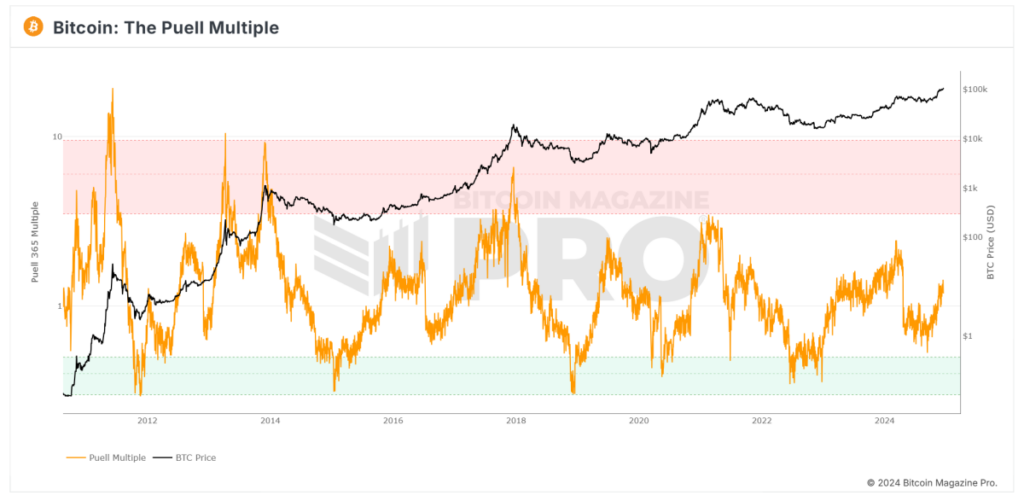

In the world of Bitcoin investing, understanding market cycles is key to identifying buying opportunities and spotting potential price peaks. One indicator that has stood the test of time in this regard is the Puell Multiple. Originally created by David Puell, this metric examines Bitcoin’s valuation through the lens of miner revenue, offering insights into whether Bitcoin might be undervalued or overvalued compared to its historical norms.

What is the Puell Multiple?

The Puell Multiple is an indicator that compares Bitcoin miners’ daily revenue to its long-term average. Miners, as the "supply side" of Bitcoin’s economy, must sell portions of their BTC rewards to cover operational costs like energy and hardware. This makes miner revenue a critical factor influencing Bitcoin’s price dynamics.

How is the Puell Multiple Calculated?

The formula is simple:

Puell Multiple = Daily Issuance Value of BTC (in USD) ÷ 365-Day Moving Average of Daily Issuance Value

By comparing current miner revenues to their yearly average, the Puell Multiple identifies periods where miner profits are unusually high or low, signaling potential market tops or bottoms.

How to Read the Puell Multiple Chart

The Puell Multiple chart uses color zones to make interpretation straightforward:

1. Red Zone (Overvaluation)

- When the Puell Multiple enters the red zone (above 3.4), it suggests miner revenues are significantly higher than usual.

- Historically, this has coincided with Bitcoin price peaks, indicating potential overvaluation.

2. Green Zone (Undervaluation)

- When the Puell Multiple drops into the green zone (below 0.5), it signals that miner revenues are unusually low.

- These periods have historically aligned with Bitcoin market bottoms, offering prime buying opportunities.

3. Neutral Zone

- When the Puell Multiple hovers between these levels, Bitcoin’s price is typically in a steady range relative to historical norms.

Current Insights: What is the Puell Multiple Telling Us?

Looking at the current Puell Multiple chart from Bitcoin Magazine Pro:

- The Puell Multiple (orange line) is trending upward but remains well below the red overvaluation zone.

- This suggests that Bitcoin is not yet in an overheated phase, where prices historically peak.

- At the same time, the metric is far above the green undervaluation zone, signaling we are no longer in a market bottom phase.

What Does This Mean for Investors?

The current Puell Multiple reading points to Bitcoin being in a mid-market cycle:

- Bullish Momentum: With the metric rising steadily, the market appears to be moving into a bullish phase, though it remains far from "overheated."

- No Immediate Peak: The lack of a red zone reading suggests there may still be room for upside growth before a major correction.

Investors should monitor this chart closely in the coming months, particularly as Bitcoin approaches its next halving event in 2028, which could further influence miner revenues.

Why the Puell Multiple Matters for Bitcoin Investors

The Puell Multiple offers a unique perspective on Bitcoin’s market cycles by focusing on the supply side (miner revenue), rather than just demand. For long-term investors, this tool can be valuable for:

- Identifying Buying Opportunities: The green zone highlights periods of undervaluation.

- Spotting Market Peaks: The red zone has historically aligned with major price tops.

- Navigating Market Cycles: Combining the Puell Multiple with other indicators can help investors time their entries and exits more strategically.

Stay Ahead of the Market with Bitcoin Magazine Pro

For professional investors and Bitcoin enthusiasts looking to deepen their analysis, tools like the Puell Multiple chart on Bitcoin Magazine Pro provide essential insights into Bitcoin’s valuation trends.

By understanding the Puell Multiple and its historical significance, you can make informed decisions and better navigate Bitcoin’s unique market cycles.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Frequently Asked Questions

Is it a good idea to open a Precious Metal IRA

Before opening an IRA, it is important to understand that precious metals aren't covered by insurance. There are no ways to recover the money you lost in an investment. This includes losing all your investments due to theft, fire, flood, etc.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items can be lost because they have real value and have been around for thousands years. You would probably get more if you sold them today than you paid when they were first created.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. Consider using a third-party custody company to keep your assets safe and allow you to access them at any time.

If you decide to open an account, remember that you won't see any returns until after you retire. Remember the future.

What is the benefit of a gold IRA?

A gold IRA has many benefits. It is an investment vehicle that can diversify your portfolio. You control how much money goes into each account and when it's withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. This will allow you to transition easily if it is your decision to retire early.

The best thing about investing in gold IRAs is that you don’t need any special skills. They're available at most banks and brokerage firms. You don't have to worry about penalties or fees when withdrawing money.

There are, however, some drawbacks. Gold is historically volatile. So it's essential to understand why you're investing in gold. Are you seeking safety or growth? Is it for security or long-term planning? Only by knowing the answer, you will be able to make an informed choice.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. A single ounce isn't enough to cover all of your needs. You could need several ounces depending on what you plan to do with your gold.

You don’t necessarily need a lot if you’re looking to sell your gold. Even one ounce is enough. But you won't be able to buy anything else with those funds.

How Much of Your IRA Should Be Made Up Of Precious Metals

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don't need to be rich to make an investment in precious metals. You can actually make money without spending a lot on gold or silver investments.

You might also be interested in buying physical coins, such bullion rounds or bars. You could also buy shares in companies that produce precious metals. Your retirement plan provider may offer an IRA rollingover program.

You'll still get the benefit of precious metals no matter which country you live in. They are not stocks but offer long-term growth.

Their prices are more volatile than traditional investments. If you decide to sell your investment, you will likely make more than with traditional investments.

Can I purchase gold with my self directed IRA?

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

Individuals can contribute as much as $5,500 per year ($6,500 if married filing jointly) to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts are financial instruments based on the price of gold. They allow you to speculate on future prices without owning the metal itself. Physical bullion, however, is real gold and silver bars that you can hold in your hand.

What are the fees associated with an IRA for gold?

Six dollars per month is the fee for an Individual Retirement Account (IRA). This includes the account maintenance fees and any investment costs associated with your chosen investments.

If you want to diversify, you may be required to pay extra fees. The type of IRA you choose will determine the fees. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Most providers also charge annual management costs. These fees vary from 0% to 11%. The average rate is.25% annually. These rates can be waived if the broker is TD Ameritrade.

Are gold investments a good idea for an IRA?

For anyone who wants to save some money, gold can be a good investment. You can also diversify your portfolio by investing in gold. But gold is not all that it seems.

It has been used as a currency throughout history and is still a popular method of payment. It is sometimes called the “oldest currency in the world”.

Gold, unlike other paper currencies created by governments is mined directly from the earth. Because it is rare and difficult to make, it is extremely valuable.

The supply-demand relationship determines the gold price. The economy that is strong tends to be more affluent, which means there are less gold miners. Gold's value rises as a result.

On the other hand, people will save cash when the economy slows and not spend it. This results in more gold being produced, which drives down its value.

This is why investing in gold makes sense for individuals and businesses. If you invest in gold, you'll benefit whenever the economy grows.

Your investments will also generate interest, which can help you increase your wealth. If gold's value falls, you don't have to lose any of your investments.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

finance.yahoo.com

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads, Example, and Risk Metrics

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was popular because of its purity, divisibility. uniformity. scarcity and beauty. Aside from its inherent value, it could be traded internationally. There were different measures and weights for gold, as there was no standard to measure it. For example, one pound sterling in England equals 24 carats; one livre tournois equals 25 carats; one mark equals 28 carats; and so on.

The United States started issuing American coins in the 1860s made of 90% copper and 10% zinc. This caused a drop in foreign currency demand which resulted in an increase of their prices. The United States began minting large quantities gold coins at this time, which led to a drop in the price. Due to the excessive amount of money flowing into the United States, they had to find a way for them to repay some of their debt. They decided to return some of the gold they had left to Europe.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. Many European countries started to accept paper money as a substitute for gold after World War I. The price of gold rose significantly over the years. Although the price of gold fluctuates today, it remains one of your most safe investments.

—————————————————————————————————————————————————————————————–

By: Mark Mason

Title: The Puell Multiple: A Powerful Indicator for Bitcoin Investors

Sourced From: bitcoinmagazine.com/markets/what-is-the-bitcoin-puell-multiple-indicator-and-how-does-it-work

Published Date: Wed, 18 Dec 2024 16:53:49 GMT