As we step into 2024, the buzz in the cryptocurrency community intensifies with the looming Bitcoin halving event that has the potential to reshape the market dynamics. This event has a historical significance of triggering substantial changes in the crypto sphere. Drawing insights from past halvings, it is crucial to analyze the upcoming halving and its implications.

Bitcoin's Journey: Transition from Digital Gold to Rare Platinum

The essence of Bitcoin lies in its design to become increasingly scarce over time, effectively controlling inflation. With a maximum cap of 21 million Bitcoins, the current circulation stands at 19.62 million. The limited release of Bitcoin into the market echoes the scarcity of precious metals like gold, earning it the moniker "digital gold."

Viewing the Bitcoin blockchain as a ticking clock reveals that halving occurs approximately every four years or every 210,000 blocks. This process involves reducing the reward for mining new blocks by half. Since its inception in 2009, Bitcoin's block reward has decreased from 50 BTC to 3.125 BTC in 2024.

Stock-to-Flow Ratio: Bitcoin's Path to Rarity

The Stock-to-Flow ratio, which compares the existing supply of Bitcoin to the new coins entering the market, indicates that Bitcoin is on course to become rarer than a platinum album. Following the halvings in 2024 and 2030, Bitcoin's scarcity will elevate, solidifying its status as a prized asset.

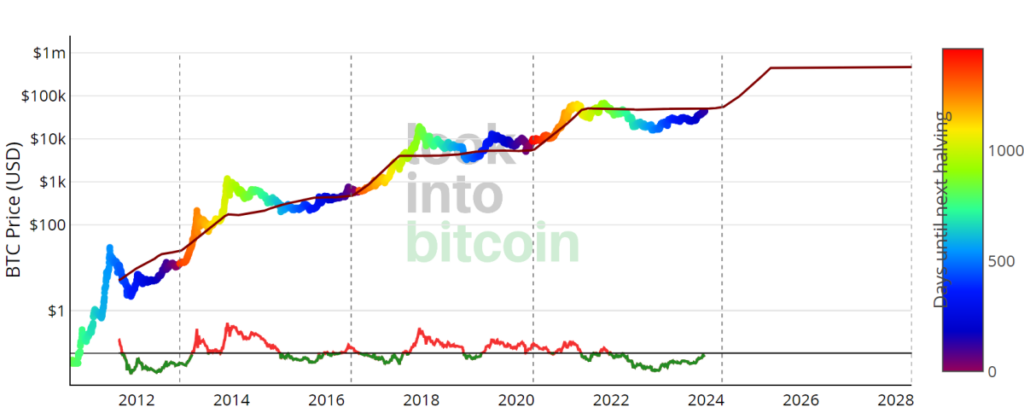

Post-Halving Growth Trends of Bitcoin

Reflecting on Bitcoin's performance post previous halving events unveils a pattern of significant price surges. Following the 2012 halving, Bitcoin's market cap surged by 342%, with the price reaching $1,152 the subsequent year, marking an 8,761% leap. The 2016 halving saw the price escalate to $17,760 in the following year, translating to a 2,572% increase. The most recent halving in 2020 led to a price spike to $67,549, reflecting a growth of 594%.

By analyzing past growth rates post-halving events and projecting forward, Bitcoin could potentially achieve a growth rate of 155.79% post the 2024 halving, hinting at a price point of approximately $111,807 within a year to eighteen months. However, it is essential to note that these projections are speculative and not to be solely relied upon for investment decisions.

Challenges for Miners Post 2024 Halving

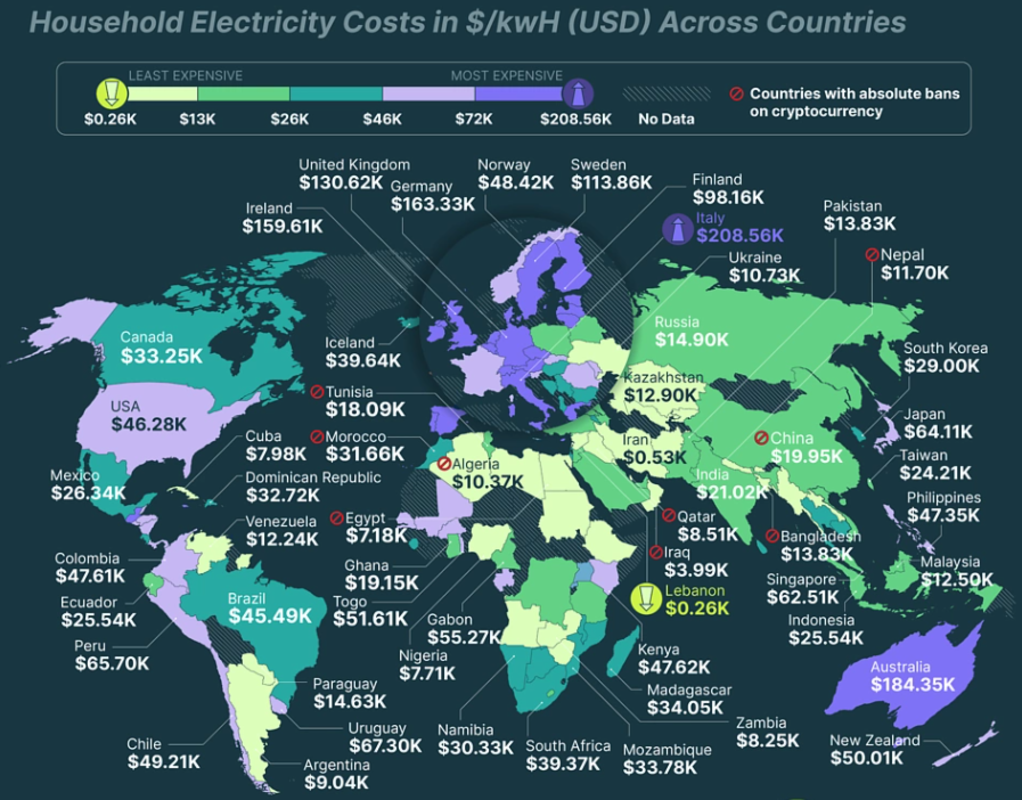

The impending 2024 halving poses challenges for Bitcoin miners, especially those with outdated equipment and high operational costs. Mining expenses in countries like Italy can amount to the cost of luxury sports cars, creating a daunting scenario for miners. The halving will separate the resilient miners equipped with efficient technology and affordable energy sources from those struggling to sustain profitability.

Concluding Thoughts on the 2024 Bitcoin Halving

The 2024 Bitcoin halving is set to bring about significant transformations, impacting mining operations and potentially influencing Bitcoin's price trajectory. This event merges economic theories with technological advancements, encapsulating the essence of the crypto world. Whether you are actively involved in mining, holding Bitcoin, or observing from the sidelines, the upcoming halving promises an exciting ride that will be etched in the history of cryptocurrencies.

Frequently Asked Questions

Is gold a good choice for an investment IRA?

Anyone who is looking to save money can make gold an excellent investment. It can be used to diversify your portfolio. But there is more to gold than meets the eye.

It's been used as a form of payment throughout history. It is sometimes called the “oldest currency in the world”.

But gold is mined from the earth, unlike paper currencies that governments create. It is very valuable, as it is rare and hard to create.

The supply-demand relationship determines the gold price. The strength of the economy means people spend more, and so, there is less demand for gold. The value of gold rises as a consequence.

The flip side is that people tend to save money when the economy slows. This means that more gold is produced, which reduces its value.

This is why it makes sense to invest in gold for individuals and companies. You'll reap the benefits of investing in gold when the economy grows.

Your investments will also generate interest, which can help you increase your wealth. Plus, you won't lose money if the value of gold drops.

Is physical gold allowed in an IRA.

Not only is gold paper currency, but it's also money. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. Although owning gold does not guarantee that you will make money investing in it, there are many reasons to consider adding gold into your retirement portfolio.

Gold has historically performed better during financial panics than other assets. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Even if your stock portfolio is down, your shares are still yours. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold provides liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. Because gold is so liquid compared to other investments, buying it in small amounts makes sense. This allows you to profit from short-term fluctuations on the gold market.

How much should you have of gold in your portfolio

The amount you make will depend on the amount of capital you have. Start small with $5k-10k. You could then rent out desks and office space as your business grows. You don't need to worry about paying rent every month. You just pay per month.

Also, you need to think about the type of business that you are going to run. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

If you are doing freelance work, you probably won't have a monthly salary like I do because the project pays freelancers. You may get paid just once every 6 months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I recommend starting with $1k to $2k of gold, and then growing from there.

How do I open a Precious Metal IRA

It is important to decide if you would like an Individual Retirement Account (IRA). If you do, you must open the account by completing Form 8606. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should be filled within 60 calendar days of opening the account. Once you have completed this form, it is possible to begin investing. You could also opt to make a contribution directly from your paycheck by using payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. Otherwise, the process is identical to an ordinary IRA.

To be eligible for a precious metals IRA, you will need to meet certain requirements. The IRS says you must be 18 years old and have earned income. You can't earn more than $110,000 per annum ($220,000 in married filing jointly) for any given tax year. And, you have to make contributions regularly. These rules apply to contributions made directly or through employer sponsorship.

You can use a precious-metals IRA to purchase gold, silver and palladium. However, you can't purchase physical bullion. This means you won’t be able to trade stocks and bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. Some IRA providers offer this option.

An IRA is a great way to invest in precious metals. However, there are two important drawbacks. First, they're not as liquid as stocks or bonds. It is therefore harder to sell them when required. They don't yield dividends like bonds and stocks. Therefore, you will lose money over time and not gain it.

How much should precious metals be included in your portfolio?

To answer this question we need to first define precious metals. Precious Metals are elements that have a very high relative value to other commodities. This makes them very valuable in terms of trading and investment. Gold is today the most popular precious metal.

There are also many other precious metals such as platinum and silver. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is not affected by inflation or deflation.

The general trend is for precious metals to increase in price with the overall market. That said, they do not always move in lockstep with each other. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. Investors expect lower interest rates which makes bonds less appealing investments.

However, when an economy is strong, the reverse effect occurs. Investors prefer safe assets such as Treasury Bonds and demand fewer precious metals. They are more rare, so they become more expensive and less valuable.

You must therefore diversify your investments in precious metals to reap the maximum profits. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

Is it possible to hold a gold ETF within a Roth IRA

This option may not be available in a 401(k), but you should look into other options such as an Individual Retirement account (IRA).

A traditional IRA allows for contributions from both employer and employee. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP gives employees tax advantages as they share the stock of the company and the profits it makes. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

Also available is an Individual Retirement Annuity. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs don't have to be taxable

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

irs.gov

bbb.org

investopedia.com

cftc.gov

How To

How to Keep Physical Gold in an IRA

The most obvious way to invest in gold is by buying shares from companies producing gold. However, this method comes with many risks because there's no guarantee that these companies will continue to survive. If they survive, there's still the risk of losing money due to fluctuations in the price of gold.

The alternative is to buy physical gold. You'll need to open a bank account, buy gold online from a trusted seller, or open an online bullion trading account. These options offer the convenience of easy access, as you don't need stock exchanges to do so. You can also make purchases at lower prices. It is also easier to check how much gold you have stored. You'll get a receipt showing exactly what you paid, so you'll know if any taxes were missed. There's also less chance of theft than investing in stocks.

However, there are disadvantages. You won't be able to benefit from investment funds or interest rates offered by banks. It won't allow you to diversify any of your holdings. Instead, you'll be stuck with what's been bought. Finally, tax man may want to ask where you put your gold.

Visit BullionVault.com to find out more about gold buying in an IRA.

—————————————————————————————————————————————————————————————–

By: Maria Carola

Title: The 2024 Bitcoin Halving: Impact on BTC Value and Mining Industry

Sourced From: bitcoinmagazine.com/markets/the-2024-bitcoin-halving-a-btc-value-boom-or-a-survival-crisis-for-miners

Published Date: Mon, 19 Feb 2024 17:30:02 GMT

Related posts:

The Fourth Bitcoin Halving: Anticipation Grows as Scarcity Beckons

The Fourth Bitcoin Halving: Anticipation Grows as Scarcity Beckons

Current Block Times Suggest Bitcoin’s Halving Is Coming Sooner Than Expected

Current Block Times Suggest Bitcoin’s Halving Is Coming Sooner Than Expected

Robert Kiyosaki Emphasizes the Importance of Bitcoin Halving

Robert Kiyosaki Emphasizes the Importance of Bitcoin Halving

Bitcoin’s Hashrate Skyrockets: An In-depth Look at the Impending Reward Halving Amidst Market Challenges

Bitcoin’s Hashrate Skyrockets: An In-depth Look at the Impending Reward Halving Amidst Market Challenges