Introduction

The research team at Matrixport has noticed a significant increase in deposits in U.S. money market funds since the outbreak of Covid-19. This growth is seen as a positive sign for the expansion of the crypto asset market. Analysts believe that bitcoin will continue to rise, regardless of the approval of a spot exchange-traded fund (ETF), due to various factors driving its sustained demand.

Bitcoin's Value Projection

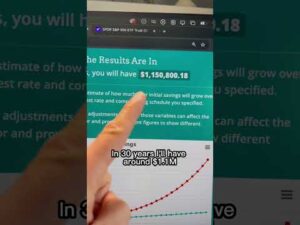

In a mid-October analysis, Matrixport's crypto financial services experts projected that the value of bitcoin could range between $42,000 and $56,000 per unit if the U.S. Securities and Exchange Commission endorses a spot bitcoin ETF. However, a more recent report led by Matrixport's Head of Research Markus Thielen suggests that bitcoin (BTC), along with the broader crypto market, is poised for growth even without ETF approval.

Optimistic Outlook

The report states, "Even if the SEC still disapproves of bitcoin spot ETFs in January 2024, we will likely see higher crypto prices in 2024. Crypto investors should monitor the bitcoin dominance chart daily as a declining indicator could signal that an altcoin rally is imminent."

Growth in U.S. Money Market Funds

Matrixport's analysts highlight the substantial growth in U.S. money market funds, which have doubled from $3 trillion to $6.1 trillion since the start of the Covid-19 pandemic. This surge in funds results in an additional $320 billion in annual interest payments, totaling $370 billion per year or approximately $1 billion daily. The research team believes that such financial movements create a favorable landscape for investments in volatile assets like stocks and crypto assets.

The Significance of 2024

The year 2024 is considered pivotal in the crypto domain. The researchers note, "Not only is 2024 a Bitcoin halving year, in which bitcoin prices have historically risen by an average of +192%, but 2024 is also an election year, and the likelihood of former President Donald Trump being reelected is high." The report suggests that Trump's potential policies could stimulate growth in the U.S. economy, thereby benefiting U.S. stocks and crypto tokens.

Validation of Previous Predictions

One of Matrixport's earlier predictions has already come to fruition, with BTC surpassing the $42,000 mark. As of the latest data, the leading cryptocurrency is trading at $42,834 per unit as of 2:40 p.m. (EST) on Thursday. The report also mentions discussions among Federal Reserve members, including Fed Chair Jerome Powell, about potential rate cuts. In a report published in July, the researchers predicted that BTC could reach $125,000 per coin by the end of 2024.

Conclusion

The research conducted by Matrixport suggests that the crypto economy will continue to thrive even without the approval of a spot bitcoin ETF. The observed growth in U.S. money market funds and the potential impact of the 2024 Bitcoin halving year and election year contribute to the positive outlook for the crypto asset market. Now, we would like to hear your thoughts and opinions on this subject. Please share them in the comments section below.

Frequently Asked Questions

Should You Buy or Sell Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Experts believe this could change soon. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- First, consider whether or not you need the money you're saving for retirement. It is possible to save for retirement while still investing your gold savings. Gold does offer an extra layer of protection for those who reach retirement age.

- Second, you need to be clear about what you are buying before you decide to buy gold. Each one offers different levels security and flexibility.

- Keep in mind that gold may not be as secure as a bank deposit. Losing your gold coins could result in you never being able to retrieve them.

So, if you're thinking about buying gold, make sure you do your research first. And if you already own gold, ensure you're doing everything possible to protect it.

What are the pros & cons of a Gold IRA?

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. An IRA is a great way to save money and not have to pay taxes on the interest you earn. This type of investment has its downsides.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

You will also need to pay fees for managing your IRA. Many banks charge between 0.5%-2.0% per year. Others charge management fees that range from $10 to $50 per month.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. Insurance companies will usually require that you have at least $500,000. Some insurers may require you to have insurance that covers losses up $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers restrict the amount you can own in gold. Others let you choose your weight.

It's also important to decide whether or not to buy gold futures contracts. The price of physical gold is higher than that of gold futures. Futures contracts, however, allow for greater flexibility in buying gold. They let you set up a contract that has a specific expiration.

You also need to decide the type and level of insurance coverage you want. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. However, it does cover damage caused by natural disasters. You may consider adding additional coverage if you live in an area at high risk.

Insurance is not enough. You also need to think about the cost of gold storage. Insurance doesn't cover storage costs. Banks charge between $25 and $40 per month for safekeeping.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians are not allowed to sell your assets. Instead, they must keep your assets for as long you request.

Once you've chosen the best type of IRA for you, you need to fill in paperwork describing your goals. You should also include information about your desired investments, such as stocks or bonds, mutual funds, real estate, and mutual funds. Also, you should specify how much each month you plan to invest.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. The company will review your application and send you a confirmation letter.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can help you find cheaper insurance options to lower your costs.

How much should I contribute to my Roth IRA account?

Roth IRAs allow you to deposit your money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. There are some rules that you need to keep in mind if you want to withdraw funds from these accounts before you reach 59 1/2. First, you can't touch your principal (the initial amount that was deposited). This means that you can't take out more money than you originally contributed. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule states that income taxes must be paid before you can withdraw earnings. When you withdraw, you will have to pay income tax. Let's take, for example, $5,000 in annual Roth IRA contributions. Let's also say that you earn $10,000 per annum after contributing. Federal income taxes would apply to the earnings. You would be responsible for $3500 That leaves you with only $6,500 left. The amount you can withdraw is limited to the original contribution.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

There are two types if Roth IRAs: Roth and Traditional. Traditional IRAs allow you to deduct pretax contributions from your taxable income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. There are no restrictions on the amount you can withdraw from a Traditional IRA.

Roth IRAs are not allowed to allow you deductions for contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. There is no minimum withdrawal amount, unlike traditional IRAs. You don't have to wait until you turn 70 1/2 years old before withdrawing your contribution.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

cftc.gov

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

bbb.org

How To

The growing trend of gold IRAs

As investors look for ways to diversify their portfolios and protect themselves against inflation, the gold IRA trend is on the rise.

The gold IRA allows investors to purchase physical gold bars and bullion. It can be used as a tax-free way to grow and it is an alternative investment option for people who are not comfortable with stocks or bonds.

Investors can manage their assets with a gold IRA without worrying about market volatility. Investors can protect themselves from inflation and other possible problems by using the gold IRA.

Investors also have the benefit of physical gold, which has unique properties such durability, portability and divisibility.

The gold IRA also offers many other benefits, such as the ability to quickly transfer the ownership of the gold to heirs, and the fact the IRS doesn't consider gold a currency.

All this means that the gold IRA is becoming increasingly popular among investors seeking a haven during financial uncertainty.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: The Potential Impact of U.S. Money Market Growth on the Crypto Asset Market

Sourced From: news.bitcoin.com/analysts-predict-higher-crypto-prices-in-2024-regardless-of-spot-bitcoin-etf-approval/

Published Date: Thu, 14 Dec 2023 21:00:09 +0000

Did you miss our previous article…

https://altcoinirareview.com/treasury-secretary-janet-yellen-discusses-us-economy-recession-risk-soft-landing/

Related posts:

Bitwise Unveils 10 Crypto Predictions for 2024: Bitcoin to Surpass $80,000, Spot Bitcoin ETFs Could Capture $72 Billion

Bitwise Unveils 10 Crypto Predictions for 2024: Bitcoin to Surpass $80,000, Spot Bitcoin ETFs Could Capture $72 Billion

7 Best Bitcoin IRA Companies 2023 (Ranked by lowest fees)

7 Best Bitcoin IRA Companies 2023 (Ranked by lowest fees)

What is Insurance and How It Works?

What is Insurance and How It Works?

Vaneck Unveils 15 Crypto Predictions: Spot Bitcoin ETF Approvals, US Recession, BTC’s Historic Rally

Vaneck Unveils 15 Crypto Predictions: Spot Bitcoin ETF Approvals, US Recession, BTC’s Historic Rally