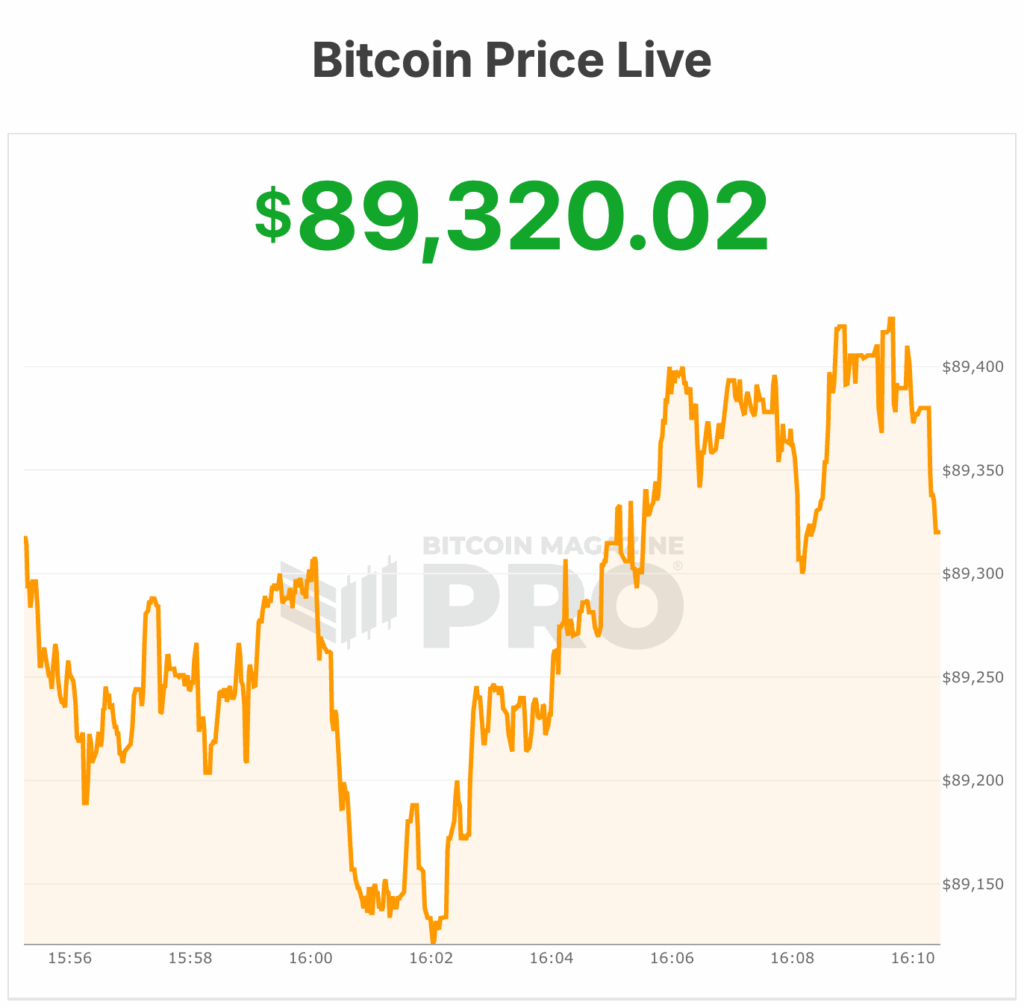

Are you ready for the rollercoaster ride of the Bitcoin market? Brace yourself as the Bitcoin price surged near $90,000, fueled by Trump's nonchalant attitude towards the dollar decline and gold hitting unprecedented highs. Let's dive into the details!

Trump's Dollar Dismissal Sparks Bitcoin Surge

The Presidential Effect

Imagine this: Trump's words echoing across the market, causing a ripple effect that sent the Bitcoin price skyrocketing. From a low of $87,100 to a high above $89,400, the market danced to the tune of Trump's economic remarks.

Gold Shines Bright

As the dollar stumbled, gold took the spotlight, hitting a record high of $5,223 per ounce. Investors sought refuge in tangible assets, amplifying the demand for gold amidst economic uncertainties.

The Bitcoin Market Dance

Macro Winds Favor Bitcoin

Picture this: Bitcoin riding the macroeconomic winds, shedding caution and embracing optimism. Despite initial hesitance, Bitcoin embraced the bullish wave, defying technical pressures and Federal Reserve jitters.

Buyers Take the Reins

Fast forward to Monday's breakout: Bitcoin punched above $89,000, signaling buyer dominance in the short term. However, the market remains vigilant, awaiting cues from the Federal Reserve's impending policy decision.

Bitcoin Mining: Riding the Wave

The Mining Metamorphosis

Bitcoin mining stocks are not far behind in the race. Companies like IREN, Cipher Mining, Hut 8, and TeraWulf are capitalizing on AI and HPC trends, propelling their stocks upwards by leveraging diversified revenue streams.

From Miners to Data Powerhouses

These mining giants are evolving into data and power-focused entities, distancing themselves from mere Bitcoin dependence. By venturing into AI and HPC hosting contracts, they secure stable cash flows and robust margins.

Ready to ride the Bitcoin wave and witness the market's thrilling twists and turns? Stay tuned for more updates on the Bitcoin revolution, only at Bitcoin Magazine!

Frequently Asked Questions

What is a Precious Metal IRA and How Can You Benefit From It?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These precious metals are extremely rare and valuable. They make excellent investments for your money and help you protect your future from inflation and economic instability.

Precious metals are sometimes called “bullion.” Bullion is the physical metal.

Bullion can be bought via various channels, such as online retailers, large coin dealers and grocery stores.

You can invest directly in bullion with a precious metal IRA instead of buying shares of stock. This ensures that you will receive dividends each and every year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. You pay only a small percentage of your gains tax. Additionally, you have access to your funds at no cost whenever you need them.

What is the value of a gold IRA

There are many benefits to a gold IRA. It's an investment vehicle that lets you diversify your portfolio. You decide how much money you want to put into each account, and when you want it to be withdrawn.

You also have the option to transfer funds from other retirement plans into a IRA. If you are planning to retire early, this makes it easy to transition.

The best thing is that investing in gold IRAs doesn't require any special skills. They're readily available at almost all banks and brokerage firms. You do not need to worry about fees and penalties when you withdraw money.

But there are downsides. The volatility of gold has been a hallmark of its history. So it's essential to understand why you're investing in gold. Are you seeking safety or growth? Do you want to use it as an insurance strategy or for long-term growth? Only then will you be able make informed decisions.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. A single ounce will not be sufficient to meet all your requirements. You may need several ounces, depending on what you intend to do with your precious gold.

You don't need to have a lot of gold if you are selling it. You can even manage with one ounce. These funds won't allow you to purchase anything else.

How much of your portfolio should be in precious metals?

First, let's define precious metals to answer the question. Precious metals refer to elements with a very high value relative other commodities. This makes them very valuable in terms of trading and investment. Gold is by far the most common precious metal traded today.

There are also many other precious metals such as platinum and silver. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is also unaffected significantly by inflation and Deflation.

In general, all precious metals have a tendency to go up with the market. However, they may not always move in synchrony with each other. The price of gold tends to rise when the economy is not doing well, but the prices of the other precious metals tends downwards. Investors expect lower interest rates which makes bonds less appealing investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors prefer safe assets such as Treasury Bonds and demand fewer precious metals. They become less expensive and have a lower value because they are limited.

Diversifying across precious metals is a great way to maximize your investment returns. You should also diversify because precious metal prices can fluctuate and it is better to invest in multiple types of precious metals than in one.

Can the government take your gold

Your gold is yours and the government cannot take it. It is yours because you worked hard for it. It is yours. However, there may be some exceptions to this rule. You can lose your gold if you have been convicted for fraud against the federal governments. If you owe taxes, your precious metals could be taken away. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

What are the advantages of a gold IRA

You can save money on retirement by putting your money into an Individual Retirement Account. It's not subject to tax until you withdraw it. You control how much you take each year. There are many types available. Some are better suited for people who want to save for college expenses. Some are better suited for investors who want higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This account may be worth considering if you are looking to retire earlier.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA where you pay taxes on gains, a gold IRA doesn't require you to worry about taxation while you wait to get them. People who want to invest their money rather than spend it make gold IRA accounts a great option.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. You won't have the hassle of making deposits each month. Direct debits could be set up to ensure you don't miss a single payment.

Finally, the gold investment is among the most reliable. It is not tied to any country so its value tends stay steady. Even during economic turmoil the gold price tends to remain fairly stable. This makes it a great investment option to protect your savings from inflation.

How much is gold taxed under a Roth IRA

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

However, if the money is deposited into a traditional IRA/401(k), the tax on the withdrawal of the money is not applicable. You pay taxes only on earnings from dividends and capital gains — which apply only to investments held longer than one year.

These accounts are subject to different rules depending on where you live. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you to delay withdrawals until April 1. New York is open until 70 1/2. To avoid penalties, you should plan ahead and take distributions as soon as possible.

How Does Gold Perform as an Investment?

Supply and demand determine the gold price. Interest rates can also affect the gold price.

Because of their limited supply, gold prices can fluctuate. There is also a risk in owning gold, as you must store it somewhere.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

investopedia.com

cftc.gov

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Lawful – WSJ

How To

The growing trend of gold IRAs

As investors look for ways to diversify their portfolios and protect themselves against inflation, the gold IRA trend is on the rise.

Gold IRA owners can now invest in physical gold bullion or bars. This IRA can be used to grow your wealth tax-free and is an alternative option to stocks and bonds.

Investors can manage their assets with a gold IRA without worrying about market volatility. The gold IRA can be used to protect against inflation or other potential problems.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

Additional benefits of the gold IRA include the ability to quickly pass ownership to heirs. Additionally, the IRS does not consider gold a money or a commodity.

This means that investors who are looking for financial safety and security are becoming more interested in the gold IRA.

—————————————————————————————————————————————————————————————–

By: Micah Zimmerman

Title: The Bitcoin Revolution: Trump's Dollar Dismissal Sends Price Soaring Towards $90,000

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-surges-near-90000

Published Date: Tue, 27 Jan 2026 21:33:23 +0000