Bitcoin has a fascinating history of following a distinct four-year cycle. As we find ourselves two years into the current cycle, investors are keenly observing trends and signals in the market to gain insights into what the next two years might bring. This article delves deep into the structure of Bitcoin's four-year cycle, past market behaviors, and potential future scenarios.

Understanding the 4 Year Cycle

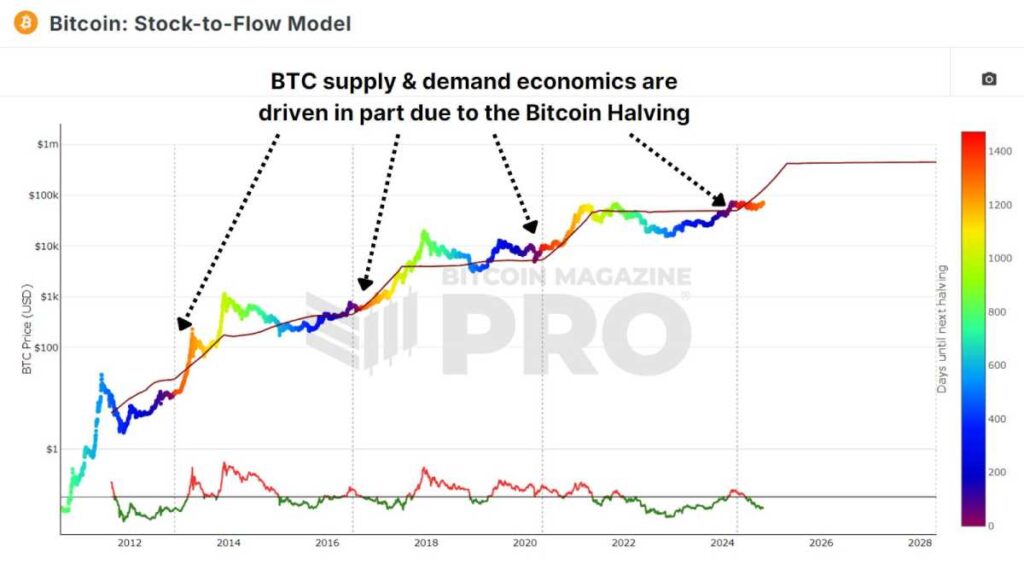

The four-year cycle of Bitcoin is significantly influenced by the scheduled halving events, where the block reward miners receive is reduced by 50% every four years. This event plays a crucial role in decreasing the supply of new Bitcoin entering the market, which often leads to supply-demand dynamics that can drive prices upwards.

An illustrative way to comprehend this phenomenon is through the Stock-to-Flow Model, which compares the circulating BTC to its inflation rate and establishes a 'fair-value' based on similar hard assets like Gold and Silver.

Reflecting on 2022

Looking back at the year 2022, Bitcoin encountered a significant crash amidst a series of corporate collapses. The downfall of FTX in November 2022, fueled by insolvency rumors, triggered massive sell-offs. This event set off a chain reaction, causing other crypto institutions such as BlockFi, 3AC, Celsius, and Voyager Digital to topple as well.

Following this turmoil, Bitcoin's price plummeted from approximately $20,000 to $15,000, echoing the widespread market panic and raising concerns about Bitcoin's sustainability. Yet, true to its nature, Bitcoin rebounded, surging back up fivefold from the 2022 lows. Investors who remained steadfast during the storm were handsomely rewarded, reinforcing the cyclical nature of Bitcoin.

Analyzing Investor Sentiment

In addition to price trends, investor sentiment also exhibits a predictable pattern throughout each cycle. By examining the Net Unrealized Profit and Loss (NUPL), a metric showcasing unrealized gains and losses in the market, we can observe recurring emotions such as euphoria, fear, and capitulation. Bitcoin investors typically navigate through phases of fear and pessimism during bear markets, only to transition towards optimism and euphoria as prices recover and surge. Currently, we are witnessing a return to the 'Belief' stage after the initial cycle upswing and subsequent consolidation.

Impact of the Global Liquidity Cycle

The global money supply and cyclical liquidity, as highlighted by the Global M2 YoY vs BTC, also adhere to a four-year cycle. Instances such as M2 liquidity hitting lows in 2015 and 2018 aligning with Bitcoin's downturns illustrate this correlation. Post periods of economic contraction, central banks and governments worldwide embark on fiscal expansion, creating a conducive environment for Bitcoin price appreciation.

Recognizing Historical Trends

Historical price analysis indicates that Bitcoin's current trajectory mirrors previous cycles. Typically, Bitcoin takes approximately 24-26 months from its lows to surpass previous highs. In the previous cycle, this timeframe was 26 months. In the current cycle, Bitcoin is on a similar upward path after 24 months. Historically, Bitcoin reaches its peak around 35 months post-lows. Should this pattern persist, we can anticipate substantial price surges until October 2025, after which a potential bear market phase may ensue.

Subsequent to the projected peak, historical data suggests Bitcoin could enter a bear phase in 2026, lasting about a year before the commencement of a new cycle. While these patterns are not definitive, they offer a roadmap that Bitcoin has historically adhered to, providing investors with a framework to anticipate and navigate market fluctuations.

Final Thoughts

Despite encountering challenges, Bitcoin's four-year cycle has endured due to its supply schedule, global liquidity trends, and investor psychology. Therefore, understanding and utilizing the four-year cycle as a tool to interpret potential price movements in Bitcoin is crucial. However, solely relying on this cycle may be myopic. By integrating on-chain metrics, liquidity analysis, and real-time investor sentiment, investors can adopt data-driven strategies to effectively respond to evolving market conditions.

To delve deeper into this subject, you can watch a recent YouTube video titled The 4 Year Bitcoin Cycle – Half Way Done?

Frequently Asked Questions

Should You Open a Precious Metal IRA?

It is essential to be aware of the fact that precious metals do not have insurance coverage before opening an IRA. It is impossible to get back money if you lose your investment. All your investments can be lost due to theft, fire or flood.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items are timeless and have a lifetime value. If you were to offer them for sale today, they would likely fetch you more than you paid when you bought them.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. You should also consider using a third party custodian to protect your assets and give you access at any time.

If you decide to open an account, remember that you won't see any returns until after you retire. So, don't forget about the future!

Can I keep a Gold ETF in a Roth IRA

A 401(k) plan may not offer this option, but you should consider other options, such as an Individual Retirement Account (IRA).

An IRA traditional allows both employees and employers to contribute. An Employee Stock Ownership Plan (ESOP) is another way to invest in publicly traded companies.

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

A Individual Retirement Annuity is also possible. An IRA allows for you to make regular income payments during your life. Contributions to IRAs don't have to be taxable

Who has the gold in a IRA gold?

The IRS considers any individual who holds gold “a form of income” that is subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

The purchase of gold can protect you from inflation and price volatility. But it's not smart to hold it if your only intention is to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

To find out what options you have, consult an accountant or financial planner.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

irs.gov

cftc.gov

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Lawful – WSJ

How To

Guidelines for Gold Roth IRA

Starting early is the best way to save for retirement. As soon as you become eligible, which is usually around age 50, start saving and keep it up throughout your career. It is important to invest enough money each and every year to ensure you get adequate growth.

You also want to take advantage of tax-free opportunities such as a traditional 401(k), SEP IRA, or SIMPLE IRA. These savings vehicles let you make contributions and not pay taxes until the earnings are withdrawn. This makes them a great choice for people who don’t have access employer matching funds.

Save regularly and continue to save over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: The Evolution of Bitcoin: Analyzing the 4 Year Cycle

Sourced From: bitcoinmagazine.com/markets/half-way-through-the-4-year-bitcoin-cycle

Published Date: Fri, 08 Nov 2024 19:02:07 GMT