Introduction

In this article, we will explore the concept of cooperation in economics and how it relates to the ideas of John F. Nash Jr., particularly his work on the Nash Bargaining Problem and Ideal Money. We will also consider how these concepts can be applied to the Bitcoin system, which shares some similarities with Nash's theories.

The Nash Bargaining Problem

The Nash Bargaining Problem, introduced by John Nash in 1950, is a game theory framework that aims to determine the fairest way to split a sum of money between two participants in a financial transaction or contract. The problem assumes that both sides have their own interests and preferences, and there must be agreement for any allocation to be made. Nash's axioms for a Nash bargain define a unique solution to this problem.

Nash Equilibrium versus Nash Bargaining

In his subsequent work on Non-Cooperative Games, Nash introduced the concept of Nash equilibria, which describes a state where no player can unilaterally change their strategy to improve their outcome. While Nash equilibria gained more attention and earned Nash a Nobel prize, Nash Bargaining is different in that it assumes no equilibrium and instead focuses on defining desired properties of a solution. Nash Bargaining is considered a form of cooperative game theory due to its nonzero-sum nature and the presence of contracts.

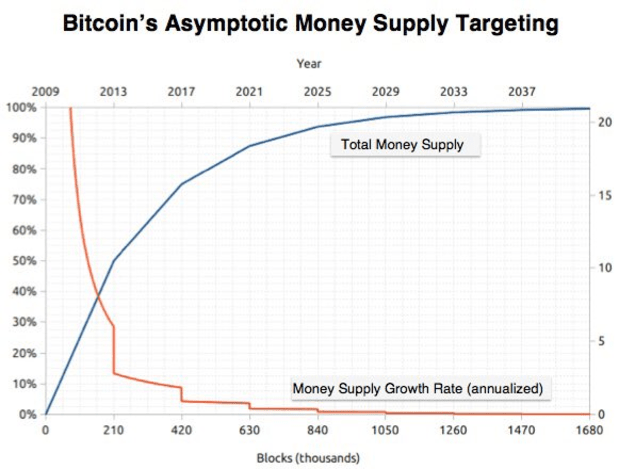

Ideal Money and Asymptotically Ideal Money

In his later works, Nash began exploring the concept of Ideal Money, which he defined as a form of currency that is free from inflation or inflationary decadence. He criticized Keynesian macroeconomics and its emphasis on inflation and currency devaluation. Nash argued for a stable value of money over the long term and introduced the idea of Asymptotically Ideal Money, which incorporates a steady rate of inflation to facilitate lending and borrowing.

Bitcoin as an Axiomatic Design

Given Nash's views on the arbitrary nature of centrally managed currencies, it is worth considering if his axioms can be applied to the Bitcoin system. Both Nash and Satoshi Nakamoto, the pseudonymous creator of Bitcoin, were critical of such currencies. We can analyze Bitcoin through the lens of Nash's axioms:

Pareto Efficiency

Bitcoin exhibits Pareto efficiency in terms of its cumulative supply density and distribution. The majority of coins are mined early on, following a Pareto 80/20 power law.

Scale Invariance

Bitcoin demonstrates scale invariance through its difficulty adjustment mechanism, which maintains a steady and constant supply. The internal divisibility of bitcoin means that the value expressed in different currencies should not affect preferences over shorter time frames.

Symmetry

The pseudonymity and decentralization of the Bitcoin network provide symmetry, ensuring equality of bargaining skill. There is no centralized authority responsible for minting coins, and participants do not need to prove their first-person identity, similar to Nash's concept of equality in bargaining.

Independence of Irrelevant Alternatives (IIA)

Nash's controversial axiom of IIA suggests that adding a third party to a two-player game should not alter the outcome. In the context of Bitcoin's proof-of-work, this axiom may be present, as the software acts as a third-party arbitrator based on predefined values or axioms.

Characteristics and Benefits of Cooperation

Cooperative games, such as Bitcoin, have several advantages over non-cooperative settings. These include reduced need for mediation or dispute resolution, less friction in trading, win-win outcomes, more intuitive decision-making, and the possibility of coalition formation. Nash believed that cooperation could lead to resolutions for complex problems, such as multilateral coordination.

Cooperative games like Bitcoin also facilitate transferable utility through the use of money. Nash noted that money acts as a lubricant in games, providing a practical currency for exchanges and contracts.

Frequently Asked Questions

What is a Precious Metal IRA (IRA)?

An IRA with precious metals allows you to diversify retirement savings into gold and silver, palladium, rhodiums, iridiums, osmium, or other rare metals. These precious metals are extremely rare and valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Precious metals often refer to themselves as “bullion.” Bullion refers actually to the metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. This means you'll receive dividends every year.

Precious metal IRAs have no paperwork or annual fees. Instead, your gains are subject to a small tax. Plus, you can access your funds whenever you like.

What precious metals can you invest in for retirement?

It is gold and silver that are the best precious metal investment. They are both simple to purchase and sell, and they have been around for a long time. You should add them to your portfolio if you are looking to diversify.

Gold: One of the oldest forms of currency, gold, is one of mankind's most valuable. It's stable and safe. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: Silver has been a favorite among investors for years. This is a great choice for people who want to avoid volatility. Silver, unlike gold, tends not to go down but up.

Platinium: Another form of precious metal is platinum, which is becoming more popular. It's durable and resists corrosion, just like gold and silver. However, it's much more expensive than either of its counterparts.

Rhodium: Rhodium is used in catalytic converters. It is also used in jewelry-making. It's also relatively inexpensive compared to other precious metals.

Palladium (or Palladium): Palladium can be compared to platinum, but is much more common. It's also much more affordable. This is why it has become a favourite among investors looking for precious metals.

Is it a good idea to open a Precious Metal IRA

Before opening an IRA, it is important to understand that precious metals aren't covered by insurance. It is impossible to get back money if you lose your investment. This includes investments that have been damaged by fire, flooding, theft, and so on.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items can be lost because they have real value and have been around for thousands years. If you were to offer them for sale today, they would likely fetch you more than you paid when you bought them.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. Consider using a third-party custody company to keep your assets safe and allow you to access them at any time.

Do not open an account unless you're ready to retire. Keep your eyes open for the future.

How does a gold IRA account work?

The Gold Ira Accounts are tax-free investment options for those who want to make investments in precious metals.

Physical gold bullion coin can be purchased at any time. To invest in gold, you don't need to wait for retirement.

An IRA allows you to keep your gold forever. When you die, your gold assets won't be subjected to taxes.

Your heirs inherit your gold without paying capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

To open a gold IRA, you will first need to create an individual retirement account (IRA). Once you've done so, you'll be given an IRA custodian. This company acts like a middleman between the IRS and you.

Your gold IRA custodian is responsible for handling all paperwork and submitting the required forms to the IRS. This includes filing annual reports.

Once your gold IRA is established, you can purchase gold bullion coins. Minimum deposit required is $1,000 If you make more, however, you will get a higher interest rate.

You'll have to pay taxes if you take your gold out of your IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

If you only take out a very small percentage of your income, you may not need to pay tax. However, there are exceptions. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

It is best to not take out more than 50% annually of your total IRA assets. You'll be facing severe financial consequences if you do.

Can I keep physical gold in an IRA?

Gold is money, not just paper currency or coinage. It is an asset that people have used over thousands of years as money, and a way to protect wealth from inflation and economic uncertainties. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Many Americans now invest in precious metals. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

Gold has historically performed better during financial panics than other assets. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Gold is one of the few assets that has virtually no counterparty risks. Your shares will still be yours even if your stock portfolio drops. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, gold offers liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. You can buy gold in small amounts because it is so liquid. This allows for you to benefit from the short-term fluctuations of the gold market.

What is the benefit of a gold IRA?

A gold IRA has many benefits. It's an investment vehicle that lets you diversify your portfolio. You can control how much money is deposited into each account as well as when it's withdrawn.

You can also rollover funds from other retirement accounts to a gold IRA. This is a great way to make a smooth transition if you want to retire earlier.

The best thing about investing in gold IRAs is that you don’t need any special skills. They're readily available at almost all banks and brokerage firms. Withdrawals can be made instantly without the need to pay fees or penalties.

However, there are still some drawbacks. Gold is historically volatile. It's important to understand the reasons you're considering investing in gold. Are you looking for safety or growth? Is it for insurance purposes or a long-term strategy? Only by knowing the answer, you will be able to make an informed choice.

If you plan to keep your gold IRA indefinitely, you'll probably want to consider buying more than one ounce of gold. A single ounce will not be sufficient to meet all your requirements. You may need several ounces, depending on what you intend to do with your precious gold.

If you're planning to sell off your gold, you don't necessarily need a large amount. Even a single ounce can suffice. These funds won't allow you to purchase anything else.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

bbb.org

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Do you want to keep your IRA gold at home? It's not legal – WSJ

How To

Three ways to invest in gold for retirement

It's essential to understand how gold fits into your retirement plan. There are several options to invest in precious metals if your employer has a 401k. You might also be interested to invest in gold outside the workplace. If you have an IRA (Individual Retirement Account), a custodial account could be opened at Fidelity Investments. If precious metals aren't your thing, you may be interested in buying them from a dealer.

These are three easy rules to remember if you invest in gold.

- Buy Gold with Cash – Avoid using credit cards or borrowing money to fund investments. Instead, instead, transfer cash to your accounts. This will help to keep your purchasing power high and protect you against inflation.

- Physical Gold Coins to Own – Physical gold coin ownership is better than having a paper certificate. Physical gold coins can be sold much faster than paper certificates. You don't have to store physical gold coins.

- Diversify Your Portfolio – Never put all of your eggs in one basket. By investing in multiple assets, you can spread your wealth. This helps reduce risk and gives you more flexibility during market volatility.

—————————————————————————————————————————————————————————————–

By: Jon Gulson

Title: The Benefits of Cooperation: Nash Bargaining and Bitcoin

Sourced From: bitcoinmagazine.com/print/the-benefits-of-cooperation-nash-bargaining-and-bitcoin-

Published Date: Wed, 03 Jan 2024 21:03:44 GMT

Did you miss our previous article…

https://altcoinirareview.com/radiant-capital-loses-4-5-million-in-digital-assets-after-flash-loan-attack/