Introduction

Gold mining has long been associated with environmental degradation and pollution. However, in comparison to the popular belief that Bitcoin mining is harmful to the environment, recent research suggests that Bitcoin mining may actually have a lower carbon footprint and could even enhance renewable energy expansion. This article aims to explore the environmental impact of gold mining and compare it to the potential benefits of Bitcoin mining.

The Reality of Gold Mining

Contrary to the perception of gold as a pure and clean substance, the reality of gold production reveals a different story. Gold mining is one of the most polluting industries worldwide, ranking second after coal mining in terms of land coverage. Gold mining sites cover more land than the combined areas of copper, iron, and aluminum mining sites.

Environmental Pollution

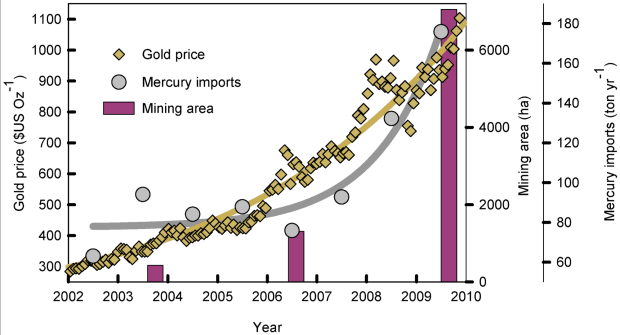

As high-yield gold mines become exhausted, chemical processes involving toxic chemicals such as cyanide-leaching and amalgamation are being used. These processes lead to the contamination of water sources, resulting in acid mine drainage. Acid mine drainage is a toxic cocktail for aquatic life and can have detrimental effects on the entire food chain. The release of cyanide and mercury waste from gold mines has caused environmental disasters, such as the contamination of rivers and the emission of mercury into the atmosphere.

Impacts on Human Health

The environmental pollution caused by gold mining has severe consequences for human health. Mercury poisoning from artisanal and small-scale gold mining in the global South has led to neurological issues, vision and hearing loss, seizures, and memory problems among exposed populations. The downstream communities in mining areas also face health risks from consuming heavily contaminated fish.

The Role of Western Mining Companies

Stricter environmental and labor regulations in Western countries have prompted mining companies to move their operations to developing countries. This shift has resulted in the export of environmental degradation and social harm to regions with weaker regulations. Surprisingly, only a small percentage of mined gold is used for industrial purposes, with the majority being processed for jewelry or purchased as a store of value. This demand for gold as a store of value drives the expansion of gold mining, further exacerbating its environmental impact.

The Potential of Bitcoin Mining

Bitcoin mining, often criticized for its energy consumption, has the potential to be a more environmentally friendly alternative to gold mining. With the upcoming halving of block subsidies, the inflation rate of Bitcoin will decrease, making it a more stable store of value. Additionally, Bitcoin mining can incentivize the expansion of renewable energy sources, as it requires a substantial amount of electricity. By subsidizing renewable energy expansion, Bitcoin mining could contribute to a cleaner and more sustainable energy future.

Conclusion

While gold mining has long been associated with environmental degradation and pollution, the potential benefits of Bitcoin mining should not be overlooked. The comparison between the two reveals that Bitcoin mining has the potential to be more environmentally friendly, with a lower carbon footprint and the ability to incentivize renewable energy expansion. As we navigate the challenges of a competitive digital world, it is essential to explore innovative solutions that can minimize our ecological impact. By leveraging the power of technology and embracing alternative store of value options like Bitcoin, we can work towards a more sustainable future.

This is a guest post by Weezel. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

What amount should I invest in my Roth IRA?

Roth IRAs allow you to deposit your money tax-free. These accounts are not allowed to be withdrawn before the age of 59 1/2. There are some rules that you need to keep in mind if you want to withdraw funds from these accounts before you reach 59 1/2. First, you cannot touch your principal (the original amount deposited). This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you take out more than the initial contribution, you must pay tax.

The second rule says that you cannot withdraw your earnings without paying income tax. So, when you withdraw, you'll pay taxes on those earnings. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. Let's also assume that you make $10,000 per year from your Roth IRA contributions. This would mean that you would have to pay $3,500 in federal income tax. This leaves you with $6,500 remaining. The amount you can withdraw is limited to the original contribution.

The $4,000 you take out of your earnings would be subject to taxes. You'd still owe $1,500 in taxes. In addition, 50% of your earnings will be subject to tax again (half of 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types if Roth IRAs, Roth and Traditional. A traditional IRA allows you to deduct pre-tax contributions from your taxable income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. You can withdraw as much as you want from a traditional IRA.

Roth IRAs don't allow you deduct contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal requirement, unlike traditional IRAs. You don't have to wait until you turn 70 1/2 years old before withdrawing your contribution.

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement Account is a more beneficial option than regular savings accounts. You don't pay taxes on any interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. But, this type of investment comes with its own set of disadvantages.

You could lose all of your accumulated money if you take out too much from your IRA. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

The downside is that managing your IRA requires fees. Most banks charge 0.5% to 2.0% per annum. Other providers may charge monthly management fees, ranging between $10 and $50.

If you prefer your money to be kept out of a bank, then you will need insurance. Insurance companies will usually require that you have at least $500,000. You may be required by some insurers to purchase insurance that covers losses as high as $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. You may be limited in the amount of gold you can have by some providers. Others let you choose your weight.

It is also up to you to decide whether you want to purchase physical gold or futures. The price of physical gold is higher than that of gold futures. Futures contracts offer flexibility for buying gold. Futures contracts allow you to create a contract with a specified expiration date.

You'll also need to decide what kind of insurance coverage you want. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. However, it does cover damage caused by natural disasters. Additional coverage may be necessary if you reside in high-risk areas.

Apart from insurance, you should consider the costs of storing your precious metals. Storage costs are not covered by insurance. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

To open a IRA in gold, you will need to first speak with a qualified custodian. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians are not allowed to sell your assets. Instead, they must maintain them for as long a time as you request.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. You should also include information about your desired investments, such as stocks or bonds, mutual funds, real estate, and mutual funds. The plan should also include information about how much you are willing to invest each month.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. The company will review your application and send you a confirmation letter.

Consider consulting a financial advisor when opening a golden IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

How much do gold IRA fees cost?

An Individual Retirement Account (IRA) fee is $6 per month. This fee includes account maintenance fees as well as any investment costs related to your selected investments.

You may have to pay additional fees if you want to diversify your portfolio. The fees you pay will vary depending on the type of IRA that you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

In addition, most providers charge annual management fees. These fees can range from 0% up to 1%. The average rate is.25% annually. These rates are often waived if a broker like TD Ameritrade is used.

What is the value of a gold IRA

There are many advantages to a gold IRA. It can be used to diversify portfolios and is an investment vehicle. You decide how much money is put in each account and when it is withdrawn.

You also have the option to transfer funds from other retirement plans into a IRA. This will allow you to transition easily if it is your decision to retire early.

The best thing about investing in gold IRAs is that you don’t need any special skills. These IRAs are available at all banks and brokerage houses. Withdrawals can be made instantly without the need to pay fees or penalties.

There are, however, some drawbacks. Gold has always been volatile. Understanding why you invest in gold is crucial. Is it for growth or safety? Are you trying to find safety or growth? Only by knowing the answer, you will be able to make an informed choice.

If you want to keep your gold IRA open for life, you might consider purchasing more than one ounce. A single ounce isn't enough to cover all of your needs. You could need several ounces depending on what you plan to do with your gold.

A small amount is sufficient if you plan to sell your gold. Even one ounce is enough. But you won't be able to buy anything else with those funds.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

irs.gov

cftc.gov

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The best place to buy silver or gold online

Understanding how gold works is essential before you buy it. Precious metals like gold are similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

Two types of gold coins are available today: the legal tender type and the bullion type. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They aren't circulated in any currency exchange systems. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Each dollar spent earns the buyer 1 gram gold.

When you are looking to purchase gold, the next thing to know is where to get it. If you want to purchase gold directly from a dealer, then a few options are available. First, go to your local coin shop. You might also consider going through a reputable online seller like eBay. You can also purchase gold through private online sellers.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. This means that you will get less back from a private seller than if you sell it through a coin shop or on eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

You can also invest in gold physical. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

You can either visit a bank, pawnshop or bank to buy gold. A bank can offer you a loan for the amount that you need to buy gold. These are small businesses that let customers borrow money against the items they bring to them. Banks tend to charge higher interest rates, while pawnshops are typically lower.

The final option is to ask someone to buy your gold! Selling gold can be as easy as selling. It is easy to sell gold by contacting a company like GoldMoney.com. You can create a simple account immediately and begin receiving payments.

—————————————————————————————————————————————————————————————–

By: Weezel

Title: The Environmental Impact of Gold Mining: A Comparison to Bitcoin

Sourced From: bitcoinmagazine.com/markets/the-environmental-cost-of-gold-mining

Published Date: Wed, 17 Jan 2024 12:30:00 GMT