The Arizona State Senate is currently reviewing a proposal that encourages the Arizona State Retirement System (ASRS) and the Public Safety Personnel Retirement System (PSPRS) to explore the possibility of including Bitcoin ETFs in their investment portfolios.

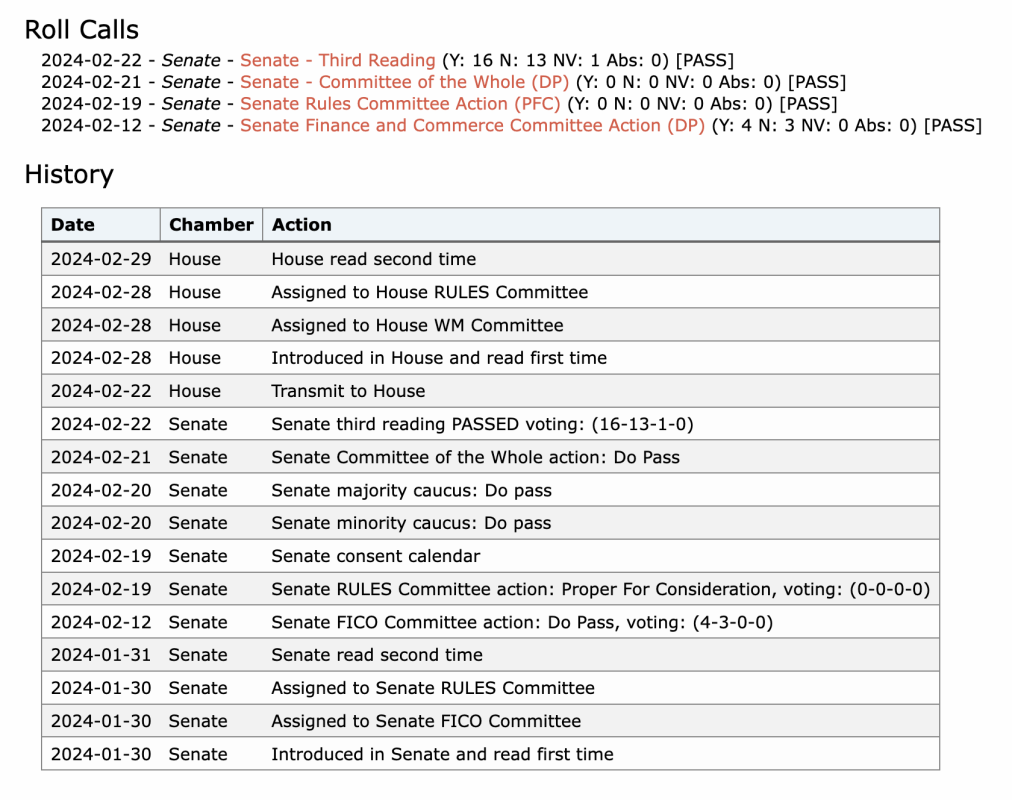

Bill Progression and Current Status

The bill, which passed the Senate's Third Reading on February 22 with a 16-13 vote, is now under review by the House for the second time.

Emphasis on Monitoring and Consideration

The proposal highlights the importance of closely monitoring developments related to Bitcoin ETFs. It also urges ASRS and PSPRS to carefully consider the potential implications of adding such assets to their portfolios. This involves seeking advice from firms authorized by the U.S. Securities and Exchange Commission to provide Bitcoin ETFs.

Requirement for Comprehensive Report

ASRS and PSPRS would need to prepare and submit a detailed report on the feasibility, risks, and possible benefits of allocating a portion of state retirement funds to Bitcoin ETFs. This report must include various options and recommendations for securely investing in this asset class. It is mandated to be presented to key state officials at least three months before the start of the Fifty-Seventh Legislature, First Regular Session.

Objective of the Proposal

The primary goal of this proposal is to equip ASRS and PSPRS with the necessary information to make well-informed decisions regarding the integration of Bitcoin ETFs into their investment strategies. By potentially diversifying their portfolios and exploring new avenues for growth, these state retirement systems aim to enhance their investment approach.

Frequently Asked Questions

Can the government take your gold

Because you have it, the government can't take it. It is yours because you worked hard for it. It belongs entirely to you. There may be exceptions to this rule. If you are convicted of fraud against the federal government, your gold can be forfeit. Additionally, your precious metals may be forfeited if you owe the IRS taxes. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

Is physical gold allowed in an IRA.

Not just paper money or coins, gold is money. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Today, investors invest in gold as part a diversified portfolio. This is because gold tends do better in financial turmoil.

Many Americans now invest in precious metals. It's not guaranteed that you'll make any money investing gold, but there are several reasons it might be worthwhile to add gold to retirement funds.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. Gold was one asset that outperformed stocks in turbulent market conditions.

Gold is one of the few assets that has virtually no counterparty risks. If your stock portfolio goes down, you still own your shares. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold provides liquidity. This allows you to sell your gold whenever you want, unlike many other investments. Gold is liquid and therefore it makes sense to purchase small amounts. This allows you to take advantage of short-term fluctuations in the gold market.

Are gold investments a good idea for an IRA?

Anyone who is looking to save money can make gold an excellent investment. You can diversify your portfolio with gold. But gold has more to it than meets the eyes.

It has been used throughout the history of currency and remains a popular payment method. It is often called “the most ancient currency in the universe.”

But unlike paper currencies, which governments create, gold is mined out of the earth. Because it is rare and difficult to make, it is extremely valuable.

The supply and demand factors determine how much gold is worth. If the economy is strong, people will spend more money which means less people can mine gold. As a result, the value of gold goes up.

On the other hand, people will save cash when the economy slows and not spend it. This leads to more gold being produced which decreases its value.

This is why gold investment makes sense for both individuals and businesses. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

Also, your investments will earn you interest which can help increase your wealth. Additionally, you won't lose cash if the gold price falls.

What is the benefit of a gold IRA?

A gold IRA has many benefits. It's an investment vehicle that lets you diversify your portfolio. You have control over how much money goes into each account.

Another option is to rollover funds from another retirement account into a IRA with gold. This makes for an easy transition if you decide to retire early.

The best part? You don’t need to have any special skills to invest into gold IRAs. They're readily available at almost all banks and brokerage firms. Withdrawals are made automatically without having to worry about fees or penalties.

However, there are still some drawbacks. Gold has always been volatile. Understanding why you want to invest in gold is essential. Is it for growth or safety? Are you looking for growth or insurance? Only by knowing the answer, you will be able to make an informed choice.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. One ounce won't be enough to meet all your needs. Depending on your plans for using your gold, you may need multiple ounces.

If you're planning to sell off your gold, you don't necessarily need a large amount. Even a single ounce can suffice. These funds won't allow you to purchase anything else.

How Do You Make a Withdrawal from a Precious Metal IRA?

First, determine if you would like to withdraw money directly from an IRA. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, determine how much money you plan to withdraw from your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

Once you have completed these calculations, you need to open your brokerage account. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. Avoid unnecessary fees by opening an account with your debit card, rather than your credit card.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will accept bullion bars, others require you to buy individual coins. Before choosing one, consider the pros and disadvantages of each.

Bullion bars are easier to store than individual coins. But you will have to count each coin separately. However, individual coins can be stored to make it easy to track their value.

Some people prefer to keep their coins in a vault. Others prefer to place them in safe deposit boxes. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

How is gold taxed by Roth IRA?

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. If you invest $1,000 in mutual funds or stocks and then later sell them, all gains are subjected to taxes.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Only earnings from capital gains and dividends are subject to tax. These taxes do not apply to investments that have been held for more than one year.

These rules vary from one state to another. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. Massachusetts allows you to delay withdrawals until April 1. And in New York, you have until age 70 1/2 . To avoid penalties, plan ahead so you can take distributions at the right time.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Legal – WSJ

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

bbb.org

irs.gov

How To

A growing trend: Gold IRAs

As investors seek to diversify their portfolios while protecting themselves from inflation, the trend towards gold IRAs is on the rise.

The gold IRA allows owners to invest in physical gold bullion and bars. It is tax-free and can be used by investors who aren't concerned about stocks and bond.

An investor can use a gold IRA to manage their assets and not worry about market volatility. The gold IRA can be used to protect against inflation or other potential problems.

Investors also benefit from physical gold's unique properties, such as durability and portability.

Additionally, the gold IRA has many benefits. It allows you to quickly transfer your gold ownership to your heirs. The IRS doesn't consider gold a commodity or currency.

This is why the gold IRA has become increasingly popular with investors looking to provide financial security during times of financial uncertainty.

—————————————————————————————————————————————————————————————–

By: Nik Hoffman

Title: The Arizona State Senate Considers Proposal to Include Bitcoin ETFs in State Retirement Systems

Sourced From: bitcoinmagazine.com/business/arizona-state-senate-considering-adding-bitcoin-etfs-to-retirement-portfolios

Published Date: Wed, 06 Mar 2024 15:29:53 GMT