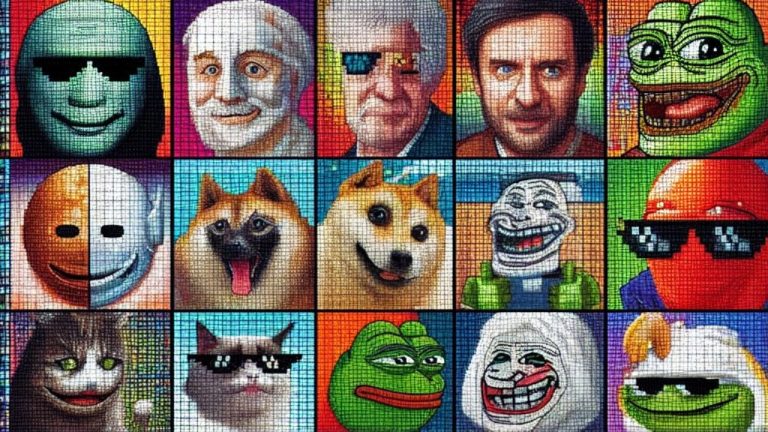

Avalanche Foundation to Invest in Meme Coins

The Avalanche Foundation, a leading institution that funds avalanche initiatives, has recently announced its decision to invest in meme coins. This strategic move is part of the foundation's efforts to explore new opportunities and expand its investment portfolio.

Investment Strategy and Selection Criteria

The selection of meme coins for investment will be based on several key factors, including the number of holders, liquidity thresholds, project maturity, fair launch principles, and overall social sentiment. By considering these aspects, the Avalanche Foundation aims to identify meme coins that not only have a strong community backing but also align with its investment strategy.

Culture Catalyst Fund and Meme Coin Investments

The investments in meme coins will be made using funds from the Culture Catalyst fund, which was launched in 2022 during the Avalanche Summit in Barcelona. This fund, initially designed to support creativity, culture, and lifestyle enabled by blockchain technology, will now also be utilized to purchase selected meme tokens.

The Cultural Significance of Meme Coins

The Avalanche Foundation recognizes the cultural importance of meme coins in the crypto market. These tokens go beyond mere utility assets and serve as social signaling mechanisms that represent the collective spirit and shared interests of diverse crypto communities.

Emin Gün Sirer, founder and CEO of Ava Labs, initially had reservations about meme coins. However, he has come to understand their value within the crypto ecosystem. He acknowledges the cultural significance of coins that serve as social signals and believes they play a unique role in the broader crypto landscape.

Growth of the Meme Coin Economy

The meme coin economy has experienced rapid growth, reaching a market cap of almost $24 billion on December 9. This surge in popularity further highlights the appeal and potential of meme coins as an investment asset class.

Your Thoughts

What are your thoughts on the Avalanche Foundation's decision to invest in meme coins? Share your opinions and insights in the comments section below.

Frequently Asked Questions

How Much of Your IRA Should Include Precious Metals?

It is important to remember that precious metals can be a good investment for anyone. It doesn't matter how rich you are to invest in precious metals. There are many methods to make money off of silver and gold investments.

You may consider buying physical coins such as bullion bars or rounds. You could also buy shares in companies that produce precious metals. Or, you might want to take advantage of an IRA rollover program offered by your retirement plan provider.

No matter what your preference, precious metals will still be of benefit to you. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

And, unlike traditional investments, their prices tend to rise over time. You'll probably make more money if your investment is sold down the line than traditional investments.

How does a gold IRA work?

The Gold Ira Accounts are tax-free investment options for those who want to make investments in precious metals.

Physical gold bullion coin can be purchased at any time. You don’t have to wait to begin investing in gold.

Owning gold as an IRA has the advantage of allowing you to keep it forever. You won't have to pay taxes on your gold investments when you die.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

First, an individual retirement account will be set up to allow you to open a golden IRA. Once you've done that, you'll receive an IRA custody. This company acts as an intermediary between you and IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual returns.

After you have established your gold IRA you will be able purchase gold bullion coin. Minimum deposit required is $1,000 However, you'll receive a higher interest rate if you put in more.

You'll have to pay taxes if you take your gold out of your IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

You may not be required to pay taxes if you take out only a small amount. There are exceptions. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

Avoid taking out more that 50% of your total IRA assets each year. Otherwise, you'll face steep financial consequences.

What precious metal is best for investing?

Answering this question will depend on your willingness to take some risk and the return you seek. Gold has been traditionally considered a haven investment, but it's not always the most profitable choice. For example, if your goal is to make quick money, gold may not suit you. Silver is a better investment if you have patience and the time to do it.

If you don’t want to be rich fast, gold might be the right choice. If you want to invest in long-term, steady returns, silver is a better choice.

How is gold taxed by Roth IRA?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. If you invest $1,000 in mutual funds or stocks and then later sell them, all gains are subjected to taxes.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

Each state has its own rules regarding these accounts. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. In Massachusetts, you can wait until April 1st. New York is open until 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Can I buy or sell gold from my self-directed IRA

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contract are financial instruments that depend on the gold price. They let you speculate on future price without having to own the metal. But physical bullion refers to real gold and silver bars you can carry in your hand.

Who is entitled to the gold in a IRA that holds gold?

The IRS considers gold owned by an individual to be “a type of money” and is subject taxation.

You must have gold at least $10,000 and it must be stored for at the least five years in order to take advantage of this tax-free status.

While gold may be a great investment to help prevent inflation and volatility in the market, it's not wise to keep it if you won't use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

Consult a financial advisor or accountant to determine your options.

How to Open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. To open the account, complete Form 8606. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. This form must be submitted within 60 days of the account opening. You can then start investing once you have this completed. You may also choose to contribute directly from your paycheck using payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, the process is identical to an ordinary IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. The IRS stipulates that you must have earned income and be at least 18-years old. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. Additionally, you must make regular contributions. These rules apply regardless of whether you are contributing directly to your paychecks or through your employer.

You can invest in precious metals IRAs to buy gold, palladium and platinum. However, physical bullion will not be available for purchase. This means you won't be allowed to trade shares of stock or bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option is offered by some IRA providers.

There are two main drawbacks to investing through an IRA in precious metallics. First, they don't have the same liquidity as stocks or bonds. It's also more difficult to sell them when they are needed. Second, they don't generate dividends like stocks and bonds. You'll lose your money over time, rather than making it.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- You want to keep gold in your IRA at home? It's not exactly legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement funds

irs.gov

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Investing gold vs. stocks

Investing in gold as an investment vehicle might seem like a very risky proposition these days. This is because many people believe that gold investment is no longer profitable. This belief comes from the fact most people see gold prices falling due to the global economy. They fear that investing in gold will result in a loss of money. However, investing in gold can still provide significant benefits. Let's take a look at some of the benefits.

One of the oldest forms known of currency is gold. Its use can be traced back to thousands of years ago. It is a valuable store of value that has been used by many people throughout the world. It continues to be used in South Africa, as a way of paying their citizens.

When deciding whether to invest in gold, the first thing you need to do is to decide what price per gram you are willing to pay. It is important to determine the price per gram you are willing and able to pay for gold bullion. If you don’t know what the current market price is, you can always call a local jewelry store and ask them their opinion.

It's worth noting, however, that while gold prices have fallen recently the cost of producing gold is on the rise. The price of gold may have fallen, but the production costs haven’t.

Another thing to remember when thinking about whether or not you should buy gold is the amount of gold you plan on purchasing. If you intend to only purchase enough gold to cover your wedding rings it may be a smart decision to not buy any gold. It is worth considering if you intend to use it for long-term investment. It is possible to make a profit by selling your gold at higher prices than when you purchased it.

We hope you have gained a better understanding about gold as an investment tool. It is important to research all options before you make any decision. Only then can informed decisions be made.

—————————————————————————————————————————————————————————————–

By: Sergio Goschenko

Title: The Avalanche Foundation Expands Investment Portfolio to Include Meme Coins

Sourced From: news.bitcoin.com/avalanche-foundation-to-hop-onto-the-meme-coin-train-announces-investment-in-selected-projects/

Published Date: Mon, 01 Jan 2024 00:30:58 +0000

Did you miss our previous article…

https://altcoinirareview.com/the-u-s-sec-may-approve-spot-bitcoin-etfs-this-week/