Institutional Accumulation

Bitcoin enthusiasts have long awaited a substantial change in value due to institutional investors' involvement. The expectation was that as companies and large financial entities entered the Bitcoin market, there would be explosive growth and a sustained period of rising prices. However, the reality has been more intricate than anticipated. While institutions have indeed poured significant capital into Bitcoin, the projected 'supercycle' has not materialized as expected.

In recent years, institutional participation in Bitcoin has surged with major purchases from large companies and the introduction of Bitcoin Exchange-Traded Funds (ETFs) earlier this year.

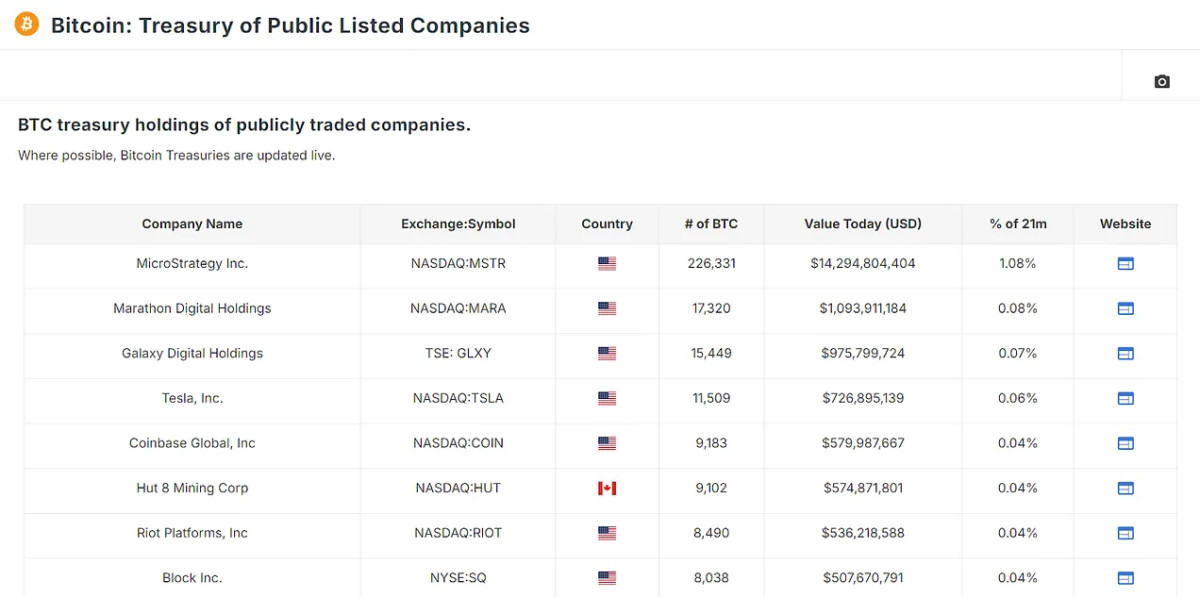

MicroStrategy leads this movement, holding over 1% of the total Bitcoin supply. Other key players include Marathon Digital, Galaxy Digital, Tesla, Hut 8, Hive, Nexon, and Phoenix Digital Assets. These companies collectively hold over 340,000 bitcoin. The introduction of Bitcoin ETFs has been a game-changer, attracting billions of dollars in investments and accumulating over 91,000 bitcoin. In total, private companies and ETFs control around 1.24 million bitcoin, representing about 6.29% of all circulating bitcoin.

A Look at Bitcoin's Recent Price Movements

Since the approval of Bitcoin ETFs in January, Bitcoin's price movements have been indicative of potential future impacts of institutional investment. Despite a brief dip after the ETF approval, the market quickly rebounded, witnessing a surge of approximately 60% within two months. This surge aligns with institutional investors' accumulation of Bitcoin through ETFs. A sustained bullish momentum in Bitcoin prices may be witnessed if institutions continue to buy at the current or increased pace, assuming they are long-term holders unlikely to sell off their assets soon.

The Money Multiplier Effect: Amplifying the Impact

Institutional accumulation of assets possesses a significant impact, amplified by the money multiplier effect. This effect states that when a substantial portion of an asset's supply is withdrawn from active circulation, the price of the remaining circulating supply can become more volatile. For Bitcoin, with only about 25% of its supply being actively traded, the money multiplier effect can be potent. Institutional ownership of 6.29% of all bitcoin could influence around 25% of the circulating supply, potentially leading to significant market impacts.

If institutional investors begin offloading their holdings, the market could experience a downturn, triggering retail holders to follow suit. Conversely, continued buying from institutions could lead to a dramatic surge in BTC price, especially if they remain long-term holders. This highlights the dual nature of institutional involvement in Bitcoin, which steadily gains influence over the asset.

Conclusion

Institutional investment in Bitcoin carries both positive and negative implications. While it brings legitimacy and capital that could drive prices to new highs, the concentration of Bitcoin among a few institutions could heighten volatility and pose downside risks if these players decide to exit their positions.

For a more comprehensive exploration of this topic, you can watch a recent YouTube video here.

Frequently Asked Questions

How much gold should your portfolio contain?

The amount you make will depend on the amount of capital you have. A small investment of $5k-10k would be a great option if you are looking to start small. As you grow, you can move into an office and rent out desks. So you don't have all the hassle of paying rent. It's only one monthly payment.

Also, you need to think about the type of business that you are going to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. So you might only get paid once every 6 months or so.

Decide what kind of income do you want before you calculate how much gold is needed.

I recommend starting with $1k-$2k in gold and working my way up.

Can I buy or sell gold from my self-directed IRA

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contract are financial instruments that depend on the gold price. These financial instruments allow you to speculate about future prices without actually owning the metal. But physical bullion refers to real gold and silver bars you can carry in your hand.

What is a gold IRA account?

The Gold Ira Accounts are tax-free investment options for those who want to make investments in precious metals.

Physical gold bullion coin can be purchased at any time. You don't have a retirement date to invest in gold.

An IRA lets you keep your gold for life. Your gold holdings won't be subject to taxes when you pass away.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). Once you've done so, you'll be given an IRA custodian. This company acts as a mediator between you, the IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

After you have created your gold IRA, the only thing you need to do is purchase gold bullion. Minimum deposit required is $1,000 The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

You will pay taxes when you withdraw your gold from your IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

You may not be required to pay taxes if you take out only a small amount. There are exceptions. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

You should avoid taking out more than 50% of your total IRA assets yearly. Otherwise, you'll face steep financial consequences.

What are the benefits to having a gold IRA

You can save money on retirement by putting your money into an Individual Retirement Account. It is tax-deferred until it's withdrawn. You control how much you take each year. There are many types of IRAs. Some are more suitable for students who wish to save money for college. Others are designed for investors looking for higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. These earnings don't get taxed if they withdraw funds. This account is a good option if you plan to retire early.

An IRA with a gold status is like any other IRA because you can put money into different asset classes. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. This means that you don't need to worry about making monthly deposits. To make sure you don't miss any payments, you can also set up direct deductions.

Gold is one of today's most safest investments. Because it isn't tied to any particular country its value tends be steady. Even during economic turmoil the gold price tends to remain fairly stable. It is therefore a great choice for protecting your savings against inflation.

What is a Precious Metal IRA (IRA)?

You can diversify your retirement savings by investing in precious metal IRAs. This allows you to invest in gold, silver and platinum as well as iridium, osmium and other rare metals. These metals are known as “precious” because they are rare and extremely valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Precious metals are often referred to as “bullion.” Bullion refers only to the actual metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

You can invest directly in bullion with a precious metal IRA instead of buying shares of stock. This allows you to receive dividends every year.

Precious metal IRAs do not require paperwork nor annual fees, unlike regular IRAs. Instead, your gains are subject to a small tax. You also have unlimited access to your funds whenever and wherever you wish.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

irs.gov

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options? Types, Spreads and Example. Risk Metrics

How To

Three ways to invest in gold for retirement

It's important to understand how gold fits in with your retirement plan. If you have a 401(k) account at work, there are several ways you can invest in gold. You might also consider investing in gold outside your workplace. If you have an IRA (Individual Retirement Account), a custodial account could be opened at Fidelity Investments. If precious metals aren't your thing, you may be interested in buying them from a dealer.

These are the three rules to follow if you decide to invest in gold.

- You can buy gold with your cash – No need to use credit cards or borrow money for investment financing. Instead, deposit cash into your accounts. This will protect your against inflation and increase your purchasing power.

- Physical Gold Coins to Own – Physical gold coin ownership is better than having a paper certificate. The reason for this is that physical gold coins are much more easily sold than certificates. Physical gold coins don't require storage fees.

- Diversify your Portfolio. In other words, spread your wealth around by investing in different assets. This reduces risk and allows you to be more flexible during market volatility.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: The Impact of Institutional Investors on Bitcoin

Sourced From: bitcoinmagazine.com/markets/the-impact-of-institutional-investors-on-bitcoin

Published Date: Fri, 30 Aug 2024 15:45:09 GMT