Ninety-one years ago today, President Franklin D. Roosevelt executed the most significant heist in American history. Unlike traditional robberies, this one was completely lawful. No safes were cracked, no ski masks or guns were involved, just a pen and some White House letterhead.

Executive Order 6102: The Turning Point in Monetary History

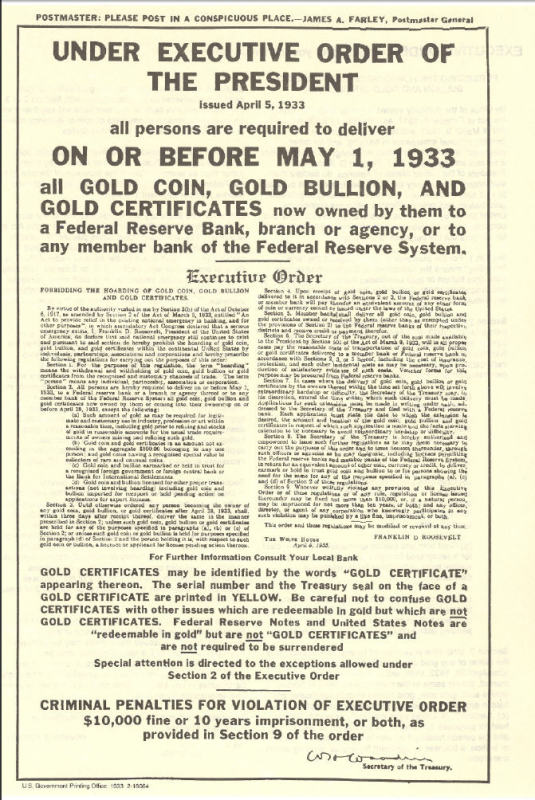

On April 5, 1933, FDR issued Executive Order 6102, which prohibited individuals in the United States from owning gold. Failure to comply could result in a $10,000 fine or 10 years in prison. This order marked a crucial milestone in the shift from the gold standard to a fiat currency system in the USA.

Bitcoin's Connection to EO 6102

Although Bitcoin enthusiasts view EO 6102 as a historical event, it serves as a vital cautionary tale about government seizure of personal property. The order highlights the importance of self-custody, showcasing the value of Bitcoin in safeguarding assets from arbitrary government actions.

The Legal Maneuver behind EO 6102

While debates often focus on the motives and justifications behind FDR's actions, understanding the legal framework of EO 6102 is crucial. Despite FDR's expansive executive powers, the order was executed within specific legal precedents, setting a precedent for future abuses of power.

The Evolution of National Emergencies

Presidential exploitation of 'national emergency' declarations dates back to Abraham Lincoln's suspension of habeas corpus in 1862. Subsequent administrations have leveraged this concept, culminating in the formalization of emergency powers under the National Emergencies Act of 1976.

From Gold Confiscation to Bitcoin Seizure?

The story of Executive Order 6102 underscores the enduring threat of government overreach. Could a modern-day administration replicate FDR's actions with Bitcoin? While the context differs, the underlying lesson remains: safeguarding private assets is paramount in times of crisis.

Preparing for an Uncertain Future

As history has shown, national emergencies empower governments to infringe on civil liberties. The looming question is not 'if' but 'when' the next crisis will arise. With the rise of Bitcoin, individuals have a potential shield against future expropriation of wealth.

In conclusion, the legacy of Executive Order 6102 serves as a stark reminder: without control of your assets, you risk losing them to government intervention. The key takeaway remains – secure your keys, safeguard your coins.

Frequently Asked Questions

Can the government take your gold?

Your gold is yours, so the government cannot confiscate it. You earned it through hard work. It is yours. This rule may not apply to all cases. You could lose your gold if convicted of fraud against a federal government agency. Additionally, your precious metals may be forfeited if you owe the IRS taxes. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

What is the best precious-metal to invest?

This depends on what risk you are willing take and what kind of return you desire. Gold has been traditionally considered a haven investment, but it's not always the most profitable choice. You might not want to invest in gold if you're looking for quick returns. If you have time and patience, you should consider investing in silver instead.

If you don’t desire to become rich quickly, gold may be your best option. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

Should you Invest In Gold For Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. If you're unsure about which option to choose then consider investing in both.

In addition to being a safe investment, gold also offers potential returns. Retirees will find it an attractive investment.

While many investments promise fixed returns, gold is subject to fluctuations. As a result, its value changes over time.

This does not mean you shouldn’t invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another benefit to gold is its tangible value. Unlike stocks and bonds, gold is easier to store. It is also easily portable.

You can always access your gold as long as it is kept safe. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold tends to rise when the stock markets fall.

Another advantage to investing in gold is the ability to sell it whenever you wish. Like stocks, you can sell your position anytime you need cash. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

You shouldn't buy too little at once. Start with a few ounces. Next, add more as required.

Don't expect to be rich overnight. It is to create enough wealth that you no longer have to depend on Social Security.

Even though gold is not the best investment, it could be an excellent addition to any retirement plan.

What are the benefits of a gold IRA

There are many benefits to a gold IRA. It's an investment vehicle that lets you diversify your portfolio. You have control over how much money goes into each account.

You also have the option to transfer funds from other retirement plans into a IRA. This will allow you to transition easily if it is your decision to retire early.

The best part is that you don't need special skills to invest in gold IRAs. They are offered by most banks and brokerage companies. Withdrawals are made automatically without having to worry about fees or penalties.

There are, however, some drawbacks. Gold has always been volatile. Understanding why you want to invest in gold is essential. Is it for growth or safety? Is it for insurance purposes or a long-term strategy? Only then will you be able make informed decisions.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. A single ounce will not be sufficient to meet all your requirements. Depending on the purpose of your gold, you might need more than one ounce.

You don't need to have a lot of gold if you are selling it. You can even live with just one ounce. These funds won't allow you to purchase anything else.

Who is the owner of the gold in a gold IRA

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

This tax-free status is only available to those who have owned at least $10,000 of gold and have kept it for at minimum five years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

A financial planner or accountant should be consulted to discuss your options.

What are the fees for an IRA that holds gold?

$6 per month is the Individual Retirement Account Fee (IRA). This includes the account maintenance fees and any investment costs associated with your chosen investments.

If you want to diversify, you may be required to pay extra fees. The fees you pay will vary depending on the type of IRA that you choose. Some companies offer free checking, but charge monthly fees for IRAs.

Many providers also charge annual management fees. These fees are usually between 0% and 1%. The average rate is.25% per year. However, these rates are typically waived if you use a broker like TD Ameritrade.

How is gold taxed within a Roth IRA

The tax on an investment account is based on its current value, not what you originally paid. If you invest $1,000 into a mutual fund, stock, or other investment account, then any gains are subjected tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

The rules governing these accounts vary by state. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. Massachusetts allows you up to April 1st. New York has a maximum age limit of 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

cftc.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

bbb.org

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The best place to buy silver or gold online

You must first understand the workings of gold before you can purchase it. Precious metals like gold are similar to platinum. It's very rare, and it is often used as money for its durability and resistance. It's difficult to use, so most people prefer purchasing jewelry made from it rather than actual bars.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins are those that are intended for circulation in a country. They typically have denominations of $1, $5 or $10.

Bullion coins are minted for investment purposes only, and their values increase over time due to inflation.

They aren't circulated in any currency exchange systems. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. Each dollar spent earns the buyer 1 gram gold.

When looking to buy precious metals, the next thing you should be aware of is where it can be purchased. If you want to purchase gold directly from a dealer, then a few options are available. First, go to your local coin shop. Another option is to go through a reputable site like eBay. Finally, you can look into purchasing gold through private sellers online.

Individuals who sell gold at wholesale and retail prices are called private sellers. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. You would receive less money from a private buyer than you would from a coin store or eBay. This option is often a great choice for investing gold as it allows you more control over its price.

You can also invest in gold physical. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank will provide you with a loan that allows you to purchase the amount of gold you desire. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks charge higher interest rates than those offered by pawn shops.

You can also ask for help to purchase gold. Selling gold can be as easy as selling. Contact a company such as GoldMoney.com, and you can set up a simple account and start receiving payments immediately.

—————————————————————————————————————————————————————————————–

By: Julian Fahrer

Title: The Legal Heist of American Gold: How Executive Order 6102 Shaped History

Sourced From: bitcoinmagazine.com/culture/national-emergency-executive-order-6102-and-the-heist-of-the-century-

Published Date: Fri, 05 Apr 2024 16:30:00 GMT

Related posts:

MicroStrategy And Its Executive Chairman Michael Saylor Are Being Sued For Tax Fraud

MicroStrategy And Its Executive Chairman Michael Saylor Are Being Sued For Tax Fraud

Predictions For Bitcoin And World Markets With The Upcoming FOMC Meeting

Predictions For Bitcoin And World Markets With The Upcoming FOMC Meeting

Balaji Srinivasan Equates Bitcoin ETF Move to Reversal of FDR’s Historic Gold Seizure

Balaji Srinivasan Equates Bitcoin ETF Move to Reversal of FDR’s Historic Gold Seizure

Michael Saylor Publishes Open Letter Discussing the ‘Sheer Volume of Misinformation’ Tied to Bitcoin

Michael Saylor Publishes Open Letter Discussing the ‘Sheer Volume of Misinformation’ Tied to Bitcoin