As we look ahead to 2025, it is essential to adopt a methodical and data-driven approach in forecasting what lies ahead for Bitcoin. By examining on-chain data, market cycles, macroeconomic indicators, and other key factors in tandem, we can move beyond mere speculation and construct a well-informed projection for the upcoming months.

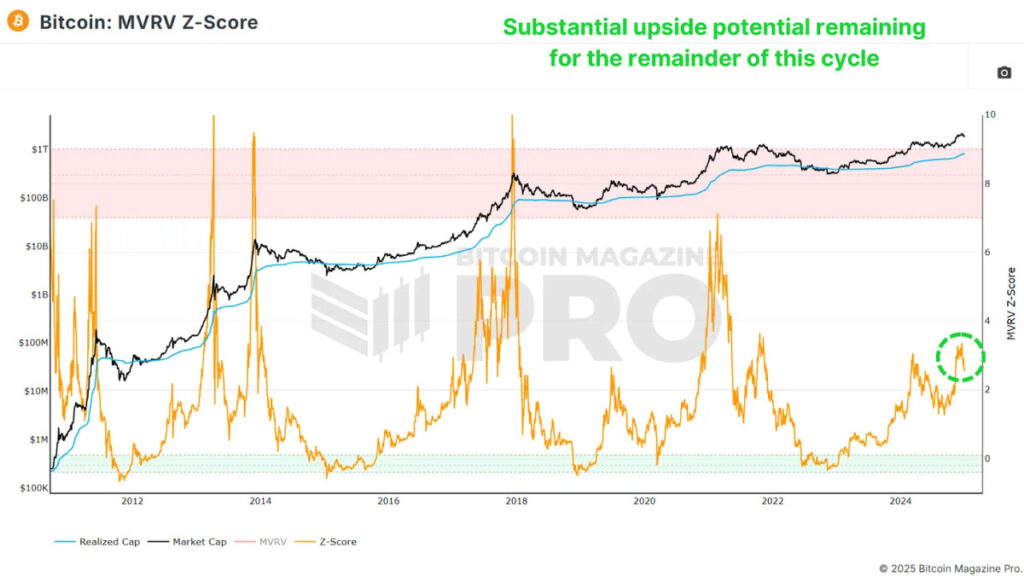

The MVRV Z-Score: A Key Indicator

The MVRV Z-Score is a pivotal metric that gauges the relationship between Bitcoin's realized price (the average purchase price of all BTC transactions on the network) and its market capitalization. By standardizing this ratio to account for volatility, the Z-Score offers valuable insights into market cycles based on historical trends.

At present, the MVRV Z-Score indicates a significant upside potential. While past cycles have witnessed Z-Score values exceeding 7, any figure above 6 signals potential overextension, necessitating a closer examination of additional metrics to pinpoint a potential market peak. Currently, we find ourselves at levels akin to those observed in May 2017, when Bitcoin's value was merely a few thousand dollars. Given this historical context, there is ample room for substantial gains, potentially in the hundreds of percentage points from current levels.

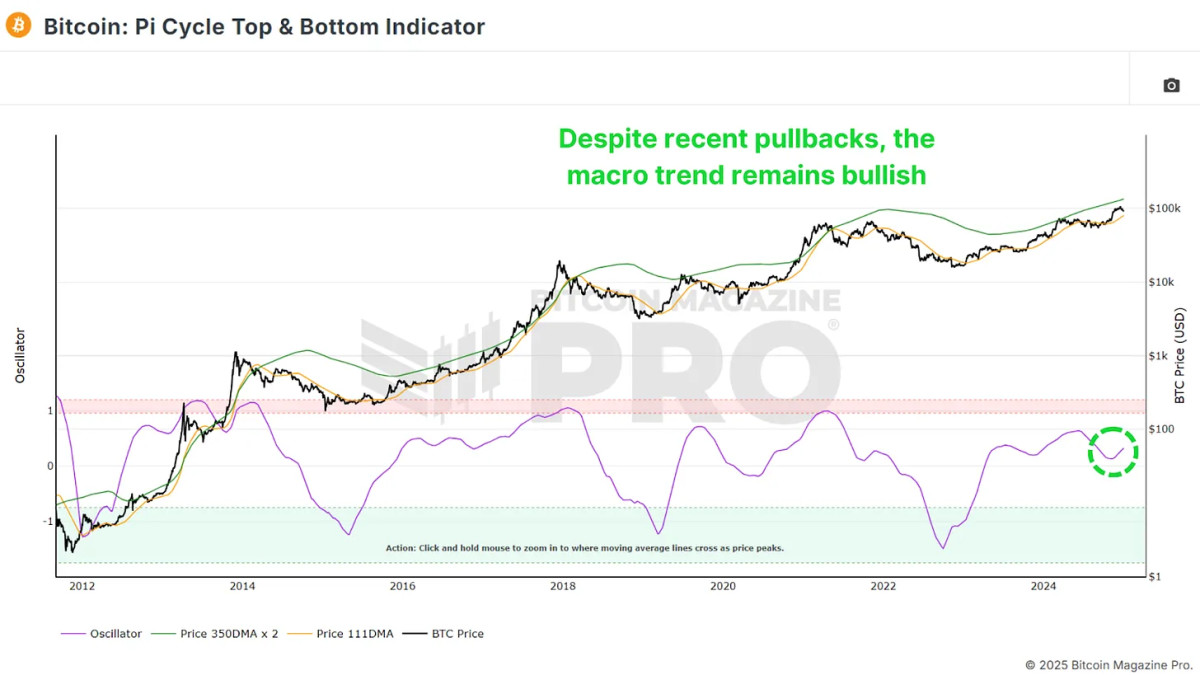

The Pi Cycle Top and Bottom Indicator

An additional crucial metric to consider is the Pi Cycle Top and Bottom indicator, which monitors the 111-day and 350-day moving averages (with the latter multiplied by 2). Historically, the convergence of these moving averages often heralds a Bitcoin price peak within a few days.

The expanding gap between these two moving averages indicates a resurgence of bullish momentum. While 2024 witnessed phases of sideways consolidation, the breakout presently underway suggests that Bitcoin is entering a robust growth phase that could endure for several months.

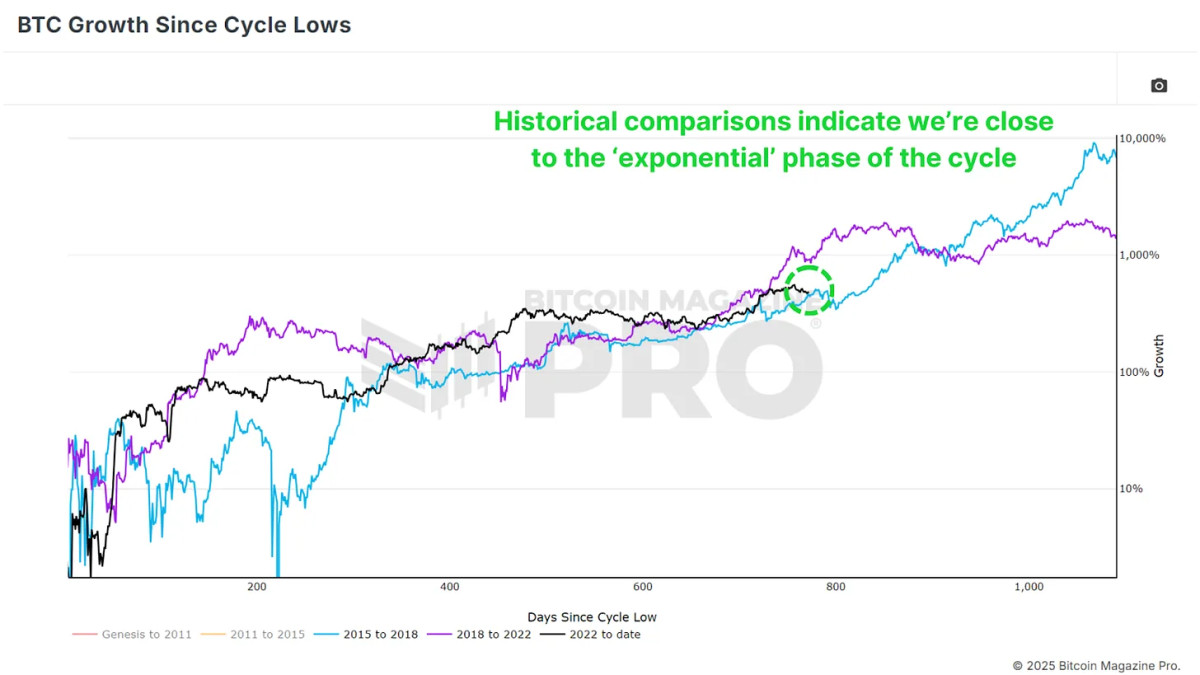

Bitcoin's Price Action: Past and Present

A historical analysis of Bitcoin's price movements reveals recurring cycles characterized by a "post-halving cooldown" lasting 6–12 months before transitioning into a period of exponential growth. Drawing from past cycles, we are approaching a critical juncture. While the anticipated returns may be more modest compared to earlier cycles, there remains potential for substantial growth.

For perspective, surpassing the previous all-time high of $20,000 during the 2020 cycle culminated in a peak near $70,000—an increase of 3.5 times. Even with a conservative projection of 2x or 3x from the $70,000 peak, Bitcoin could feasibly reach $140,000–$210,000 in the current cycle.

Macro Factors and Bitcoin's Trajectory

Despite challenges faced in 2024, Bitcoin exhibited resilience, notably in the backdrop of a strengthening U.S. Dollar Index (DXY). Historically, Bitcoin and the DXY exhibit an inverse relationship, implying that any weakening of the DXY could further propel Bitcoin's upward trajectory.

Moreover, macroeconomic indicators such as high-yield credit cycles and the global M2 money supply point towards a favorable environment for Bitcoin. The anticipated reversal of the money supply contraction seen in 2024 in 2025 sets the stage for a more conducive landscape.

The Bitcoin Cycle Master Chart

The Bitcoin Cycle Master Chart, which consolidates various on-chain valuation metrics, illustrates that Bitcoin still possesses considerable room for growth before approaching overvaluation territory. The upper threshold, currently positioned around $190,000, continues to ascend, reinforcing the narrative of sustained upward momentum.

Outlook for Bitcoin in 2025

On the whole, multiple data points align towards a bullish outlook for Bitcoin in 2025. While past performance serves as a guide rather than a guarantee of future results, the data strongly indicates that Bitcoin may have brighter days ahead, building upon the positive momentum witnessed in 2024.

For a deeper dive into this subject matter, you can watch a recent YouTube video titled "Bitcoin 2025 – A Data-Driven Outlook." To access more comprehensive Bitcoin analysis, including live charts, personalized indicator alerts, and detailed industry reports, consider exploring Bitcoin Magazine Pro.

Disclaimer: The content provided in this article is for informational purposes only and should not be construed as financial advice. It is advisable to conduct thorough research before making any investment decisions.

Frequently Asked Questions

What proportion of your portfolio should you have in precious metals

To answer this question, we must first understand what precious metals are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them very valuable in terms of trading and investment. Today, gold is the most commonly traded precious metal.

But, there are other types of precious metals available, including platinum and silver. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is not affected by inflation or deflation.

In general, prices for precious metals tend increase with the overall marketplace. That said, they do not always move in lockstep with each other. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

However, when an economy is strong, the reverse effect occurs. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. Because they are rare, they become more pricey and lose value.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. However, there are disadvantages to this type investment.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. The IRS may prevent you from taking out your IRA funds until you reach 59 1/2. A penalty fee will be charged if you decide to withdraw funds.

Another problem is the cost of managing your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management costs ranging from $10-50.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. Insurance companies will usually require that you have at least $500,000. You might be required to buy insurance that covers losses up to $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. You may be limited in the amount of gold you can have by some providers. Some providers allow you to choose your weight.

You will also have to decide whether to purchase futures or physical gold. Gold futures contracts are more expensive than physical gold. Futures contracts allow you to buy gold with more flexibility. They enable you to establish a contract with an expiration date.

You also need to decide the type and level of insurance coverage you want. Standard policies don't cover theft protection, loss due to fire, flood or earthquake. It does provide coverage for damage from natural disasters, however. You might consider purchasing additional coverage if your area is at high risk.

You should also consider the cost of storage for your gold. Storage costs will not be covered by insurance. In addition, most banks charge around $25-$40 per month for safekeeping.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians don't have the right to sell assets. Instead, they must retain them for as long and as you require.

Once you've decided which type of IRA best suits your needs, you'll need to fill out paperwork specifying your goals. You should also include information about your desired investments, such as stocks or bonds, mutual funds, real estate, and mutual funds. It is also important to specify how much money you will invest each month.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. The company will review your application and send you a confirmation letter.

A financial planner is a good idea when opening a gold IRA. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can also help you lower your expenses by finding cheaper alternatives to purchasing insurance.

How much are gold IRA fees?

A monthly fee of $6 for an Individual Retirement Account is charged. This includes the account maintenance fees and any investment costs associated with your chosen investments.

If you want to diversify, you may be required to pay extra fees. These fees will vary depending upon the type of IRA chosen. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

In addition, most providers charge annual management fees. These fees range between 0% and 1 percent. The average rate per year is.25%. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads. Example. And Risk Metrics

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

How To

Guidelines for Gold Roth IRA

Start saving as soon as possible to save for your retirement. Start saving as soon and as often as you're eligible (usually around 50 years old) and keep going until retirement. It is essential to save enough money each year in order to maintain a steady growth rate.

Additionally, tax-free opportunities like a traditional 401k or SEP IRA are available. These savings vehicles allow you the freedom to contribute without having to pay tax on your earnings until they are withdrawn. These savings vehicles can be a great option for individuals who don't qualify for employer matching funds.

It's important to save regularly and over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: The Future of Bitcoin in 2025: A Data-Driven Analysis

Sourced From: bitcoinmagazine.com/markets/2025-bitcoin-outlook-insights-backed-by-metrics-and-market-data

Published Date: Fri, 03 Jan 2025 13:50:00 GMT