereum in November and December.

The Leading Platforms and Collections in the NFT Market

When looking at the overall market, Ethereum remains the dominant platform with $42.12 billion in NFT sales. Solana follows closely behind with $4.62 billion, and the Ronin blockchain, known for hosting Axie Infinity, comes in third with $4.25 billion. Bitcoin-focused NFT sales have climbed to the fourth rank with a total of $1.83 billion. Despite the rise of BTC-related NFTs, the Axie Infinity collection maintains its position as the top seller overall, surpassing other popular collections like Bored Ape Yacht Club (BAYC) and Cryptopunks.

A Shift in Value for Bored Ape Yacht Club (BAYC) and Cryptopunks

Both Bored Ape Yacht Club (BAYC) and Cryptopunks experienced a significant decrease in their base value over the past year. On January 1, 2023, the BAYC floor value was 69.49 ether, with ETH priced at $1,195, totaling approximately $84K. However, as of January 1, 2024, the BAYC floor has dropped to 26.17 ETH, and with ether now at $2,325 per coin, the value equates to about $60K.

The Resilience and Evolution of the NFT Market

Despite the notable dip in overall NFT sales, the increased activity and diversification of platforms and collections highlight the resilience and evolution of the sector. The shifting demographics of buyers and sellers, coupled with the emergence of Bitcoin-centric NFTs, point to a market that is continuously evolving. While Ethereum remains the leader, the presence of new contenders signifies a broadening horizon for the NFT ecosystem.

What are your thoughts on the 63% decrease in NFT sales in 2023 compared to the previous year? Feel free to share your opinions in the comments section below.

Frequently Asked Questions

How much of your portfolio should be in precious metals?

To answer this question, we must first understand what precious metals are. Precious metals have elements with an extremely high worth relative to other commodity. They are therefore very attractive for investment and trading. The most traded precious metal is gold.

There are many other precious metals, such as silver and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It is also relatively unaffected both by inflation and deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. But they don't always move in tandem with one another. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. Investors expect lower interest rate, making bonds less appealing investments.

When the economy is healthy, however, the opposite effect occurs. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. Since these are scarce, they become more expensive and decrease in value.

It is important to diversify your portfolio across precious metals in order to maximize your profit from precious metals investments. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

What is the value of a gold IRA

Many benefits come with a gold IRA. It's an investment vehicle that allows you to diversify your portfolio. You decide how much money is put in each account and when it is withdrawn.

You can also rollover funds from other retirement accounts to a gold IRA. This will allow you to transition easily if it is your decision to retire early.

The best part? You don’t need to have any special skills to invest into gold IRAs. They are readily available at most banks and brokerages. Withdrawals are made automatically without having to worry about fees or penalties.

But there are downsides. Gold has historically been volatile. Understanding why you invest in gold is crucial. Are you looking for safety or growth? Are you trying to find safety or growth? Only then will you be able make informed decisions.

If you plan to keep your gold IRA indefinitely, you'll probably want to consider buying more than one ounce of gold. You won't need to buy more than one ounce of gold to cover all your needs. You may need several ounces, depending on what you intend to do with your precious gold.

You don't have to buy a lot of gold if your goal is to sell it. You can even get by with less than one ounce. You won't be capable of buying anything else with these funds.

What are the benefits of a Gold IRA?

The best way to save money for retirement is to place it in an Individual Retirement Account. It's tax-deferred until you withdraw it. You can decide how much money you withdraw each year. There are many types available. Some are better suited for college students. Others are intended for investors seeking higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This account may be worth considering if you are looking to retire earlier.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. This means that you don't need to worry about making monthly deposits. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, the gold investment is among the most reliable. Because it isn't tied to any particular country its value tends be steady. Even during economic turmoil, gold prices tend to stay relatively stable. Gold is a good option for protecting your savings from inflation.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

finance.yahoo.com

- Yahoo Finance: Barrick Gold Corporation, (GOLD), Stock Prices, News, Quotes & History

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads and Example. Risk Metrics

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

bbb.org

How To

The History of Gold as an Asset

From ancient times to the beginning of the 20th century, gold was used as a currency. It was widely accepted around the world and enjoyed its purity, divisibility and uniformity. Because of its intrinsic value, it was also widely traded. Because there were no internationally recognized standards for measuring and weighing gold, the different weights of this metal could be used worldwide. For example in England, a pound sterling equals 24 carats. In France, a livre tournois equals 25. Carats of golden. Germany had one mark which equals 28. Carats.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. This led to a decrease of demand for foreign currencies which in turn caused their prices to rise. At this point, the United States minted large amounts of gold coins, causing the price of gold to drop. Due to the excessive amount of money flowing into the United States, they had to find a way for them to repay some of their debt. They decided to return some of the gold they had left to Europe.

Because most European countries did not trust the U.S. dollar, they started accepting gold as payment. However, after World War I, many European countries stopped taking gold and began using paper money instead. The price of gold rose significantly over the years. Even though the price of gold fluctuates, it remains one the best investments you can make.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: The Rise and Fall of NFT Sales: A Look at the Numbers

Sourced From: news.bitcoin.com/market-dynamics-shift-as-nft-sales-tumble-63-year-over-year/

Published Date: Mon, 01 Jan 2024 21:13:39 +0000

Related posts:

This Week’s NFT Sales Slide, Bored Ape Market Cap Drops 21%, Floor Prices Sink Lower

This Week’s NFT Sales Slide, Bored Ape Market Cap Drops 21%, Floor Prices Sink Lower

2024 Sees Steepest Weekly Plunge in NFT Sales, 5 Major Blockchains Register Double-Digit Losses

2024 Sees Steepest Weekly Plunge in NFT Sales, 5 Major Blockchains Register Double-Digit Losses

Bitcoin Reigns Supreme in NFT Market With Record-Breaking $853 Million in December Sales

Bitcoin Reigns Supreme in NFT Market With Record-Breaking $853 Million in December Sales

Analyzing the Recent Dip in Non-Fungible Token (NFT) Sales

Analyzing the Recent Dip in Non-Fungible Token (NFT) Sales